Global Ethanol Derivatives Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Ethyl Acetate, Ethylamines, Ethylene, Ethyl Ether, Ethyl Chloride, and Others), By End User (Pharmaceuticals, Paints & Coatings, Food & Beverages, Personal Care & Cosmetics, Agrochemicals, Plastics & Resins, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ethanol Derivatives Market Insights Forecasts To 2035

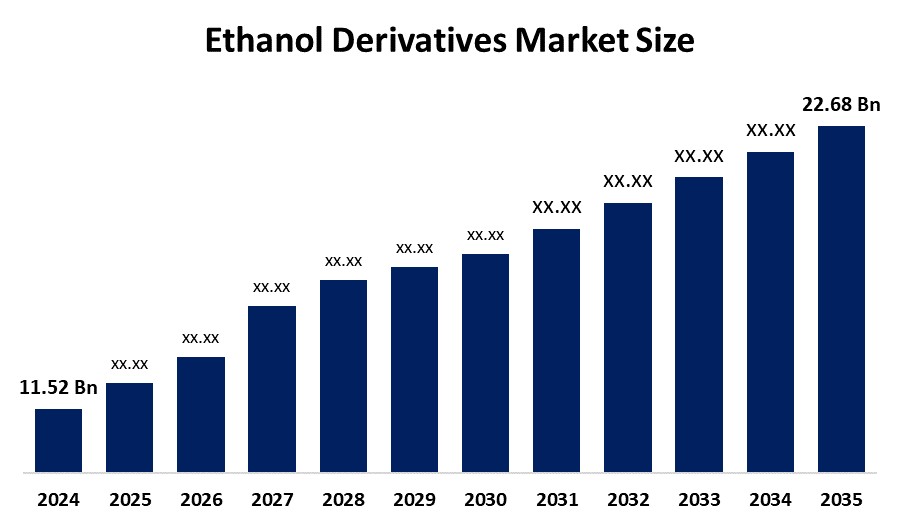

- The Global Ethanol Derivatives Market Size Was Estimated At USD 11.52 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 6.35 % From 2025 To 2035

- The Worldwide Ethanol Derivatives Market Size Is Expected To Reach USD 22.68 Billion By 2035

- North America Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Ethanol Derivatives Market Size Was Valued At Around USD 11.52 Billion In 2024 And Is Predicted To Grow To Around USD 22.68 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.35 % From 2025 To 2035. Opportunities in sustainable fuel generation, green chemicals, medicines, and industrial solvents are presented by the ethanol derivatives industry, which is fueled by growing renewable energy projects, bio-based product demand, and environmental restrictions.

Market Overview

The Manufacture, Distribution, And Consumption Of Chemical Compounds Produced From Ethanol Constitute The Global Or Regional Monopoly Of Commercial Activity Known As The "Ethanol Derivatives Market Size." The primary derivatives are acetaldehyde, diethyl ether, ethyl acetate, and ethylene glycol. They are utilized in the pharmaceutical, food and beverage, paint, and personal care sectors. These materials are widely used in many different industries, including biofuels, paints and coatings, food and beverage, cosmetics, medicines, and adhesives. For Instance, in August 2025, Sumitomo Chemical launched a pilot facility at Chiba Works, successfully producing propylene directly from ethanol, marking a major step in its demonstration project aimed at full-scale commercialization of the innovative process by the 2030s. The market is expanding due to the growing need for ethanol derivatives as a solvent and cleaning agent. The need for greener energy options is being driven by rising environmental consciousness and worries about carbon emissions and air pollution.

Report Coverage

This Research Report Categorizes The Ethanol Derivatives Market Size Based On Various Segments And Regions, Forecasts Revenue Growth, And Analyzes Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ethanol derivatives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the ethanol derivatives market.

