Global EPP Foam Market Size By Product (Low Density, Medium Density, High Density), By Application (Bumpers, Roof Pillars, Seat Bracing, Armrests, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2032.

Industry: Chemicals & MaterialsGlobal EPP Foam Market Size Insights Forecasts to 2032

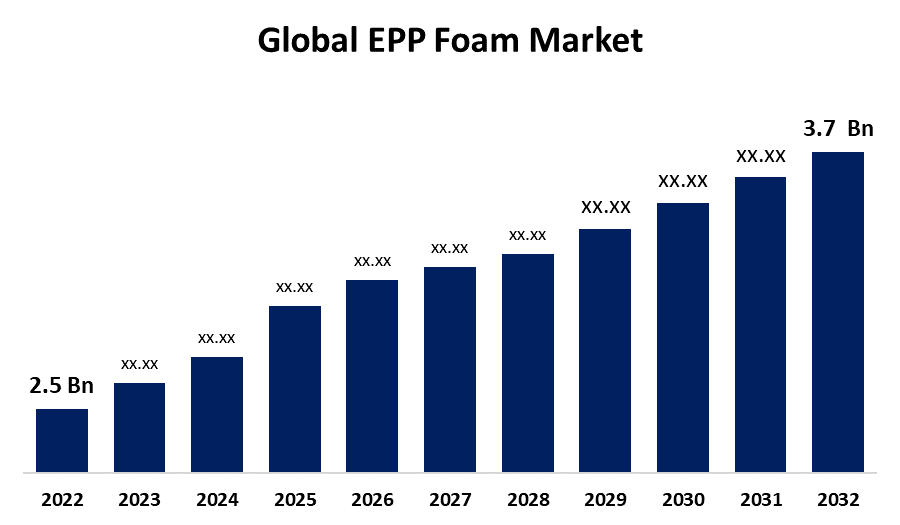

- The Global EPP Foam Market Size was valued at USD 2.5 Billion in 2022

- The Market Size is growing at a CAGR of 12.1% from 2022 to 2032

- The Worldwide EPP Foam Market Size is expected to reach USD 3.7 Billion by 2032

- Asia-Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global EPP Foam Market Size is expected to reach USD 3.7 Billion by 2032, at a CAGR of 12.1% during the forecast period 2022 to 2032.

The EPP foam market has been expanding, and it is anticipated to do so in the years to come. Numerous sectors favour the material because of its distinctive combination of lightweight construction, impact resistance, thermal insulation, and recyclability. EPP foam is widely used in the automotive industry to produce elements like bumpers, interior components, and safety measures. It improves vehicle safety due to its capacity to absorb energy during accidents. EPP foam is an excellent material for protective packaging because of its cushioning qualities. It is frequently employed to protect fragile and sensitive goods during shipment. Due to its impact-absorbing qualities, EPP foam is used in sports and leisure gear like helmets, protective clothing, and even some athletic items.

EPP Foam Market Value Chain Analysis

Suppliers of raw materials, typically polypropylene beads, are where the value chain starts. These suppliers offer the raw materials required to make EPP foam. Expanded polypropylene foam is produced by EPP foam manufacturers by moulding polypropylene beads. This entails utilising steam to expand the beads, then moulding them into the appropriate shapes. End consumers of EPP foam products include businesses in the automotive, packaging, consumer goods, sports and leisure, construction, medical, and other sectors. They get EPP foam parts to employ in their individual applications. The end user of products created with or utilising EPP foam is the last step in the value chain. There can be a recycling and trash management stage at the conclusion of the life cycle of the product. There is an increasing focus on ethical disposal and recycling practises because EPP foam is recyclable.

EPP Foam Market Price Analysis

The principal raw material for EPP foam, polypropylene beads, has a direct impact on production costs. Prices for polypropylene can fluctuate, which might affect how much EPP foam products cost overall. The overall cost structure is influenced by the complexity of the manufacturing process, which includes energy costs for steam expansion and moulding, labour expenses, and overhead costs. The overall cost and future pricing can change if certain additives or characteristics, such as flame retardants, colourants, or other upgrades, are included into the EPP foam. Costs can be affected by the complexity of the design and the moulds used to make EPP foam items. More intricate designs or moulds could need more processing time and materials. Products with higher quality requirements or certifications could cost more to produce. An expensive price can be justified by the guarantee of quality. The fundamental economic tenet of supply and demand is very important. Prices may increase if there is a large demand for EPP foam and a limited supply, and vice versa. Pricing can be affected by the market's level of competition. In order to acquire a competitive advantage or keep market share, businesses may modify their prices.

Global EPP Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.1% |

| 2032 Value Projection: | USD 3.7 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region, By Geographic Scope |

| Companies covered:: | JSP, BASF SE, KANEKA CORPORATION, DS Smith, FURUKAWA ELECTRIC CO. LTD., Hanwha Group, Sonoco Products Company, Knauf Industries, Izoblok, DONGSHIN INDUSTRY INCORPORATED, Clark Foam Products Corporation, Paracoat Products Ltd., Molan-Pino South Africa, Signode Industrial Group LLC, Armacel and Other Key Vendors. |

| Growth Drivers: | Use of EPP foam in toys and sporting products in market growth |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

EPP Foam Market Dynamics

Use of EPP foam in toys and sporting products in market growth

EPP foam is renowned for its superior capacity to absorb impact. The safety of children's toys and recreational goods is a key concern. To lessen the effects of falls and collisions, EPP foam is used to make protective elements like helmet liners, padding for sports equipment, and even toys. It's common for toys and athletic goods to call for materials that are both light and strong. EPP foam is the ideal solution. It is perfect for things like light sporting equipment and toys because it provide the required strength without adding extra weight. It's common for toys and athletic goods to call for materials that are both light and strong. EPP foam is the ideal solution. It is perfect for things like light sporting equipment and toys because it provide the required strength without adding extra weight. The demand for materials like EPP foam, which provide both performance and safety benefits, has increased as customers' awareness of safety and quality in toys and recreational goods has increased.

