Europe Ethanol Market Size, Share, and COVID-19 Impact Analysis, by Type (Absolute Ethanol [99-100%], Ethanol [95%], Denatured Ethanol, and Others), by Source (Bio-Based and Synthetic), by Application (Automotive, Food & Beverages, Commercial, Pharmaceuticals, Personal Care, Agriculture, Marine, Household, and Others), with Europe Ethanol Market Insights, Industry Trends, and Forecast to 2035

Industry: Chemicals & MaterialsEurope Ethanol Market Insights, Forecast to 2035

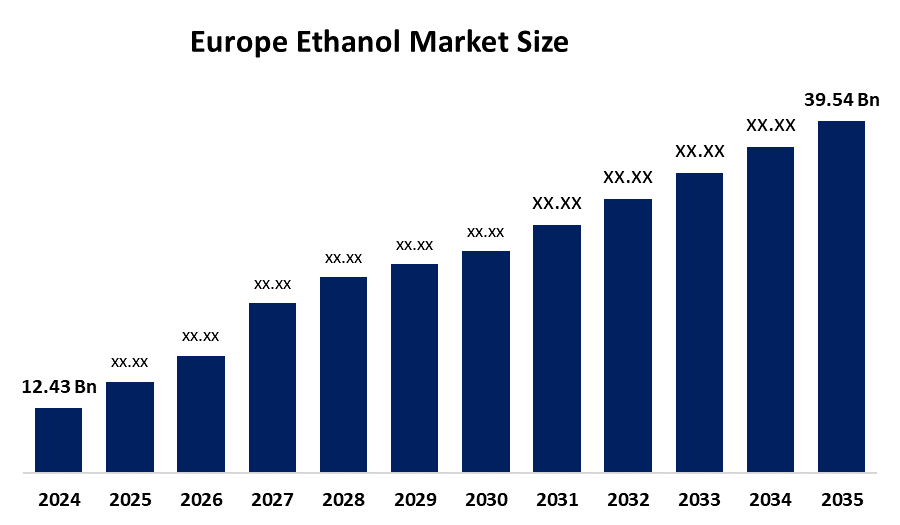

- The Europe Ethanol Market size was estimated at USD 12.43 billion in 2024.

- The market is expected to grow at a CAGR of approximately 11.09% from 2025 to 2035.

- The Europe Ethanol Market size is projected to reach USD 39.54 billion by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Ethanol Market is anticipated to reach USD 39.54 billion by 2035, growing at a CAGR of 11.09% from 2025 to 2035. The market growth is driven by increasing government mandates for biofuel blending in gasoline and the rising demand for environmentally friendly biofuels, including ethanol.

Market Overview

The European ethanol market is undergoing significant technological advancements driven by environmental regulations, performance requirements, and cost-reduction initiatives. The production of ethanol from domestic feedstocks—such as corn, sugarcane, wheat, and cassava—helps reduce fuel import dependence while supporting economic development in rural areas. Ethanol is widely used in the chemical industry as a solvent and is utilized in the manufacturing of a broad range of products, including cosmetics, alcoholic beverages, pharmaceuticals, lacquers and polishes, paints, plastics, and plasticizers.

In December 2024, ArcelorMittal and LanzaTech announced their first ethanol production milestone, marked by the initial barge shipment from the Flagship Steelanol facility in Belgium.

The European Union imposed a penalty of €47.7 million (approximately USD 55.9 million) on Swedish agricultural cooperative Lantmännen and its biofuels subsidiary for their involvement in a cartel that manipulated European ethanol price benchmarks. Additionally, the ethanol import tariff applies a charge of €0.192 per litre of undenatured ethanol and €0.102 per litre of denatured ethanol.

Report Coverage

This research report categorizes the European ethanol market by various segments and regions, providing revenue forecasts and trend analysis for each submarket. The report examines the key growth drivers, opportunities, and challenges shaping the Europe ethanol market. It also includes recent market developments and competitive strategies—such as expansions, product launches, developments, partnerships, mergers, and acquisitions—to illustrate the competitive landscape. Additionally, the report strategically identifies and profiles key market players, analyzing their core competencies across each sub-segment of the European ethanol market.

