Europe Gas Generator Market Size, Share, and COVID-19 Impact Analysis, By Capacity (Less than 75 kVA, Between 75-375 kVA, More than 375 kVA), By End User (Residential, Commercial, and Industrial), and Europe Gas Generator Market Insights, Industry Trends, Forecast to 2035

Industry: Automotive & TransportationEurope Gas Generator Market Insights Forecasts to 2035

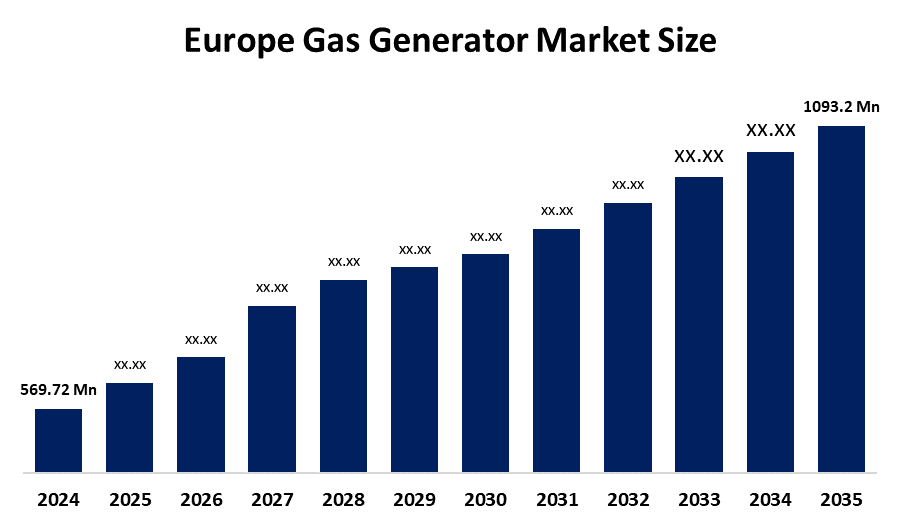

- The Europe Gas Generator Market Size Was Estimated at USD 569.72 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Europe Gas Generator Market Size is Expected to Reach USD 1093.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Gas Generator Market size is anticipated to reach USD 1093.2 million by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The market is driven by the growing need for hydrogen gas as an alternative to helium, the growing significance of analytical techniques in drug and food approval processes, and rising R&D spending in target industries.

Market Overview

A gas generator is equipment that generates power by transforming the chemical energy obtained from gaseous fuel. The increasing acceptance of gas generators across all major end-users is contributing immensely to the growth of the gas generators market. Gas generators are used for the purpose of producing specific gases that are required for research, analysis, or experimental purposes. In various industrial processes, they are an integral part of generating fuel gases like producer gas from coal, which is sometimes needed for powering different operations.

A new pure hydrogen fuel cell generator was announced by Panasonic Corporation in April 2024 through its Electric Works Company division. It will be powering Europe, Australia, and China in October 2024, via a chemical reaction between high-purity hydrogen and oxygen in the air. A powerful smart generator supporting propane as a fuel source besides standard gas was released by EcoFlow, which termed it a smart generator.

The German government and the European Commission have come to an agreement on the initial conditions for the state to financially support the creation of new gas-powered plants. Germany is still planning to add more wind and solar power capacity while gradually eliminating coal, and thus will have to rely on the development of backup capacity that will be ready for use at any moment.

Report Coverage

This research report categorizes the market for the Europe gas generator market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe gas generator market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe gas generator market.

Europe Gas Generator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 569.72 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.1% |

| 2035 Value Projection: | USD 1093.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Capacity, By End User |

| Companies covered:: | Caterpillar Inc, Cummins Inc, Generac Holdings Inc, MTU Onsite Energy Corp, Himoinsa S.L., Ansaldo Energia, Generator Power, Gasgen, Peak Scientific, LNI Swissgas,and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The gas generator market in Europe is driven by the heavy-duty generators used for various operating conditions, such as marine, mining, and oil and gas exploration, which are the industrial activities that require them. The growing number of power grid failures has resulted in a greater demand for backup power solutions, thereby paving the way for market expansion. The increase in the repair and remanufacturing of energy equipment is a factor that is opening up markets for gas generator manufacturers. Uninterrupted power supply guaranteeing the functioning of life-saving equipment and providing essential services is a necessity for healthcare facilities like hospitals, clinics and research centers.

