Global Ethylene Dichloride Market Size, Share, and COVID-19 Impact Analysis, By End User (Construction, Automotive, Packaging, Furniture, Medical, and Others), By Application (Vinyl Chloride Monomer, Ethylene Amines, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ethylene Dichloride Market Insights Forecasts to 2035

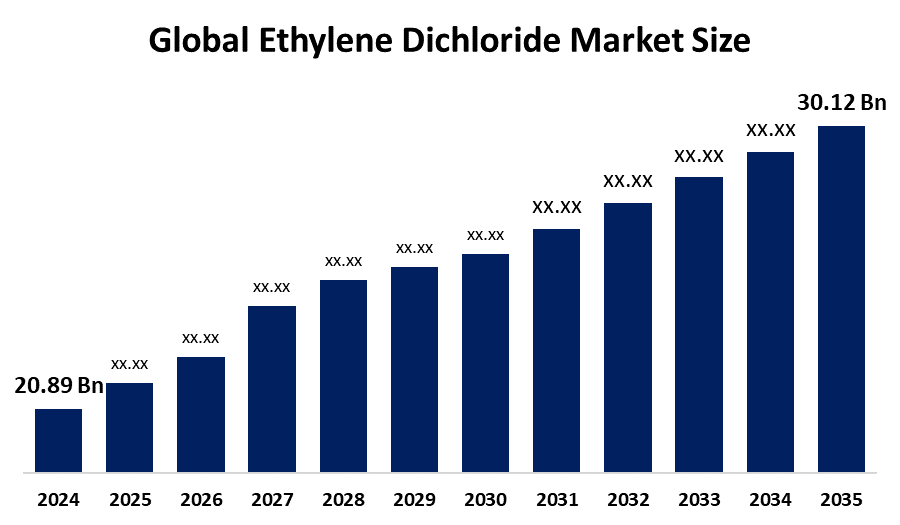

- The Global Ethylene Dichloride Market Size Was Estimated at USD 20.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.38% from 2025 to 2035

- The Worldwide Ethylene Dichloride Market Size is Expected to Reach USD 30.12 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Ethylene Dichloride Market Size was worth around USD 20.89 Billion in 2024 and is predicted to grow to around USD 30.12 Billion by 2035 with a compound annual growth rate (CAGR) of 3.38% from 2025 to 2035. The Opportunities in the ethylene dichloride (EDC) market include growing PVC production applications, growing demand in emerging economies, technological developments in production processes, environmental regulations driving sustainable alternatives, and possible expansion in downstream chemical industries.

Global Ethylene Dichloride Market Forecast and Revenue Outlook

- 2024 Market Size: USD 20.89 Billion

- 2035 Projected Market Size: USD 30.12 Billion

- CAGR (2025-2035): 3.38%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The manufacture, distribution, and consumption of 1,2-dichloroethane, a chlorinated hydrocarbon intermediate produced by direct chlorination or oxychlorination of ethylene, are all included in the global ecosystem known as the ethylene dichloride (EDC) market. EDC is used as a solvent in organic synthesis and extraction processes, but it is primarily used as a precursor for vinyl chloride monomer (VCM) in the production of polyvinyl chloride (PVC) resin, which accounts for more than 90% of demand. For Instance, in September 2025, India’s Ministry of Chemicals and Fertilizers introduced the Quality Control Order (QCO) 2025 for Ethylene Dichloride (EDC), updating import and production standards to enhance safety and quality, replacing the previous 2021 regulatory framework. Increased demand for fuels and gasoline, urbanization, and infrastructure development are important factors. The main usage of ethylene dichloride is in the synthesis of vinyl chloride monomer, a precursor for PVC, which is widely used in the packaging, automotive, and construction sectors. Conveniently, dichloroethane can be recycled and used again in the same building. The dichloroethane market is largely driven by PVC and the building industry.

Key Market Insights

- North America is expected to account for the largest share in the ethylene dichloride market during the forecast period.

- In terms of end user, the construction segment is projected to lead the ethylene dichloride market throughout the forecast period

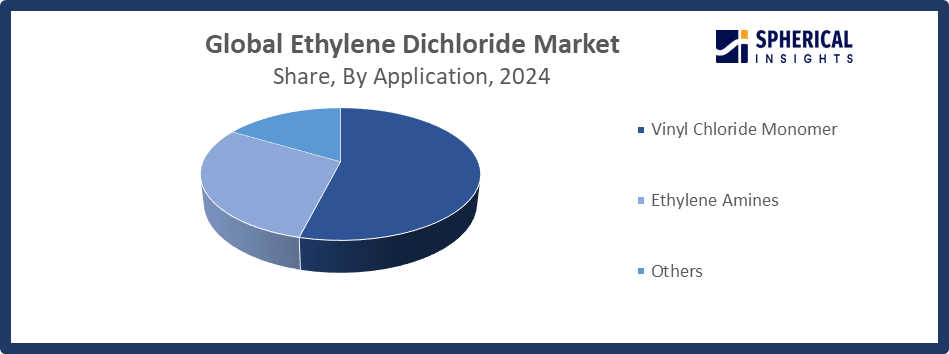

- In terms of application, the vinyl chloride monomer segment captured the largest portion of the market

Ethylene Dichloride Market Trends

- Infrastructure Development: The demand for PVC and, by extension, EDC, is being driven by rapid urbanization and infrastructure development, especially in Asia-Pacific and Latin America.

