Europe Biodiesel Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Rapeseed Oil, Palm Oil, Used Cooking Oil, Animal Fats and Others), By Type (B100, B20, B10, and B5), and Europe Biodiesel Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Biodiesel Market Size Insights Forecasts to 2035

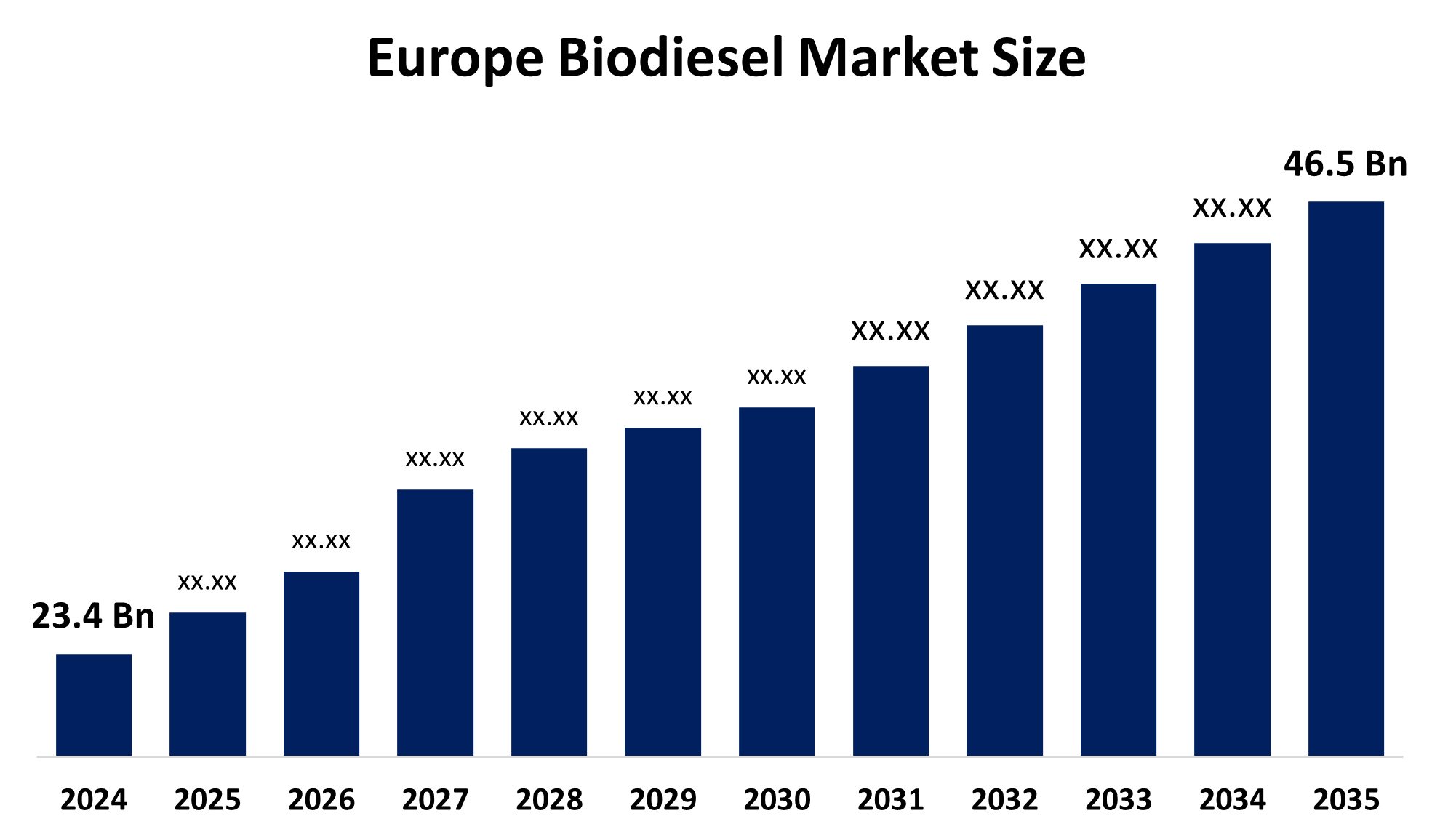

- The Europe Biodiesel Market Size Was Estimated at USD 23.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.44% from 2025 to 2035

- The Europe Biodiesel Market Size is Expected to Reach USD 46.5 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Biodiesel Market Size is Anticipated to Reach USD 46.5 Billion by 2035, Growing at a CAGR of 6.44% from 2025 to 2035. The market is driven by the rising awareness about carbon footprint reduction, fluctuating crude oil prices, and the implementation of stringent environmental regulations.

Market Overview

Biodiesel refers to a group of esterified vegetable oils produced from different oil-containing crops. The category of biodiesel includes various liquid biofuels, which include biodiesel, bio-dimethyl ether, Fischer-Tropsch and cold-pressed bio-oil as products that can serve as transportation diesel through blending or direct application. Most biodiesel production derives from discarded waste vegetable oils, which food establishments, chip shops and industrial food producers throw away, although rapeseed oil extraction yields high-quality biodiesel.

