Global Ethylene Propylene Diene Monomer Market Size, By Product (Hoses, Seals & O-Rings), By Application (Building & Construction, Tires & Tubes, Automotive), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 to 2032.

Industry: Chemicals & MaterialsGlobal Ethylene Propylene Diene Monomer Market Insights Forecasts to 2032

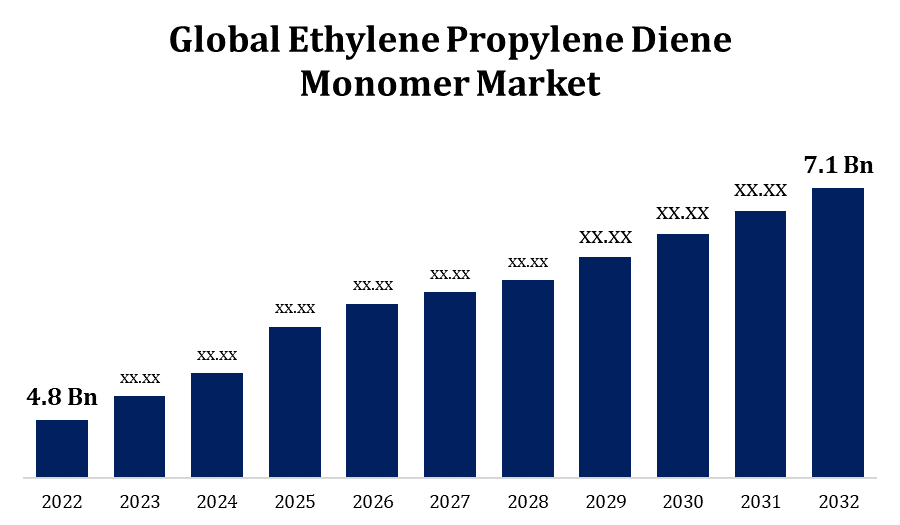

- The Global Ethylene Propylene Diene Monomer Market Size was valued at USD 4.8 Billion in 2022.

- The Market is Growing at a CAGR of 6.6% from 2022 to 2032

- The Worldwide Ethylene Propylene Diene Monomer Market Size is Expected to reach USD 7.1 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Ethylene Propylene Diene Monomer Market Size is expected to reach USD 7.1 Billion by 2032, at a CAGR of 6.6% during the forecast period 2022 to 2032.

Several factors contribute to the growth of the EPDM market. Increased demand for weatherstripping, gaskets, and seals in the automotive industry has played a significant influence. EPDM is commonly used for roofing membranes and seals, therefore the building industry also participates. EPDM's resilience to severe temperatures, UV radiation, and ozone makes it a long-lasting material for a variety of applications. Given EPDM's recyclability and environmental friendliness, the global quest for sustainable and energy-efficient solutions has increased its popularity.

Ethylene Propylene Diene Monomer Market Value Chain Analysis

The process starts with the creation of ethylene, propylene, and diene monomers. These raw ingredients serve as the foundation for EPDM. The basic components are polymerized, which means they are chemically linked to form the EPDM polymer. Catalysts are frequently employed to speed up this process. To obtain certain qualities, curing agents, accelerators, and fillers are added to the EPDM polymer. This procedure improves properties such as heat resistance, flexibility, and UV stability. Depending on the required end product, the compounded EPDM is subsequently processed through extrusion, calendaring, or moulding. This could be in the shape of sheets, profiles, gaskets, or other materials. Vulcanization is a critical step that involves treating EPDM with heat and sulphur or other cross-linking agents. To ensure consistency and compliance with industry standards, stringent quality control methods are used throughout the manufacturing process. To reach end-users in diverse industries, completed EPDM products are distributed through a network of suppliers, distributors, and wholesalers. EPDM is used in industries such as automotive, construction, and electrical for weatherstripping, sealing, roofing, and wire insulation.

