Global Emission Monitoring System (EMS) Market Size, Share, and COVID-19 Impact Analysis, By Offering (Hardware, Software, Service), By System Type (Continuous Emission Monitoring System (CEMS), Predictive Emission Monitoring System (PEMS)), By End-Use Verticals (Power Generation, Oil & Gas, Chemicals, Petrochemicals, Building Materials, Pulp & Paper, Pharmaceuticals, Metals & Mining, Marine & Shipping, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Semiconductors & ElectronicsGlobal Emission Monitoring System (EMS) Market Insights Forecasts to 2032

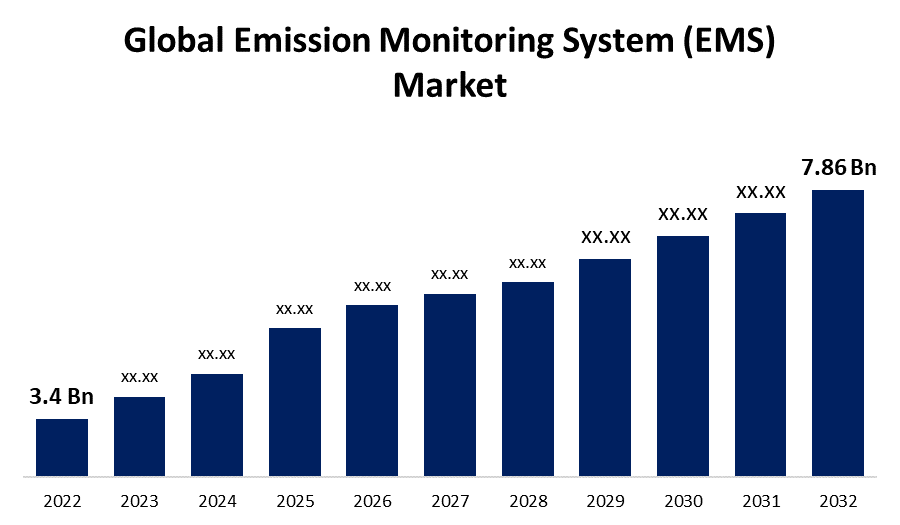

- The Global Emission Monitoring System (EMS) Market Size was valued at USD 3.4 Billion in 2022.

- The Market is Growing at a CAGR of 8.7% from 2022 to 2032.

- The Worldwide Emission Monitoring System (EMS) Market Size is expected to reach USD 7.86 Billion by 2032.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Emission Monitoring System (EMS) Market Size is expected to reach USD 7.86 Billion by 2032, at a CAGR of 8.7% during the forecast period 2022 to 2032.

Emission Monitoring Systems (EMS) are systems that gauge, monitor, and store the total amount of pollutants discharged into the environment by industrial processes, facilities, or equipment. An EMS's principal function is to make certain that a facility or process is in compliance with environmental legislation and standards. These systems are able to discern any violations of emission limitations and offer data to support compliance reporting by continually keeping track of and recording emission levels. These types of systems are frequently employed by industries whose operations have a major effect on air quality, such as power plants, chemical refineries, recycling centers, and industrial facilities. EMS is capable of monitoring a wide range of emissions, including carbon dioxide (CO2), sulfur dioxide (SO2), nitrogen oxides (NOx), particulate matter (PM), and other pollutants. EMS is essential for ensuring environmental sustainability since it allows enterprises to monitor and mitigate their environmental effect. These systems enable the execution of effective emission reduction measures and contribute to improving the standard of air quality by giving reliable data on pollutant levels. They also deliver regulatory agencies with the information they need to implement environmental laws and standards. In addition, because of the increasing realization of the harmful effects of industrial activities on the quality of air and climate change, there has been an increased emphasis on emissions monitoring over the past decade. As a result, EMS technology and techniques have been constantly developing.

