Global Elemental Sulfur Market Size, Share, and COVID-19 Impact Analysis, By Source (Gas-Based, Oil-Based, and Mining Sources), By Application (Agrochemicals, Chemical & Petroleum Refining, Rubber & Plastics, Mining & Metallurgy, and Paper & Pulp), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Elemental Sulfur Market Insights Forecasts To 2035

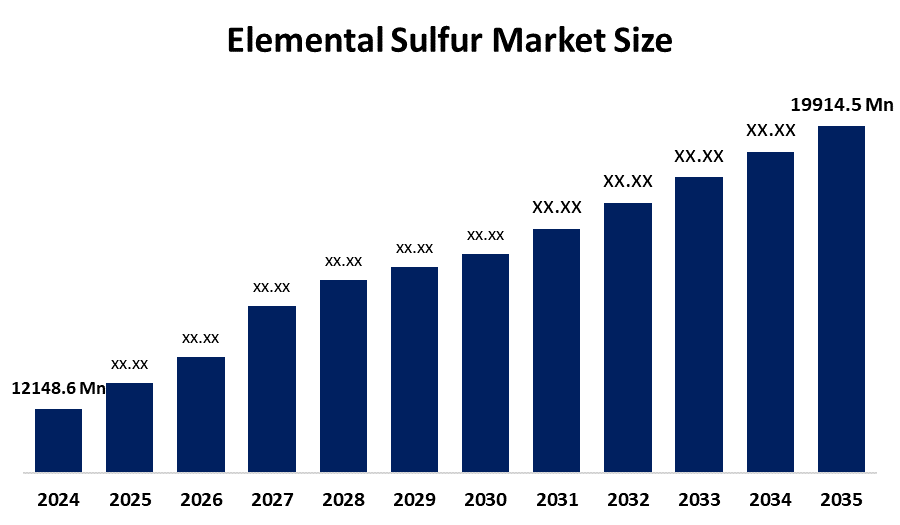

- The Global Elemental Sulfur Market Size Was Estimated At USD 12148.6 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 4.6% From 2025 To 2035

- The Worldwide Elemental Sulfur Market Size Is Expected To Reach USD 19914.5 Million By 2035

- North America Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Elemental Sulfur Market Size Was Worth Around USD 12148.6 Million In 2024 And Is Predicted To Grow To Around USD 19914.5 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 4.6% From 2025 To 2035. The elemental sulfur market worldwide is increasing owing to the rise in usage of sulfur in fertilizers, chemistry, petroleum production, and other industries, along with rising agricultural and industrial activities and advancements in technologies associated with sulfur recovery and processing worldwide.

Market Overview

The International Market Size For Elemental Sulfur Refers To The Processing And Demand For Sulfur As An Element, An Important Non-Metallic Element That Finds Large Applications In Agriculture, Chemicals, Petroleum, And Other Industries. Generally, the applications of elemental sulfur include fertilizer applications, wherein it increases soil fertility and agricultural production. In addition, sulfur works as an important raw material in the manufacture of chemicals, pesticides, and the vulcanization of rubbers, apart from being an important material in pharmaceuticals and construction chemicals. The market for elemental sulfur is mainly fueled by agricultural demands, growing industries, and environmental regulations to recycle sulfur from petroleum and natural gas.

In March 2024, the US government allocated a total of USD 6 billion towards industrial decarbonization, focusing on sulfur recovery in low-carbon projects. On the other hand, California and New York have adopted more stringent regulations regarding the emission of oil, gas, and sulfur. This affects the supply of by-products of sulfur, stimulated by policies towards industrial and environmental sustainability. There are emerging markets within economies that are witnessing rising infrastructure investments, chemical manufacturing, and practices of sustainable farming, resulting in higher usage of sulfur. Notable major players that are utilizing technological innovations and partnerships to improve manufacturing efficiency and global reach of their products related to sulfur are Sinopec, Shell Chemicals, Saudi Aramco, Mosaic Company, and Koch Industries.

Report Coverage

This Research Report Categorizes The Elemental Sulfur Market Size Based On Various Segments And Regions, Forecasts Revenue Growth, And Analyzes Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the elemental sulfur market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the elemental sulfur market.

Elemental Sulfur Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12148.6 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 4.6% |

| 2023 Value Projection: | USD 19914.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Saudi Arabian Oil Co, Mosaic Company, Sinopec, ADNOC Group, Shell Chemicals, Gazprom, Koch Industries, Suncor Energy Inc., ExxonMobil Corporation, Valero Energy, Nutrien Ltd., ConocoPhillips Company, Kuwait Petroleum Corporation, Yara International ASA, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Main Driving Factors In The Global Market Size For Elemental Sulfur Are The Increased Use In The Agricultural Industry, Particularly In Fertilizers That Contain Sulfur, Such As Ammonium Sulfate. Another key driving force in this market is the growth in the industrial production of chemicals, petroleum, and rubber. The growing use in the pharmaceutical industry and the development of sectors in emerging nations are other factors that stimulate market expansion. Environmental regulation enforcing sulfur recovery from the processing of petroleum and natural gas adds to a stable supply. Besides, technological advances in the extraction and processing of sulfur promote efficiency that supports sustainable production and the global growing demand across multiple industries.

