Europe Butadiene Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Acrylonitrile-Butadiene-Styrene, Adiponitrile, Nitrile-Butadiene Latex, Styrene-Butadiene Latex, Polybutadiene Rubber, Styrene-Butadiene Rubber, and Others), By End User (Automotive & Transportation, Plastics & Electronics, Construction & Infrastructure, Healthcare & Medical, and Others), and Europe Butadiene Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Butadiene Market Size Insights Forecasts to 2035

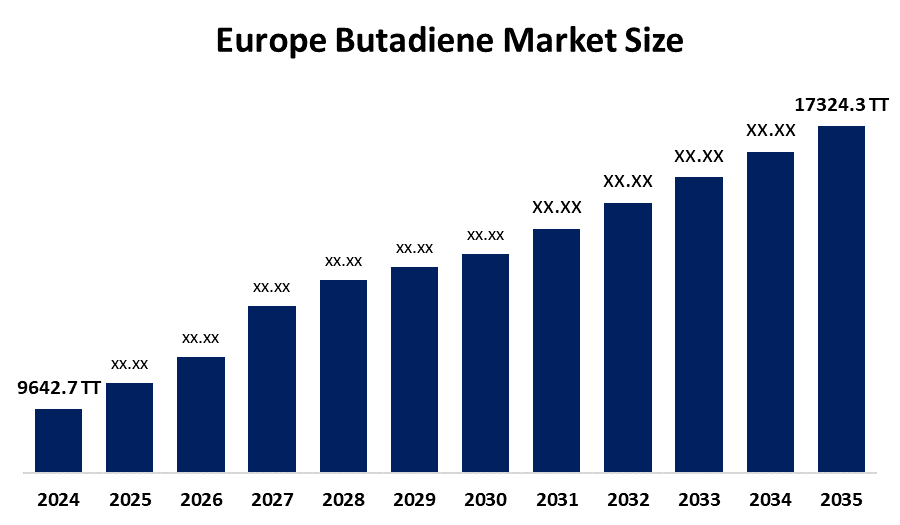

- The Europe Butadiene Market Size Was Estimated at 9642.7 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.47% from 2025 to 2035

- The Europe Butadiene Market Size is Expected to Reach 17324.3 Thousand Tonnes by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Butadiene Market Size is anticipated to Reach USD 17324.3 Thousand Tonnes by 2035, Growing at a CAGR of 5.47% from 2025 to 2035. The market is driven by the growth in petrochemical production capacity, increasing demand for synthetic elastomers, availability of C4 feedstock streams, industrialization of polymer processing.

Market Overview

The butadiene market consists of sales of polychloroprene and 1,3 butadiene, synthetic rubber, polybutadiene, and elastomer. Butadiene serves as a fundamental petrochemical component that manufacturers use to create synthetic rubbers and thermoplastics through its use as a monomer. The material delivers essential characteristics which include elasticity, resilience and abrasion resistance, thus establishing its necessary role within automotive tyres, industrial rubber products, plastics and specialty chemicals. The material serves industrial functions through its use in hoses, gaskets, seals and medical gloves due to its ability to resist chemicals.

SABIC formed a partnership with Kraton in March 2022 to create certified renewable styrenic block copolymers through the development of certified renewable butadiene production.

The UK introduced its first national PFAS Plan in February 2026 to fight PFAS, while France prohibited PFAS use in multiple consumer products starting January 2026. Europe holds 61.8% of the bio-butadiene market, making it the top market in this sector. The European Union Green Deal, with its stringent environmental regulations, creates an increasing demand for sustainable products that originate from biomass materials. The company maintains its competitive strength through constant spending on technology improvements, production expansion and business partnerships with the automotive and plastics sectors.

Report Coverage

This research report categorises the European butadiene market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe butadiene market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe butadiene market.

