Global EMI Shielding Market Size By Material (EMC/EMI Filters, Conductive Polymers, Metal Shielding Product), By Industry (Healthcare, Automotive, Consumer Electronics), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2032

Industry: Advanced MaterialsGlobal EMI Shielding Market Insights Forecasts to 2032

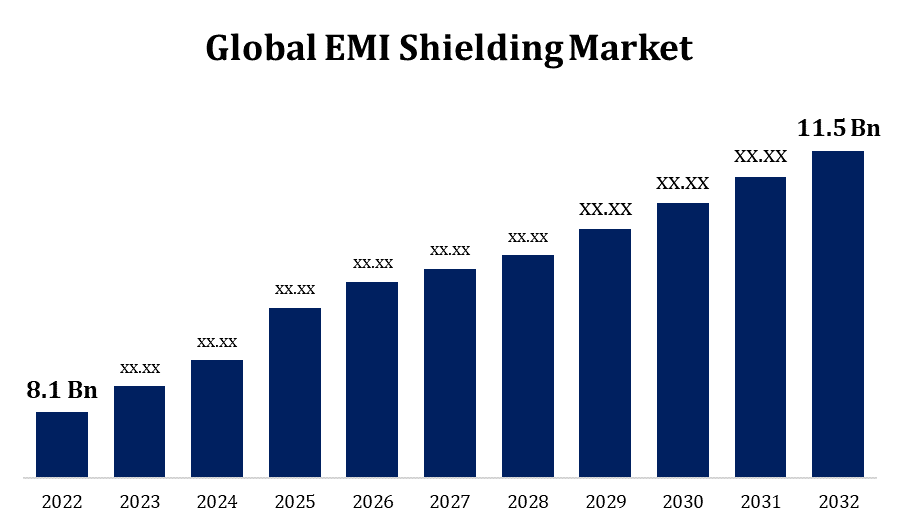

- The EMI Shielding Market Size was valued at USD 8.1 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.3% from 2022 to 2032

- The Worldwide EMI Shielding Market Size is Expected To Reach USD 11.5 Billion by 2032

- Asia Pacific is Expected To Grow the fastest during the forecast period

Get more details on this report -

The Global EMI Shielding Market Size is Expected To Reach USD 11.5 Billion by 2032, at a CAGR of 6.3% during the forecast period 2022 to 2032.

The EMI shielding market is like a seed planted in rich soil. With the rising complexity and density of electronic gadgets in our life, there is a greater need for effective EMI shielding solutions. As technology evolves, so does the demand for electromagnetic interference protection. Telecommunications, automobiles, healthcare, and consumer electronics are driving growth, since electronic components must coexist without generating interference problems. The EMI shielding market is changing and evolving as new materials and designs emerge, offering a sturdy shield against the ever-expanding electronic noise. One of the difficulties is constantly playing catch-up with developing technologies. As our gadgets become smaller, faster, and more complex, developing efficient EMI shielding without sacrificing performance becomes a delicate ballet.

Global EMI Shielding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.3% |

| 2032 Value Projection: | USD 11.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By Industry. |

| Companies covered:: | Laird Technologies Inc., 3M Company, Huntsman International LLC, ETS-Lindgren, Omega Shielding Products, RTP Company, PPG Industries, Henkel AG & Co. KGaA, Parker Hannifin Corp., Tech-Etch Inc., HEICO Corp., SCHAFFNER Holding AG, and Others |

| Growth Drivers: | Rapid progress in the 5G technology sector |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

EMI Shielding Market Value Chain Analysis

The raw materials such as metallic foams, conductive polymers, gaskets, and coatings are the starting point. These are the unsung heroes that serve as the foundation for EMI shielding solutions. The manufacturers are the wizards who turn raw materials into actual shielding components. This is where the magic happens, whether it's moulding metal into a conductive enclosure or weaving conductive fibres into cloth. The various components are assembled by manufacturers into the finished EMI shielding solutions. This could range from electronic shielding enclosures to conductive gaskets that snugly fill the gaps. The focus then shifts to testing. Strict quality control guarantees that the EMI shielding meets industry requirements and specifications. You wouldn't want a shield with chinks in its armour, after all. Distributors play an important role in getting these shielding solutions into the hands of the firms and industries who require them the most.

EMI Shielding Market Opportunity Analysis

The demand for good EMI shielding is increasing as our lives become more entwined with electronic devices. As businesses such as IoT, 5G, and electric cars expand, so does the demand for improved EMI shielding solutions. The healthcare industry is booming. As the usage of electronic medical equipment grows, the necessity for dependable EMI shielding becomes crucial. It acts as a guardian angel for such high-tech medical devices, ensuring they run well. Electric vehicles are taking front stage in the automobile industry's green revolution. As automobiles become more electric, there will be a greater demand for robust EMI shielding solutions to ensure smooth, interference-free trips. With the world's attention focused on sustainability, there is a potential for environmentally acceptable EMI shielding materials and techniques. Companies who can provide efficient shielding solutions while also being environmentally conscious are expected to find an increasing market.

Market Dynamics

EMI Shielding Market Dynamics

Rapid progress in the 5G technology sector

5G uses greater frequencies than previous generations. While this allows for speedier data transport, it also implies that electromagnetic interference is more likely. Enter EMI shielding as the hero who guarantees all those high-frequency emissions coexist peacefully. 5G is based on dense networks with a high density of tiny cells. These cells are frequently found in close proximity to one another, providing a fertile environment for interference. In this congested electronic scene, EMI shielding becomes critical to maintaining signal integrity. Industries other than telecommunications are embracing 5G because it promises ultra-fast and dependable connectivity. Everyone wants a piece of the 5G pie: automotive, healthcare, and manufacturing. As a result, there is a greater demand for EMI shielding in a variety of applications.

