Europe Energy Drinks Market Size, Share, and COVID-19 Impact Analysis, By Type (Traditional, Sugar-Free or Low-Calorie, Natural/Organic, Energy Shots, and Other), By Packaging Type (PET Bottles, Glass Bottles, and Others), By Functionality (Endurance/Energy Boost, Muscle Recovery, Other), By Distribution Channel (HoReCa, Retail), and Europe Energy Drinks Market Insights Forecasts to 2035

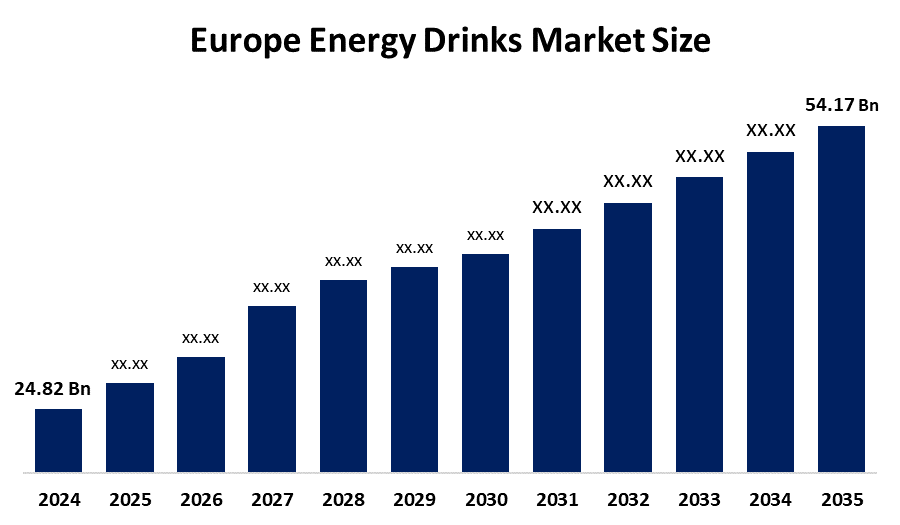

Industry: Food & Beverages- The Europe Energy Drinks Market Size Was Estimated at USD 24.82 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.35% from 2025 to 2035

- The Europe Energy Drinks Market Size is Expected to Reach USD 54.17 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Energy Drinks Market size is anticipated to reach USD 54.17 Billion by 2035, Growing at a CAGR of 7.35% from 2025 to 2035. The market is driven by among the respondents, people who were living in Germany and energy drinks were their daily habit. The majority of regular drinkers were young adults. The three main reasons people consume energy drinks were also the same: taste, refreshment, and concentration enhancement.

Market Overview

An energy drink is a beverage with non-alcoholic functional properties that consists of stimulant compounds, mainly caffeine, and commonly taurine, B-vitamins and sugars or sweeteners. Their promotion is based on the claims that the drinks will keep one awake and will increase physical performance; among others, the stimulants are the main active ingredients. Energy drinks have become a common source of energy, fatigue alleviator, and alertness and concentration improver in Europe. They are largely taken by various people like professionals, students, athletes, and gamers to the extent that they are necessary for productivity.

PepsiCos partnership facilitated 19.3 million euros in funding for Dutch drink startup Founteyn in December 2025. The financing attracted investors such as APG, representing ABP, and, in addition, Flying Fish and Leysern Aquacore.

Germany exported 733 shipments of energy drinks. These exports were made by 178 German exporters to 176 Buyers.

Competition and regulatory scrutiny, a large industry development with potential retail/competition impacts. The European Commission opened an antitrust investigation into Red Bull (2025) over alleged practices that could limit rivals’ shelf presence.

Report Coverage

This research report categorizes the market for the Europe energy drinks market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe energy drinks market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe energy drinks market.

Europe Energy Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 24.82 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.35% |

| 2035 Value Projection: | USD 54.17 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Straumann, Danaher, Dentsply, Zimmer Biomet, Osstem, Henry Schein, Dentium, DIO, Neobiotech, and And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The energy drinks market in Europe is driven by evolving with the constant shift in customer preferences. Customers are pressing for products that are healthier, sugar-free, and carry functional benefits. The demand for natural caffeine sources, and clean-label ingredients, along with sustainable packaging, will be those factors driving the luxury market segmentation and long-term consumer health-consciousness. Being easily accessible and keeping fit and drinking for energy/alertness are the major drivers, along with the fast development of sugar-free and functional energizers. Moreover, urban living, e-commerce presence, and new product launches keep being major contributors to the market expansion.

Restraining Factors

The energy drinks market in Europe is restrained by strict government regulations like age restrictions, high-caffeine warning requirements, and, in some countries, sugar taxes. Public health concerns arising from the excessive consumption of caffeine and sugar, primarily by the younger generation, are also a factor that curtails the growth of the market. Intense market competition has resulted in pressure on prices and the cutting of margins, which, along with the consumers' negative perception of energy drinks as unhealthy, are still affecting the market negatively.

Market Segmentation

The Europe energy drinks market share is categorised into type, packaging type, functionality, and distribution channel.

