Europe Bubble Tea Market Size, Share, and COVID-19 Impact Analysis, By Type (Black Tea, Green Tea, Oolong Tea, and White Tea), By Flavor (Fruit, Original, Chocolate, Coffee, and Others), and Europe Bubble Tea Market Insights, Industry Trends, Forecast to 2035

Industry: Food & BeveragesEurope Bubble Tea Market Insights Forecasts to 2035

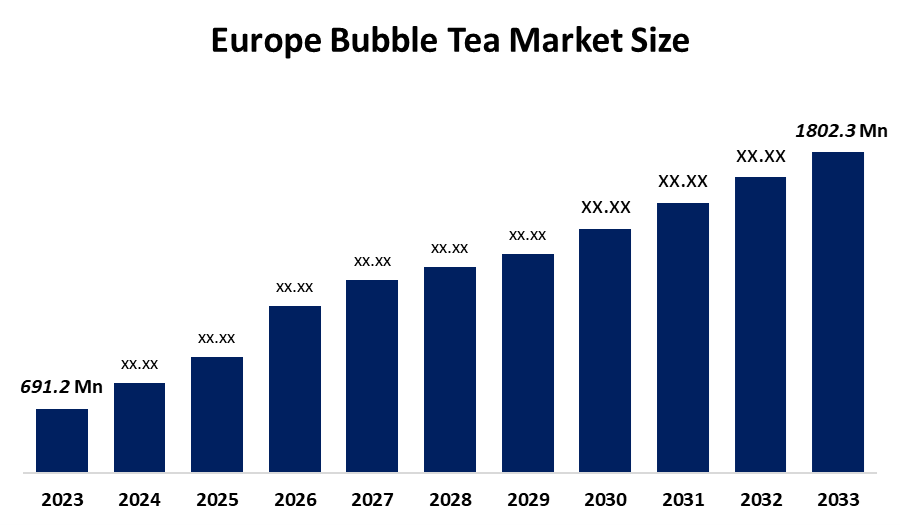

- The Europe Bubble Tea Market Size Was Estimated at USD 691.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.1% from 2025 to 2035

- The Europe Bubble Tea Market Size is Expected to Reach USD 1802.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Bubble Tea Market size is anticipated to reach USD 1802.3 Million by 2035, growing at a CAGR of 9.1% from 2025 to 2035. The market is driven by an increase in diabetes cases. Consumers are shifting toward low-sugar, plant-based bubble tea alternatives like soy and oat milk

Market Overview

Bubble tea, or boba, pearl milk tea, and tapioca tea, is a sweet beverage made with tea that originates from Taiwan and is known for its bubbles, the majority of which are chewy tapioca pearls. The growing need for different, personalized drinks, especially among youngsters, is the main reason for the bubble tea market's expansion. Moreover, brands are introducing healthier choices by making low-sugar versions and offering plant-based milk alternatives like soy and oat to be in line with the growing presence of health issues like diabetes and obesity in countries such as the U.K., Germany, and Italy.

The International Tea Committee (ITC), based in the UK, reports a huge increase in tea consumption over the past two decades, which was more than doubled and reached 6.7 million metric tons in 2022, a rise of 113%. Thus, the demand for bubble tea will be supported by the growing tea consumption. Germany's bubble tea market is expected to expand to 28.5% in 2024. The change in consumer preferences and the growing demand for new-fangled drinks are the main reasons behind this. Young health-conscious consumers are looking for healthy but at the same time indulgent experiences.

Gong Cha takes the lead in the market with a share of about 4%, which is estimated, taking advantage of its Taiwanese roots, international brand recognition, and a well-planned expansion through franchising. In June 2024, Bubbleology, a tea provider from London, collaborated with the famous energy drink company Red Bull to introduce the very first energising bubble tea in the U.K. The new drink, named Red Bull Watermelon Boba Infusion, consists of the latter's watermelon-flavoured bubs and ice-like pearls as its main ingredients.

Report Coverage

This research report categorizes the market for the Europe bubble tea market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe bubble tea market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe bubble tea market.

Europe Bubble Tea Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 691.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.1% |

| 2035 Value Projection: | USD 1802.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 85 |

| Segments covered: | By Type |

| Companies covered:: | Gong Cha, Chatime, CoCo Fresh Tea& Juice, Rainbow Bubble Tea Ltd, Boba Buzz, Bubble Tea House Company, Dot Dot, Milksha UK, Pearls Bubble Tea, Bubble Stop, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bubble tea market in Europe is driven by Germany's advanced cafe culture, which is characterized by a strong presence of coffee shops; it is also a good match for bubble tea; hence, retailers can easily support their businesses by teaming up with tea shops, cafes, and food delivery services. Digitization in food services, like the enhancement of delivery apps, has also been a factor in the increase of bubble tea consumption, thus making it available outside the physical outlets. Due to social media, where the most attractive and colorful bubble tea drinks are constantly posted, it has also played a great role in creating a buzz around the drink. The market is forecasted to be worth 1500 USD Million by the year 2024, which is a sign of growing consumer preference for new and customizable options in flavors.

