Europe Coated Steel Market Size, Share, and COVID-19 Impact Analysis, By Product (Galvanised Steel, Pre-painted Steel, and Others), By End Use (Automotive, Building & Construction, Appliances and Others), and Europe Coated Steel Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsEurope Coated Steel Market Insights Forecasts to 2035

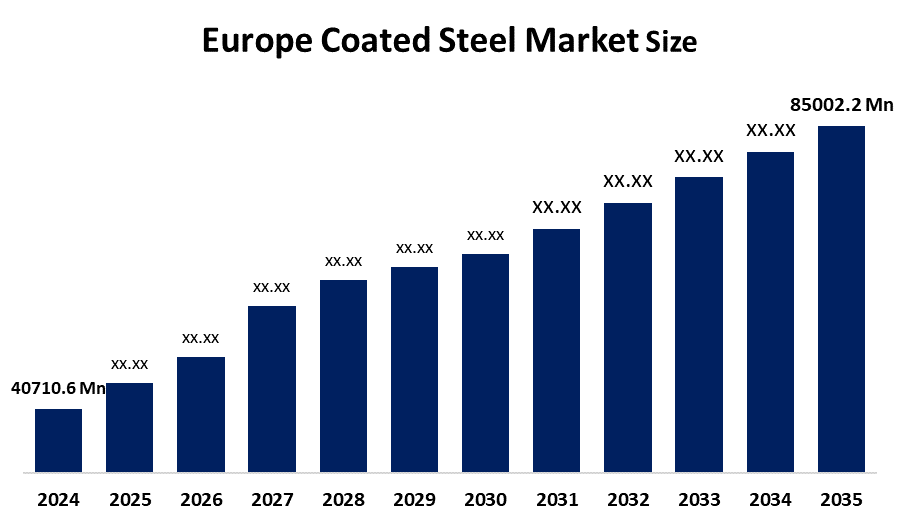

- The Europe Coated Steel Market Size Was Estimated at USD 40710.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.92% from 2025 to 2035

- The Europe Coated Steel Market Size is Expected to Reach USD 85002.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Coated Steel Market Size is anticipated to reach USD 85002.2 million by 2035, growing at a CAGR of 6.92% from 2025 to 2035. The Europe coated steel market is driven by increasing emphasis on sustainability as well as significant demand in the automotive and construction sectors. Additionally, the business is moving toward eco-friendlier materials and state-of-the-art coating methods. In the coming years, the market is expected to rebound modestly despite recent economic challenges.

Market Overview

The Europe Coated Steel Market Size involves the production, distribution and application of steel coated with protective materials such as zinc, aluminium or polymers to enhance durability, corrosion resistance and aesthetic appeal. Market opportunities include using the demand from the appliance, automotive and construction industries, focusing on pre-painted coated steel, which is expanding more rapidly, and taking advantage of the movement towards sustainable and energy-efficient goods. Additionally, digital integration and technological improvements open up possibilities, particularly for intelligent systems and increased operational efficiency. Growth is also driven by the growing need for stronger, longer-lasting materials in both developing and established infrastructure in Eastern Europe. The government actions include larger investment in green steel manufacturing and more stringent trade protection measures, such as tighter tariffs. The Industrial Decarbonization Accelerator Act, the circular economy and excessive energy costs are all being addressed by the Europe Commission.

Report Coverage

This research report categorises the Europe coated steel market size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe coated steel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe Coated Steel market.

Europe Coated Steel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 40710.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.92% |

| 2035 Value Projection: | USD 4.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 18 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type. By End Users |

| Companies covered:: | Toyota Tsusho Corporation Mitsubishi Corporation Sumitomo Corporation ArcelorMittal SSAB AB Thyssenkrupp AG Salzgitter AG Voestalpine AG Tata Steel Europe Nippon Steel Corporation and Other, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Europe coated steel market size is expected to expand in the automotive and manufacturing sectors, with advancements in technology and support from the government. The market is expanding due to factors such as rapid urbanisation, infrastructure creation and increasing demand for strong and attractive materials such as colour-coated steel. Additionally, new market expansion opportunities are being created by government incentives for sustainability, R&D improvements and digital transformation projects. The need for colour-coated steel in appliances, architecture, and other applications is being driven by consumers' growing preference for long-lasting, visually pleasing, and low-maintenance products.

Restraining Factors

The energy and raw material price fluctuations, geopolitical unrest, and economic recession have resulted in increased manufacturing costs due to lower demand and competition from alternative materials. The "green impact" of the production process and stringent environmental regulations also create difficulties, especially as the sector struggles with decarbonization initiatives.

Market Segmentation

The Europe coated steel market share is classified into product and end-use.

- The galvanised steel segment accounted for the highest market share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

The Europe coated steel market is segmented by product into galvanised steel, pre-painted steel, and others. Among these, the galvanised steel segment accounted for the highest market share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The galvanised segment due to for structural applications, galvanised steel is preferred its resistance to corrosion, whereas pre-painted steel is being utilised more and more for decorative roofing and cladding. Given their resistance to corrosion and durability, they are mostly used in industrial and structural applications, such as framing and various industrial equipment.

- The building and construction segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe coated steel market size is segmented by end-use into automotive, building & construction, appliances, and others. Among these, the building and construction segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The building and construction segment is driven by the growing need for long-lasting, corrosion-resistant materials for infrastructure, cladding and roofing applications. While the building and construction industry is at the forefront, the automobile industry is also an important driver, displaying strong growth due to the increased use of coated steel for body panels and other components, particularly as the desire for innovative and lightweight vehicles increases.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations or companies involved within the Europe coated steel market, along with a comparative evaluation based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toyota Tsusho Corporation

- Mitsubishi Corporation

- Sumitomo Corporation

- ArcelorMittal

- SSAB AB

- Thyssenkrupp AG

- Salzgitter AG

- Voestalpine AG

- Tata Steel Europe

- Nippon Steel Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe coated steel market based on the following segments:

Europe Coated Steel Market, By Product

- Galvanised Steel

- Pre-painted Steel

- Others

Europe Coated Steel Market, By End Use

- Automotive

- Building & Construction

- Appliances

- Others

Frequently Asked Questions (FAQ)

-

What is the CAGR of the Europe coated steel market over the forecast period?The Europe coated steel market is projected to expand at a CAGR of 6.92% during the forecast period.

-

What is the market size of the Europe coated steel market?The Europe coated steel market size is expected to grow from USD 40710.6 million in 2024 to USD 85002.2 million by 2035, at a CAGR 6.92% of during the forecast period 2025-2035.

-

Who are the top companies operating in the Europe coated steel market?Toyota Tsusho Corporation, Mitsubishi Corporation, Sumitomo Corporation, ArcelorMittal, SSAB AB, Thyssenkrupp AG, Salzgitter AG, Voestalpine AG, Tata Steel Europe, Nippon Steel Corporation, and Others.

-

What factors are driving the growth of the Europe coated steel market?The Europe coated steel market is expanding due to technological advancements, government support and rapid urbanisation. Growing infrastructure development and increased demand for durable, aesthetic materials such as colour-coated steel drive sustainability initiatives, supported by R&D, and growing consumer preference for long-lasting, low-maintenance products in the automotive and construction sectors.

-

What are the opportunities in the Europe coated steel market?The growing demand in the appliance, automotive and construction sectors creates market opportunities, especially for pre-painted coated steel. Advances in digital integration, sustainability and energy-efficient technologies drive growth and operational efficiency across the industry.

Need help to buy this report?