Europe Harvester Market Size, Share, and COVID-19 Impact Analysis, By Type (Forage Harvester, Combine Harvester, Sugarcane Harvester, Potato Harvester, and Others), By Automation Level (Manual, Semi-Automatic, Automatic), By Propulsion Type (ICE, Electric), and Europe Harvester Market Insights, Industry Trends, Forecast to 2035

Industry: AgricultureEurope Harvester Market Insights Forecasts To 2035

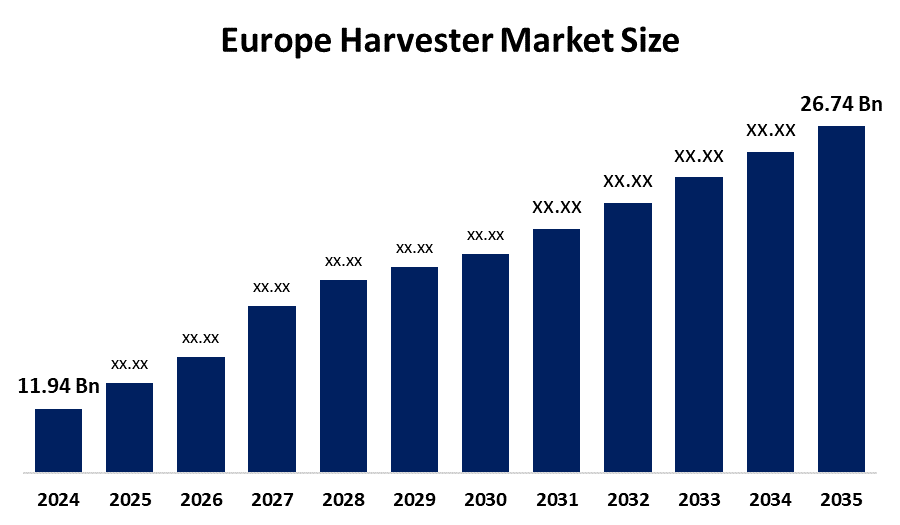

- The Europe Harvester Market Size Was Estimated At USD 11.94 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 7.61% From 2025 To 2035

- The Europe Harvester Market Size Is Expected To Reach USD 26.74 Billion By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Europe Harvester Market Size Is Anticipated To Reach USD 26.74 Billion By 2035, Growing At A CAGR Of 7.61% From 2025 To 2035. The market is driven by the sustainable practices that manufacturers adopt has given a significant boost to the demand for environmentally friendly harvesting methods. Among the newly introduced concepts are energy-saving engines and emission control technologies that not only take care of the environment but also keep the companies abreast of the changing regulations.

Market Overview

The Market Size For Harvesters Is Well-Established, And It Is Mainly Powered By The Demand For More Efficient Operations And Lower Labor Costs. A harvester is an agricultural machine that is utilised for the collection of ripe crops in an efficient manner, and most times several operations can be performed at the same time, like reaping, threshing, and winnowing. Grain harvesting, for example, wheat, barley, oats, and corn, is the area where harvesters find their most common application. The use of harvesters is especially important in large fields that are not manually feasible due to the hired labor's unproductive and time-consuming nature.

In October 2025, The Area Of Land For Potato Cultivation For EU-04 Consumption Increased Drastically In The Season, Growing By Almost 40,000 Hectares Compared To The Previous Year, 2024. A total of 608,000 hectares were utilised for planting, which is 7% more than last year's figure. Initial test digs show that the total harvest will be 27.3 million tons, which is 2.65 million tons (11%) more than last year's crop.

In The EU, The Common Agricultural Policy (CAP), Combined With Different National Measures, Provide Monetary Rewards, Grants, And Subsidies For The Acquisition Of New, Low-Emission, And Sustainable Farming Equipment. The increasing environmental concern and stringent rules have forced manufacturers to come up with green harvesters and alternative power sources, such as electric engines.

Report Coverage

This Research Report Categorizes The Market Size For The Europe Harvester Market Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe harvester market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe harvester market.

Europe Harvester Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.94 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 7.61% |

| 2023 Value Projection: | USD 26.74 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Propulsion Type |

| Companies covered:: | SDF S.p.A., CNH Industrial NV, CLAAS KGaA mbH, KUHN Group, KRONE Group, AGCO Corporation, CLAAS KGaA mbH, Deere & Company, CNH Industrial N.V., GRIMME Group, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Harvester Market Size In Europe Is Driven By The Ageing Group Of People Who Have To Deal With More And More Bodily Constraints And Less And Less Ability To Do Physically Demanding Harvesting Jobs By Hand, Resulting In Faster Dependence On Automation. The use of technology in farming, such as artificial intelligence, GPS, Internet of Things (IoT), and remote sensing, makes farming more efficient, lowers costs, and increases the quality of the produce. The combination of a larger population and changing eating habits translates into an increased demand for food, which in turn means that more efficient and large-scale farming operations that advanced harvesters can help with are needed.

