Europe Fluoroelastomer Market Size, Share, and COVID-19 Impact Analysis, By Type (Fluorocarbons, Fluorosilicone, and Perfluoroelastomers), By End User (Automotive, Aerospace, Chemicals, Oil & Gas, Energy & Power and Others), and Europe Fluoroelastomer Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Fluoroelastomer Market Insights Forecasts to 2035

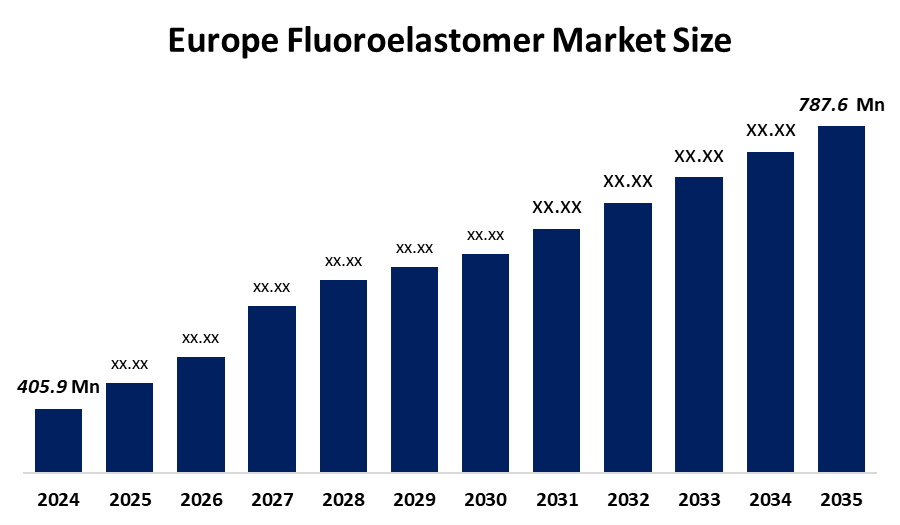

- The Europe Fluoroelastomer Market Size Was Estimated at USD 405.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.21% from 2025 to 2035

- The Europe Fluoroelastomer Market Size is Expected to Reach USD 787.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Fluoroelastomer Market Size is anticipated to Reach USD 787.6 Million by 2035, Growing at a CAGR of 6.21% from 2025 to 2035. The market is driven by technological advancements in polymer chemistry, which are enabling the production of low-temperature-resistant and high-purity fluoroelastomers.

Market Overview

Fluoroelastomers serve as essential materials in high-performance applications because their synthetic rubber composition demonstrates outstanding protection against thermal exposure, chemical contact, and oil substances. European industries employ fluoroelastomers widely for manufacturing automotive seals and gaskets, O-rings and fuel system components, which also serve in chemical plants, semiconductor fabs and aerospace systems. The material exhibits extended operational performance because its mechanical strength properties allow it to maintain functionality in extreme environmental conditions.

In June 2022, Solvay announced the introduction of its latest portfolio, which contains Tecnoflon high-performance fluoroelastomers (FKM) that the company produces without using fluorosurfactants.

The European Council and the European Parliament approved a US$ 3.6 billion investment from European Union funds in April 2023. This funding will be used to attract US$ 43.7 billion in private investment to develop Europe's semiconductor manufacturing capabilities. The European Commission stands as one of the leading global producers of motor vehicles. The automobile industry employs 13.8 million Europeans directly and indirectly, which represents 6.1% of total European Union employment.

Report Coverage

This research report categorises the European fluoroelastomer market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe fluoroelastomer market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe fluoroelastomer market.

Europe Fluoroelastomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 405.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.21% |

| 2035 Value Projection: | USD 787.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | Solvay SA, 3M, James Walker & Co., LANXESS, Trip Polymer Solutions, Freudenberg Sealing Technologies, HaloPolymer, TRP Polymer Solutions Ltd, Zrunek Gummiwaren GmbH, The Chemours Company, and Others key palyersa |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The fluoroelastomer market in Europe is driven by fluoroelastomers (FKM), which serve as critical components that enable turbochargers and direct-injection systems to achieve effective sealing and decreased emissions through their airtight sealing capability. Advanced materials are required to meet demand in battery-coolant circuits and thermal management systems because traditional elastomers cannot withstand specific chemical and thermal stress. Europe has established a sustainability movement that creates new applications for hydrogen fuel cells and storage systems, which need materials that can withstand high-pressure gases and extreme temperatures.

Restraining Factors

The fluoroelastomer market in Europe is restrained by fluoroelastomers are more expensive than conventional elastomers because their production requires complex manufacturing methods and their production needs special raw materials. European manufacturers face challenges because they have to deal with rising energy expenses, and their market demand remains unchanged when compared to other regions.

Market Segmentation

The Europe fluoroelastomer market share is categorised into type and end user.

- The fluorocarbon segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe fluoroelastomer market is segmented by type into fluorocarbons, fluorosilicones, and perfluoroelastomers. Among these, the fluorocarbon segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The 2024 revenue distribution showed fluorocarbon as the dominant segment, which generated 79.47% of total revenue. These elastomers demonstrate outstanding protection against high temperatures reaching 250°C, as well as oils and fuels, solvents and various chemicals, which makes them suitable for automotive, aerospace and industrial applications.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe fluoroelastomer market is segmented into automotive, aerospace, chemicals, oil & gas, energy & power and others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the materials that find extensive application in seals and gaskets, hoses and O-rings, which protect engines and fuel systems and transmissions that operate under extreme conditions, which require durability and long-term performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe fluoroelastomer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay SA

- 3M

- James Walker & Co.

- LANXESS

- Trip Polymer Solutions

- Freudenberg Sealing Technologies

- HaloPolymer

- TRP Polymer Solutions Ltd

- Zrunek Gummiwaren GmbH

- The Chemours Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe fluoroelastomer market based on the below-mentioned segments:

Europe Fluoroelastomer Market, By Product

- Fluorocarbon

- Fluorosilicone

- Perfluoroelastomers

Europe Fluoroelastomer Market, By End User

- Automotive

- Aerospace

- Chemicals

- Oil & Gas

- Energy & Power

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe fluoroelastomer market size?Europe fluoroelastomer market size is expected to grow from USD 405.9 million in 2024 to USD 787.6 million by 2035, growing at a CAGR of 6.21% during the forecast period 2025-2035.

-

What is fluoroelastomer, and its primary use?Fluoroelastomers serve as essential materials in high-performance applications because their synthetic rubber composition demonstrates outstanding protection against thermal exposure, chemical contact, and oil substances.

-

What are the key growth drivers of the market?Market growth is driven by the fluoroelastomers (FKM), which serve as critical components that enable turbochargers and direct-injection systems to achieve effective sealing and decreased emissions through their airtight sealing capability.

-

What factors restrain the Europe fluoroelastomer market?The market is restrained by European manufacturers facing challenges because they have to deal with rising energy expenses, and their market demand remains unchanged when compared to other regions

-

How is the market segmented by type?The market is segmented into fluorocarbons, fluorosilicones, and perfluoroelastomers.

-

Who are the key players in the Europe fluoroelastomer market?Key companies include Solvay SA, 3M, James Walker & Co., LANXESS, Trip Polymer Solutions, Freudenberg Sealing Technologies, HaloPolymer, TRP Polymer Solutions Ltd, Zrunek Gummiwaren GmbH, and The Chemours Company.

Need help to buy this report?