Ethanol Derivatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.52 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.35% |

| 2023 Value Projection: | USD 22.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End User, By Product Type |

| Companies covered:: | Archer Daniels Midland Company (ADM), Cargill, Incorporated, Flint Hills Resources (A subsidiary of Koch Industries), Green Plains Inc., MGP Ingredients, Inc., Pacific Ethanol, Inc., Poet, LLC, The Andersons, Inc., Valero Energy Corporation, VeraSun Energy (Acquired by Valero Energy),and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Expanding Use Of Ethanol Derivatives In Industrial Solvents, Pharmaceuticals, And Personal Care Products, As Well As The Growing Use Of Biofuels As An Alternative Energy Source, Are The Main Factors Propelling The Growth Of The Ethanol Derivatives Market Size. Efficiency and product quality are improved by technological advancements in ethanol production and derivative synthesis. Reducing air pollution and curbing greenhouse gas emissions caused by climate change requires a shift to clean, non-combustion renewable energy sources. Ethyl tert-butyl ether, or ETBE, is becoming more and more in demand in nations like China and India as a result of the automobile industry's explosive growth and growing desire for greener energy sources.

Restraining Factors

Raw material price volatility, reliance on the availability of agricultural feedstock, high production costs for some derivatives, strict environmental and safety regulations, and competition from alternative petrochemical-based products can all restrict ethanol derivatives market growth.

Market Segmentation

The ethanol derivatives market share is classified into product type and end user.

- The ethylamines segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based On The Product Type, The Ethanol Derivatives Market Size Is Divided Into Ethyl Acetate, Ethylamines, Ethylene, Ethyl Ether, Ethyl Chloride, And Others. Among these, the ethylamines segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The widespread use of ethyl acetate as a flexible solvent in a variety of industries, such as paints and coatings, adhesives, medicines, and food processing, where it functions as a flavoring agent or reaction medium, is responsible for this. Compared to other derivatives such as ethylamines, ethyl ether, ethyl chloride, and others, its adoption has been strengthened by its advantageous characteristics, such as low toxicity, high solvency, and environmental acceptability.

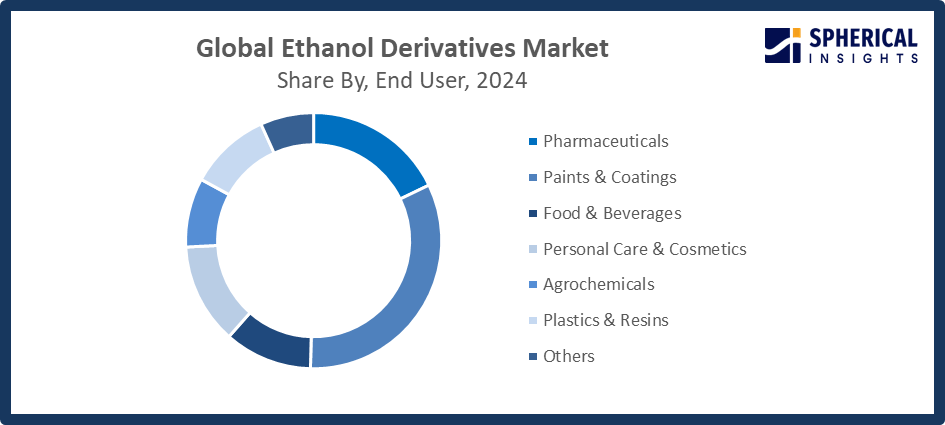

- The paints & coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based On The End User, The Ethanol Derivatives Market Size Is Divided Into Pharmaceuticals, Paints & Coatings, Food & Beverages, Personal Care & Cosmetics, Agrochemicals, Plastics & Resins, And Others. Among these, the paints & coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The construction, automotive, and industrial sectors' strong demand for high-performance coating products, which need ethanol derivatives for efficient formulation and application, drives the market for paints and coatings. In comparison to pharmaceuticals, food and drink, personal care and cosmetics, agrochemicals, plastics and resins, and other end users, the paints and coatings sector is the leading contributor to the market.

Get more details on this report -

Regional Segment Analysis of the Ethanol Derivatives Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the ethanol derivatives market over the predicted timeframe.

Get more details on this report -

Asia Pacific Is Anticipated To Hold The Largest Share Of The Ethanol Derivatives Market Size Over The Predicted Timeframe. The growing industrialization, increased population, and higher disposable income have all played a role in the rising demand for end-user sectors such as pharmaceuticals, personal care, food and beverage, and biofuels. Programs and policies that support sustainable and renewable resources are driving large investments in the manufacturing of bio-based chemicals in nations like China and India. For the 2025–2026 season, the Indian government announced that limits on the production of ethanol from sugarcane derivatives will be relaxed, leading to a 20% increase in output.