Driving Factors

The European ethanol market is driven by the growing need to reduce dependence on fossil fuel imports, supported by government-led energy security initiatives in countries such as France, Germany, and Poland, which are increasing ethanol demand. Additionally, the industrial and consumer shift toward sustainability is boosting demand for environmentally friendly biofuels, including ethanol. Demand for GHG-efficient, crop-based ethanol is also rising, as it offers a cost-effective pathway to regulatory compliance.

Restraining Factors

The European ethanol market is constrained by the updated Renewable Energy Directive (RED III), which will phase out double counting for advanced biofuels—a mechanism currently applied in countries such as Germany and the Netherlands—by 2026. Additionally, the rapid adoption of battery electric vehicles (BEVs) is expected to curb ethanol demand. BEVs accounted for 18% of new car registrations in the European Union in 2025, and their continued expansion is projected to reduce gasoline consumption and ethanol usage by approximately 20% to 25% by 2035.

Market Segmentation

The Europe ethanol market share is categorised into type, source, and application.

- The denatured ethanol segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe ethanol market is segmented by type into absolute ethanol (99-100%), ethanol (95%), denatured ethanol, and others. Among these, the denatured ethanol segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the pharmaceutical, cosmetic, and laboratory research sectors, which require water-sensitive processes because even small amounts of water can impact the quality of products. The industrial sectors of Germany and the UK depend on ultra-pure solvents to support their advanced chemical manufacturing operations.

- The bio-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on source, the Europe ethanol market is segmented into bio-based and synthetic. Among these, the bio-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the system, which maintains its reputation for being environmentally sustainable while ensuring it can be used in various transportation applications. The material exists as a renewable resource because its main production method uses biomass, which results in decreased fossil fuel dependence.

- The food & beverages segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe ethanol market is segmented by application into automotive, food & beverages, commercial, pharmaceuticals, personal care, agriculture, marine, household and others. Among these, the food & beverages segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by research that the solution can preserve food products and make beverages, which it uses to extract flavors from ingredients. The sector receives advantages from growing consumer demand for organic and natural products because ethanol serves as an essential element to fulfill these market needs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe ethanol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CropEnergies AG

- Tereos SCA

- Verbio SE

- Pannonia Bio Zrt.

- Alcogroup SA

- Lantmannen Agroethanol

- Vertex Bioenergy

- British Sugar

- Sekab Biofuels and Chemicals

- TotalEnergies SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2026, AGRANA and OMV launched a pilot for e-ethanol production in Austria, combining renewable hydrogen with fermentation CO2.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe ethanol market based on the below-mentioned segments:

Europe Ethanol Market, By Type

- Absolute Ethanol (99-100%)

- Ethanol (95%)

- Denatured Ethanol

- Others

Europe Ethanol Market, By Source

- Bio-Based

- Synthetic

Europe Ethanol Market, By Application

- Automotive

- Food & Beverages

- Commercial

- Pharmaceuticals

- Personal Care

- Agriculture

- Marine

- Household

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe ethanol market size?A: The Europe ethanol market size is expected to grow from USD 12.43 billion in 2024 to USD 39.54 billion by 2035, growing at a CAGR of 11.09% during the forecast period 2025-2035.

-

Q: What is ethanol, and its primary use?A: The European ethanol market is experiencing major technological changes which environmental regulations, performance requirements and cost reduction needs. The production of ethanol from domestic feedstocks which include corn, sugarcane, wheat and cassava, helps decrease fuel import costs while it boosts economic development in rural areas.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising need to reduce fossil fuel import dependency with the governmental energy security initiatives in France, Germany, and Poland, resulting in increased ethanol demand.

-

Q: What factors restrain the Europe ethanol market?A: The market is restrained by the rapid expansion of Battery Electric Vehicles (BEVs), which represented 18% of new-car registrations in the European Union during 2025.

-

Q: How is the market segmented by type?A: The market is segmented into absolute ethanol (99-100%), ethanol (95%), denatured ethanol, and others

-

Q: Who are the key players in the Europe ethanol market?A: Key companies include CropEnergies AG, Tereos SCA, Verbio SE, Pannonia Bio Zrt., Alcogroup SA, Lantmannen Agroethanol, Vertex Bioenergy, British Sugar, Sekab Biofuels and Chemicals, and TotalEnergies SE.

Need help to buy this report?