Europe Digital Signage Market Size, Share, and COVID-19 Impact Analysis, By Type (Video Walls, Video Screens, Transparent LED Screens, Digital Posters, Kiosks, and Others), By Component (Hardware, Software, and Services), By Technology (LCD, LED, OLED, Projection and Others), By Application (Retail, Hospitality, Entertainment, Corporate, Healthcare, Education and Transportation), and Europe Digital Signage Market Insights, Industry Trends, Forecast to 2035

Industry: Semiconductors & ElectronicsEurope Digital Signage Market Insights Forecasts to 2035

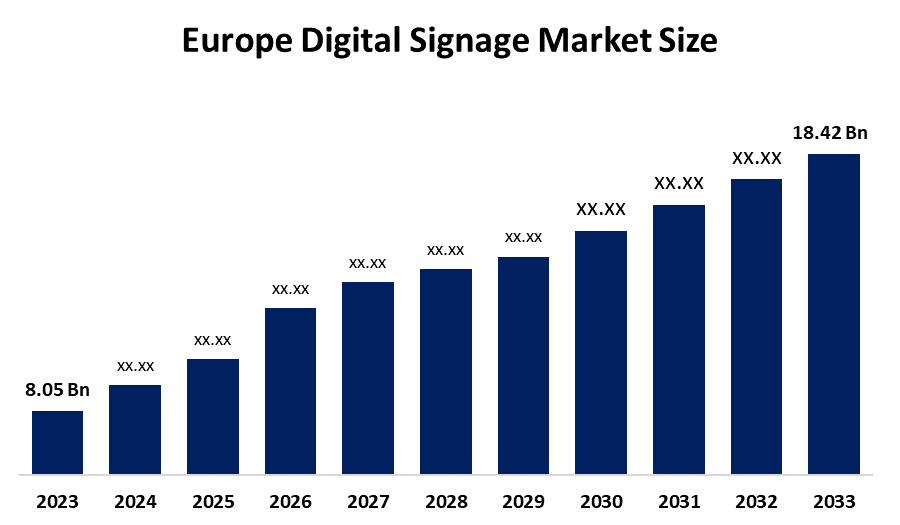

- The Europe Digital Signage Market Size Was Estimated at USD 8.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.82% from 2025 to 2035

- The Europe Digital Signage Market Size is Expected to Reach USD 18.42 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe digital signage market size is anticipated to reach USD 18.42 Billion by 2035, growing at a CAGR of 7.82% from 2025 to 2035. The market is driven by the rising trend of Europe's retail and e-commerce industries is another factor that the demand for 4K embedded displays relies on. 4Kers are adopting more and more sophisticated technologies to engage customers in shopping and even to personalize the whole shopping experience.

Market Overview

Digital signage refers to the use of electronic displays for the distribution of information in a way that is visually appealing. It can be compared to having a giant TV that broadcasts videos, photos, and messages in places like eateries, banks, and malls. Digital signage is attempting to get the audience's attention and subsequently interact with them through the displayed content. It can show different things like ads, alerts that are of significance, or even informative materials such as directions to different places or the timetable of activities. Digital signage technology is also part of the green building certification process, where it replaces paper posters with electronic directories and monitors for energy consumption.

The electronics giant Huawei (projected annual revenue for 2024: US$120 billion), together with the CCTV solution producers Hikvision and Dahua, constituted the whole digital signage area in September 2025. In June 2025, the city of Frankfurt saw the official opening of BBVA's new digital bank, which is based in Germany. It offers the world's leading financial app combined with a strong value proposition through the use of cutting-edge technology.

The European Commission launched a public consultation in July 2025, as part of the first review process of the Digital Markets Act, to evaluate the success of the legislation. The reason for passing the DMA was to make regulation of the large online platforms that had been marked as gatekeepers to the European Union and to guarantee the ability of business users to be guaranteed through the use of the law, thus leading to digital markets that are fair and contestable in the EU. The large-scale investments in smart city technologies in Germany, the UK, and France are the main reason for people to start using digital signage to post public information, guide people, control traffic, and issue emergency alerts. The combination of Artificial Intelligence (AI), the Internet of Things (IoT), and cloud-based content management systems (CMS) is leading to the development of signage networks that are more dynamic, personalized, and can be managed remotely.

Report Coverage

This research report categorizes the market for the Europe digital signage market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe digital signage market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe digital signage market.

Europe Digital Signage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.82% |

| 2035 Value Projection: | USD 18.42 Bllion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type,By Component |

| Companies covered:: | Samsung,LG,NEC,Sony,Philips,Panasonic,Barco,Daktronics,Leyard,AU Optronics And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The digital signage market in Europe is driven by the SOC technology can be implemented in commercial displays for digital signage applications, thereby eliminating various devices like media players. Thus, the entire system can operate from the screen with the added benefit of being able to receive diagnostic information as well. The stricter advertising regulations, coupled with the EU's green and digital transitions investments, are affecting the design and deployment of digital signage. Belgium is more concerned about customer acquisition in digital signage solutions, especially in the retail sector, with an increasing demand for digitalization.

