Europe Biodegradable Polymers Market Size, Share, and COVID-19 Impact Analysis, By Type (PLA, Starch, PBS, and PHA), By Substrate (Paper & Paperboard, Cellulose Films), By Application (Rigid Packaging, Flexible Packaging, and Liquid Packaging), and Europe Biodegradable Polymers Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Biodegradable Polymers Market Insights Forecasts to 2035

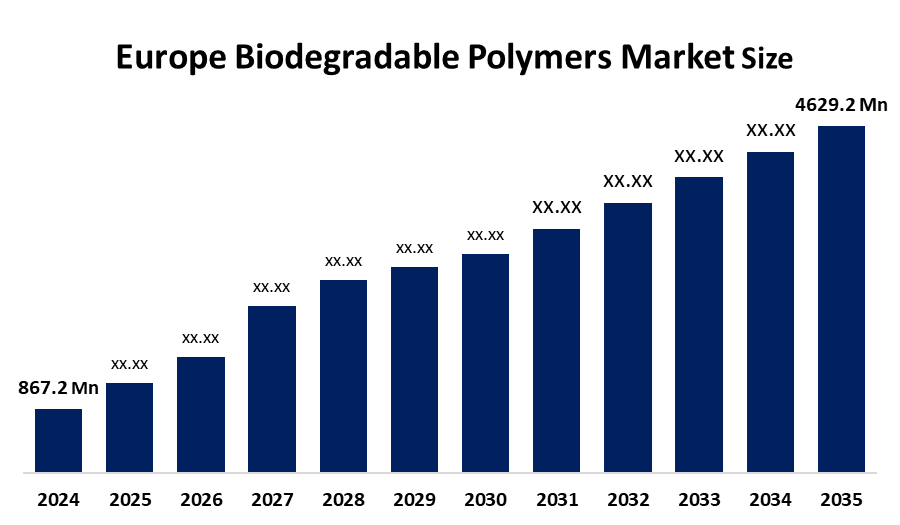

- The Europe Biodegradable Polymers Market Size Was Estimated at USD 867.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16.45% from 2025 to 2035

- The Europe Biodegradable Polymers Market Size is Expected to Reach USD 4629.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Biodegradable Polymers Market Size is Anticipated to reach USD 4629.2 Million by 2035, Growing at a CAGR of 16.45% from 2025 to 2035. The market is driven by the growing consumer demand for sustainable, bio-based materials, and awareness of environmental impact boosts adoption.

Market Overview

The Europe biodegradable polymers market is a growing industry that develops due to strict environmental regulations, sustainable business practices and the transition to circular economic systems. The market includes polymers which are made from bio-based materials and synthetic materials that microorganisms can degrade into water, carbon dioxide and biomass within a defined period. The biomedical field uses bioresorbable sutures, medical implants, drug delivery systems and tissue engineering scaffolds for their high-value applications.

Power Adhesives introduced its biodegradable hot melt adhesive product in September 2024. The adhesive product serves carton manufacturers and corrugated packaging companies and point of sale converters, and contract packers. Swedish greentech company Lignin Industries AB announced the mass commercialisation of its Renol technology in June 2024. The technology uses lignin from trees to create a bio-based material, which serves as its main product.

The Swedish company Lignin Industries has secured €3.9 million in funding to expand its tree-based bioplastic production operations. The European Union established a countrywide ban on Per- and Polyfluoroalkyl Substances through its Packaging and Packaging Waste Regulation, which the EU published in February 2025 and which will take effect in food-contact packaging products from August 2026. The country experiences strong demand because flexible packaging solutions are used for multiple products, which include biscuits and snacks, noodles and pasta and additional items.

Report Coverage

This research report categorises the European biodegradable polymers market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe biodegradable polymers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe biodegradable polymers market.

Europe Biodegradable Polymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 867.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 16.45% |

| 2035 Value Projection: | USD 4629.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 1 |

| Segments covered: | By Type |

| Companies covered:: | BASF SE, Novamont S.P.A., TotalEnergies Corbion, NatureWorks LLC, Mitsubishi Chemical Group Co., Biome Bioplastics, FKuR Kunststoff GmbH, Plantic Technologies, TIPA Corp Ltd, Bio-On S.P.A., and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The biodegradable polymers market in Europe is driven by the Carbon Border Adjustment Mechanism (CBAM), which raises fossil polymer import costs, enabling certified bio-based plastics produced in domestic markets to compete at lower prices. European citizens show strong environmental awareness, which leads them to choose environmentally sustainable packaging materials. Approximately 80–87% of EU consumers express concern over plastic pollution and a willingness to pay premiums for eco-friendly products. Investments in composting and biowaste collection provide the necessary end-of-life pathways for certified biodegradable products, which enable better product disposal through waste collection systems.

