Global Ethyl Cellulose Market Size, Share, and COVID-19 Impact Analysis, By Viscosity Grade (100-400 mPa.s, 400-1000 mPa.s, and Above 1000 mPa.s), By Application (Pharmaceuticals, Adhesives and Sealants, Coatings, Food, Printing Inks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ethyl Cellulose Market Insights Forecasts to 2035

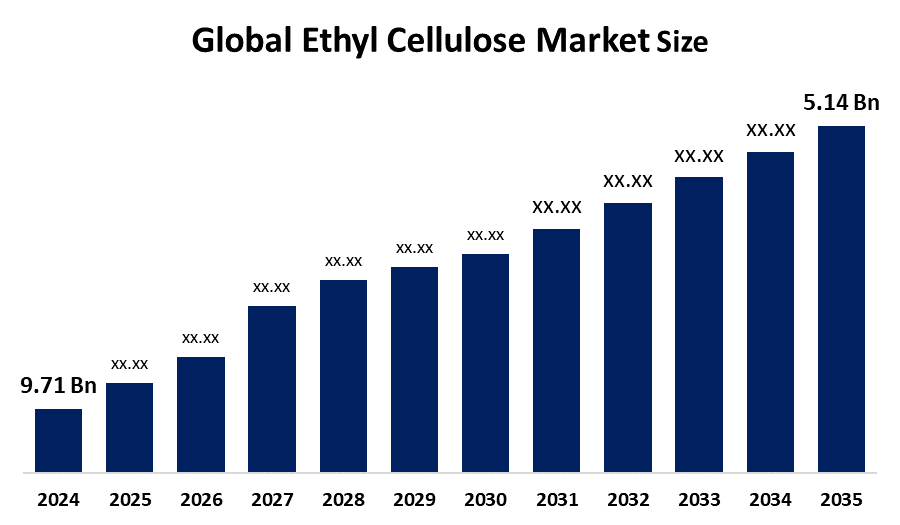

- The Global Ethyl Cellulose Market Size Was Estimated at USD 5.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.95% from 2025 to 2035

- The Worldwide Ethyl Cellulose Market Size is Expected to Reach USD 9.71 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Ethyl Cellulose Market Size was worth around USD 5.14 billion in 2024 and is predicted to grow to around USD 9.71 billion by 2035 with a compound annual growth rate (CAGR) of 5.95% from 2025 to 2035. Opportunities for the ethyl cellulose market include growing pharmaceutical applications, growing demand for bio-based and sustainable polymers, technological developments in formulation development, growth in specialty coatings, and growing adoption in the food, packaging, and industrial sectors that need high-performance functional materials.

Market Overview

A semi-synthetic derivative of cellulose, ethyl cellulose (EC) is a white, tasteless, odorless powder that is soluble in organic solvents but insoluble in water. It is a versatile polymer used in food processing as a thickening and stabilizer, in pharmaceuticals for sustained-release coatings, and in coatings for adhesives and moisture barriers. The production, distribution, and use of this substance in various industrial sectors are all included in the ethyl cellulose market. For instance, in May 2025, Colorcon and ASHA Cellulose launched ASHAKOTE, a 30% aqueous ethyl cellulose dispersion, marking a significant breakthrough for taste-masking and sustained-release pharmaceutical and nutraceutical formulations, highlighting advancing excipient innovation globally. The constant growth of oral solid-dose (OSD) medication tablets and capsules that use ethyl cellulose (EC) as a binder, film-forming, and release-control polymer is a clear, single driver for the ethyl cellulose market. This financing contributes to the expansion of API and formulation capacity, which provides a reliable offtake for essential excipients like ethyl cellulose across coatings and controlled-release systems. The market for ethyl cellulose is also expanding due to the growth of digital and communication technologies, which are easier to use and cleaner.

Report Coverage

This research report categorizes the ethyl cellulose market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ethyl cellulose market. Recent market developments and competitive strategies, such as expansion, Viscosity Grade launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ethyl cellulose market.

Global Ethyl Cellulose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.14 Billion |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 9.71 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | KG Dow Chemicals Fenchem Biotek Ltd Daicel Fine Chem Ltd Lotte Fine Chemicals SE Tylose GmbH & Co Shandong Head Co. Ltd. JRS PHARMA GmbH & Co AkzoNobel Specialty chemicals Dai-Ichi Kogyo Seiyaku Co. Ltd and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market size for ethyl cellulose is expanding due to advancements in electrical technology. The pharmaceutical industry's growing need for eco-friendly coatings, sustainable packaging, and controlled-release coatings is driving the ethyl cellulose market. Ethyl cellulose polymers are expanding due to the increasing use of solar panels and cells worldwide. The market for ethyl cellulose is being driven by the growth of the pharmaceutical industry, where it is an essential extender. The Biden-Harris Administration launched a low-carbon materials plan, increasing industry compliance, sustainability efforts, and incentives for better production techniques, while the U.S. EPA announced new 2025 emission criteria for cellulose manufacture.

