Euro 7 Regulations Compliant Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Cars, LCVs, HCVs), By Sensors (Exhaust Gas Pressure & Temperature, PM, Oxygen/Lamba, NOx, & MAP/MAF Sensors), and Europe Analysis and Forecast 2026 – 2036

Industry: Automotive & TransportationEuro 7 Regulations Compliant Market Insights Forecasts to 2036

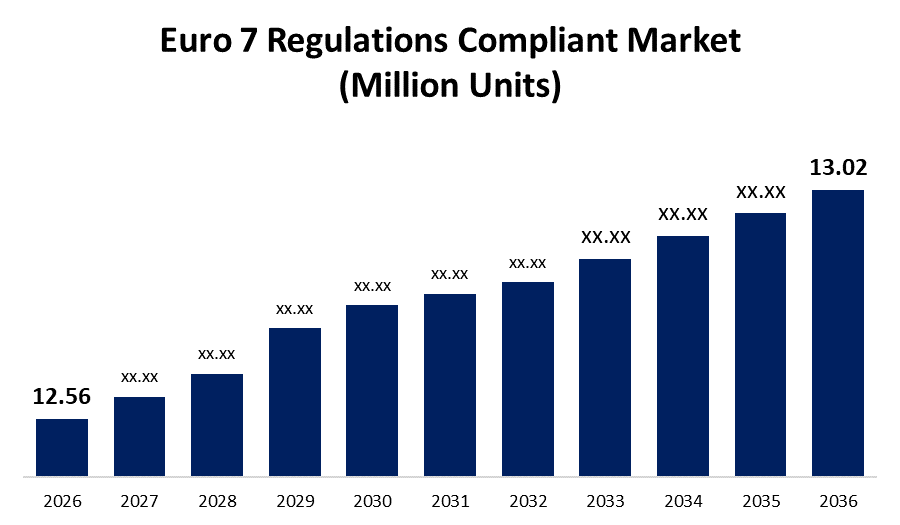

- The Euro 7 Regulations Compliant Market Size was Valued at 12.56 Million Units in 2026

- The Market Size is Growing at a CAGR of 0.36% from 2026 to 2036

- The Worldwide Euro 7 Regulations Compliant Market Size is Expected to Reach 13.02 Million Units by 2036

Get more details on this report -

The Euro 7 Regulations Compliant Market Size is Anticipated to Exceed 13.02 Million Units by 2036, Growing at a CAGR of 0.36% from 2026 to 2036.

Market Overview

Euro 7 emission requirements will substantially decrease NOx and PM emissions, resulting in cleaner air. To monitor emissions and use onboard sensors, periodic technical safeguards and compliance checks will be performed to ensure that emissions do not grow over time. When the brake is applied, the frictional force generates heat and emits small airborne particulates from the braking disc and pads. These particles are referred to as emissions, and several top braking system manufacturers are working to develop less-emitting systems. For example, in 2020, Brembo (Italy) introduced the greentive brake disc with high-velocity-oxy-fuel (HVOF) technology to lessen environmental effects by lowering CO2 emissions. Similarly, the Euro 7 regulation compliant is expected to boost the development of emission-reducing technology, sensors, and other related systems. Increased fuel economy will be necessary without sacrificing the protection of challenging engines and aftertreatment equipment, demanding higher performance fuel and lubricant technologies in Euro 7 compliant vehicles. Engine oils have always played a critical role in providing clean, efficient engine running, and their relevance will grow with the introduction of Euro 7. Vehicle braking system emissions are another essential type of emission under the Euro 7 legislation.

Report Coverage

This research report categorizes the market for the Euro 7 regulations compliant market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Euro 7 regulations compliant market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Euro 7 regulations compliant market.

