Global Encapsulants Market Size, Share, and COVID-19 Impact Analysis, By Curing Type (Room Temperature, UV, Heat Temperature), By Chemistry (Epoxy, Urethane, Silicone), End-Use Industry (Consumer Electronics, Medical, Energy And Power, Transportation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Encapsulants Market Insights Forecasts To 2035

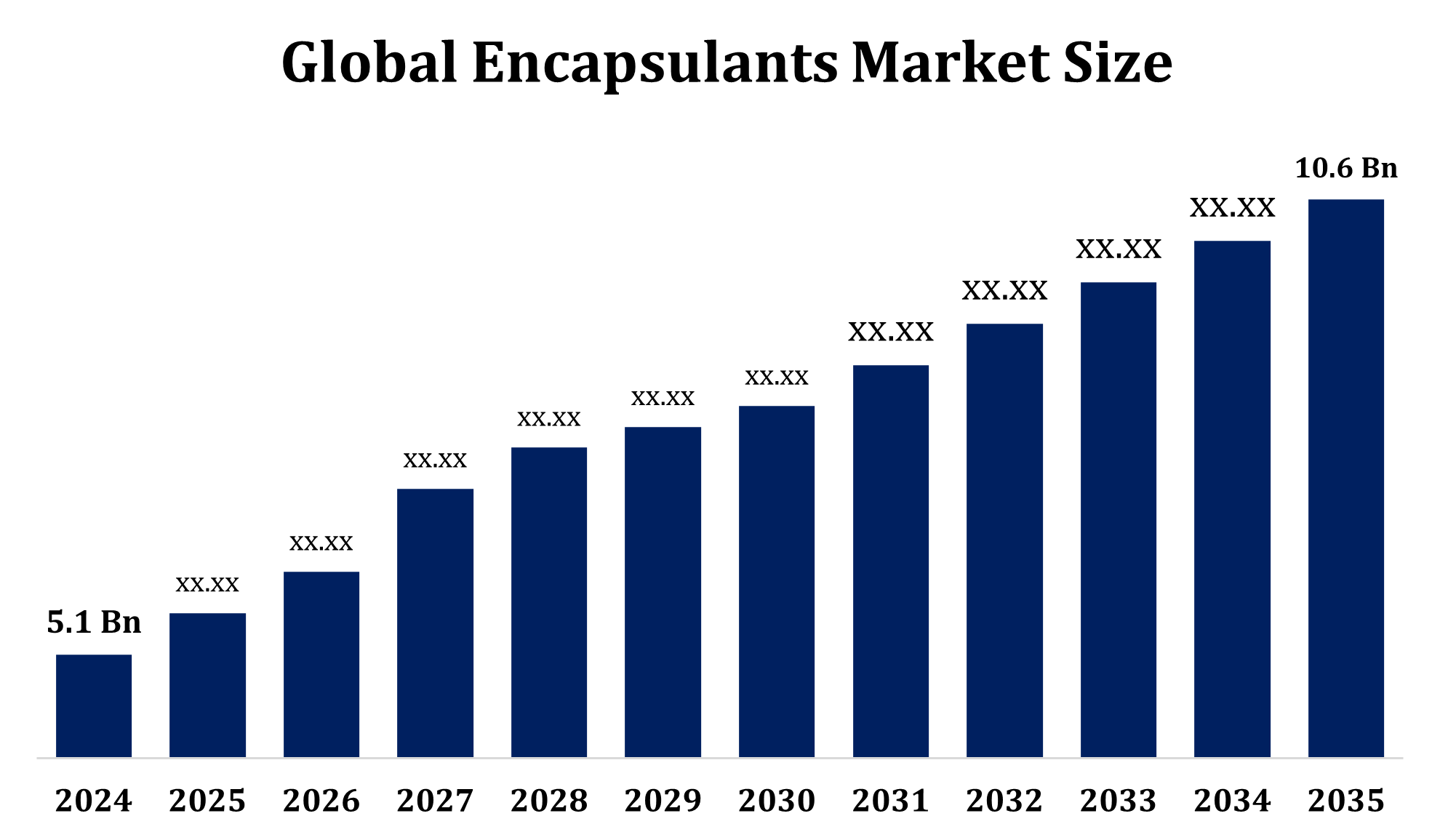

- The Encapsulants Market Size Was Valued at USD 5.1 Billion in 2024.

- The Market is Growing at a CAGR of 7.59% from 2025 to 2035.

- The Global Encapsulants Market Size is Expected To Reach USD 10.6 Billion by 2035.

- Asia Pacific is Expected To Grow Fastest During the Forecast Period.