Vopak announced that as of May 2023, they had put sixteen new tanks, with a total storage size of 64,000 m³, on the Port of Rotterdam, Europe, at their terminal in Vlaardingen.

The European Union plans to reach a 32% renewable energy target for its total energy consumption, which will require renewable sources to provide 1200 terawatt-hours of energy. The EU has dedicated about 1.5 billion to renewable energy initiatives, encompassing biodiesel production through its Green Deal. The new catalysts will reduce production costs by €50 per ton, which will allow biodiesel to compete with fossil fuels more effectively in the upcoming years.

Report Coverage

This research report categorises the Europe Biodiesel Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe biodiesel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe biodiesel market.

Europe Biodiesel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.4 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.44% |

| 2035 Value Projection: | USD 46.5 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Feedstock, By Type |

| Companies covered:: | Neste Oyj, Total Energies SE, Eni SPA, Verbio AG, Archer Daniels Midland, Cargill, Bunge, Greenergy, Argent Energy, CropEnergies AG and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The biodiesel market in Europe is driven by the increasing requirement for renewable energy, with the strict environmental regulations, the unpredictable crude oil market and the rising energy security issues, leading to market expansion. The European Parliament established a new renewable energy target of 42.5% for 2030, which EU member states must pursue, while the Commission supports this goal through its REPowerEU program.

Restraining Factors

The biodiesel market in Europe is restrained by the price of palm oil, which reached an average of €1,200 per ton, marking a 20% increase from the previous year. Bioethanol production costs and profitability within the EU will experience changes because market competition will increase as consumer demand grows for cleaner fuel alternatives. The competition restricts market access for biodiesel because both consumers and industries show a preference for other fuels.

Market Segmentation

The Europe biodiesel market share is categorised into feedstock and type.

- The rapeseed oil segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Biodiesel Market Size is segmented by feedstock into rapeseed oil, palm oil, used cooking oil, animal fats and others. Among these, the rapeseed oil segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rapeseed accounted 62.5% of the 2025 volume, equal to 13.8 million tonnes out of a 22 million tonne pool, underlining its entrenched position in the Europe biodiesel market for feedstocks. The growth of the segment is driven by its high oil yield and regional availability. There is a rising popularity in the use of cooking oil and animal fat for sustainability and cost-effectiveness.

- The B100 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on type, the Europe Biodiesel Market Size is segmented into B100, B20, B10, and B5. Among these, the B100 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by its high purity and performance, particularly in industrial and fleet applications, while blended options like B20 and B10 maintain their popularity because they work well with current diesel engine technology and infrastructure systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe biodiesel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Neste Oyj

- Total Energies SE

- Eni SPA

- Verbio AG

- Archer Daniels Midland

- Cargill

- Bunge

- Greenergy

- Argent Energy

- CropEnergies AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Adamant Group announced the acquisition of a majority stake in a biorefinery located in the Milan metropolitan area of Italy, marking a significant milestone in the company’s strategic expansion within the biofuels and renewable feedstocks sector.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Biodiesel Market Size based on the below-mentioned segments:

Europe Biodiesel Market, By Feedstock

- Rapeseed Oil

- Palm Oil

- Used Cooking Oil

- Animal Fats

- Others

Europe Biodiesel Market, By Type

- B100

- B20

- B10

- B5

Frequently Asked Questions (FAQ)

-

Q: What is the Europe biodiesel market size?A: Europe biodiesel market size is expected to grow from USD 23.4 billion in 2024 to USD 46.5 billion by 2035, growing at a CAGR of 6.44% during the forecast period 2025-2035.

-

Q: What is biodiesel, and its primary use?A: Biodiesel refers to a group of esterified vegetable oils produced from different oil-containing crops. The category of biodiesel includes various liquid biofuels, which include biodiesel, bio-dimethyl ether, Fischer-Tropsch and cold-pressed bio-oil as products that can serve as transportation diesel through blending or direct application.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing requirement for renewable energy, with the strict environmental regulations, the unpredictable crude oil market and the rising energy security issues, leading to market expansion.

-

Q: What factors restrain the Europe biodiesel market?A: The market is restrained by the price of palm oil, which reached an average of €1,200 per ton, marking a 20% increase from the previous year.

-

Q: How is the market segmented by feedstock?A: The market is segmented into rapeseed oil, palm oil, used cooking oil, animal fats and others.

-

Q: Who are the key players in the Europe biodiesel market?A: Key companies include Neste Oyj, Total Energies SE, Eni SPA, Verbio AG, Archer Daniels Midland, Cargill, Bunge, Greenergy, Argent Energy, and CropEnergies AG.

Need help to buy this report?