Europe BOPET Film Market Size, Share, and COVID-19 Impact Analysis, By Thickness (Below 15 Micron BOPET Packaging Films, 15-30 Micron BOPET Packaging Films, 30-50 Micron BOPET Packaging Films, and Above 50 Micron BOPET Packaging Films), By Application (Labels, Tapes, Wraps, Bags, Pouches, and Laminates), By End User (Food, Beverages, Cosmetics and Personal Care, Electrical and Electronics, Pharmaceuticals), and Europe BOPET Film Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope BOPET Film Market Insights Forecasts to 2035

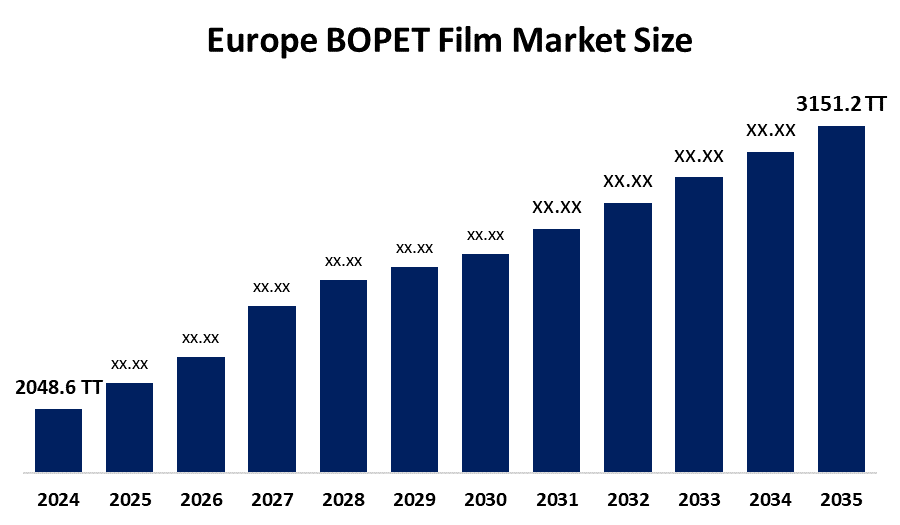

- The Europe BOPET Film Market Size Was Estimated at 2048.6 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.99% from 2025 to 2035

- The Europe BOPET Film Market Size is Expected to Reach 3151.2 Thousand Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe BOPET Film Market Size Is Anticipated To Reach 3151.2 Thousand Tonnes By 2035, Growing At A CAGR Of 3.99% From 2025 to 2035. The market is driven by the high demand for packaged food, and the rising trend toward lightweight and durable packaging will boost the BOPET films market.

Market Overview

The BOPET Film Market operates as a sustainable high-performance sector that experiences rapid expansion because of increasing demand for flexible, lightweight, recyclable packaging solutions that customers need for their food, pharmaceutical and consumer electronics packaging needs. BOPET films function as essential materials for packaging, electronics, industrial, and imaging uses due to their durability, clarity and ability to withstand moisture and chemical exposure. BOPET films show growing adoption in food packaging and labelling, insulation and protective applications because industries require high-performance sustainable packaging solutions.

Flex Packaging Films business launched F-TFE Thermoform able BOPET film. The F-TFE Mono or Co-extruded transparent Biaxial-Oriented Polyethene Terephthalate BOPET film has been developed specifically for thermoforming applications that require deep formation.

In 2020, Dow Packaging and Speciality Plastics introduced new tender frame systems together with TF-BOPE materials used to create linear low-, medium and high-density packaging films. The governments of Germany, France and the United Kingdom currently support research and development for environmentally friendly BOPET films and bio-based materials that will decrease dependence on new fossil-based plastic products.

Report Coverage

This research report categorises the Europe BOPET film market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe BOPET film market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe BOPET film market.

Europe BOPET Film Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 2048.6 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.99% |

| 2035 Value Projection: | 3151.2 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By Thickness |

| Companies covered:: | Mitsubishi Polyester Film GmbH Toray Films Europe Jindal Poly Films Fatwa A.S. Flex Polynyas SRF Europe Real Industries Ltd Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The BOPET Film Market Size in Europe is driven by a rising demand for food and beverage products due to improved barrier materials, which extend product shelf life. Industrial applications now use materials with high thermal resistance for solar panels, automotive components and electrical insulation. European environmental regulations and consumer demands drive people to choose sustainable packaging solutions that can be recycled.