Restraints & Challenges

The price of polypropylene, the main component of EPP foam, is susceptible to changes in the market. For manufacturers, the manufacturing costs may be impacted by this volatility. Other materials with comparable or different qualities compete with EPP foam. Depending on their particular requirements and preferences, businesses may choose various foams, plastics, or even bio-based materials. EPP foam manufacturing procedures, particularly the moulding procedure, can call for substantial initial equipment investments. The number of new companies joining the market may be constrained by this entrance barrier. Although EPP foam can be recycled, not all areas may have easy access to collection and recycling facilities. Different disposal methods can be used, and poor disposal might raise environmental issues.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the EPP Foam market from 2023 to 2032. In North America, the automotive industry is a significant consumer of EPP foam. Numerous car parts, such as bumpers, interior pieces, and safety systems, are made with EPP foam. Its prominence in the automobile sector is largely due to its capacity to absorb energy during crashes. In North America, EPP foam is widely used in packaging purposes. It is a great option for shielding fragile and sensitive goods during shipment because to its light weight and cushioning qualities. The production of consumer products and electronics uses EPP foam. Appliances and electronic equipment can be made using it because of its impact resilience and light weight. EPP foam is used to package delicate medical equipment in the medical industry.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Rapid industrialization has occurred in the Asia-Pacific area, which includes nations like China, India, and Japan. Due to this expansion, there is now more demand for products like EPP foam, which is used in the packaging, automotive, and other industries. The EPP foam market is mostly driven by the Asia-Pacific automobile industry. Due to its light weight and capacity to absorb impact energy, EPP foam is frequently utilised in the manufacture of automotive components. The demand for protective packaging materials has expanded as a result of Asia-Pacific's expanding e-commerce market. EPP foam is perfect for assuring the secure transportation of goods due to its cushioning qualities. EPP foam's adaptability enables it to serve a variety of end-user sectors in the Asia-Pacific region, including those in the automotive, packaging, electronics, and construction.

Segmentation Analysis

Insights by Product

The high density segment accounted for the largest market share over the forecast period 2023 to 2032. For safety applications, high-density EPP foam is widely employed in the automotive sector. It's used to make interior pieces, energy-absorbing materials, and bumper cores, among other things. The high density enables for better energy absorption and impact resistance, which helps to increase vehicle safety. For industrial packaging applications where strength and protection are essential, high-density EPP foam is used. It is employed to provide packaging options for bulky or delicate objects that demand the highest level of impact resistance while being transported. For the packing of delicate medical devices, the high-density EPP foam type is used in the medical sector. Due to its protective qualities, fragile equipment is safely carried without the chance of harm.

Insights by Application

Bumpers segment is witnessing the fastest market growth over the forecast period 2023 to 2032. EPP foam is renowned for being incredibly light. EPP foam is recommended for bumper applications in the automotive sector where decreasing vehicle weight is a goal for fuel economy. It gives the required impact resistance without significantly increasing the vehicle's weight. Vehicle bumpers, which are built to absorb and distribute energy during collisions, are crucial safety elements. EPP foam is quite useful in this application because of its capacity to absorb impact energy and disperse it over a greater surface area, which contributes to increased safety. The need for materials like EPP foam for bumpers has increased as a result of the global expansion of the automobile industry, particularly in areas with high production volumes.

Recent Market Developments

- In January 2022, JSP developed ARPRO Revolution with materials that were almost entirely recycled.

Competitive Landscape

Major players in the market

- JSP

- BASF SE

- KANEKA CORPORATION

- DS Smith

- FURUKAWA ELECTRIC CO. LTD.

- Hanwha Group

- Sonoco Products Company

- Knauf Industries

- Izoblok

- DONGSHIN INDUSTRY INCORPORATED

- Clark Foam Products Corporation

- Paracoat Products Ltd.

- Molan-Pino South Africa

- Signode Industrial Group LLC

- Armacel

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

EPP Foam Market, Product Analysis

- Low Density

- Medium Density

- High Density

EPP Foam Market, Application Analysis

- Bumpers

- Roof Pillars

- Seat Bracing

- Armrests

- Others

EPP Foam Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the EPP Foam Market?The Global EPP Foam Market Size is expected to Grow from USD 2.5 Billion in 2023 to USD 3.7 Billion by 2032, at a CAGR of 12.1% during the forecast period 2023-2032.

-

2. Who are the key market players of the EPP Foam Market?Some of the key market players of market are JSP, BASF SE, KANEKA CORPORATION, DS Smith, FURUKAWA ELECTRIC CO. LTD., Hanwha Group, Sonoco Products Company, Knauf Industries, Izoblok, DONGSHIN INDUSTRY INCORPORATED, Clark Foam Products Corporation, Paracoat Products Ltd., Molan-Pino South Africa, Signode Industrial Group LLC, Armacel

-

3. Which segment holds the largest market share?Bumpers segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the EPP Foam Market?North America is dominating the EPP Foam Market with the highest market share.

Need help to buy this report?