Restraining Factors

The bubble tea market in Europe is restrained by bubble tea is facing a considerable challenge in the form of competition from well-established beverage categories like coffee and traditional tea in Europe where bubble tea brands are trying to find a foothold. Additionally, importing the main ingredients like tapioca pearls along with the special flavoring from Asia is very expensive. The average import tariff for these ingredients is approximately 6-8%, which results in higher operational costs for the bubble tea business in Europe.

Market Segmentation

The Europe bubble tea market share is categorised into type and flavor.

- The black tea segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

-

The Europe bubble tea market is segmented by type into black tea, green tea, oolong tea, and white tea. Among these, the black tea segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2022, black tea was the largest segment with a revenue share of 42.54%. Black tea is a drink that is produced from Camellia sinensis and has numerous health benefits, and is rich in antioxidants. Black tea, being the primary ingredient used in bubble tea, provides many health benefits such as increased energy, improved metabolism, heart health, and better mental alertness. Additionally, it promotes good intestinal health, metabolism, and prevents kidney stones, dental cavities, osteoporosis, diabetes, and high cholesterol.

- The fruit segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

- Based on flavor, the Europe bubble tea market is segmented into fruit, original, chocolate, coffee, and others. Among these, the fruit segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the variety of fruit flavors available in bubble tea, which not only enhances the taste but also maintains the real fruit flavor of the drink. Bubble tea has a vast selection of fruit flavors, such as banana, jackfruit, honeydew, peach, mango, lychee, avocado, plum, strawberry, banana, watermelon, pineapple, and kiwi.

-

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe bubble tea market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the mar

-

List of Key Companies

- Gong Cha

- Chatime

- CoCo Fresh Tea& Juice

- Rainbow Bubble Tea Ltd

- Boba Buzz

- Bubble Tea House Company

- Dot Dot

- Milksha UK

- Pearls Bubble Tea

- Bubble Stop

- Others

-

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

Recent Development

In July 2025, Food Empire Holdings (SGX: F03), a global leader in instant beverage FMCG with strong market leadership across Eastern Europe, Central Asia and Southeast Asia, and Capital A Berhad, an investment holding company with a synergistic ecosystem of travel-focused and digitally driven businesses, have announced a strategic partnership to co-develop and launch a new range of ready-to-drink beverages.

In March 2025, Bubble tea chain Gong Cha announced a new franchise agreement with Jinziex, aiming to open at least 225 new stores in the UK over the coming years

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Bubble Tea Market based on the below-mentioned segments

Europe Bubble Tea Market, By Type

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

Europe Bubble Tea Market, By Flavor

- Fruit

- Original

- Chocolate

- Coffee

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe bubble tea market size?Europe Bubble Tea market size is expected to grow from USD 691.2 million in 2024 to USD 1802.3 million by 2035, growing at a CAGR of 9.1% during the forecast period 2025-2035

-

What is bubble tea, and its primary use?Bubble tea, or boba, pearl milk tea, and tapioca tea, is a sweet beverage made with tea that originates from Taiwan and is known for its bubbles, the majority of which are chewy tapioca pearls. The growing need for different, personalized drinks, especially among youngsters, is the main reason for the bubble tea market's expansion

-

What are the key growth drivers of the market?Market growth is driven by Germany's advanced cafe culture, which is characterized by a strong presence of coffee shops; it is also a good match for bubble tea; hence, retailers can easily support their businesses by teaming up with tea shops, cafes, and food delivery services. digitization in food services, like the enhancement of delivery apps, has also been a factor in the increase in bubble tea consumption.

-

What factors restrain the Europe bubble tea market?The market is restrained by the bubble tea being faced with a considerable challenge in the form of competition from well-established beverage categories like coffee and traditional tea in Europe where bubble tea brands are trying to find a foothold. Additionally, importing the main ingredients like tapioca pearls along with the special flavoring from Asia is very expensive

-

How is the market segmented by type?The market is segmented into black tea, green tea, oolong tea, and white tea.

-

Who are the key players in the Europe bubble tea market?Who are the key players in the Europe bubble tea market?

Need help to buy this report?