Global Ethylene Butyl Acrylate Market Size, Share, and COVID-19 Impact Analysis, By Product Type (High Purity and Low Purity), By Application (Adhesives, Sealants, Coatings, Plastics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ethylene Butyl Acrylate Market Size Insights Forecasts to 2035

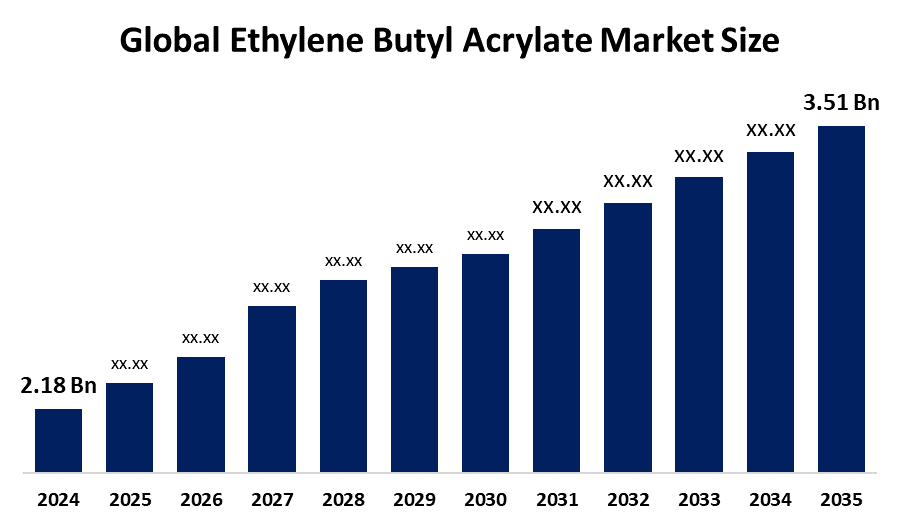

- The Global Ethylene Butyl Acrylate Market Size Was Estimated at USD 2.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.43% from 2025 to 2035

- The Worldwide Ethylene Butyl Acrylate Market Size is Expected to Reach USD 3.51 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Ethylene Butyl Acrylate Market Size was worth around USD 2.18 Billion in 2024, Growing to 2.28 Billion in 2025, and is predicted to Grow to around USD 3.51 Billion by 2035 with a compound annual growth rate (CAGR) of 4.43% from 2025 to 2035. Growing applications in the adhesives, packaging, and automotive industries, as well as increased demand for flexible films and environmentally friendly goods, as well as expansion in emerging markets due to greater industrialization, are some of the opportunities in the ethylene butyl acrylate market.

Global Ethylene Butyl Acrylate Market Forecast and Revenue Size

- 2024 Market Size: USD 2.18 Billion

- 2025 Market Size: USD 2.28 Billion

- 2035 Projected Market Size: USD 3.51 Billion

- CAGR (2025-2035): 4.43%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The manufacturing and distribution of EBA copolymers, which are low-density polyethylene resins created by copolymerizing ethylene and butyl acrylate monomers, are included in the ethylene butyl acrylate (EBA) market. These adaptable materials are used in wire insulation, adhesives, coatings, flexible packaging, and automotive parts owing to their improved flexibility, adhesion, and thermal stability. For instance, in October 2025, BASF has successfully launched the butyl acrylate (BA) plant and completed the mechanical installation of the steam cracker and integrated petrochemical plants at its Zhanjiang Verbund site. These milestones advance BASF’s plan for full operational launch by the end of 2025, strengthening supply of high-quality petrochemicals in Asia Pacific. Growing uses in surface coatings, sealants, adhesives, and co-monomers in end-use industries like packaging, textiles, leather, and plastics are responsible for the growth spike. The market growth for ethylene butyl acrylate is expected to be positively driven by the growing use of these acrylate compounds in a variety of applications, the introduction of novel and sustainable manufacturing techniques, and the increase in demand in the petrochemical end-use sector.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the ethylene butyl acrylate market during the forecast period.

- In terms of product type, the high purity segment is projected to lead the ethylene butyl acrylate market throughout the forecast period

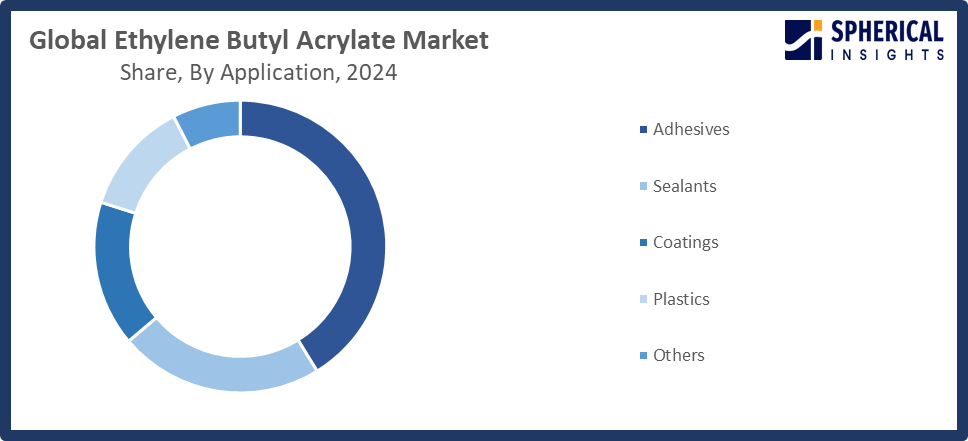

- In terms of application, the adhesives segment captured the largest portion of the market

Ethylene Butyl Acrylate Market Trends

- Growing use of cable and wire insulation to improve weather resistance

- Increasing R&D expenditures for novel EBA formulations and applications

- Growing demand for sustainable and environmentally friendly polymer products

- Durability has led to an increase in use in the construction and automotive industries.