Restraints & Challenges

Fitting efficient EMI shielding without losing performance becomes increasingly difficult as electronics become smaller and more compact. It's like attempting to put a superhero suit on an action figure without making it seem sloppy. Finding the ideal materials for EMI shielding is a never-ending quest. Some materials may be effective at blocking interference yet are expensive or harmful to the environment. It is difficult to strike the correct balance between effectiveness, affordability, and sustainability. The frequency range that EMI shielding must cover is expanding as high-frequency technologies such as 5G become more prevalent. Keeping up with these higher frequencies without sacrificing shielding efficacy is like to attempting to catch a fast-moving superhero in action.

Regional Forecasts

North America Market Statistics

Get more details on this report -

America is anticipated to dominate the EMI Shielding Market from 2023 to 2032. With tech powerhouses like Silicon Valley, North America is a hub for innovation. The ongoing push for cutting-edge technologies in electronics and telecommunications drives demand for high-quality EMI shielding solutions. The broad adoption of 5G networks is akin to a technological revolution, with North America leading the way. As the region embraces the faster and more connected future promised by 5G, the demand for effective EMI shielding is skyrocketing to ensure that all those high-frequency signals coexist peacefully. In North America, the automobile sector is undergoing a tremendous transformation, with electric vehicles taking centre stage. As the region strives for a more environmentally friendly automotive landscape, there is an increasing demand for robust EMI shielding solutions to ensure the smooth operation of electric vehicles.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Asia Pacific is a manufacturing behemoth, producing a sizable portion of the world's electronics. The region's significance as a worldwide manufacturing hub stimulates demand for EMI shielding solutions to assure electronic component dependability. The Asia Pacific automobile market is heating up, and electric vehicles are gaining pace. As the region embraces vehicle electrification, there is a growing demand for EMI shielding solutions to ensure that these high-tech rides run smoothly. Asia Pacific is home to some of the world's largest electronic gadget customers. The increasing consumer electronics sector, which includes anything from smartphones to smart appliances, stimulates the demand for EMI shielding to keep all of these gadgets running smoothly.

Segmentation Analysis

Insights by Material

Conductive coatings and paints segment accounted for the largest market share over the forecast period 2023 to 2032. The necessity to shield electronic devices from electromagnetic interference (EMI) has grown in importance as these gadgets become more and more commonplace in our daily lives. Paints and coatings that conduct electricity provide a flexible and efficient answer to this problem. These paints and coatings are made to create a conductive layer on the exterior of electronic equipment, enclosures, or parts in order to shield delicate electronics from electromagnetic radiation and guarantee their correct operation. Numerous causes have contributed to this segment's rise. There is a growing need for flexible and lightweight EMI shielding solutions, particularly in the automotive, aerospace, and telecommunications industries. Compared to more conventional shielding materials like metal enclosures, conductive coatings and paints provide a lightweight, flexible alternative.

Insights by Industry

Polymerization and blowing agents segment accounted for the largest market share over the forecast period 2023 to 2032. The risk of electromagnetic interference increases with the sophistication and complexity of consumer devices. Because of its complexity, which comprises utilising several parts and functions in one unit, the gadget is more vulnerable to electromagnetic interference (EMI). In order to preserve signal integrity and avoid interference, EMI shielding becomes essential. Effective EMI shielding has become more important as wireless communication has become more common in consumer electronics like smartwatches, smartphones, and wireless headphones. Performance may be impacted by interference caused by multiple wireless technologies coexisting close to one another in a single device. By reducing these problems, EMI shielding ensures uninterrupted wireless connection. EMI problems are brought on by the move towards smaller, more compact electrical gadgets. The likelihood of electromagnetic interference between components within a device grows with miniaturisation.

Recent Market Developments

- In August 2023, SCHAFFNER Holding AG introduced a new line of RT-Common mode chokes to expand its product line of EMI filtering solutions.

Competitive Landscape

Major players in the market

- Laird Technologies Inc.

- 3M Company

- Huntsman International LLC

- ETS-Lindgren

- Omega Shielding Products

- RTP Company

- PPG Industries

- Henkel AG & Co. KGaA

- Parker Hannifin Corp.

- Tech-Etch Inc.

- HEICO Corp.

- SCHAFFNER Holding AG

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

EMI Shielding Market, Material Analysis

- EMC/EMI Filters

- Conductive Polymers

- Metal Shielding Product

EMI Shielding Market, Industry Analysis

- Healthcare

- Automotive

- Consumer Electronics

EMI Shielding Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the EMI Shielding Market?The global EMI Shielding Market is expected to grow from USD 8.1 Billion in 2023 to USD 11.5 Billion by 2032, at a CAGR of 6.3% during the forecast period 2023-2032.

-

2. Who are the key market players of the EMI Shielding Market?Some of the key market players of market are Laird Technologies Inc., 3M Company, Huntsman International LLC, ETS-Lindgren, Omega Shielding Products, RTP Company, PPG Industries, Henkel AG & Co. KGaA, Parker Hannifin Corp., Tech-Etch Inc., HEICO Corp., SCHAFFNER Holding AG.

-

3. Which segment holds the largest market share?Consumer electronics segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the EMI Shielding Market?North America is dominating the EMI Shielding Market with the highest market share.

Need help to buy this report?