- Technological Advancements: Improved catalytic processes and energy-efficient manufacturing are two innovations in EDC production that are increasing production capacity while lowering environmental impact.

- Regulatory Pressures: Strict environmental laws about emissions control and chlorinated solvents may hinder market expansion, but they are also encouraging businesses to use sustainable production techniques.

- Regional Dynamics: The Asia-Pacific region is predicted to develop at the highest rate, while North America is projected to dominate the market due to increased PVC manufacturing capacity.

Report Coverage

This research report categorizes the ethylene dichloride market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the ethylene dichloride market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the ethylene dichloride market.

Global Ethylene Dichloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.38% |

| 2035 Value Projection: | USD 30.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By End User, By Application, By Region |

| Companies covered:: | PPG Industries, Olin Corporation, Axiall Corporation, PT Asahimas Chemical, The Dow Chemical Company, Formosa Plastics Corporation, Westlake Chemical Corporation, Occidental Petroleum Corporation, Horizon Chemical Industry Co. Ltd, Punjab Chemicals & Crop Protection Limited, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving factors

The widespread use of ethylene dichloride (EDC) in the manufacturing of polyvinyl chloride (PVC), which makes up more than 95% of all EDC usage, is the main factor driving the market's expansion. Due to rising demand for vinyl chloride monomer manufacturing and growing applications across a range of industries, the global market for ethylene dichloride is expected to increase. The demand for polyvinyl chloride (PVC), the main derivative of ethylene dichloride, has significantly increased in the global ethylene dichloride market. PVC's growing usage is a result of its widespread use in electrical, automotive, and construction applications.

Restraining Factor

The market for ethylene dichloride (EDC) is restricted by a number of issues, including strict environmental laws, health and safety concerns, unstable raw material prices, high energy costs, and the growing trend for eco-friendly alternatives, which could restrict market expansion.

Market Segmentation

The global ethylene dichloride market is divided into end user and application.

Global Ethylene Dichloride Market, By End User:

- The construction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the global ethylene dichloride market is segmented into construction, automotive, packaging, furniture, medical, and others. Among these, the construction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The construction market is widely used in the manufacturing of polyvinyl chloride (PVC), a crucial EDC derivative. Because of its strength, chemical resistance, and affordability, PVC is frequently used in building materials such as pipes, window profiles, flooring, roofing membranes, and insulation. Demand was further boosted by emerging economies' rapid urbanization, infrastructure expansion, and government spending on public services and housing.

The automotive segment in the ethylene dichloride market is expected to grow at the fastest CAGR over the forecast period. The growing use of polyvinyl chloride (PVC) in the production of automobiles is driving the automotive sector. Because of its flexibility, durability, and affordability, PVC derived from EDC is widely utilized in lightweight components, electrical insulation, vehicle interiors, and seals. Demand is further accelerated by the growing trend toward electric vehicles (EVs) and lightweight materials to increase fuel economy and lower emissions.

Global Ethylene Dichloride Market, By Application:

- The vinyl chloride monomer segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global ethylene dichloride market is segmented into vinyl chloride monomer, ethylene amines, and others. Among these, the vinyl chloride monomer segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Vinyl chloride monomer (VCM) is the main component used in the production of polyvinyl chloride (PVC), a versatile synthetic plastic. PVC is used in many different industries and applications. PVC pipes are widely used in irrigation, plumbing, drainage systems, and subterranean cable protection.

Get more details on this report -

The ethylene amines segment in the ethylene dichloride market is expected to grow at the fastest CAGR over the forecast period. The growing need for ethylene amines in the manufacturing of chelating agents, corrosion inhibitors, resins, agrochemicals, and medicines is the main factor propelling the expansion of the ethylene amines segment.

Regional Segment Analysis of the Global Ethylene Dichloride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Ethylene Dichloride Market Trends

Get more details on this report -

North America is expected to hold the largest share of the global ethylene dichloride market over the forecast period.

The company's Plaquemine, Louisiana, complex, which currently has a new vinyl chloride monomer unit with a production capacity of about 1 million mt/year and an ethylene dichloride unit with a production capacity of 680,388 mt/year, had to extend the entire PVC production chain for North America. In 2025, EPA launched strict emission and waste management guidelines for chlorine-based chemicals, including EDC, designating production sites as high-risk and promoting sustainable recovery through REMADE Institute-funded PVC recycling research. North America's strong petrochemical infrastructure and plentiful, inexpensive ethylene feedstock from shale gas production more than two million barrels per day in 2023 are its main drivers.

U.S Ethylene Dichloride Market Trends

The manufacture, distribution, and consumption of ethylene dichloride (EDC), a crucial intermediary in the creation of vinyl chloride monomer (VCM) and polyvinyl chloride (PVC), are all included in the U.S. market. The market is mainly driven by the strong demand for PVC in the packaging, automotive, and construction industries, which is bolstered by infrastructure development and industrial expansion. Operational standards and environmental compliance are impacted by technological developments in manufacturing as well as strict regulatory frameworks from organizations like the EPA.