- Technological developments enhancing EBA performance and manufacturing efficiency

Report Coverage

This research report categorizes the ethylene butyl acrylate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the ethylene butyl acrylate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the ethylene butyl acrylate market.

Global Ethylene Butyl Acrylate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.18 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.43% |

| 2035 Value Projection: | USD 3.51 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Dow, BASF, INEOS, SABIC, Evonik, Arkema, Kuraray, Celanese, ExxonMobil, Sanyo Chemical, Shanxi Sanwei, Formosa Plastics, Mitsubishi Chemical, LyondellBasell, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors:

The expanding automotive and construction sectors are driving the market for ethylene butyl acrylate market. Furthermore, new and improved EBA formulations with improved qualities are being developed as a result of technological breakthroughs, which is growing the market. The EBA industry is expanding as a result of rising demand for sustainable building solutions and lightweight automobiles. Growing demand in a number of industries, such as consumer products, construction, and the automotive sector, is fueling the ethylene butyl acrylate market. A growing emphasis on sustainability and the changing field of material science indicate that ethylene butyl acrylate will be essential in upcoming applications, strengthening its place in the ethylene butyl acrylate market.

Restraining Factors:

The market for ethylene butyl acrylate is restricted by a number of factors, including fluctuating raw material prices, environmental laws, high production costs, competition from substitute polymers, and a lack of recycling infrastructure. These elements work together to hamper market expansion and delay broad adoption in particular areas and sectors.

Market Segmentation

The global ethylene butyl acrylate market is divided into product type and application.

Global Ethylene Butyl Acrylate Market, By Product Type:

Why is high-purity ethylene butyl acrylate primarily used in industries like electronics, healthcare, and specialty coatings?

The high purity segment led the ethylene butyl acrylate market, generating the largest revenue share. High-purity ethylene butyl acrylate is mostly utilized in applications that need exacting performance characteristics and quality criteria. High purity materials are frequently required by sectors including electronics, healthcare, and specialty coatings to guarantee dependability and effectiveness.

The low purity segment in the ethylene butyl acrylate market is expected to grow at the fastest CAGR over the forecast period. Low-purity applications for ethylene butyl acrylate can be found in fields with considerable performance needs but no such strict regulations. Because of their affordability and suitable functional qualities, low-purity variants are frequently used in the construction and packaging industries.

Global Ethylene Butyl Acrylate Market, By Application:

What makes ethylene butyl acrylate a preferred choice in construction, automotive, and packaging adhesives?

The adhesives segment held the largest market share in the ethylene butyl acrylate market. The adhesive application segment is expanding significantly because of the compound's superior bonding qualities and flexibility, which make it a popular option in the construction, automotive, and packaging sectors. Ethylene butyl acrylate's capacity to offer robust adhesive qualities while preserving flexibility is essential in dynamic settings where materials are subjected to a range of pressures.

Get more details on this report -

The sealants segment in the ethylene butyl acrylate market is expected to grow at the fastest CAGR over the forecast period. Another important market for ethylene butyl acrylate is sealants. The construction sector requires sealants that are easy to apply, long-lasting, and resistant to weather. Ethylene butyl acrylate satisfies these demands by offering strong sealing solutions that improve structural integrity and stop leaks.

Regional Segment Analysis of the Global Ethylene Butyl Acrylate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Ethylene Butyl Acrylate Market Trends

Get more details on this report -

Why is the demand for ethylene butyl acrylate increasing in countries like China, India, and Southeast Asia?

The demand for ethylene butyl acrylate is being driven by the fast expansion of the packaging, construction, and automotive sectors in nations like China, India, and Southeast Asia. A new production complex comprising plants for glacial acrylic acid (GAA), butyl acrylate (BA), and 2-ethylhexyl acrylate (2-EHA) was announced by BASF at its Verbund facility in Zhanjiang, China. The complex, which is expected to be operational by 2025, will serve the rapidly expanding acrylic acid value chain in China and Asia Pacific with an annual production capacity of about 400,000 metric tons of BA and 100,000 metric tons of 2-EHA.

Japan Ethylene Butyl Acrylate Market Trends

What factors are driving the growth of Japan's ethylene butyl acrylate (EBA) market?

Japan's ethylene butyl acrylate (EBA) market is undergoing significant changes as a result of industry breakthroughs, government programs, and strategic investments. The rising demand in sectors like adhesives, coatings, and packaging is expected to propel the growth of the Japanese EBA market. The region's increasing demand for high-quality petrochemical products is anticipated to be satisfied by strategic investments made by major companies like BASF and partnerships with regional partners.