Restraining Factors

The biodegradable polymers market in Europe is restrained by the supply chain of bio-based raw materials, which includes starch and sugar faces two main challenges because of its limited supply and unstable availability. The existing high-speed plastic processing equipment cannot process these materials because their shelf life is too short.

Market Segmentation

The Europe biodegradable polymers market share is categorised into type, substrate, and application.

- The PLA segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe biodegradable polymers market is segmented by type into PLA, starch, PBS, and PHA. Among these, the PLA segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The PLA segment had 40.7% of the Europe biodegradable polymers market in 2024. The growth of the segment is driven by the packaging of hot soup, coffee and other hot beverages needs special materials. The material could be used for biodegradable purposes because its cost was reduced through the combination with starch. The material serves as an extrusion coating for dairy containers, disposable tableware, agricultural mulch films, milk, juice cartons and planter boxes. The product achieved quick market acceptance because it offered customers simple access and produced affordable manufacturing expenses.

- The paper & paperboard segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on substrate, the Europe biodegradable polymers market is segmented into paper & paperboard, cellulose films. Among these, the paper & paperboard segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The paper & paper board segment was the largest substrate segment in the Europe biodegradable polymers market and held 61.7% of the market share in 2024. Biodegradable polymers have gained popularity for coating paper cups and food containers because they offer an environmentally friendly alternative to traditional plastics, which use petroleum as their base material.

- The rigid packaging segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe biodegradable polymers market is segmented by application into rigid packaging, flexible packaging, and liquid packaging. Among these, the rigid packaging segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rigid packaging segment captured 44.7% of the Europe biodegradable polymers market share in 2024. The rigid plastics segment holds a main market position because the industry uses it to manufacture bottles, containers and trays, which are essential for the food and beverages sector. Rigid packaging reduces contamination risks during recycling because it can be composted together with organic waste.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe biodegradable polymers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Novamont S.P.A.

- TotalEnergies Corbion

- NatureWorks LLC

- Mitsubishi Chemical Group Co.

- Biome Bioplastics

- FKuR Kunststoff GmbH

- Plantic Technologies

- TIPA Corp Ltd

- Bio-On S.P.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, Algenesis Labs, a leader in plant-based, fully biodegradable polyurethanes (PU) designed to lower carbon footprint and prevent microplastic pollution, announced a strategic partnership with Safic-Alcan, a top global distributor of specialty chemicals.

In December 2024, Symphony Environmental launches biodegradable resin for the plastics industry. The new product, branded NbR, is made with natural minerals to reduce the amount of fossil-derived polyethylene (PE) or polypropylene (PP) used.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe biodegradable polymers market based on the below-mentioned segments:

Europe Biodegradable Polymers Market, By Type

- PLA

- Starch

- PBS

- PHA

Europe Biodegradable Polymers Market, By Substrate

- Paper & Paperboard

- Cellulose Films

Europe Biodegradable Polymers Market, By Application

- Rigid Packaging

- Flexible Packaging

- Liquid Packaging

Frequently Asked Questions (FAQ)

-

What is the Europe biodegradable polymers market size?Europe biodegradable polymers market size is expected to grow from USD 867.2 million in 2024 to USD 4629.2 million by 2035, growing at a CAGR of 16.45% during the forecast period 2025-2035.

-

What are biodegradable polymers, and their primary use?The European biodegradable polymers market is a growing industry that develops because of strict environmental regulations and sustainable business practices, and the transition to circular economic systems

-

What are the key growth drivers of the market?Market growth is driven by the Carbon Border Adjustment Mechanism (CBAM), which raises fossil polymer import costs enabling certified bio-based plastics produced in domestic markets to compete at lower prices

-

What factors restrain the Europe biodegradable polymers market?The market is restrained by the supply chain of bio-based raw materials, which includes starch and sugar faces two main challenges because of its limited supply and unstable availability.

-

How is the market segmented by type?The market is segmented into PLA, starch, PBS, and PHA.

-

Who are the key players in the Europe biodegradable polymers market?Key companies include BASF SE, Novamont S.P.A., TotalEnergies Corbion, NatureWorks LLC, Mitsubishi Chemical Group Co., Biome Bioplastics, FKuR Kunststoff GmbH, Plantic Technologies, TIPA Corp Ltd, and Bio-On S.P.A.

Need help to buy this report?