Restraining Factors

Fluctuating Raw Material Prices And Dependency On The Petroleum And Natural Gas Industries Are The Main Constraints To The Global Elemental Sulfur Market Size. Growth is further constrained by environmental concerns with sulfur handling, stringent regulations, and high costs of transportation. Besides, there is a possibility of moving to alternative nutrient sources in agriculture that will lower the demand for sulfur in some regions.

Market Segmentation

The elemental sulfur market share is classified into source and application.

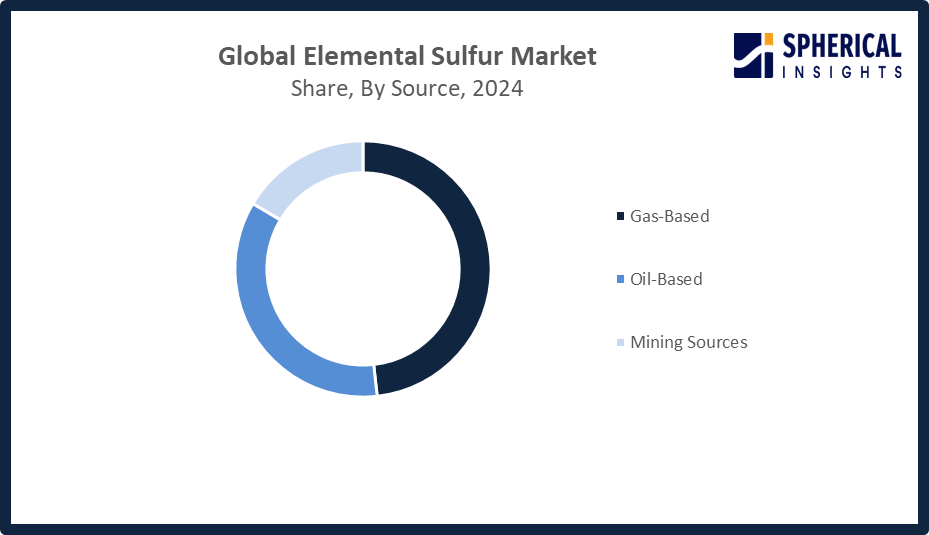

- The gas-based segment dominated the market in 2024, approximately 48% and is projected to grow at a substantial CAGR during the forecast period.

Based On The Source, The Elemental Sulfur Market Size Is Divided Into Gas-Based, Oil-Based, And Mining Sources. Among these, the gas-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The gas-based market had the leading share in the elemental sulfur market due to the vast recovery of sulfur as a byproduct from gas and petroleum refining. Gas-based sulfur has high purity, meets constant demand, and is cost-effective as well, making it the preferred product in fertilizers, chemicals, and other industries. This trend will be fueled by rising gas production, environmental regulations on gas emissions, and the establishment of sulfur recovery units as well.

Get more details on this report -

- The agrochemicals segment accounted for the highest market revenue in 2024, approximately 53% and is anticipated to grow at a significant CAGR during the forecast period.

Based On The Application, The Elemental Sulfur Market Size Is Divided Into Agrochemicals, Chemical & Petroleum Refining, Rubber & Plastics, Mining & Metallurgy, And Paper & Pulp. Among these, the agrochemicals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The agrochemicals industry is growing in the global market for elemental sulfur due to the increasing demand for sulfur fertilizers such as ammonium sulfate, which has the effect of increasing the fertility of the soil. Agricultural production, programs implemented by the government to ensure food security, and the need to adopt environmentally friendly techniques to produce food, such as the sulfur fertilizer, are the factors for the highest growth rate in this market.

Regional Segment Analysis of the Elemental Sulfur Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the elemental sulfur market over the predicted timeframe.

Get more details on this report -

Asia Pacific Is Anticipated To Hold The Largest Share Of The Elemental Sulfur Market Size Over The Predicted Timeframe. The Asia Pacific is expected to continue with the 42% market share of the elemental sulfur market due to strong demand emanating from agriculture, chemicals, and industry. In addition, rapid population growth and increasing food needs have boosted the application of sulfur-based fertilizers. Large-scale farming and the vast expansion of the fertilizer industries make China and India the leading consumers of elemental sulfur in the world, while other significant consumers, such as Japan and South Korea, contribute through their applications in the chemical industry and petroleum refining. Rapid industrialization, infrastructure development, and the availability of by-product sulfur from refining also further support the growth. In January 2024, the Indian Prime Minister launched Urea Gold Sulfur Coated Urea for the improvement of fertilizer efficiency, reduction in soil sulfur deficiency, improvement in crop yields, enhancement of food security, and better sustainable agricultural practices.