China Ethylene Butyl Acrylate Market Trends

Which sectors are contributing to the growing demand for EBA in China?

The growing demand in sectors like adhesives, coatings, and packaging is expected to propel the Chinese EBA market's expansion. The region's increasing demand for high-quality petrochemical products is anticipated to be satisfied by strategic investments made by major companies like BASF and partnerships with regional partners. The aforementioned trends show the dynamic character of the Chinese EBA market and the significance of strategic alliances and investments in propelling industry growth and satisfying the changing needs of diverse sectors.

North America Ethylene Butyl Acrylate Market Trends

Why is EBA in high demand across construction, automotive, and packaging industries in North America?

North America's established construction and automobile industries are responsible for this. The expansion in North America is ascribed to the growing need for EBA in a variety of industries, including as construction, automotive, and packaging, which is fueled by its special qualities like flexibility, durability, and resistance to environmental factors. Dow's improved ELVALOYTM AC 3717 acrylate copolymers, which optimizes ethylene-butyl acrylate blends for recyclable films and coatings, is one of the new products being introduced in September 2025.

U.S Ethylene Butyl Acrylate Market Trends

What factors are driving the expansion of the U.S. ethylene butyl acrylate (EBA) market?

The rising demand for EBA in a variety of industries, such as construction, automotive, and packaging, due to its special qualities like flexibility, durability, and resistance to environmental factors, is responsible for the expansion of the U.S. EBA market. the United States, emphasizing the value of partnerships and smart investments in promoting business expansion and satisfying the changing needs of many sectors.

Canada Ethylene Butyl Acrylate Market Trends

What role does the Canadian Environmental Protection Act (CEPA) play in regulating polymers in Canada?

The Canadian Environmental Protection Act (CEPA) is being used to strengthen Canada's regulatory oversight of polymers. Around 264 polymers that met the "Reduced Regulatory Requirement" (RRR) criteria were marked with a "P" as part of the Domestic Substances List (DSL) amendments (May 2024), which eased regulatory burdens for low-concern forms. Variants that do not meet the RRR criteria must be evaluated for environmental and health risks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ethylene butyl acrylate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Ethylene Butyl Acrylate Market Include

- Dow

- BASF

- INEOS

- SABIC

- Evonik

- Arkema

- Kuraray

- Celanese

- ExxonMobil

- Sanyo Chemical

- Shanxi Sanwei

- Formosa Plastics

- Mitsubishi Chemical

- LyondellBasell

- Others

Recent Development

- In October 2024, Arkema has launched bio-based Ethyl Acrylate production at its Carling, France facility, using sustainably sourced bioethanol. The product features 40% bio carbon content (BCC) and reduces the product carbon footprint (PCF) by up to 30%, advancing sustainability in specialty materials.

- In October 2024, Rehau Group, a global supplier of polymer product solutions with its main office in Germany, spent Rs. 46 crore to acquire a 51 percent stake in Chennai-based Red Star Polymers Pvt Ltd. With plans to purchase the remaining 49% within three years, Rehau's Switzerland-based business is closing the deal.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ethylene butyl acrylate market based on the following segments:

Global Ethylene Butyl Acrylate Market, By Product Type

- High Purity

- Low Purity

Global Ethylene Butyl Acrylate Market, By Application

- Adhesives

- Sealants

- Coatings

- Plastics

- Others

Global Ethylene Butyl Acrylate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ethylene butyl acrylate market over the forecast period?The global ethylene butyl acrylate market is projected to expand at a CAGR of 4.43% during the forecast period.

-

2. What is the market size of the ethylene butyl acrylate market?The global ethylene butyl acrylate market size is expected to grow from USD 2.18 billion in 2024 to USD 3.51 billion by 2035, at a CAGR 4.43% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ethylene butyl acrylate market?Asia Pacific is anticipated to hold the largest share of the ethylene butyl acrylate market over the predicted timeframe.

-

4. Who are the top companies operating in the global ethylene butyl acrylate market?Dow, BASF, INEOS, SABIC, Evonik, Arkema, Kuraray, Celanese, ExxonMobil, Sanyo Chemical, Shanxi Sanwei, Formosa Plastics, Mitsubishi Chemical, LyondellBasell, and Others.

-

5. What factors are driving the growth of the ethylene butyl acrylate market?Rising demand in packaging, adhesives, and construction applications, combined with advancements in polymer technology and increasing preference for lightweight, flexible materials, are key factors driving market expansion

-

6. What are market trends in the ethylene butyl acrylate market?The move toward recyclable and bio-based materials, the rise in hot-melt adhesive use, the growth of regional capacity, and the rising need for low-VOC, environmentally friendly formulations across a range of industrial sectors are some of the major trends in the market.

-

7. What are the main challenges restricting wider adoption of the ethylene butyl acrylate market?Price fluctuations for raw materials, strict environmental laws, low awareness in developing nations, and the availability of less expensive alternative copolymers with comparable qualities all restrict the ethylene butyl acrylate market.

Need help to buy this report?