Restraining Factors

The gas generator market in Europe is restrained by various factors including strict environmental rules, low gas prices, increased demand for the availability of power supply, and the requirement for more transmission of renewable energy. The rise in the demand for a constant power supply during blackouts and failures has led to the widespread use of gas generators across all the main industries in Europe. Factors like limited power generation capacity, high maintenance & operating costs, and a growing preference for renting gas generators have boosted the demand for gas generators.

Market Segmentation

The Europe gas generator market share is categorised into capacity and end user.

- The less than 75 kVA segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe gas generator market is segmented by capacity into less than 75 kVA, between 75-375 kVA, more than 375 kVA. Among these, the less than 75 kVA segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the residential, small commercial, and light industrial sectors have shown strong demand for gas generators in this range. They are the main areas where the generators are used, providing a trustworthy power backup solution for indispensable devices and machines whenever there is a blackout or power cut.

- The industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe gas generator market is segmented into residential, commercial, and industrial. Among these, the industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the various and significant uses of gas generators in different sectors. The indispensable role of generators in ensuring power supply to the electric utilities, coal mining, agricultural sectors, food processing, refineries, district heating plants, and wastewater treatment plants, as well as the steel industry, is to support uninterrupted operations in the industries where power supply is of primary importance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe gas generator market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Caterpillar Inc

- Cummins Inc

- Generac Holdings Inc

- MTU Onsite Energy Corp

- Himoinsa S.L.

- Ansaldo Energia

- Generator Power

- Gasgen

- Peak Scientific

- LNI Swissgas

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Rolls-Royce launched its new 20V4000 mtu gas generator, which will have a full output of 2.8MW. The gas-powered generator will have fast start capabilities, be able to ramp up in 45 seconds, and will not require a gearbox

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Gas Generator Market based on the below-mentioned segments:

Europe Gas Generator Market, By Capacity

- Less than 75 kVA

- Between 75-375 kVA

- More than 375 kVA

Europe Gas Generator Market, By End User

- Residential

- Commercial

- Industrial

Frequently Asked Questions (FAQ)

-

What is the Europe gas generator market size?The Europe Gas Generator market size is expected to grow from USD 569.72 million in 2024 to USD 1093.2 million by 2035, growing at a CAGR of 6.1% during the forecast period 2025-2035.

-

: What is gas generator, and its primary use?A gas generator is equipment that generates power by transforming the chemical energy obtained from gaseous fuel. The increasing acceptance of gas generators across all major end-users is contributing immensely to the growth of the gas generators market. Gas generators are used for the purpose of producing specific gases that are required for research, analysis, or experimental purposes.

-

What are the key growth drivers of the market?Market growth is driven by the heavy-duty generators used for various operating conditions, such as marine, mining, and oil and gas exploration, which are the industrial activities that require them. The growing number of power grid failures has resulted in a greater demand for backup power solutions, thereby paving the way for market expansion

-

What factors restrain the Europe gas generator market?The market is restrained by various factors including strict environmental rules, low gas prices, increased demand for the availability of power supply, and the requirement for more transmission of renewable energy. The rise in the demand for a constant power supply during blackouts and failures has led to the widespread use of gas generators across all the main industries in Europe.

-

: How is the market segmented by capacity?The market is segmented into less than 75 kVA, between 75-375 kVA, and more than 375 kVA.

-

Who are the key players in the Europe gas generator market?Key companies include Caterpillar Inc., Cummins Inc., Generac Holdings Inc., MTU Onsite Energy Corp, Himoinsa S.L., Ansaldo Energia, Generator Power, Gasgen, Peak Scientific, and LNI Swissgas.

Need help to buy this report?