North America Is Expected To Grow At A Rapid CAGR In The Ethanol Derivatives Market Size During The Forecast Period. The region benefits from substantial investments in the manufacturing of bio-based chemicals, especially in the United States and Canada, as well as well-established infrastructure and cutting-edge research skills. The rising need for ethanol derivatives in the food and beverage and pharmaceutical sectors is responsible for the market's expansion in this area. Amendments to the Clean Fuel Regulations and a CAD 370 million Biofuel Production Incentive for 2026–2027, aimed toward low-carbon derivatives, were proposed by Canada in September 2025.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Ethanol Derivatives Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Flint Hills Resources (A subsidiary of Koch Industries)

- Green Plains Inc.

- MGP Ingredients, Inc.

- Pacific Ethanol, Inc.

- Poet, LLC

- The Andersons, Inc.

- Valero Energy Corporation

- VeraSun Energy (Acquired by Valero Energy)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Eastman Chemical Company launched a new range of ethanol-based vinyl acetate monomers for use in plastics, paints, and adhesives, providing a more sustainable alternative to conventional VAM products.

- In February 2023, DuPont, a global chemical manufacturer, launched a new line of bio-based ethanolamines derived from renewable resources to address increasing demand for sustainable and environmentally friendly chemical solutions.

- In January 2023, BASF, a leading chemical company, launched a new range of ethanolamines designed for diverse applications, including personal care products, plastics, and pharmaceuticals, offering enhanced performance and versatility.

Global Ethanol Derivatives Market, By Product Type

- Ethyl Acetate

- Ethylamines

- Ethylene

- Ethyl Ether

- Ethyl Chloride

- Others

Global Ethanol Derivatives Market, By End User

- Pharmaceuticals

- Paints & Coatings

- Food & Beverages

- Personal Care & Cosmetics

- Agrochemicals

- Plastics & Resins

- Others

Global Ethanol Derivatives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ethanol derivatives market based on the below-mentioned segments:

Global Ethanol Derivatives Market, By Product Type

- Ethyl Acetate

- Ethylamines

- Ethylene

- Ethyl Ether

- Ethyl Chloride

- Others

Global Ethanol Derivatives Market, By End User

- Pharmaceuticals

- Paints & Coatings

- Food & Beverages

- Personal Care & Cosmetics

- Agrochemicals

- Plastics & Resins

- Others

Global Ethanol Derivatives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ethanol derivatives market over the forecast period?The global ethanol derivatives market is projected to expand at a CAGR of 6.35% during the forecast period.

-

2. What is the market size of the ethanol derivatives market?The global ethanol derivatives market size is expected to grow from USD 11.52 billion in 2024 to USD 22.68 billion by 2035, at a CAGR of 6.35 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ethanol derivatives market?Asia Pacific is anticipated to hold the largest share of the ethanol derivatives market over the predicted timeframe.

-

4. Who are the top companies operating in the global ethanol derivatives market?Archer Daniels Midland Company (ADM), Cargill, Incorporated, Flint Hills Resources (A subsidiary of Koch Industries), Green Plains Inc., MGP Ingredients, Inc., Pacific Ethanol, Inc., Poet, LLC, The Andersons, Inc., Valero Energy Corporation, VeraSun Energy (Acquired by Valero Energy), AND Others.

-

5. What factors are driving the growth of the ethanol derivatives market?The ethanol derivatives market is driven by rising demand across pharmaceuticals, personal care, biofuels, and food industries, increasing environmental awareness, government incentives for renewable resources, and technological advancements in production efficiency.

-

6. What are the market trends in the ethanol derivatives market?Growing use of sustainable and bio-based chemicals, growth in developing nations, incorporation of cutting-edge production methods, and a growing inclination for environmentally friendly substitutes over traditional petrochemical derivatives are some of the major trends.

-

7. What are the main challenges restricting the wider adoption of the ethanol derivatives market?The main obstacles preventing ethanol derivatives from being widely used throughout the world include high production costs, unstable feedstock supplies, strict regulatory compliance, and competition from well-established petrochemical substitutes.

Need help to buy this report?