Get more details on this report -

The Encapsulants Market Size is witnessing steady growth, driven by rising demand for reliable protection of electronic components against moisture, dust, thermal stress, and chemical exposure. Encapsulants, including resins, gels, and potting compounds, are widely used in consumer electronics, automotive, renewable energy, aerospace, and industrial applications to enhance durability, insulation, and performance. The rapid expansion of electric vehicles (EVs) and renewable energy systems, such as solar and wind, is boosting the need for high-performance encapsulation materials that ensure safety and efficiency. Technological advancements, such as UV-curable and silicone-based formulations, are further supporting adoption. However, fluctuating raw material prices and strict environmental regulations present challenges. Asia-Pacific dominates the market due to strong electronics and automotive manufacturing, while North America and Europe show steady demand.

Encapsulants Market Size Value Chain Analysis

The Encapsulants Market Size value chain involves multiple stages, from raw material suppliers to end-use industries. It begins with producers of key raw materials such as epoxy resins, silicones, polyurethane, and acrylics, along with additives that enhance performance. These materials are processed by encapsulant manufacturers who formulate specialized products tailored for electronics, automotive, solar, and industrial applications. Distributors and channel partners play a crucial role in bridging manufacturers with component makers and system integrators. Original equipment manufacturers (OEMs) and electronics assemblers then integrate encapsulants into devices, ensuring insulation, protection, and reliability. Finally, end users in sectors like consumer electronics, renewable energy, aerospace, and healthcare benefit from enhanced product durability. Continuous R&D and sustainability initiatives influence every stage of the value chain.

Encapsulants Market Opportunity Analysis

The encapsulants market presents significant opportunities driven by rapid advancements in electronics, renewable energy, and electric mobility. The surge in electric vehicles (EVs) and battery technologies requires high-performance encapsulants to ensure safety, thermal stability, and protection from harsh environments. Similarly, the growing adoption of solar photovoltaic (PV) systems and wind energy creates demand for encapsulation solutions that enhance reliability and extend lifespan. In consumer electronics, the miniaturization of devices and rise of 5G connectivity open avenues for advanced, lightweight encapsulants with superior dielectric properties. Aerospace and healthcare sectors also offer growth prospects through increasing use of high-end electronic systems. Additionally, opportunities lie in developing sustainable, bio-based, and low-VOC encapsulants that align with environmental regulations and evolving customer preferences.

Market Dynamics

Encapsulants Market Dynamics

Growth in manufacturing sector to boost the market growth

The growth of the global manufacturing sector is a key driver for the encapsulants market, as rising production across industries increases demand for reliable protection materials. Expanding electronics manufacturing, particularly in Asia-Pacific, is fueling the need for encapsulants to safeguard semiconductors, printed circuit boards, and sensors from heat, moisture, and mechanical stress. Similarly, the automotive sector, driven by electric vehicle (EV) adoption, relies on encapsulants for battery systems, power electronics, and lighting components. In renewable energy, the large-scale manufacturing of solar panels and wind turbines further accelerates encapsulant consumption. Industrial automation and IoT device production also contribute to market growth. As manufacturers prioritize product durability, efficiency, and safety, encapsulants are becoming indispensable, ensuring consistent performance in demanding operating environments.

Restraints & Challenges

One major concern is the volatility of raw material prices, particularly epoxy resins, silicones, and polyurethanes, which directly impacts production costs and profit margins. Environmental regulations around chemicals and VOC emissions add compliance burdens, pushing manufacturers to invest in sustainable alternatives. Technical challenges, such as ensuring long-term thermal stability, adhesion, and compatibility with miniaturized, high-power electronic devices, also persist. In sectors like automotive and renewable energy, encapsulants must withstand extreme conditions, making performance reliability critical. Additionally, the market is highly competitive, with pressure on pricing and innovation. Supply chain disruptions and dependence on specific regional suppliers further create uncertainties, potentially slowing down market expansion and new technology adoption.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Encapsulants Market from 2025 to 2035. The region’s advanced manufacturing base and increasing adoption of electric vehicles (EVs) are fueling demand for high-performance encapsulants that ensure thermal stability, insulation, and protection of critical components. The renewable energy sector, particularly solar and wind, further supports growth as encapsulants enhance reliability and extend the lifespan of energy systems. The presence of leading aerospace and defense industries also creates opportunities for specialized formulations that perform under extreme conditions. Additionally, the push for sustainable and low-VOC materials aligns with regulatory frameworks in the U.S. and Canada.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. China, Japan, South Korea, and India are key contributors due to their dominance in semiconductors, consumer electronics, and electric vehicle (EV) industries. Rising adoption of renewable energy, especially solar power in China and India, is driving demand for encapsulants that improve durability and efficiency of photovoltaic modules. The booming EV sector across the region requires high-performance encapsulants for batteries and power electronics. Additionally, growing investments in 5G infrastructure and IoT devices are expanding application areas. Cost-effective manufacturing, coupled with technological advancements and supportive government initiatives, positions Asia-Pacific as the fastest-growing market with significant long-term opportunities.