- The traditional segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe energy drinks market is segmented by type into traditional, sugar-free or low-calorie, natural/organic, energy shots, and other. Among these, the traditional segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Segment growth is fueled by in 2024, traditional energy drinks captured a lion's share of 41.60% of the market, which was the highest among all the categories. This was due to their strong customer base, even though there were health concerns regarding them. December 2024 was an exciting month for Red Bull as it launched Red Bull Zero. The UK market for sugar-free and low-calorie options has grown in value by 24%, which is higher than the overall category growth.

- The glass bottles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on packaging type, the Europe energy drinks market is segmented into PET bottles, glass bottles, and others. Among these, the glass bottles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment's growth is the glass bottle, which held a leading 54.14% share of the energy drinks packaging market in 2024. Their main advantages are the very efficient recycling systems, low weight for shipping, and the aspect of being convenient for consumers. Moreover, the European Aluminium Packaging Group is advocating for uniformity and is targeting the production of totally recyclable cans.

- The muscle recovery segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe energy drinks market is segmented by functionality into endurance/energy boost, muscle recovery, other. Among these, the muscle recovery segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market segment growth can be attributed to the year 2024, when the formulas focusing on endurance and energy enhancement captured a remarkable 59.18% of the functionality market. Companies reinforce their strong position via well-established distribution networks and consumer confidence in the quick effects of their products. QNT, by its guarana-injected shots and L-carnitine drinks, carefully selects sports retailers as its market, skillfully staying out of the mass market competition.

- The HoReCa segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the Europe energy drinks market is segmented into HoReCa, retail. Among these, the HoReCa segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment's growth was led by a significant 68.16% share of the turnover in 2024, namely supermarkets, hypermarkets, and convenience stores, in the energy drinks market of Europe. Off-trade channels, mainly these retail formats, were reported by recent analyses to have an 85.4% market share, being the most significant channel. Wide networks like Tesco, Carrefour, and Lidl are largely responsible for this dominance as they stock popular brands like Red Bull and Monster prominently.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe energy drinks market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Suntory Holdings Limited

- Lucozade Ribena Suntory

- Palladium Germany Premium

- Rush Energy Drinks Ltd

- Happy Drinks Co.

- Active Pro Energy Drinks

- Black Insomia Coffee Company

- Applied Nutrition

- Vimto

- Virtue Drinks

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, the C4 launched the shots with three bold flavours: Frozen Bombsicle, Hawaiian Punch fruit, Juicy Red, and Popsicle Grape.

- In December 2025, Energy drink brand Celsius will launch four new fruit-flavoured, zero-sugar variants in the UK and Ireland from January 2026. The new flavours, Sparkling Raspberry Peach, Sparkling Mango Lemonade, Sparkling Kiwi Guava and Sparkling Strawberry Watermelon

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Energy Drinks Market based on the below-mentioned segments:

Europe Energy Drinks Market, By Type

- Traditional

- Sugar-Free or Low-Calorie

- Natural/Organic

- Energy Shots

- Other

Europe Energy Drinks Market, By Packaging Type

- PET Bottles

- Glass Bottles

- Others

Europe Energy Drinks Market, By Functionality

- Endurance/Energy Boost

- Muscle Recovery

- Other

Europe Energy Drinks Market, By Distribution Channel

- HoReCa

- Retail

Frequently Asked Questions (FAQ)

-

Q: What is the Europe energy drinks market size?A: Europe Energy Drinks market size is expected to grow from USD 24.82 billion in 2024 to USD 54.17 billion by 2035, growing at a CAGR of 7.35% during the forecast period 2025-2035.

-

Q: What is energy drinks, and its primary use?A: An energy drink is a beverage with non-alcoholic functional properties that consists of stimulant compounds, mainly caffeine, and commonly taurine, B-vitamins and sugars or sweeteners. Their promotion is based on the claims that the drinks will keep one awake and will increase physical performance; among others, the stimulants are the main active ingredients. Energy drinks have become a common source of energy, fatigue alleviator, and alertness and concentration improver in Europe.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by evolving with the constant shift in customer preferences. Customers are pressing for products that are healthier, sugar-free, and carry functional benefits. The demand for natural caffeine sources, and clean-label ingredients, along with the sustainable packaging will be those factors driving the luxury market segmentation and long-term consumer health-consciousness.

-

Q: What factors restrain the Europe energy drinks market?A: The market is restrained by strict government regulations like age restrictions, high-caffeine warning requirements, and, in some countries, sugar taxes. Public health concerns arising from the excessive consumption of caffeine and sugar, primarily by the younger generation, are also a factor that curtails the growth of the market.

-

Q: How is the market segmented by type?A: The market is segmented into traditional, sugar-free or low-calorie, natural/organic, energy shots, and other.

-

Q: Who are the key players in the Europe energy drinks market?A: Key companies include Suntory Holdings Limited, Lucozade Ribena Suntory, Palladium Germany Premium, Rush Energy Drinks Ltd, Happy Drinks Co., Active Pro Energy Drinks, Black Insomia Coffee Company, Applied Nutrition, Vimto, and Virtue Drinks.

Need help to buy this report?