Restraining Factors

The market for ethyl cellulose is restricted by a number of factors, including price fluctuations for raw materials, strict regulations, limited solubility issues, and competition from other polymers. These factors collectively hamper production efficiency, cost stability, and wider adoption across a range of industrial applications.

Market Segmentation

The ethyl cellulose market share is classified into viscosity grade and application.

- The 100-400 mPa.s segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the viscosity grade, the ethyl cellulose market is divided into 100-400 mPa.s, 400-1000 mPa.s, and above 1000 mPa.s. Among these, the 100-400 mPa.s segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The mid-range viscosity of 100–400 mPa provides the best thickness control for tablet coatings and inks, enabling easy application without undue drag. Giants in the pharmaceutical industry depend on it for sustained-release formulations where exact barrier layers guarantee consistent drug delivery.

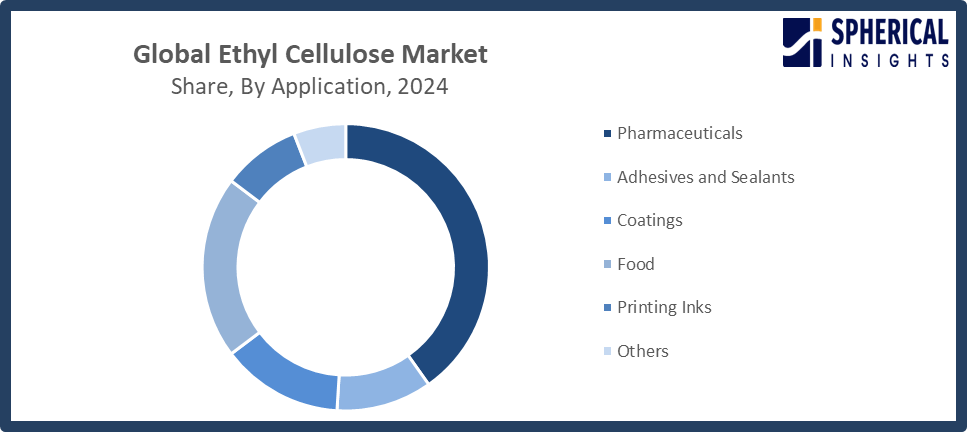

- The pharmaceuticals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the ethyl cellulose market is divided into the pharmaceuticals, adhesives and sealants, coatings, food, printing inks, and others. Among these, the pharmaceuticals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Pharmaceuticals is the industry leader in extended-release pills, moisture protection, and taste masking. As the frequency of chronic diseases rises globally, formulators are searching for safe, biodegradable polymers that satisfy strict FDA and EMA regulations, which is driving up demand.

Get more details on this report -

Regional Segment Analysis of the Ethyl Cellulose Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the ethyl cellulose market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the ethyl cellulose market size over the predicted timeframe. Rising R&D spending, strong production capacity, and government-backed sustainability initiatives that encourage cellulose-based solutions in the food, pharmaceutical, and coatings industries are all projected to contribute to the Asia-Pacific's continued dominance. The Asia Pacific region's growing food, pharmaceutical, and coatings industries, especially in China, India, Japan, and South Korea, are its main drivers. Further, research in cellulose derivatives to lessen environmental footprints is being encouraged by South Korea's and Japan's increased emphasis on bio-based and sustainable polymers. India launched its expanded 2025 Production Linked Incentive (PLI) scheme for pharmaceuticals, promoting domestic excipient production, enhancing API self-reliance, and reducing dependence on imports, strengthening the nation’s pharmaceutical manufacturing ecosystem.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the ethyl cellulose market during the forecast period. North America's market for ethyl cellulose is a result of the existence of major producers and distributors in the area. The demand for the product is further increased by the growing need for ethyl cellulose in the medicine formulation process and the accelerated use of solar panels and cells in this area, because ethyl cellulose polymers are essential to the production of solar panels. In January 2025, the U.S. Department of Energy launched a USD 23 million effort to encourage the development of bio-based cellulose derivatives, increasing domestic production and lowering dependency on imports in the face of supply chain difficulties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ethyl cellulose market, along with a comparative evaluation primarily based on their Viscosity Grade of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Viscosity Grade development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- KG

- Dow Chemicals

- Fenchem Biotek Ltd

- Daicel Fine Chem Ltd

- Lotte Fine Chemicals

- SE Tylose GmbH & Co

- Shandong Head Co. Ltd.

