Europe 3D Printing Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware and Services), By Technology (Stereolithography, Fused Deposition Modeling, and Others), By Material (Polymers, Metals and Alloys, and Others), By End-User (Automotive, Aerospace and Defense, Healthcare), and Europe 3D Printing Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope 3D Printing Market Insights Forecasts to 2035

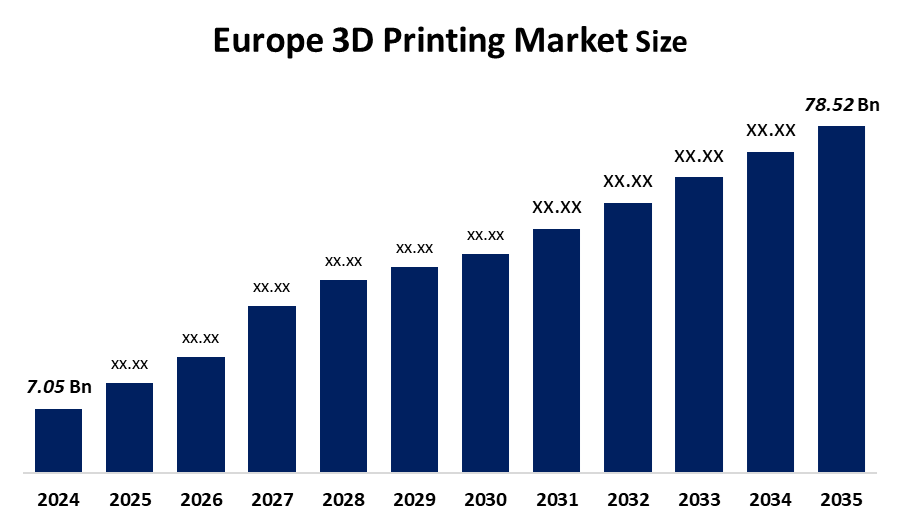

- The Europe 3D Printing Market Size Was Estimated at USD 7.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 24.5% from 2025 to 2035

- The Europe 3D Printing Market Size is Expected to Reach USD 78.52 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe 3D Printing Market size is anticipated to reach USD 78.52 Billion by 2035, growing at a CAGR of 24.5% from 2025 to 2035. The market is driven by the increasing acceptance of additive manufacturing across various sectors like automotive, aerospace, and medical is mainly due to the requirements of rapid prototyping and custom manufacturing services.

Market Overview

The 3D printing market, also called additive manufacturing, has undergone a major transformation being an expensive prototyping tool in a few sectors to a universal technology adopted for production in almost all industries. The indisputable advantages of 3D printing over traditional technology in terms of production time, production costs, and the possibility of creating complex geometries have been the major factors pushing the market size to grow. The industries are more likely to opt for the 3D printing technology solution as an agile and cost-efficient one; thus, the global 3D printing market is moving with strong momentum, and the expansion continues

.

Europe’s new rocket is to launch polymer 3d printing technology into space in May 2024. Toyota Europe will use the world's largest 3D-printed die casting insert in automotive manufacturing by September 2025.

The European Patent Office (EPO) has reported a significant increase in innovation in the field of 3D printing or additive manufacturing over the last years. The research analysis, in the report titled Innovation trends in additive manufacturing, states that international patent families in 3D printing technologies have a yearly growth rate of 26.3% on average, which is almost 8 times faster than in all technology sectors combined during the same period (3.3%) in 2020.

The 3D printing market is predicted to continually grow as it is being accepted as a core manufacturing solution instead of being just a niche technology. Italy is experiencing a growing 3D printing market development that is basically due to its influential automotive, machinery, and fashion industries, which are all looking for customization capabilities. The industries are the main players that provoke the growing trend of minimizing production waste and maximizing production cycles. Besides, the companies have been investing in R&D and government support has also been a contributing factor in the rapid development of the industry.

Report Coverage

This research report categorizes the market for the Europe 3D printing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe 3D printing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe 3D printing market.

Europe 3D Printing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 24.5% |

| 2035 Value Projection: | USD 78.52 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Companies covered:: | Voxeljet AG ADR, 3D Printing Industry, Sculpteo, Get 3D, 3D Print Bureau, Mark3D- Markforged, Alphacam GnbH, 3ddrucken, Craftcloud, 3D Print Shop Ltd, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The 3D printing market in Europe is driven by the growing consumer demand for mass customization. Companies in the manufacturing sector are moving towards personalized products more and more, particularly in the fields of medical implants, dental equipment, fashion accessories, and electronics. 3D printing allows for the cost-effective manufacturing of uniquely designed parts without having to devote money and time to expensive labor and facilities, hence it appeals to both large enterprises and tiny ventures alike. The development of focused attention on rapid prototyping and shortened product development cycles. Every industry is adopting 3D printing to rapidly and simultaneously carry out the processes of designing, testing, and modifying products, so that the time between creation and selling is minimized.

