Europe Draught Beer Market Size, Share, and COVID-19 Impact Analysis, By Type (Keg Beer, Cask Beer), By Category (Super Premium, Premium, and Regular), By End User (Commercial Use, Home Use), By Production Type (Macro Breweries, Microbreweries), and Europe Draught Beer Market Insights, Industry Trends, Forecast to 2035

Industry: Food & BeveragesEurope Draught Beer Market Size Insights Forecasts to 2035

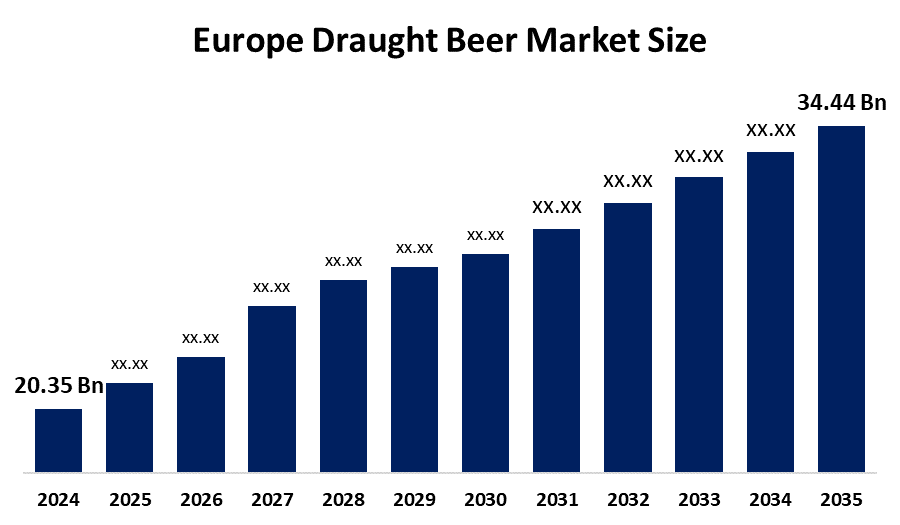

- The Europe Draught Beer Market Size Was Estimated at USD 20.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.9% from 2025 to 2035

- The Europe Draught Beer Market Size is Expected to Reach USD 34.44 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Draught Beer Market Size is anticipated to Reach USD 34.44 Billion by 2035, Growing at a CAGR of 4.9% from 2025 to 2035. The market is driven by the expansion in the use of alcohol by the general public, the increasing interest in beer tourism by beer lovers, and the widespread practice of serving alcoholic drinks at different parties, events, or celebrations.

Market Overview

Draught beer is the term used for beer that gets its distribution through a keg or cask and through a tap system. It is often carbonated with either pure carbon dioxide (CO2) or a mixture of CO2 and nitrogen (N2) to get the exact amount of carbonation and foam. Usually, it's served at a pretty low temperature and has a particular creamy feeling to the palate due to the carbonation. The most common pick for beer lovers and connoisseurs who cherish the freshness of draught beer, the taste, and the luxury of serving.

PerfectDraft, with the help of Stella Artois and David Beckham, kicked off its new Pub Quality Beer At Home campaign in November 2024 to showcase the perfect draught beer experience at home with PerfectDraft.

The organic beer market in Europe was estimated at USD 1.2 billion and has an anticipated annual growth rate of 10%. The trend is greatly impacted by the health policies of the European Union, which encourage moderate consumption. The beer distribution scenario in Europe is changing, as online sales are expected to hit USD 3 billion, thereby marking a 25% increase from the preceding period. Moreover, the traditional retail channels are in a transformation phase, with a projected 30% craft beer assortment expansion for supermarkets in the future.

Report Coverage

This research report categorizes the market for the Europe draught beer market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe draught beer market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe draught beer market.

Europe Draught Beer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.35 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.9% |

| 2035 Value Projection: | USD 34.44 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Category |

| Companies covered:: | Anadolu Efes Biracilik, Carlsberg A/S, Heineken NV, Morepour Ltd, Micro Matic, The Keg Company, Tankbeer, Damm, Clear Brew Ltd, Pinter, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The draught beer market in Europe is driven by the increase in the intake of alcohol by the masses can be attributed to various factors like social and cultural influence, economic conditions, and individual lifestyle changes. alcoholic beverages have become more attractive and desirable to customers due to the marketing and advertising strategies practised by the alcohol companies, which have also been playing a part in the consumption rise. The trend is positively affecting the consumption and sales of draught beer, especially in areas that are famous for beer culture. Proper dispensing systems are very important in helping the beer to maintain its original quality by making sure that the beer is served at the right temperature, with the perfect carbonation level, and free from any contaminants.