Ethylene Propylene Diene Monomer Market Opportunity Analysis

The automotive industry offers enormous opportunities for EPDM, particularly in the manufacture of weatherstrips, gaskets, and seals. As the automobile sector expands, so does the demand for dependable and long-lasting materials such as EPDM. EPDM is an important material in the construction sector due to its waterproofing and weather-resistant qualities, particularly for roofing membranes and seals. The growing emphasis on sustainable and energy-efficient construction processes opens up new opportunities. EPDM is an excellent choice for solar panel installations and other renewable energy applications. Because of its resilience to UV radiation and weathering, it is an excellent choice for outdoor applications, helping to the expansion of the renewable energy sector. Exploration and expansion into newer markets can provide new opportunities for EPDM growth. As infrastructure projects such as roads, bridges, and tunnels remain a global priority, EPDM can find uses in a variety of construction components, offering market growth potential.

Global Ethylene Propylene Diene Monomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.6% |

| 2032 Value Projection: | USD 7.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Region. |

| Companies covered:: | DuPont (U.S.), Exxon Mobil Corporation (U.S.), Lanxess (Germany), Mitsui Chemicals, Inc (Japan), Sumitomo Chemical Co. Ltd (Japan), SK geo centric Co., Ltd. (South Korea), China Petrochemical Corporation (china), Johns Manville. (U.S.), Berkshire Hathaway Inc. (U.S.), JSR Corporation (Japan), KUMHO POLYCHEM (South Korea), Lion Elastomers (U.S), PJSC |

| Growth Drivers: | Increasing investments in the automotive sector |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Ethylene Propylene Diene Monomer Market Dynamics

Increasing investments in the automotive sector

EPDM is commonly used in the automotive sector to make weatherstrips and seals. As investments in the automotive sector increase, so does demand for these components, which ensure that vehicles are weather-tight and soundproof. EPDM is utilised in both the exterior and interior of automobiles, including as window seals, door seals, and grommets. Demand for these EPDM applications is projected to rise as the automobile industry expands. The increased emphasis on electric vehicles confronts EPDM with a once-in-a-lifetime opportunity. As the automobile industry transitions towards EV production, materials that can endure the unique challenges given by electric drivetrains are in demand. EPDM is a good choice because of its electrical insulating qualities.

Restraints & Challenges

The market price of ethylene, propylene, and diene monomers can fluctuate. Any changes in raw material prices can have an impact on EPDM production costs. Other elastomers and synthetic materials compete with EPDM. Alternative materials with similar or improved qualities may represent a challenge to EPDM's market share. Economic downturns or uncertainty can diminish demand in important industries such as automotive and construction, influencing the entire EPDM market. The performance of EPDM in the market is highly related to the automotive, construction, and electrical industries. Any slowdown or difficulty in these industries can have an influence on EPDM demand. EPDM is a material that is commonly used in the construction sector for roofing membranes and seals. Fluctuations in construction demand, caused by economic conditions or regulatory changes, might have an impact on EPDM demand.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Ethylene Propylene Diene Monomer Market from 2023 to 2032. EPDM is widely used in the automotive industry in North America for weatherstrips, seals, and other uses. EPDM demand is increasing as the automotive sector expands, particularly the production of electric automobiles. EPDM is used in the construction industry in North America for roofing membranes and seals due to its durability and weather resistance. EPDM demand is being supported by continued increase in construction and infrastructure projects. North America's concentration on renewable energy presents potential for EPDM in solar panel installations. EPDM's UV protection makes it ideal for outdoor applications in the renewable energy sector.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Rapid industrialization and urbanisation in countries such as China and India drive demand for construction materials such as EPDM for roofing and sealing. The Asia-Pacific automobile sector, notably in China, is driving demand for EPDM in automotive components such as weatherstrips, gaskets, and seals. The expanding electrical and electronics industry in Asia-Pacific opens up new possibilities for EPDM, such as wire insulation and grommets. The Asia-Pacific EPDM market trends reflect a significant emphasis on industrial and infrastructure development, as well as a growing need for high-performance elastomers.