Europe Butadiene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 9642.7 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.47% |

| 2035 Value Projection: | 17324.3 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 154 |

| Tables, Charts & Figures: | 89 |

| Segments covered: | By Derivative, By End User and COVID-19 Impact Analysis |

| Companies covered:: | INEOS Group, Shell Chemicals, BASF SE, Lyondell Basell Industries, Versalis SPA, Synthos, Lanxess AG, Total Energies SE, Borealis AG, Repsol, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The butadiene market in Europe is driven by the production of electric vehicles (EVs), requires specialized tires which need greater durability with reduced rolling resistance, though the tyres depend on butadiene-based synthetic rubbers that include SBR and PBR. The Ineos Antwerp cracker will begin operations in 2026, while the industry moves toward using ethane as its primary feedstock. The development of new petrochemical technologies together with improved production methods has enhanced butadiene extraction efficiency, which results in greater butadiene availability.

Restraining Factors

The butadiene market in Europe is restrained by the environmental regulations that organisations must follow to reduce emissions and achieve sustainable operations, which will create operational difficulties for manufacturers who need to produce butadiene. The production costs and profit margins of a business will be affected by changes in raw material costs, with crude oil and natural gas prices being major factors.

Market Segmentation

The Europe butadiene market share is categorised into derivative and end user

Get more details on this report -

- The polybutadiene rubber segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe butadiene market is segmented by derivative into acrylonitrile-butadiene-styrene, adiponitrile, nitrile-butadiene latex, styrene-butadiene latex, polybutadiene rubber, styrene-butadiene rubber, and others. Among these, the polybutadiene rubber segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the shift toward higher performance requirements. The PBR material shows resilience and wear resistance and generates minimal heat during operation, which makes it essential for use in both premium tyres and heavy-duty tyre manufacturing. Its application extends beyond tyres to include golf balls, industrial belts and impact-resistant plastics, which demonstrate its flexible usage.

- The automotive & transportation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe butadiene market is segmented into automotive & transportation, plastics & electronics, construction & infrastructure, healthcare & medical, and others. Among these, the automotive & transportation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the company, which depends on PBR and SBR materials to produce its tyres. The materials deliver essential properties because they provide durability along with fuel efficiency and safety for use in both new tyres and replacement tyres. The combination of increasing vehicle ownership in emerging markets and established markets, and maintaining their regular replacement schedules.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe butadiene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS Group

- Shell Chemicals

- BASF SE

- Lyondell Basell Industries

- Versalis SPA

- Synthos

- Lanxess AG

- Total Energies SE

- Borealis AG

- Repsol

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe butadiene market based on the below-mentioned segments:

Europe Butadiene Market, By Derivative

- Acrylonitrile-Butadiene-Styrene

- Adiponitrile

- Nitrile-Butadiene Latex

- Styrene-Butadiene Latex

- Polybutadiene Rubber

- Styrene-Butadiene Rubber

- Others

Europe Butadiene Market, By End User

- Automotive & Transportation

- Plastics & Electronics

- Construction & Infrastructure

- Healthcare & Medical

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe butadiene market size?A: Europe butadiene market size is expected to grow from USD 9642.7 thousand tonnes in 2024 to USD 17324.3 thousand tonnes by 2035, growing at a CAGR of 5.47% during the forecast period 2025-2035.

-

Q: What is butadiene, and its primary use?A: The butadiene market consists of sales of polychloroprene and 1,3 butadiene, synthetic rubber, polybutadiene, and elastomer. Butadiene serves as a fundamental petrochemical component that manufacturers use to create synthetic rubbers and thermoplastics through its use as a monomer.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the production of electric vehicles (EVs), requires specialized tires which need greater durability with reduced rolling resistance, though the tyres depend on butadiene-based synthetic rubbers that include SBR and PBR.

-

Q: What factors restrain the Europe butadiene market?A: The market is restrained by the environmental regulations that organizations must follow to reduce emissions and achieve sustainable operations, which will create operational difficulties for manufacturers who need to produce butadiene.

-

Q: How is the market segmented by derivative?A: The market is segmented into acrylonitrile-butadiene-styrene, adiponitrile, nitrile-butadiene latex, styrene-butadiene latex, polybutadiene rubber, styrene-butadiene rubber, and others.

-

Q: Who are the key players in the Europe butadiene market?A: Key companies include INEOS Group, Shell Chemicals, BASF SE, Lyondell Basell Industries, Versalis SPA, Synthos, Lanxess AG, Total Energies SE, Borealis AG, and Repsol.

Need help to buy this report?