Restraining Factors

The draught beer market in Europe is restrained by a lot of hospitality firms are encountering the problem of escalating costs for energy, labor, and adhering to legal requirements. The difficulties that these problems create are affecting the profits and occasionally driving the closure of the small independent places. Heavy taxes on liquor might result in the customer paying more for the product, and then the demand might go down. Likewise, economic recessions and ups and downs may greatly determine the sum of money that customers will spend on luxury products like draft beer, and thus, they will harm the sales of draft beer.

Market Segmentation

The Europe draught beer market share is categorised into type, category, end user, and production type.

- The keg beer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe draught beer market is segmented by type into keg beer, cask beer. Among these, the keg beer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, keg beer represented 50.5% of the total revenue share. Keg beer is recognized as being pasteurised, filtered, and delivered in small casks. The usual keg measurement in the UK is 11 gallons. A keg contains 50 litres or 88 pints of beer. The kegs are not only for storing beer but also for other non-alcoholic drinks. The quality of having a constant taste and longer shelf life is one of the reasons why they are the preferred option for both.

- The regular segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on category, the Europe draught beer market is segmented into super premium, premium, and regular. Among these, the regular segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2024, the revenue share of regular draught beer was a whopping 50.5%. The main reason for the rise in consumption of regular beers is that they are affordable. Standard category beers in Europe get widely dispensed through supermarkets, hypermarkets, convenience stores, and bars. All these outlets are very convenient for consumers to get to.

- The commercial use segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe draught beer market is segmented by end user into commercial use, home use. Among these, the commercial use segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the commercial draught beer segment claimed 86.6% of the market share. The beer draught sector has been booming due to the industry's continuous growing response to on-site beer consumption, increasing patronage of pubs and clubs, as well as an influx of tourists to different countries worldwide after the pandemic. In addition, the market has become more vibrant due to the fact that even the luxurious hotels and resorts have gotten engaged with the brewers in such a way that they have offered their exclusive range of limited-edition products through a partnership.

- The macro breweries segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on production type, the Europe draught beer market is segmented into macro breweries, microbreweries. Among these, the macro breweries segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The share of macro-breweries was 78.6% in the year 2024. The industry has a considerable influence on microbreweries, as such breweries produce draught beers in huge volumes and meet the needs of the mass market. Macro breweries produce by far the largest volumes of beers in a way that they keep on pouring money into the aspects like infrastructure, manufacturing plants, machines, and high-end technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe draught beer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anadolu Efes Biracilik

- Carlsberg A/S

- Heineken NV

- Morepour Ltd

- Micro Matic

- The Keg Company

- Tankbeer

- Damm

- Clear Brew Ltd

- Pinter

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In February 2025, Molson Coors Beverage Company launched Madrí Excepcional 0.0%, a zero-alcohol version of its popular Spanish-style lager, which was created in partnership with La Sagra brewery in Spain, as consumer demand for no- and low-alcohol world beer continues to grow.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Draught Beer Market based on the below-mentioned segments:

Europe Draught Beer Market, By Type

- Keg Beer

- Cask Beer

Europe Draught Beer Market, By Category

- Super Premium

- Premium

- Regular

Europe Draught Beer Market, By End User

- Commercial Use

- Home Use

Europe Draught Beer Market, By Production Type

- Macro Breweries

- Microbreweries

Frequently Asked Questions (FAQ)

-

Q: What is the Europe draught beer market size?A: Europe Draught Beer market size is expected to grow from USD 20.35 billion in 2024 to USD 34.44 billion by 2035, growing at a CAGR of 4.9% during the forecast period 2025-2035.

-

Q: What is draught beer, and its primary use?A: Draught beer is the term used for beer that gets its distribution through a keg or cask and through a tap system. It is often carbonated with either pure carbon dioxide (CO2) or a mixture of CO2 and nitrogen (N2) to get the exact amount of carbonation and foam. Usually, it's served at a pretty low temperature and has a particular creamy feeling to the palate because of the carbonation.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increase in the intake of alcohol by the masses can be attributed to various factors like social and cultural influence, economic conditions, and individual lifestyle changes. alcoholic beverages have become more attractive and desirable to customers due to the marketing and advertising strategies practised by the alcohol companies, which have also been playing a part in the consumption rise.

-

Q: What factors restrain the Europe Draught Beer market?A: The market is restrained by a lot of hospitality firms are encountering the problem of escalating costs for energy, labor, and adhering to legal requirements. These challenges are impacting profits and sometimes even forcing the shutdown of minor independent places. High taxes on alcohol can make the product more expensive for the customer, which might lead to less demand.

-

Q: How is the market segmented by type?A: The market is segmented into keg beer, cask beer

-

Q: Who are the key players in the Europe Draught Beer market?A: Key companies include Anadolu Efes Biracilik, Carlsberg A/S, Heineken NV, Morepour Ltd, Micro Matic, The Keg Company, Tankbeer, Damm, Clear Brew Ltd, and Pinter.

Need help to buy this report?