Europe Automotive Sensors Market Size, Share, and COVID-19 Impact Analysis, By Sales Channel (Original Equipment Manufacturers and Aftermarkets), By Sensor Types (Temperature Sensors, Pressure Sensors, Oxygen Sensors, NOx Sensors, Position Sensors, Speed Sensors, Inertial Sensors, Image Sensors, and Others) By Vehicle Types (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), and Europe Automotive Sensors Market Insights, Industry Trends, Forecast to 2035

Industry: Automotive & TransportationEurope Automotive Sensors Market Insights Forecasts to 2035

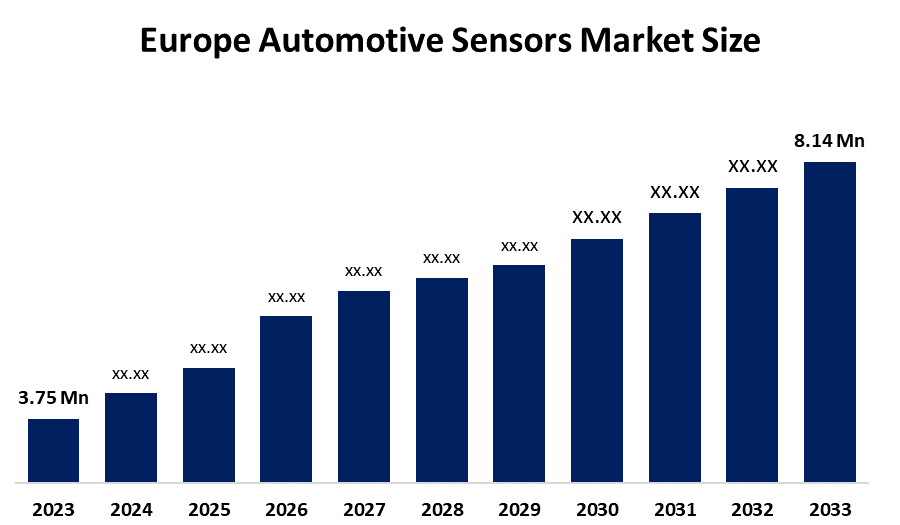

- The Europe Automotive Sensors Market Size Was Estimated at USD 3.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.3% from 2025 to 2035

- The Europe Automotive Sensors Market Size is Expected to Reach USD 8.14 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe automotive Sensors Market Size is anticipated to reach USD 8.14 Billion by 2035, growing at a CAGR of 7.3% from 2025 to 2035. The market is driven by the increasing demand for advanced driver-assisted systems (ADAS) and autonomous vehicles, growing to focus on implementing vehicle authentication to ensure driver safety and comfort, and minimising driver stress through the adoption of advanced driver assistance systems.

Market Overview

The automotive sensor market is developed for detection and response to environmental changes and functionalities by transforming physical inputs like temperature, pressure, light, motion, etc., into electrical signals. Sensing devices have become a vital part of the automotive industry in terms of their functions in monitoring, controlling, and improving vehicle performance, safety, efficiency, and comfort. The market for automotive sensors includes a huge range of different types of sensors, comprising, among others, those for temperature, pressure, position and motion, proximity detection, and so on.

The automotive sector in Europe is mighty, with top car makers like BMW and Volkswagen. The governing authority imposes severe safety regulations on auto producers and makes it compulsory to use automobile sensors for functions like the anti-lock braking system (ABS).

European car makers are collaborating with the Chinese autonomous driving specialist Momenta to strengthen their presence in the largest and most advanced automotive market in terms of technology. The Horizon Europe Programme, along with a proposed public-private partnership, are funnelling about €1 billion into the automotive R&I sector by 2027 for technologies such as AI, connectivity and automation.

Report Coverage

This research report categorizes the market for the Europe automotive sensors market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe automotive sensors market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe automotive sensors market.

Europe Automotive Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.75 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.3% |

| 2035 Value Projection: | USD 8.14 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Sales Channel,By Sensor |

| Companies covered:: | Robert Bosch GmbH,Continental AG,Infineon Technologies,ST Microelectronics,NXP Semiconductors,Valeo S.A,ZF Friedrichshafen,TE Connectivity,Melexis NV,FORVIA And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The automotive sensors market in Europe is driven by the rapid developments in MEMS and IoT-enabled sensors, improving accuracy and productivity. The rise of automotive sensor manufacturers to meet aftermarket demands, mainly for sensors used in braking systems. The need for specific sensors in electric and hybrid cars is not only increasing but also very visible. The European connected car market is predicted to exceed 100 billion euros by the year 2025, showing a rapid growth rate. The European Union has enforced regulations that make it mandatory for new cars to have specific safety features, and this has a direct impact on the demand for sensors employed in systems such as collision avoidance and stability control in the automobile sector.

