Europe Endpoint Detection and Response Market Size, Share, and COVID-19 Impact Analysis, By Solution (Software and Services), By Deployment (Cloud and On-Premise), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises), By Vertical (Banking, Financial Services and Insurance, Healthcare and Life Sciences, Government and Defence, BFSI, IT and Telecom, Energy and Utilities, Manufacturing and Others), and Europe Endpoint Detection and Response Market Insights, Industry Trends, Forecast to 2035

Industry: Information & TechnologyEurope Endpoint Detection and Response Market Insights Forecasts to 2035

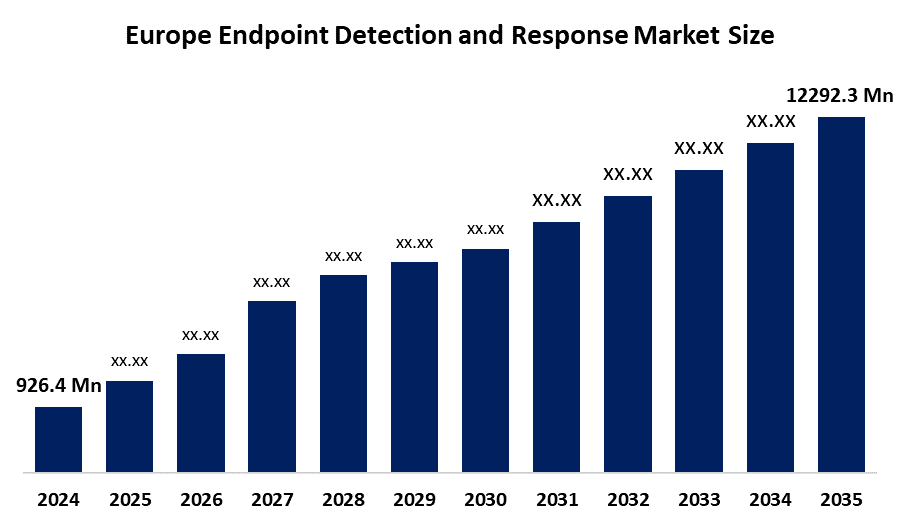

- The Europe Endpoint Detection and Response Market Size Was Estimated at USD 926.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 26.5% from 2025 to 2035

- The Europe Endpoint Detection and Response Market Size is Expected to Reach USD 12292.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Endpoint Detection and Response Market size is anticipated to reach USD 12292.3 Million by 2035, growing at a CAGR of 26.5% from 2025 to 2035. The market is driven by the increasing cybersecurity threats and the growing demand for proactive security measures.

Market Overview

The Europe endpoint detection and response (EDR) Solutions market is characterised by a sector that comprises a range of technologies and services aimed at safeguarding the company's endpoints from cyber threats. The main functions of EDR solutions are surveillance, discovery, and incident response at the endpoints, including but not limited to personal computers, mobile devices, and IoT devices. The attack surface for using advanced EDR solutions has been large due to the growing number of highly skilled cyber-criminal organizations as well as the shift to remote and hybrid working environments. The latter has also caused vulnerabilities as a result of the continuous stream of connected devices.

In October 2025, Bitdefender, a cybersecurity firm with European roots, made a joint announcement with secunet, a firm operating in the domain of digital sovereignty and the safeguarding of extremely sensitive environments like government sectors.

The EU Member States were given time until October 18, 2024, to implement the NIS2 Directive into their respective laws. The decree imposed tougher risk and incident management as well as national Computer Security Incident Response Teams coordination. Then, on January 15, 2025, the Commission came up with an action plan to reinforce the cybersecurity of hospitals and healthcare professionals, a field that has been experiencing an influx of cyberattacks.

Report Coverage

This research report categorises the Europe endpoint detection and response market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe endpoint detection and response market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe endpoint detection and response market.

Europe Endpoint Detection and Response Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 926.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 26.5% |

| 2035 Value Projection: | USD 12292.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Solution, By Deployment, By Enterprise Size, By Vertical |

| Companies covered:: | Sophos, Bitdefender, ESET, Check Point Software Technologies, Fortinet, Mcfee, Trend Micro, CrowdStrike, Microsoft, Cisco, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The endpoint detection and response market in Europe is driven by the continuous rise and improvement of cyberattacks such as ransomware, malware, and zero-day threats compel businesses to put up money for EDR solutions with a strong base for advanced threat detection and incident response. European laws like the General Data Protection Regulation (GDPR) and the NIS2 Directive require solid data protection and cybersecurity measures to be in place, thus forcing companies to go for EDR solutions as a way to comply with the regulations and not incur large fines.