- JRS PHARMA GmbH & Co

- AkzoNobel Specialty chemicals

- Dai-Ichi Kogyo Seiyaku Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Ashland launched a partnership appointing Tilley Distribution as its exclusive U.S. distributor, expanding the availability of cellulosic hydrocolloids, including ethyl cellulose, for food, beverage, and nutraceutical thickeners and stabilizers.

- In January 2024, Dow launched sustainable initiatives at its Freeport, Texas facility, earning ISCC PLUS certification, while continuing production of ETHOCEL ethyl cellulose, widely utilized in pharmaceuticals, food, and industrial coating applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ethyl cellulose market based on the below-mentioned segments:

Global Ethyl Cellulose Market, By Viscosity Grade

- 100-400 mPa.s

- 400-1000 mPa.s

- Above 1000 mPa.s

Global Ethyl Cellulose Market, By Application

- Pharmaceuticals

- Adhesives and Sealants

- Coatings

- Food

- Printing Inks

- Others

Global Ethyl Cellulose Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ethyl cellulose market over the forecast period?The global ethyl cellulose market is projected to expand at a CAGR of 5.95% during the forecast period.

-

2. What is the market size of the ethyl cellulose market?The global ethyl cellulose market size is expected to grow from USD 5.14 billion in 2024 to USD 9.71 billion by 2035, at a CAGR of 5.95% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ethyl cellulose market?Asia Pacific is anticipated to hold the largest share of the ethyl cellulose market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global ethyl cellulose market?KG, Dow Chemicals, Fenchem Biotek Ltd, Daicel Fine Chem Ltd, Lotte Fine Chemicals, SE Tylose GmbH & Co, Shandong Head Co. Ltd., JRS PHARMA GmbH & Co, AkzoNobel Specialty Chemicals, Dai-Ichi Kogyo Seiyaku Co. Ltd, and others. KG, Dow Chemicals, Fenchem Biotek Ltd, Daicel Fine Chem Ltd, Lotte Fine Chemicals, SE Tylose GmbH & Co, Shandong Head Co. Ltd., JRS PHARMA GmbH & Co, AkzoNobel Specialty Chemicals, Dai-Ichi Kogyo Seiyaku Co. Ltd, and others.

-

5. What factors are driving the growth of the ethyl cellulose market?The ethyl cellulose market is propelled by rising pharmaceutical applications, demand for sustainable polymers, growth in coatings and adhesives, technological advancements, and increasing use in food, nutraceuticals, and industrial sectors.

-

6. What are the market trends in the ethyl cellulose market?The trends include the adoption of bio-based and non-toxic polymers, innovations in controlled-release drug formulations, expansion in specialty coatings, increasing regulatory support for sustainable materials, and regional growth in Asia-Pacific and North America.

-

7. What are the main challenges restricting wider adoption of the ethyl cellulose market?The market growth is constrained by raw material price volatility, stringent regulatory requirements, limited solubility and processing challenges, high production costs, and competition from alternative polymers and synthetic excipients

-

1. What is the CAGR of the ethyl cellulose market over the forecast period?The global ethyl cellulose market is projected to expand at a CAGR of 5.95% during the forecast period.

-

2. What is the market size of the ethyl cellulose market?The global ethyl cellulose market size is expected to grow from USD 5.14 billion in 2024 to USD 9.71 billion by 2035, at a CAGR of 5.95% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ethyl cellulose market?Asia Pacific is anticipated to hold the largest share of the ethyl cellulose market over the predicted timeframe

-

4. Who are the top 10 companies operating in the global ethyl cellulose market?KG, Dow Chemicals, Fenchem Biotek Ltd, Daicel Fine Chem Ltd, Lotte Fine Chemicals, SE Tylose GmbH & Co, Shandong Head Co. Ltd., JRS PHARMA GmbH & Co, AkzoNobel Specialty Chemicals, Dai-Ichi Kogyo Seiyaku Co. Ltd, and others.

-

5. What factors are driving the growth of the ethyl cellulose market?The ethyl cellulose market is propelled by rising pharmaceutical applications, demand for sustainable polymers, growth in coatings and adhesives, technological advancements, and increasing use in food, nutraceuticals, and industrial sectors.

-

6. What are the market trends in the ethyl cellulose market?The trends include the adoption of bio-based and non-toxic polymers, innovations in controlled-release drug formulations, expansion in specialty coatings, increasing regulatory support for sustainable materials, and regional growth in Asia-Pacific and North America

-

7. What are the main challenges restricting wider adoption of the ethyl cellulose market?The market growth is constrained by raw material price volatility, stringent regulatory requirements, limited solubility and processing challenges, high production costs, and competition from alternative polymers and synthetic excipients.

Need help to buy this report?