Global Emission Monitoring System (EMS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.7% |

| 2032 Value Projection: | USD 7.86 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Offering, By System Type, By End-Use Verticals, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | SICK AG, ABB Ltd., AMETEK, Inc., Emerson Electric Company, Baker Hughes, Siemens AG, Parker-Hannifin, Rockwell Automation, Teledyne Technologies, Inc., Thermo Fisher Scientific Inc., Enviro Technology Services Plc, Horiba Ltd., Fuji Electric Co., Ltd., CMC Solutions and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Emission Monitoring Systems (EMS) market is expanding rapidly as a result of greater environmental consciousness, strengthened norms, and increasing demands for enterprises to monitor and minimize their emissions. In addition, factors such as increased rigorous environmental laws, rapid industrialization and urbanization, technological developments, rising adoption of IoT and cloud-based solutions, global climate change initiatives, and several others are driving the emission monitoring system market. There has been a rise in demand for smart, automated, and real-time EMS systems that utilize technologies such as the Internet of Things (IoT), Machine Learning (ML), and Artificial Intelligence (AI). These solutions had been designed to provide greater precision in data analysis, predictive capabilities, and user-friendliness. These technological improvements are projected to improve the effectiveness of pollution monitoring and analysis, hence boosting market growth for emission monitoring systems.

Furthermore, the rising reliance on coal-fired power stations for electricity generation is likely to fuel growth in the worldwide emission monitoring system market over the projected time frame. Expansion opportunities are prevalent in developing economies where industries are expanding, as is the demand for pollution monitoring. Additionally, there is a growing need for cloud-based EMS and real-time monitoring services, which presents prospective growth prospects.

Restraining Factors

However, the expenditure associated with setting up EMS might be prohibitively expensive for some businesses, particularly small and medium-sized businesses. In addition, installing and maintaining EMS requires specialized employees, which may be an obstacle for some firms. Furthermore, the increasing emphasis on clean energy is projected to stifle the expansion of the emission monitoring system market.

Market Segmentation

By Offering Insights

The hardware segment is witnessing significant CAGR growth over the forecast period.

On the basis of offering, the global emission monitoring system (EMS) market is segmented into hardware, software, and service. Among these, the hardware segment is witnessing significant CAGR growth over the forecast period. This includes sensors, analyzers, gas sampling systems, flow meters, and other physical devices that measure and collect emissions data. The recent expansion of the hardware EMS market can be ascribed to the fact that they are utilized to collect emissions data in both CEMS and PEMS. The CEMS operates using hardware components, whereas the PEMS operates using software and hardware components such as sensors to anticipate gas emissions. Because the vast majority of plants currently utilize continuous emission monitoring systems, the hardware system is likely to be in high demand during the estimated time frame.

By System Type Insights

The continuous emission monitoring system (CEMS) segment is dominating the market with the largest revenue share over the forecast period.

On the basis of system type, the global emission monitoring system (EMS) market is segmented as a continuous emission monitoring system (CEMS) and predictive emission monitoring system (PEMS). Among these, the continuous emission monitoring system (CEMS) segment is dominating the market with the largest revenue share of 47.5% over the forecast period. In real-time, these devices continuously monitor and measure pollution emissions. They are commonly employed for monitoring environmental compliance in businesses such as power plants, refineries, chemical plants, and waste incinerators. Since emission laws have gotten more strict in numerous sectors, demand for CEMS is projected to rise over the forecast period.