Restraining Factors

The Harvester Market Size In Europe Is Restrained By The Requirement Of Pre-Owned Farming Equipment, which is largely due to the financial crisis and saving farmers money is one of the factors affecting the sale of new machines all over Europe. Also, the lack of farmers with proper technical skills is a negative factor for both the launching and the effective operation of these advanced machines.

Market Segmentation

The Europe harvester market share is categorised into type, automation level, and propulsion type.

- The combine harvester segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Harvester Market Size Is Segmented By Type Into Forage Harvester, Combine Harvester, Sugarcane Harvester, Potato Harvester, And Others. Among these, the combine harvester segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the combine harvester segment represented 57.9% of the total market. The segment's growth is attributed to the vast cereal crop production in the continent and the government policies that support the grain self-sufficiency. Moreover, the adoption of intensive agriculture in countries such as France, Germany, and Poland strengthens the segment's position.

- The semi-automatic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based On Automation Level, The Europe Harvester Market Size Is Segmented Into Manual, Semi-Automatic, Automatic. Among these, the semi-automatic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Semi-automatic harvesters were the largest segment of the European harvester market, taking a share of 52.3%. The growth of the semiautomatic harvester segment is mainly due to a practical compromise between cost and technology suited to the different farm types in the region. The versatility and gradual integration option provided by semi-automatic harvesters are in line with the market's economic and operational realities.

- The ICE segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Harvester Market Is Segmented By Propulsion Type Into ICE, Electric. Among These, The ICE Segment Accounted For The Largest Revenue Market Size Share In 2024 And Is Expected To Grow At A Significant CAGR During The Forecast Period. The segment of internal combustion engine-powered harvesters was in the lead in the European market in 2024. The reliability, high power-to-weight ratio and existing fuelling infrastructure in the countryside are the main reasons for the internal combustion engine-powered harvester segment's leading position. The power needed for harvesting is very high, with combine harvesters usually needing between 300 and 600 horsepower, mainly because of their weight and time limits.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Europe Harvester Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SDF S.p.A.

- CNH Industrial NV

- CLAAS KGaA mbH

- KUHN Group

- KRONE Group

- AGCO Corporation

- CLAAS KGaA mbH

- Deere & Company

- CNH Industrial N.V.

- GRIMME Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In August 2025, John Deere Launched F8 And F9 Forage Harvesters With Over 1000hp. The arrival of new F8 and F9 designations for its 8000 and 9000 series forage harvesters signals a swag of upgrades from John Deere, highlighted by topping the 1000hp mark for the first time.

Market Segment

This Study Forecasts Revenue At The Europe, Regional, And Country Levels From 2020 to 2035. Spherical Insights has segmented the Europe harvester market based on the below-mentioned segments:

Europe Harvester Market, By Type

- Forage Harvester

- Combine Harvester

- Sugarcane Harvester

- Potato Harvester

- Others

Europe Harvester Market, By Automation Level

- Manual

- Semi-Automatic

- Automatic

Europe Harvester Market, By Propulsion Type

- ICE

- Electric

Frequently Asked Questions (FAQ)

-

What is the Europe harvester market size?Europe harvester market size is expected to grow from USD 11.94 billion in 2024 to USD 26.74 billion by 2035, growing at a CAGR of 7.61% during the forecast period 2025-2035

-

What is Harvester, and its primary use?The market for harvesters is well-established, and it is mainly powered by the demand for more efficient operations and lower labor costs. A harvester is an agricultural machine that is utilised for the collection of ripe crops in an efficient manner, and most times several operations can be performed at the same time, like reaping, threshing, and winnowing.

-

What are the key growth drivers of the market?Market growth is driven by the ageing group of people who have to deal with more and more bodily constraints and less and less ability to do physically demanding harvesting jobs by hand, resulting in faster dependence on automation

-

What factors restrain the Europe harvester market?The market is restrained by the requirement of pre-owned farming equipment, which is largely due to the financial crisis and saving farmers money is one of the factors affecting the sale of new machines all over Europe.

-

How is the market segmented by type?The market is segmented into forage harvester, combine harvester, sugarcane harvester, potato harvester, and others

-

Who are the key players in the Europe harvester market?Key companies include SDF S.p.A., CNH Industrial NV, CLAAS KGaA mbH, KUHN Group, KRONE Group, AGCO Corporation, CLAAS KGaA mbH, Deere & Company, CNH Industrial N.V., and GRIMME Group.

Need help to buy this report?