Restraining Factors

The endpoint detection and response market in Europe is restrained by the initial deployment, licensing fees, and ongoing maintenance costs of EDR solutions, which pose a considerable financial obstacle, especially for small and medium-sized enterprises, as they are usually the ones affected the most. The continuous shortage of competent cybersecurity professionals hampers the effective installation, running, and 24/7 monitoring of EDR and Security Operations Centers (SOCs), which, in turn, prolongs incident response.

Market Segmentation

The Europe endpoint detection and response market share is categorised into solution, deployment, enterprise size and vertical.

- The software segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe endpoint detection and response market is segmented by solution into software and services. Among these, the software segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. With a revenue share of 63.6%, the software segment was the most significant in 2023. The EDR software security features provide the highest level of providing such as behavioral protection, threat insight and intelligence, cloud-based endpoint protection, and security analytics based on a range of techniques. The IT administrators can configure security policies and protocols in a manner that guarantees the compliance of all devices with the security measures.

- The cloud segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on deployment, the Europe endpoint detection and response market is segmented into cloud and on-premise. Among these, the cloud segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by cloud solutions, which are favored mainly because of their scalability, flexibility, and cost-effectiveness. On-premises solutions are more secure but they can be quite costly in terms of maintenance. Hybrid solutions provide a balanced approach to cybersecurity by combining both cloud and on-premises offerings.

- The large enterprises segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe endpoint detection and response market is segmented by enterprise size into small and medium sized enterprises, large enterprises. Among these, the large enterprises segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by large organisations progressively adopting EDR solutions as a measure against cyber threats to their devices. Enhanced productivity, security, and reduction in costs, among others, are the main advantages they bring to rather large companies. Complete visibility over the actions carried out on servers, desktops, and laptops is one of the features they offer.

- The surgical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on vertical, the Europe endpoint detection and response market is segmented into banking, financial services and insurance, healthcare and life sciences, government and defence, BFSI, IT and telecom, energy and utilities, manufacturing and others. Among these, the surgical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the volume of delicate data that they manage is very high, which makes it a necessity to have strong security in a single location. EDR solutions, on the other hand, provide an additional protection layer by identifying attacks that cannot be spotted through conventional antivirus software solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe endpoint detection and response market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sophos

- Bitdefender

- ESET

- Check Point Software Technologies

- Fortinet

- Mcfee

- Trend Micro

- CrowdStrike

- Microsoft

- Cisco

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2025, DUAL Europe announced the launch of DUAL Cyber Active Protect, a new product that combines comprehensive Cyber Insurance with proactive Cyber prevention services, and a new entity, DUAL Cyber Prevention and Response (DUAL CPR), which offers customized incident prevention and management solutions.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe endpoint detection and response market based on the below-mentioned segments:

Europe Endpoint Detection and Response Market, By Solution

- Software

- Services

Europe Endpoint Detection and Response Market, By Deployment

- Cloud

- On-Premise

Europe Endpoint Detection and Response Market, By Enterprise Size

- Small and Medium Sized Enterprises

- Large Enterprises

Europe Endpoint Detection and Response Market, By Vertical

- Banking

- Financial Services and Insurance

- Healthcare and Life Sciences

- Government and Defence

- BFSI

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe endpoint detection and response market size?A: Europe endpoint detection and response market size is expected to grow from USD 926.4 million in 2024 to USD 12292.3 million by 2035, growing at a CAGR of 26.5% during the forecast period 2025-2035.

-

Q: What is endpoint detection and response, and its primary use?A: The Europe endpoint detection and response (EDR) Solutions market is characterized by a sector that comprises the whole range of technologies and services aimed at safeguarding the company's endpoints from cyber threats.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the continuous rise and improvement of cyberattacks such as ransomware, malware, and zero-day threats compel businesses to put up money for EDR solutions with a strong base for advanced threat detection and incident response.

-

Q: What factors restrain the Europe endpoint detection and response market?A: The market is restrained by the initial deployment, licensing fees, and ongoing maintenance costs of EDR solutions, which pose a considerable financial obstacle.

-

Q: How is the market segmented by solution?A: The market is segmented into software and services.

-

Q: Who are the key players in the Europe endpoint detection and response market?A: Key companies include Sophos, Bitdefender, ESET, Check Point Software Technologies, Fortinet, Mcfee, Trend Micro, CrowdStrike, Microsoft, and Cisco.

Need help to buy this report?