Restraining Factors

The automotive sensors market in Europe is restrained by the product's high cost is attributed to the expensive raw materials and the intricate manufacturing processes, the high demand for the sensors. When various disparate sensor technologies have to be integrated into complex vehicle architectures, the difficulty and the cost become particularly high through having to invest heavily in research and development and by creating a very demanding condition for software validation in terms of interoperability and robustness.

Market Segmentation

The Europe automotive sensors market share is categorised into sales channel, sensor types, and vehicle types.

- The original equipment manufacturers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe automotive sensors market is segmented by sales channel into original equipment manufacturers and aftermarkets. Among these, the original equipment manufacturers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by its established connections with automakers. OEMs are closely tied to the car industry's supply chain, making sure that the sensors comply with certain manufacturer specifications. Sensors manufacturers' direct or indirect sales to automakers are their main distribution channels. The category enjoys long-term agreements and the constant demand for sensors designed specifically for the new car models.

- The temperature sensors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on sensor types, the Europe automotive sensors market is segmented into temperature sensors, pressure sensors, oxygen sensors, NOx sensors, position sensors, speed sensors, inertial sensors, image sensors, and others. Among these, the temperature sensors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by various automotive applications that have extensively employed them for keeping track of engine performance and efficiency. They are dependable and found in almost all kinds of vehicles. Temperature sensors are becoming more and more important in the automotive industry as it shifts mainly to electric and hybrid technologies, and thus they are being used for energy management.

- The passenger car segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe automotive sensors market is segmented by vehicle types into passenger car, light commercial vehicle, and heavy commercial vehicle. Among these, the passenger car segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the broad-scale acceptance and great utilization of sophisticated driver-assistance systems (ADAS) as a part of the vehicle. The latter ones are getting more and more fitted with sensors that improve the overall safety, performance, and comfort, thus leading to a better position in the market for cars equipped with such technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe automotive sensors market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- Robert Bosch GmbH

- Continental AG

- Infineon Technologies

- ST Microelectronics

- NXP Semiconductors

- Valeo S.A.

- ZF Friedrichshafen

- TE Connectivity

- Melexis NV

- FORVIA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In September 2025, Mitsubishi Motors Corporation announced that Mitsubishi Motors Europe B.V., Mitsubishi Motors' subsidiary in Europe, will begin a sequential launch of the all-new Eclipse Cross battery electric vehicle for the European market before the end of 2025. The model will be manufactured at Renault's ElectriCity Douai Plant, the Renault Group's EV production hub.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe automotive sensors market based on the below-mentioned segments:

Europe Automotive Sensors Market, By Sales Channel

- Original Equipment Manufacturers

- Aftermarkets

Europe Automotive Sensors Market, By Sensor Types

- Temperature Sensors

- Pressure Sensors

- Oxygen Sensors

- NOx Sensors

- Position Sensors

- Speed Sensors

- Inertial Sensors

- Image Sensors

- Others

Europe Automotive Sensors Market, By Vehicle Types

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Frequently Asked Questions (FAQ)

-

Q: What is the Europe automotive sensors market size?A: Europe automotive sensors market size is expected to grow from USD 3.75 billion in 2024 to USD 8.14 billion by 2035, growing at a CAGR of 7.3% during the forecast period 2025-2035

-

Q: What is automotive sensors, and its primary use?A: The automotive sensor market is developed for detection and response to environmental changes and functionalities by transforming physical inputs like temperature, pressure, light, motion, etc., into electrical signals. Sensing devices have become a vital part of the automotive industry in terms of their functions in monitoring, controlling, and improving vehicle performance, safety, efficiency, and comfort.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid developments in MEMS and IoT-enabled sensors, improving accuracy and productivity. The rise of automotive sensor manufacturers to meet aftermarket demands. The need for specific sensors in electric and hybrid cars is not only increasing but also very visible.

-

Q: What factors restrain the Europe automotive sensors market?A: The market is restrained by the product's high cost is not only attributed to the expensive raw materials and the intricate manufacturing processes, but above all, the high demand for the sensors

-

Q: How is the market segmented by sales channel?A: The market is segmented into original equipment manufacturers and aftermarkets

-

Q: Who are the key players in the Europe automotive sensors market?A: Key companies include Robert Bosch GmbH, Continental AG, Infineon Technologies, ST Microelectronics, NXP Semiconductors, Valeo S.A., ZF Friedrichshafen, TE Connectivity, Melexis NV, and FORVIA.

Need help to buy this report?