Canada Ethylene Dichloride Market Trends

The manufacturing, distribution, and use of ethylene dichloride (EDC), mostly as a precursor for vinyl chloride monomer (VCM) and polyvinyl chloride (PVC), are all part of the Canada market. Urbanization and infrastructure development boost the growing demand for PVC in the packaging, automotive, and construction industries. While regulatory frameworks guarantee environmental and safety compliance, technological developments in EDC production processes improve efficiency and sustainability.

Asia Pacific Ethylene Dichloride Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the ethylene dichloride market during the forecast period.

The growing urbanization and government initiatives to build infrastructure for both commercial and public benefit. Ethylene dichloride is also used to create ethylene amines, which are utilized as wood preservatives, lubricants and fuel additives, corrosion inhibitors, and surfactants. Additionally, the ethylene dichloride market in China had the biggest market share, while the Asia-Pacific region's fastest-growing ethylene dichloride market was in India. In September 2025, India’s Ministry of Chemicals and Fertilizers launched the Quality Control Order (QCO) 2025 for EDC, implementing IS 869:2020 standards to strengthen import quality, ensure domestic production safety, and promote compliance across the chemical industry.

China Ethylene Dichloride Market Trends

The manufacture, distribution, and consumption of ethylene dichloride (EDC), which is primarily utilized as a precursor for vinyl chloride monomer (VCM) and polyvinyl chloride (PVC), are all included in the China market. Rapid urbanization and industrialization are driving the strong demand for PVC in the packaging, automotive, and construction industries. Environmental compliance and production efficiency are improved by technological developments in EDC manufacturing. Safe chemical management is guided by sustainability goals and regulatory frameworks.

Japan Ethylene Dichloride Market Trends

The manufacturing, distribution, and use of ethylene dichloride (EDC), mainly as a precursor for vinyl chloride monomer (VCM) and polyvinyl chloride (PVC), are all included in the Japanese market. Japan's advanced industrial and manufacturing sectors promote the need for PVC in the construction, automotive, and packaging industries, which propels market expansion. While strict regulations guarantee sustainability and safety, technological developments in EDC production improve operational effectiveness and environmental compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ethylene dichloride market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Ethylene Dichloride Market Include

- PPG Industries

- Olin Corporation

- Axiall Corporation

- PT Asahimas Chemical

- The Dow Chemical Company

- Formosa Plastics Corporation

- Westlake Chemical Corporation

- Occidental Petroleum Corporation

- Horizon Chemical Industry Co. Ltd

- Punjab Chemicals & Crop Protection Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In June 2025, Indonesia’s Chandra Asri Petrochemical launched an $800 million joint venture with Danantara and INA to build a chlor-alkali-EDC plant in Cilegon, targeting 500,000 tons/year capacity by 2027, enhancing self-sufficiency and boosting EDC exports.

- In March 2022, Olin Corporation’s stock launched a strong rally last week; however, analysts anticipate a possible correction, prompting investors to reassess the company’s fundamentals and three-year performance to determine fair valuation.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ethylene dichloride market based on the following segments:

Global Ethylene Dichloride Market, By End User

- Construction

- Automotive

- Packaging

- Furniture

- Medical

- Others

Global Ethylene Dichloride Market, By Application

- Vinyl Chloride Monomer

- Ethylene Amines

- Others

Global Ethylene Dichloride Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Ethylene Dichloride market over the forecast period?The global Ethylene Dichloride market is projected to expand at a CAGR of 3.38% during the forecast period.

-

2. What is the market size of the Ethylene Dichloride market?The global Ethylene Dichloride market size is expected to grow from USD 20.89 billion in 2024 to USD 30.12 billion by 2035, at a CAGR 3.38% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Ethylene Dichloride market?North America is anticipated to hold the largest share of the Ethylene Dichloride market over the predicted timeframe.

-

4. Who are the top companies operating in the global Ethylene Dichloride market?PPG Industries, Olin Corporation, Axiall Corporation, PT Asahimas Chemical, The Dow Chemical Company, Formosa Plastics Corporation, Westlake Chemical Corporation, Occidental Petroleum Corporation, Horizon Chemical Industry Co. Ltd, Punjab Chemicals & Crop Protection Limited, and others.

-

5. What factors are driving the growth of the Ethylene Dichloride market?The Ethylene Dichloride market is driven by increasing PVC demand in construction, automotive, and packaging sectors, rapid industrialization, technological advancements in production, and government initiatives promoting quality and sustainability.

-

6. What are market trends in the Ethylene Dichloride market?Rising PVC usage, the use of energy-efficient production technologies, growth in developing nations, regulatory focus on sustainability and safety, and increasing investments in recycling and environmentally friendly chemical management are some of the major developments.

-

7. What are the main challenges restricting wider adoption of the Ethylene Dichloride market?Market growth is constrained by stringent environmental regulations, health and safety concerns, volatile raw material prices, high production costs, and increasing preference for sustainable and eco-friendly alternatives.

Need help to buy this report?