By End-Use Verticals Insights

The oil & gas segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of end-use verticals, the global emission monitoring system (EMS) market is segmented into power generation, oil & gas, chemicals, petrochemicals, building materials, pulp & paper, pharmaceuticals, metals & mining, marine & shipping, and others. Among these, the oil & gas segment is dominating the market with the largest revenue share of 34.2% over the forecast period. EMS is widely used in the oil and gas industry to monitor and reduce dangerous substances including sulfur dioxide (SO2) and methane (CH4), as well as to collect data for monitoring emissions to government regulatory organizations. Rapid industrial expansion and increased energy demand are the primary causes of greenhouse gas emissions. As a result, several governments have enforced the adoption of EMS in oil and gas, and power facilities in order to restrict the discharge of greenhouse gases and environmental contaminants.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 41.3% market share over the forecast period. North America has the highest percentage of EMS deployments due to its well-established and well-defined emission-control policies. Strict greenhouse gas emission laws and regulations, technological advancements aimed at green solutions, and the involvement of strict government and regulatory bodies such as the United States Environmental Protection Agency, among others, are expected to boost the growth of the North American emission monitoring system market.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. China and India are the two most significant contributors to the current expansion of the Asia Pacific emission monitoring system (EMS) market. It may additionally be attributed to the region's expanding power generation and chemical industries, both of which rely heavily on pollution monitoring systems. Furthermore, new business prospects have emerged as a result of the Indian government's ongoing "Make in India" campaign.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. Europe is implementing decisive action to mitigate carbon emissions and the continuously growing greenhouse gas emissions. The emission monitoring system is expected to rise as a result of major vehicle manufacturer’s global adoption of the system and growing awareness about environmental deterioration.

List of Key Market Players

- SICK AG

- ABB Ltd.

- AMETEK, Inc.

- Emerson Electric Company

- Baker Hughes

- Siemens AG

- Parker-Hannifin

- Rockwell Automation

- Teledyne Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Enviro Technology Services Plc

- Horiba Ltd.

- Fuji Electric Co., Ltd.

- CMC Solutions

Key Market Developments

- On July 2023, Hyundai Motor Company and Kia Corporation unveiled their AI-powered, blockchain-based Supplier CO2 Emission Monitoring System (SCEMS) to control the carbon emissions of its collaborative business partners. SCEMS is intended to calculate carbon emissions at each stage of a cooperative partner's supply chain while maintaining data transparency and integrity. This technology is also expected to relieve suppliers of this time-consuming and costly task, allowing them to accurately manage their carbon emissions. Business partners can efficiently monitor and manage the collected data and carbon emission status at their different workplaces by employing artificial intelligence (AI) and high-performance blockchain technology.

- On March 2023, Picarro, Inc. and LESNI A/S have established a collaborative agreement to provide industry-leading Ethylene Oxide (EtO or EO) monitoring systems to medical device and contract sterilization plants worldwide. Picarro's innovative Continuous Emission Monitoring Systems (CEMS) will be combined with experience in emissions control and abatement in the full solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Emission Monitoring System (EMS) Market based on the below-mentioned segments:

Emission Monitoring System (EMS) Market, Offering Analysis

- Hardware

- Software

- Service

Emission Monitoring System (EMS) Market, System Type Analysis

- Continuous Emission Monitoring System (CEMS)

- Predictive Emission Monitoring System (PEMS)

Emission Monitoring System (EMS) Market, End-Use Verticals Analysis

- Power Generation

- Oil & Gas

- Chemicals

- Petrochemicals

- Building Materials

- Pulp & Paper

- Pharmaceuticals

- Metals & Mining

- Marine & Shipping

- Others

Emission Monitoring System (EMS) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Emission Monitoring System (EMS) market?The Global Emission Monitoring System (EMS) Market is expected to grow from USD 3.4 billion in 2022 to USD 7.86 billion by 2032, at a CAGR of 8.7% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?SICK AG, ABB Ltd., AMETEK, Inc., Emerson Electric Company, Baker Hughes, Siemens AG, Parker-Hannifin, Rockwell Automation, Teledyne Technologies, Inc., Thermo Fisher Scientific Inc., Enviro Technology Services Plc, Horiba Ltd., Fuji Electric Co., Ltd., CMC Solutions.

-

3. Which segment dominated the Emission Monitoring System (EMS) market share?The oil & gas segment in end-use verticals type dominated the Emission Monitoring System (EMS) market in 2022 and accounted for a revenue share of over 34.2%.

-

4. Which region is dominating the Emission Monitoring System (EMS) market?North America is dominating the Emission Monitoring System (EMS) market with more than 41.3% market share.

-

5. Which segment holds the largest market share of the Emission Monitoring System (EMS) market?The continuous emission monitoring system (CEMS) segment based on system type holds the maximum market share of the Emission Monitoring System (EMS) market.

Need help to buy this report?