Segmentation Analysis

Insights by Product

The seals and O-rings product segment accounted for the largest market share over the forecast period 2023 to 2032. EPDM seals and O-rings are critical components in the automotive sector. As the automotive industry expands, driven by traditional vehicle manufacturing and the rise of electric vehicles, the demand for high-quality seals and O-rings has expanded. Seals and O-rings are used in the construction sector for a variety of applications, including doors, windows, and infrastructure projects. Because of its weather-resistant features, EPDM is a popular choice, which contributes to the expansion of this product area. EPDM seals and O-rings are used in the electrical and electronics industries to offer insulation and protection in wire and electronic components. The growing demand for electronic devices and wiring solutions has boosted this category even further.

Insights by Application

The automotive segment accounted for the largest market share over the forecast period 2023 to 2032. Due to its great resistance to weathering, UV radiation, and temperature extremes, EPDM is frequently utilised in the automotive sector for weatherstrips. These weatherstrips provide a tight seal around car doors, windows, and other openings. EPDM is a suitable material for creating seals and gaskets in automotive applications due to its sealing qualities. These components are critical in preventing leaks and maintaining the integrity of various systems such as engines and transmissions. EPDM is used to make interior components like as air vent seals, dashboard gaskets, and other parts that require durability and resistance to environmental influences. With the increased emphasis on electric vehicles, EPDM remains an important component in EVs.

Recent Market Developments

- In April 2021, HOLCIM purchased Firestone Building Products Company, LLC from Bridgestone Corporation for USD 3.4 billion in order to expand its position in the elastomer sector.

Competitive Landscape

Major players in the market

- DuPont (U.S.)

- Exxon Mobil Corporation (U.S.)

- Lanxess (Germany)

- Mitsui Chemicals, Inc (Japan)

- Sumitomo Chemical Co. Ltd (Japan)

- SK geo centric Co., Ltd. (South Korea)

- China Petrochemical Corporation (china)

- Johns Manville. (U.S.)

- Berkshire Hathaway Inc. (U.S.)

- JSR Corporation (Japan)

- KUMHO POLYCHEM (South Korea)

- Lion Elastomers (U.S)

- PJSC "Nizhnekamskneftekhim’’ (Russia)

- American Rubber (U.S.)

- Rotadyne Tools Pvt. Ltd. (India)

- American Urethane, (U.S.)

- Argonics, Inc. (U.S.)

- Griffith Rubber Mills (U.S.)

- HINDUSTAN RUBBER INDUSTRIES (India)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Ethylene Propylene Diene Monomer Market, Product Analysis

- Hoses

- Seals & O-Rings

Ethylene Propylene Diene Monomer Market, Application Analysis

- Building & Construction

- Tires & Tubes

- Automotive

Ethylene Propylene Diene Monomer Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Ethylene Propylene Diene Monomer Market?The global Ethylene Propylene Diene Monomer Market is expected to grow from USD 4.8 Billion in 2023 to USD 7.1 Billion by 2032, at a CAGR of 6.6% during the forecast period 2023-2032.

-

2. Who are the key market players of the Ethylene Propylene Diene Monomer Market?Some of the key market players of market are DuPont (U.S.), Exxon Mobil Corporation (U.S.), Lanxess (Germany), Mitsui Chemicals, Inc (Japan), Sumitomo Chemical Co. Ltd (Japan), SK geo centric Co., Ltd. (South Korea), china petrochemical corporation (china), Johns Manville. (U.S.), Berkshire Hathaway Inc. (U.S.), JSR Corporation (Japan), KUMHO POLYCHEM (South Korea), Lion Elastomers (U.S), PJSC "Nizhnekamskneftekhim’’ (Russia), American Rubber (U.S.), Rotadyne Tools Pvt. Ltd. (India), American Urethane, (U.S.), Argonics, Inc. (U.S.), Griffith Rubber Mills (U.S.), HINDUSTAN RUBBER INDUSTRIES (India).

-

3. Which segment holds the largest market share?The automotive segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Ethylene Propylene Diene Monomer Market?North America is dominating the Ethylene Propylene Diene Monomer Market with the highest market share.

Need help to buy this report?