Global Electronic Films Market Size, Share, and COVID-19 Impact Analysis, By Film Type (Conductive, Non-Conductive), By Material Type (Polymer, Metal Mesh), By Application (Electronic Display, Semiconductors), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Electronic Films Market Insights Forecasts to 2035

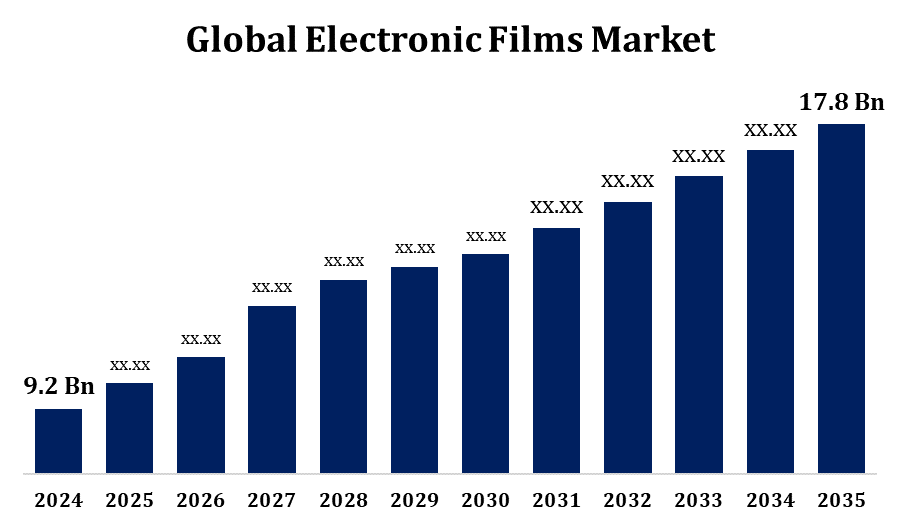

- The Global Electronic Films Market was Valued at USD 9.2 Billion in 2024.

- The Market Size is Growing at a CAGR of 6.82% from 2025 to 2035.

- The WorldWide Electronic Films Market Size is Expected to Reach USD 17.8 Billion by 2035.

- Asia Pacific is Expected to Grow the Fastest During the Forecast Period.

Get more details on this report -

The Global Electronic Films Market Size is Expected to Reach USD 17.8 Billion By 2035, at a CAGR of 6.82% during the forecast period 2025 to 2035.

The Electronic Films Market Size is witnessing significant growth driven by the increasing demand for advanced electronic devices, flexible displays, and high-performance components. These films, which include conductive, dielectric, and optical films, are essential in applications such as smartphones, tablets, solar panels, automotive electronics, and medical devices. Rising adoption of smart electronics, growing investment in renewable energy technologies, and the expansion of electric vehicles (EVs) are fueling market expansion. Moreover, the trend toward miniaturization and lightweight materials in electronics is boosting demand for thin, durable, and multifunctional films. Asia-Pacific dominates the market due to its strong electronics manufacturing base in countries like China, South Korea, and Japan. Technological advancements and increasing R&D activities are expected to further propel market growth in the coming years.

Electronic Films Market Value Chain Analysis

The electronic films market value chain comprises several key stages, beginning with raw material suppliers providing polymers, metals, and specialty chemicals essential for film production. These materials are processed by film manufacturers into various types such as conductive, dielectric, and optical films. Component manufacturers then integrate these films into semiconductors, displays, sensors, and circuit assemblies. The next stage involves original equipment manufacturers (OEMs) who use these components in consumer electronics, automotive systems, medical devices, and renewable energy products. Distributors and suppliers play a vital role in logistics and product availability across global markets. End-users include industries such as electronics, automotive, healthcare, and energy. R&D institutions and technology partners also contribute to innovation and quality improvements, strengthening the overall efficiency and competitiveness of the value chain.

Electronic Films Market Opportunity Analysis

The electronic films market presents substantial growth opportunities driven by emerging technologies and evolving application demands. The surge in flexible and foldable electronics, including smartphones, tablets, and wearables, is creating strong demand for durable, bendable films. In the healthcare sector, rising adoption of wearable biosensors, electronic skin, and smart patches is accelerating the need for conformable, high-performance films. Additionally, the proliferation of IoT devices and miniaturized sensors fuels requirements for thin, flexible electronic films. Renewable energy advancements, especially in flexible solar panels and smart windows, are also expanding market prospects. Furthermore, the push for sustainability is encouraging the development of eco-friendly and recyclable film materials. Innovations in nanotechnology, such as incorporating graphene and metal meshes, are enhancing conductivity and durability, offering a competitive edge. These dynamics collectively underscore the market's strong potential across electronics, healthcare, and energy sectors.