Restraining Factors

The digital signage market in Europe is restrained by the resistance to the adoption of digital signage is mainly due to the high initial capital investment demanded. However, smaller businesses and institutions with restricted IT infrastructure or limited operational budgets may push their deployment back or even not take it up at all. The General Data Protection Regulation lays down rigid controls regarding personal data collection, storage, and use.

Market Segmentation

The Europe digital signage market share is categorised into type, component, technology and application.

- The video walls segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe digital signage market is segmented by type into video walls, video screens, transparent led screens, digital posters, kiosks, and others. Among these, the video walls segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the video wall segment is expected to account for 24.8% of the total revenue share. These installations, which are made up of several screens operating perfectly together as one display, are being chosen more and more due to their sharp pictures, easy adjustment to larger sizes, and variety of uses. Retail, transportation, hospitality, and corporate are all among the sectors that are using video walls to impress their audiences strongly.

- The hardware segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on component, the Europe digital signage market is segmented into hardware, software, and services. Among these, the hardware segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2024, the hardware segment of the Europe digital signage industry accounted for about 65.0% of revenue, thus it was the major segment. One of the main factors responsible for the growth of the segment is the demand for durable and weather-resistant hardware for outdoor digital signage applications. In Europe, outdoor advertising is still a very important marketing strategy, which makes it necessary to have hardware that can cope with different environmental conditions, such as heavy rain in the UK and very high temperatures in Southern Europe.

- The LCD segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe digital signage market is segmented by technology into LCD, LED, OLED, projection and others. Among these, the LCD segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the LCD segment accounted for more than 39.0% of the Europe digital signage market in terms of revenue. The LCD segment is significantly aided in its growth by the retail and hospitality industries of Europe. Digital signage is being more and more utilized by retailers to make their shopping experience more interactive and personalized, and LCD screens are the major communication channel for displaying product information, promotional content, and ads within the store.

- The retail segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe digital signage market is segmented into retail, hospitality, entertainment, corporate, healthcare, education and transportation. Among these, the retail segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The retail sector in 2024 with a revenue share of more than 18.0%. The adoption of digital signage together with omnichannel retailing strategies is the major driver of segment growth. The growing popularity of click-and-collect services and in-store pickup is making the digital signage technology an essential customer directing factor in the store.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe digital signage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung

- LG

- NEC

- Sony

- Philips

- Panasonic

- Barco

- Daktronics

- Leyard

- AU Optronics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In September 2025, Samsung Electronics announced the expansion of its partnership with Toyota Motor, one of the world’s top-selling automakers, which will bring Samsung’s Smart Signage solutions to additional Toyota dealerships in key markets.

In June 2025, Samsung Electronics announced the global launch of its 32-inch Color E-Paper (EM32DX model), expanding its portfolio of energy-efficient digital signage solutions.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe digital signage market based on the below-mentioned segments:

Europe Digital Signage Market, By Type

- Video Walls

- Video Screens

- Transparent LED Screens

- Digital Posters

- Kiosks

- Others

Europe Digital Signage Market, By Component

- Hardware

- Software

- Services

Europe Digital Signage Market, By Technology

- LCD

- LED

- OLED

- Projection

- Others

Europe Digital Signage Market, By Application

- Retail

- Hospitality

- Entertainment

- Corporate

- Healthcare

- Education

- Transportation

Frequently Asked Questions (FAQ)

-

Q: What is the Europe digital signage market size?A: Europe digital signage market size is expected to grow from USD 8.05 billion in 2024 to USD 18.42 billion by 2035, growing at a CAGR of 7.82% during the forecast period 2025-2035.

-

Q: What is digital signage, and its primary use?A: Digital signage is the term used to refer to the use of electronic displays for the distribution of information in a way that is visually appealing. It can be compared to having a giant TV that broadcasts videos, photos, and messages in places like eateries, banks, and malls. Digital signage is attempting to get the audience's attention and subsequently interact with them through the displayed content

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the SOC technology can be implemented in commercial displays for digital signage applications thereby eliminating various devices like media players. Thus, the entire system can operate from the screen with the added benefit of being able to receive diagnostic information as well.

-

Q: What factors restrain the Europe digital signage market?A: The market is restrained by the resistance to the adoption of digital signage is mainly because of the high initial capital investment demanded. However, smaller businesses and institutions with restricted IT infrastructure or limited operational budgets may push their deployment back or even not take it up at all.

-

Q: How is the market segmented by type?A: The market is segmented into video walls, video screens, transparent led screens, digital posters, kiosks, and others.

-

Q: Who are the key players in the Europe digital signage marketA: Key companies include Samsung, LG, NEC, Sony, Philips, Panasonic, Barco, Daktronics, Leyard, and AU Optronics.

Need help to buy this report?