Restraining Factors

The 3D printing market in Europe is restrained by the limitations of material availability and the qualification standards that come with them are some of the obstacles that the 3D printing market has to deal with, and that also have an impact on its overall size. The above also particularly increases the difficulty of the regulated industries when it comes to adopting this technology. Moreover, the question of maintaining quality and repeatability in the high-volume production process is another challenge that the printing market faces. Also, the whole situation surrounding the Intellectual Property protection and the cybersecurity risks that come with the digital design files is another challenge in itself.

Market Segmentation

The Europe 3D printing market share is categorised into component, technology, material, and end user.

The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe 3D printing market is segmented by component into hardware and services. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hardware segment is 68.34% in 2024, making it the largest segment. This is mainly due to the critical role that 3D printers played in the adoption of this technology in various sectors. The presence of high-performance metal 3D printers, along with their significant demand in industries such as automotive and aerospace, has also contributed to the demand growth. Besides, the development of modern 3D printers that are multi-material capable has also created an increasing demand.

The fused deposition modelling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on technology, the Europe 3D printing market is segmented into stereolithography, fused deposition modeling, and others. Among these, the fused deposition modelling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2024, FDM had a market share of 29.56%. By the month of February 2025, Shapeways' 3D printing services in Europe became richer with Fused Deposition Modeling (FDM), which allowed for affordable, industrial-grade prototyping and finished part production.

The polymers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe 3D printing market is segmented by material into polymers, metals and alloys, and others. Among these, the polymers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, polymers accounted for 54.67% of revenue, due to their wide-ranging applications in prototyping and tooling. One of the main reasons was the automotive industry's starting to produce lighter parts and the need to have them made from more fuel-efficient materials. Furthermore, the low density of the polymers is the main reason for the weight reduction of the vehicles, which in turn increases the overall fuel efficiency and safety.

The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe 3D printing market is segmented into automotive, aerospace and defense, healthcare. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The share of the automotive sector in the 3D printing market in Europe reached 24.56% in 2024, which was mainly due to applications in wind-tunnel models, lattice seat frames, and on-demand jigs. By intensive adoption across vehicle development and manufacturing processes. Automotive manufacturers are using additive technologies all over the product development process, from the very beginning to the mass production, and for the very end, component use manufacturing

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe 3D printing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Voxeljet AG ADR

- 3D Printing Industry

- Sculpteo

- Get 3D

- 3D Print Bureau

- Mark3D- Markforged

- Alphacam GnbH

- 3ddrucken

- Craftcloud

- 3D Print Shop Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In December 2025, UK-Base Materials launched a Large-Format 3D Printing Service. Large-format tooling applications are poised to benefit most from the combination of AM and robotic arms.

In September 2025, Raise3D launched the new E3 IDEX 3D printer at FABTECH 2025. A Successor to the E2 and E2CF, the E3 is designed to meet the evolving demands of modern manufacturing.

In April 2025, Conflux Technology, an Australian firm renowned for its metal 3D printed heat exchangers, announced the opening of its first European hub in the United Kingdom. The new facility marks a key step in Conflux’s international growth strategy and is set to boost support for European customers across sectors such as aerospace, automotive, energy, defence, and e-mobility.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe 3D Printing Market based on the below-mentioned segments:

Europe 3D Printing Market, By Component

- Hardware

- Services

Europe 3D Printing Market, By Technology

- Stereolithography

- Fused Deposition Modeling

- Others

Europe 3D Printing Market, By Material

- Polymers

- Metals and Alloys

- Others

Europe 3D Printing Market, By End User

- Automotive

- Aerospace and Defense

- Healthcare

Frequently Asked Questions (FAQ)

-

What is the Europe 3D printing market size?Europe 3D Printing market size is expected to grow from USD 7.05 billion in 2024 to USD 78.52 billion by 2035, growing at a CAGR of 24.5% during the forecast period 2025-2035

-

What is 3D printing, and its primary use?The 3D printing market, also called additive manufacturing, has undergone a major transformation being an expensive prototyping tool in a few sectors to a universal technology adopted for production in almost all industries. The indisputable advantages of 3D printing over traditional technology in terms of production time, production costs, and the possibility of creating complex geometries have been the major factors pushing the market size to grow.

-

What are the key growth drivers of the market?Market growth is driven by the growing consumer demand for mass customization. Companies in the manufacturing sector are moving towards personalized products more and more, particularly in the fields of medical implants, dental equipment, fashion accessories, and electronics. 3D printing allows for the cost-effective manufacturing of uniquely designed parts without having to devote money and time to expensive labor and facilities, hence it appeals to both big enterprises and tiny ventures alike.

-

What factors restrain the Europe 3D printing market?The market is restrained by the limitations of material availability and the qualification standards that come with them are some of the obstacles that the 3D printing market has to deal with, and that also have an impact on its overall size. The above also particularly increases the difficulty of the regulated industries when it comes to adopting this technology

-

How is the market segmented by component?The market is segmented into hardware and services.

-

Who are the key players in the Europe 3D printing market?Key companies include Voxeljet AG ADR, 3D Printing Industry, Sculpteo, Get 3D, 3D Print Bureau, Mark3D- Markforged, Alphacam GnbH, 3ddrucken, Craftcloud, and 3D Print Shop Ltd.

Need help to buy this report?