Europe Bisphenol S Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Liquid, Powder), By End User (Thermal Papers, Fine Chemicals, Epoxy Resins, Phenolic Resins, Others), and Europe Bisphenol S Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsEurope Bisphenol S Market Insights Forecasts to 2035

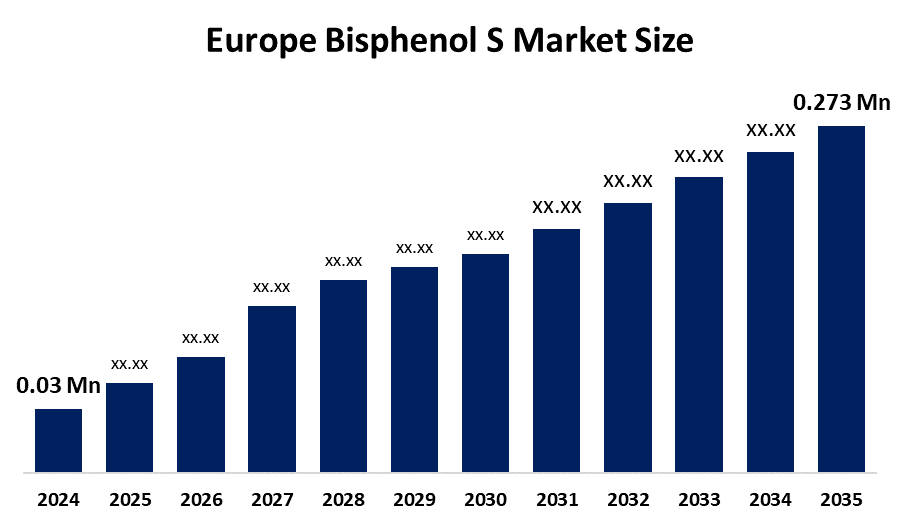

- The Europe Bisphenol S Market Size Was Estimated at 0.03 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 22.23% from 2025 to 2035

- The Europe Bisphenol S Market Size is Expected to Reach 0.273 Million Tonnes by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Europe Bisphenol S Market Size Is Anticipated To Reach 0.273 Million Tonnes By 2035, Growing At A CAGR Of 22.23% From 2025 To 2035. The market is driven by the growing need for BPA substitutes, the need to comply with regulations, the expansion of the plastics sector, the growth of thermal paper applications, and the growing use of coatings and resins

Market Overview

The Europe bisphenol S (BPS) market is rapidly evolving because European Union regulations ban endocrine disruptors which require the replacement of Bisphenol A (BPA) from thermal paper and epoxy resins. The organic compound Bisphenol S demonstrates lower toxicity levels than Bisphenol A, which enables its use in multiple applications across different industrial sectors. The regional demand for Bisphenol S is increasing because governments are providing more support for its adoption as a chemical solution that reduces environmental effects.

The Platts organization which functions under S&P Global Commodity Insights, will initiate its daily bisphenol-A price assessments for the Asian and European markets in November 2023. The assessments will start their operations in December. The UK Food Standards Agency (FSA) launched a public consultation in October 2025 to propose a total ban on bisphenol A (BPA) and all bisphenol analogues and their derivatives from use in materials that come into contact with food.

The implementation of Commission Regulation (EU) 2024/3190. The guidance establishes a compliance pathway which businesses must follow when they use Bisphenol A (BPA) and its derivatives in their materials, coatings, inks and adhesives. The guidance provides 40 Q&As which explain the different elements that businesses need to understand about their products include Bisphenols and their derivatives, their testing requirements, their market distribution and their temporary operational standards.

Report Coverage

This research report categorises the European bisphenol S market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe bisphenol S market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe bisphenol S market.

Europe Bisphenol S Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.03 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 22.23% |

| 2035 Value Projection: | 0.273 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Product Type, By End User |

| Companies covered:: | Covestro AG, BASF SE, Solvay S.A., Konishi Chemical Ind. Co., Ltd., Nisso Metallochemical Co., Ltd., Volant-Chem Corp., Nicca Chemical Co., Ltd., Chongqing Qiutian Chemical Co., Ltd., Kessler Chemical, Mitsubishi Chemical Group Corp, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bisphenol S market in Europe is driven by BPS, which functions as a thermal paper developer because its chemical properties closely match those of BPA allows production processes to operate with only basic adjustments. The European electronics and automotive sectors need high-performance epoxy resins, and polycarbonates result in increasing BPS usage for their heat resistance and durability. Engineers now prefer to utilize sustainable materials that possess high strength and unique properties for their specialized applications.

Restraining Factors

The bisphenol S market in Europe is restrained by the market faces competition from other chemical alternatives, while industrial customers increasingly prefer safer bio-based materials. The European Chemicals Agency (ECHA) has classified BPS as a substance of very great concern, which now appears on the REACH Candidate List because the chemical possesses reproductive toxic effects and endocrine-disrupting characteristics.

Market Segmentation

The Europe bisphenol S market share is categorised into product type and end user.

- The liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe bisphenol S market is segmented by product type into liquid, powder. Among these, the liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the high demand stemming from efficient handling and reduced processing time. Liquid BPS offers superior compatibility with solvents, which increases its use in manufacturing processes. Industries select this option for their operations because it allows them to maintain steady production standards.

- The thermal papers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe bisphenol S market is segmented into thermal papers, fine chemicals, epoxy resins, phenolic resins, others. Among these, the thermal papers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the BPS, which improves thermal coating heat sensitivity and serves as an essential component for point-of-sale systems. Its usage surges in retail and logistics. The BPS stability provides thermal papers with better performance. The demand for products increases because of the e-commerce market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe bisphenol S market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Covestro AG

- BASF SE

- Solvay S.A.

- Konishi Chemical Ind. Co., Ltd.

- Nisso Metallochemical Co., Ltd.

- Volant-Chem Corp.

- Nicca Chemical Co., Ltd.

- Chongqing Qiutian Chemical Co., Ltd.

- Kessler Chemical

- Mitsubishi Chemical Group Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe bisphenol s market based on the below-mentioned segments

Europe Bisphenol S Market, By Product Type

- Liquid

- Powder

Europe Bisphenol S Market, By End User

- Thermal Papers

- Fine Chemicals

- Epoxy Resins

- Phenolic Resins

Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe bisphenol S market size?A: Europe bisphenol S market size is expected to grow from 0.03 million tonnes in 2024 to 0.273 million tonnes by 2035, growing at a CAGR of 22.23% during the forecast period 2025-2035

-

Q: What is bisphenol S, and its primary use?A: The Europe bisphenol S (BPS) market is rapidly evolving because European Union regulations ban endocrine disruptors which require the replacement of Bisphenol A (BPA) from thermal paper and epoxy resins.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by BPS, which functions as a thermal paper developer because its chemical properties closely match those of BPA allows production processes to operate with only basic adjustments.

-

Q: What factors restrain the Europe bisphenol S market?A: The market is restrained by the market faces competition from other chemical alternatives, while industrial customers increasingly prefer safer bio-based materials.

-

Q: How is the market segmented by product type?A: The market is segmented into liquid, powder.

-

Q: Who are the key players in the Europe bisphenol S market?A: Key companies include Covestro AG, BASF SE, Solvay S.A., and Konishi Chemical Ind. Co., Ltd., Nisso Metallochemical Co., Ltd., Volant-Chem Corp., Nicca Chemical Co., Ltd., Chongqing Qiutian Chemical Co., Ltd., Kessler Chemical, and Mitsubishi Chemical Group Corp.

Need help to buy this report?