Segmentation Analysis

Insights by Curing Type

The UV segment accounted for the largest market share over the forecast period 2025 to 2035. UV-curable encapsulants offer advantages such as rapid processing, low energy consumption, and enhanced protection against moisture, heat, and mechanical stress, making them ideal for high-volume manufacturing. In consumer electronics and semiconductors, their use supports miniaturization, precision, and durability. The growing adoption of LEDs, displays, and advanced sensors further boosts demand. In the solar energy sector, UV encapsulants enhance module longevity and efficiency under prolonged sunlight exposure. Additionally, eco-friendly benefits, such as lower VOC emissions, align with sustainability regulations. With industries prioritizing speed, efficiency, and reliability, the UV segment is set to remain one of the fastest-growing encapsulant categories.

Insights by Chemistry

The silicone segment accounted for the largest market share over the forecast period 2025 to 2035. The growth is driven by their superior thermal stability, flexibility, and resistance to moisture, UV radiation, and chemicals. These properties make silicone-based encapsulants ideal for harsh operating environments in automotive, aerospace, and industrial applications. In the electronics sector, they provide excellent dielectric insulation and long-term reliability, especially for high-voltage components, sensors, and LEDs. The rapid expansion of electric vehicles (EVs) and renewable energy systems further fuels demand, as silicone encapsulants effectively protect battery packs, inverters, and solar modules. Their ability to perform across wide temperature ranges and under mechanical stress also supports growth in advanced consumer electronics and medical devices.

Insights by End Use

The consumer electronics segment accounted for the largest market share over the forecast period 2025 to 2035. Encapsulants play a critical role in protecting delicate electronic components from moisture, dust, heat, and mechanical stress, ensuring long-term durability and reliability. With increasing device miniaturization and the transition to 5G technology, high-performance encapsulants are required to provide superior insulation and thermal management in compact designs. The growing popularity of OLED and LED displays also fuels demand for specialized encapsulation materials that enhance brightness and lifespan. Additionally, rapid adoption of IoT devices and connected technologies boosts usage. As consumers seek more durable and efficient gadgets, encapsulants are becoming indispensable in electronics manufacturing.

Recent Market Developments

- In September 2022, Sumitomo Bakelite Co., Ltd. has established a new facility to expand its production capacity for semiconductor encapsulation packaging materials.

Competitive Landscape

Major players in the market

- DOW CORNING CORPORATION

- HB Fuller

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Bakelite Co., Ltd.

- Henkel AG & KGaA Co.

- Resin Technical Systems

- Sanyu Rec Co., Ltd.

- John C. Dolph

- Master Bond Inc.

- ACC Silicones

- Dymax Corporation

- Kyocera Corporation

- HITACHI CHEMICAL CO., LTD.

- Panasonic Corporation

- EPIC RESINS

- ELECTROLUBE

- MATERIALS PROCESSING SYSTEMS, INC.

- THE 3M COMPANY

- BASF SE

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Encapsulants Market, Curing Type Analysis

- Room Temperature

- UV

- Heat Temperature

Encapsulants Market, Chemistry Analysis

- Epoxy

- Urethane

- Silicone

Encapsulants Market, End Use Analysis

- Consumer Electronics

- Medical

- Energy And Power

- Transportation

Encapsulants Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Encapsulants Market?The global Encapsulants Market is expected to grow from USD 5.1 billion in 2024 to USD 10.6 billion by 2035, at a CAGR of 7.59% during the forecast period 2025-2035.

-

2. Who are the key market players of the Encapsulants Market?Some of the key market players of the market are DOW CORNING CORPORATION, HB Fuller, Shin-Etsu Chemical Co., Ltd., Sumitomo Bakelite Co., Ltd., Henkel AG & KGaA Co., Resin Technical Systems, Sanyu Rec Co., Ltd., John C. Dolph, Master Bond Inc., ACC Silicones, Dymax Corporation, Kyocera Corporation, HITACHI CHEMICAL CO., LTD., Panasonic Corporation, EPIC RESINS, ELECTROLUBE, MATERIALS PROCESSING SYSTEMS, INC., THE 3M COMPANY, and BASF SE.

-

3. Which segment holds the largest market share?The consumer electronics segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?