Restraining Factors

The BOPET Film Market Size in Europe is restrained by the price of PET feedstock which depends on crude oil prices directly affects the manufacturing expenses and profit margins of companies. BOPP provides a more affordable option, which allows for smoother integration into existing recycling networks for polypropylene materials. The absence of dedicated recycling facilities for flexible packaging waste exists in various areas.

Market Segmentation

The Europe BOPET film market share is categorised into thickness, application, and end user.

- The 15–30-micron BOPET packaging films segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe BOPET Film Market Size is segmented by thickness into below 15-micron BOPET packaging films, 15–30-micron BOPET packaging films, 30–50-micron BOPET packaging films, and above 50-micron BOPET packaging films. Among these, the 15–30-micron BOPET packaging films segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the flexible packaging material provides protection against oxygen and moisture better than other packaging materials. The material operates effectively at high-speed lamination processes, which makes it suitable for use in snacks, coffee pouches, and retort applications.

- The labels segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe BOPET Film Market Size is segmented into labels, tapes, wraps, bags, pouches, and laminates. Among these, the labels segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the system, which protects its scratch-resistant design, which maintains its crystal-clear graphics throughout its entire service life. The materials of the product maintain their structure under extreme conditions which include exposure to both moisture and chemical substances found in drinks and cosmetics. Their shrink-sleeve packaging system enables them to perform complete 360-degree branding through its visual design.

- The food segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe BOPET Film Market Size is segmented by end user into food, beverages, cosmetics and personal care, electrical and electronics, pharmaceuticals. Among these, the food segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the laminates which protect snacks, dairy products and meats from both oxidation and contamination. The metallized versions of the product however, create light barriers which protect delicate materials from spoilage. The introduction of microwave-safe products will enable consumers to prepare their meals more easily.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe BOPET Film Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Polyester Film GmbH

- Toray Films Europe

- Jindal Poly Films

- Fatwa A.S.

- Flex

- Polynyas

- SRF Europe

- Real Industries Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe BOPET film market based on the below-mentioned segments:

Europe BOPET Film Market, By Thickness

- Below 15 Micron BOPET Packaging Films

- 15-30 Micron BOPET Packaging Films

- 30-50 Micron BOPET Packaging Films

- Above 50 Micron BOPET Packaging Films

Europe BOPET Film Market, By Application

- Labels

- Tapes

- Wraps

- Bags and Pouches

- Laminates

Europe BOPET Film Market, By End User

- Food

- Beverages

- Cosmetics and Personal Care

- Electrical and Electronics

- Pharmaceuticals

Frequently Asked Questions (FAQ)

-

What is the Europe BOPET film market size?Europe BOPET film market size is expected to grow from 2048.6 Thousand Tonnes in 2024 to 3151.2 Thousand Tonnes by 2035, growing at a CAGR of 3.99% during the forecast period 2025-2035

-

What is BOPET film, and its primary use?The BOPET film market operates as a sustainable high-performance sector that experiences rapid expansion because of increasing demand for flexible, lightweight, recyclable packaging solutions that customers need for their food, pharmaceutical and consumer electronics packaging needs

-

What are the key growth drivers of the market?Market growth is driven by a rising demand for food and beverage products because of improved barrier materials, which extend product shelf life. European environmental regulations and consumer demands drive people to choose sustainable packaging solutions that can be recycled.

-

What factors restrain the Europe BOPET film market?The market is restrained by the price of PET feedstock which depends on crude oil prices directly affects the manufacturing expenses and profit margins of companies

-

How is the market segmented by application?The market is segmented into labels, tapes, wraps, bags, pouches, and laminates.

-

Who are the key players in the Europe BOPET film market?Key companies include Mitsubishi Polyester Film GmbH, Toray Films Europe, Jindal Poly Films, Fatra A.S., UFlex, Polinas, SRF Europe, and Retal Industries Ltd.

Need help to buy this report?