North America Is Expected To Grow At A Rapid CAGR In The Elemental Sulfur Market Size During The Forecast Period. North America is expected to have a 22% market share of the elemental sulfur market on account of growing demand from fertilizers, chemicals, and petroleum refining industries. The United States dominates this region owing to immense sulfur recovery from oil and gas processing, mainly because of stringent environmental regulations concerning sulfur emissions. Canada, with its growing agricultural sector and natural gas processing, is another key contributor. Rising investments in the recovery of sulfur, sustainable agricultural production, and industrial decarbonization projects will fuel robust market growth in North America.

The European Market Size Is Seeing Incessant Growth In The Elemental Sulfur Market Because Of Strict Environmental Regulations, A Significant Demand For Chemicals And Fertilizers, And More Efficient Ways Of Recovering Sulfur. The top three biggest markets for the Europe region in the past four years were Germany, France, and the Netherlands because of the steady chemical production and oil refinery processes in these countries. The EU Green Deal of the year 2024 further pressed down the reduction of sulfur emissions and the need for efficient recovery at oil and chemical plants.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Elemental Sulfur Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saudi Arabian Oil Co

- Mosaic Company

- Sinopec

- ADNOC Group

- Shell Chemicals

- Gazprom

- Koch Industries

- Suncor Energy Inc.

- ExxonMobil Corporation

- Valero Energy

- Nutrien Ltd.

- ConocoPhillips Company

- Kuwait Petroleum Corporation

- Yara International ASA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, The Mosaic Company announced idling SSP production at its Fospar and Araxa plants in Brazil due to rising sulfur prices and suspended future sulfur purchases. The company may reassess in 30 days, emphasizing its commitment to fertilizer availability, competitiveness, and global food security.

- In November 2025, Sultech Global Innovation Corp. signed an MoU with ADNOC Sour Gas at ADIPEC 2025 to introduce micronised elemental sulfur technology in the UAE. The partnership aims to convert sulfur by-products into high-value agricultural and clean-technology inputs, strengthening Canada-UAE collaboration on sustainability, food security, and industrial diversification.

- In September 2025, ExxonMobil began production at new facilities in its Singapore refinery, increasing Group-II base stocks by 20,000 bpd. The technology converts high-sulfur crude residues into high-value lube stocks and distillates, supporting rising high-sulfur crude demand as the refinery halts low-sulfur U.S. imports.

- In March 2023, KIPIC shipped its first 44,000 tons of solid sulfur from Al-Zour Refinery, in partnership with KPC. The milestone follows the refinery’s second-phase expansion, doubling global oil exports and positioning Al-Zour as a major supplier of environmentally compliant petroleum products and sulfur to international markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the elemental sulfur market based on the below-mentioned segments:

Global Elemental Sulfur Market, By Source

- Gas-Based

- Oil-Based

- Mining Sources

Global Elemental Sulfur Market, By Application

- Agrochemicals

- Chemical & Petroleum Refining

- Rubber & Plastics

- Mining & Metallurgy

- Paper & Pulp

Global Elemental Sulfur Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the elemental sulfur market over the forecast period?The global elemental sulfur market is projected to expand at a CAGR of 4.6% during the forecast period.

-

2. What is the market size of the elemental sulfur market?The global elemental sulfur market size is expected to grow from USD 12148.6 million in 2024 to USD 19914.5 million by 2035, at a CAGR of 4.6% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the elemental sulfur market?Asia Pacific is anticipated to hold the largest share of the elemental sulfur market over the predicted timeframe.

-

4. What is the elemental sulfur market?The elemental sulfur market involves the production, supply, and use of sulfur in fertilizers, chemicals, petroleum refining, and industrial applications globally.

-

5. Who are the top 10 companies operating in the global elemental sulfur market?Saudi Arabian Oil Co, Mosaic Company, Sinopec, ADNOC Group, Shell Chemicals, Gazprom, Koch Industries, Suncor Energy Inc., ExxonMobil Corporation, Valero Energy, and Others.

-

6. What factors are driving the growth of the elemental sulfur market?The elemental sulfur market is driven by rising demand for sulfur-based fertilizers, expanding chemical and petroleum industries, stringent environmental regulations, increasing industrialization, and growing adoption of sulfur recovery technologies worldwide.

-

7. What are the market trends in the elemental sulfur market?Key trends include sulfur recovery expansion, sustainable fertilizer adoption, strict emission regulations, growth in chemical applications, and increasing refinery and gas processing output worldwide.

-

8. What are the main challenges restricting wider adoption of the elemental sulfur market?The main challenges restricting the wider adoption of the elemental sulfur market involve supply chain volatility tied to fossil fuel production, significant environmental concerns and stringent regulations, and the high cost and complexity of logistics.

Need help to buy this report?