Euro 7 Regulations Compliant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2026 |

| Market Size in 2026: | USD 12.56 Million Units |

| Forecast Period: | 2026-2036 |

| Forecast Period CAGR 2026-2036 : | 0.36% |

| 2036 Value Projection: | USD 13.02 Million Units |

| Historical Data for: | 2023-2025 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Sensors and COVID-19 Impact Analysis. |

| Companies covered:: | Forvia, Tenneco Inc., Eberspächer, Johnson Matthey, Umicore and Other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Euro 7 represents ultra-low emissions under all operating conditions for the vehicle's entire useful life. These laws will be more thoroughly enforced than ever before, with more frequent periodic inspections and a large rise in the use of onboard sensors for continuous onboard monitoring (OBM) of system operation. The appropriate fuel and lubricant technologies will be critical for Euro 7 regulations compliance. To get the lowest engine-out emissions feasible, the engine must be kept clean and reasonably free of wear. In order to maintain high pollutant neutralization efficiency, the complicated aftertreatment systems must also be free of impurities from fuels and lubricants.

Restraining Factors

A significant amount of this e-commerce logistics is carried out by road, necessitating the use of commercial vehicles. As a result, corporations with bigger fleets of ICE vehicles will be impacted by the emission standards. Some small-scale commercial vehicle owners who cannot afford such an investment will choose pre-owned or refurbished ICE commercial vehicles. However, this may threaten the net-zero emission targets. Such factors are hampering the market growth in the forecast period.

Market Segmentation

The Euro 7 regulations compliant market share is classified into vehicle type and sensors.

- The LCVs segment is expected to hold the largest share of the Euro 7 regulations compliant market during the forecast period.

Based on the vehicle type, the Euro 7 regulations compliant market is categorized into passenger cars, LCVs, and HCVs. Among these, the LCVs segment is expected to hold the largest share of the Euro 7 regulations compliant market during the forecast period. According to the European Commission, NOx emissions will be lowered by 35-56%, with tailpipe particles decreased by 13% in passenger vehicles and vans and 39% in buses and trucks. The LCV segment will see a 27% reduction in particle emissions from brakes and tires. Diesel penetration in Europe is predicted to be between 80 and 85 per cent by 2022, with gasoline engines increasing in the LCV market. As a result, technologies like as SCR paired with EGR are employed in the LCV industry to control NOx emissions.

- The MAP/MAF sensors segment is expected to grow at the fastest CAGR during the forecast period.

Based on the sensors, the Euro 7 regulations compliant market is categorized into exhaust gas pressure & temperature, PM, oxygen/lamba, NOx, and MAP/MAF sensors. Among these, the MAP/MAF sensors segment is expected to grow at the fastest CAGR during the forecast period. These sensors measure the pressure and mixture of the engine's air intake. While both sensors measure intake air characteristics, the MAP sensor is normally located in the intake manifold and the MAF sensor in the throttle body. The proper functioning of the MAF and MAP sensors is critical to the vehicle's normal operation. These sensors are extensively employed in light- and medium-duty uses and their demand is likely to rise as more diesel engines comply with Euro 7 requirements and adopt EGR systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Euro 7 regulations compliant market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Forvia

- Tenneco Inc.

- Eberspächer

- Johnson Matthey

- Umicore

- Others

Key Market Developments

- In December 2023, on new pollution regulations for light- and heavy-duty cars, the European Parliament and the EU Council have struck a consensus. The new rule, pending formal adoption by both Parliament and Council, will replace the present Euro-6 regulation for passenger vehicles and vans (EC) 715/2007 and the Euro-VI regulation for trucks and buses (EC) 595/2009.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2036. Spherical Insights has segmented the Euro 7 regulations compliant market based on the below-mentioned segments:

Euro 7 Regulations Compliant Market, By Vehicle Type

- Passenger Cars

- LCVs

- HCVs

Euro 7 Regulations Compliant Market, By Sensors

- Exhaust Gas Pressure & Temperature

- PM

- Oxygen/Lamba

- NOx

- MAP/MAF Sensors

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Euro 7 regulations compliant market over the forecast period?The Euro 7 regulations compliant market size is expected to Grow from USD 12.56 million units in 2026 to USD 13.02 million units by 2036, at a CAGR of 0.36% during the forecast period 2026-2036.

-

2. Who are the top key players in the Euro 7 regulations compliant market?Forvia, Tenneco Inc., Eberspächer, Johnson Matthey, Umicore, and Others.

Need help to buy this report?