Market Dynamics

Electronic Films Market Dynamics

The increasing adoption of digital technologies in developing economies

The electronic films market is experiencing robust growth, driven by rising demand across consumer electronics, automotive, medical, and renewable energy sectors. A key factor fueling this growth is the increasing adoption of digital technologies in developing economies, which is accelerating the production and consumption of smart devices and connected infrastructure. The expansion of 5G networks, smart cities, and IoT-based applications in countries like India, Brazil, and Southeast Asian nations is creating new avenues for electronic film applications. Additionally, trends such as miniaturization, flexible displays, and wearable technology are boosting the need for high-performance films with properties like conductivity, transparency, and thermal stability. The growing focus on energy efficiency and sustainability is further promoting the use of advanced electronic films in solar panels, EV batteries, and next-generation electronics.

Global Electronic Films Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.2 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.82% |

| 2035 Value Projection: | USD 17.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Film Type, By Material Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | TORAY INDUSTRIES, INC. (Japan), DuPont (US), Saint-Gobain (France), Coveris (US), Nitto Denko Corporation (Japan), SABIC (Saudi Arabia), Gunze (Japan), The Chemours Company (US), 3M (US), Eastman Chemical Company (US) and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Restraints & Challenges

High production costs remain a significant barrier, driven by the use of advanced raw materials, precision manufacturing processes, and costly equipment. Maintaining consistent quality in ultra-thin and high-performance films also demands continuous R&D investment and technical expertise. Supply chain disruptions and the limited availability of specialty materials can lead to production delays and increased input costs. Additionally, stringent environmental and safety regulations, such as REACH and RoHS, require manufacturers to make expensive adjustments to formulations and processes. Intense competition among global and regional players creates pricing pressure, reducing profit margins. Moreover, the fast pace of technological change in electronics increases the risk of product obsolescence, requiring constant innovation to stay relevant in the market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Electronic Films Market from 2025 to 2035. The growth is driven by a strong consumer base, high adoption of advanced technologies, and increasing investments across key industries. The region benefits from rising demand for smartphones, tablets, wearable devices, and flexible displays, which require high-performance films offering durability, transparency, and conductivity. The automotive sector is also contributing significantly, as electric vehicles and autonomous systems integrate more electronic components that rely on specialty films. Additionally, the expansion of smart infrastructure and the adoption of IoT technologies are boosting demand in construction and industrial applications. The United States leads the regional market, supported by technological innovation and a robust electronics manufacturing ecosystem, while Canada and Mexico are also emerging as important contributors with growing investments and production capabilities.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. China, Japan, South Korea, Taiwan, and India play a pivotal role due to their well-established electronics and semiconductor industries. The region’s growth is fueled by rapid urbanization, increasing disposable incomes, and widespread digitalization, supported by the expansion of 4G/5G networks, IoT technologies, and smart city projects. High demand for smartphones, displays, electric vehicles, and printed circuit boards is boosting the use of advanced electronic films. Moreover, growing investments in renewable energy and electric mobility are expanding application areas. With low production costs, improving R&D capabilities, and a favorable industrial ecosystem, Asia-Pacific remains a key driver of innovation and volume in the electronic films market.

Segmentation Analysis

Insights by Film Type

The non-conductive films segment accounted for the largest market share over the forecast period 2025 to 2035. Valued for their excellent insulating properties such as thermal stability, chemical resistance, low moisture absorption, non-flammability, and low dielectric constant these films are critical in a range of electronic applications. They are widely used in displays, printed circuit boards (PCBs), semiconductors, and as protective layers across various industries. Polymer-based films like polyester, polyimide, and nylon are especially favored due to their flexibility, cost-effectiveness, and ease of processing. Growth in this segment is being propelled by increasing demand from the consumer electronics, automotive, renewable energy, and industrial sectors. Additionally, expanding applications in flexible and foldable devices, along with ongoing digitalization and smart infrastructure development, are further supporting the upward trend in non-conductive film adoption.

Insights by Material Type

The polymer segment accounted for the largest market share over the forecast period 2025 to 2035. Polymers such as polyester, polyimide, nylon, and polyphenylene are widely used due to their flexibility, lightweight structure, chemical resistance, and thermal durability. These attributes make polymer films ideal for use in displays, printed circuit boards, semiconductors, and photovoltaic modules. The segment is experiencing strong demand across consumer electronics, particularly in smartphones, tablets, OLEDs, and flexible displays. Additionally, the growing adoption of automotive electronics, renewable energy solutions, and smart infrastructure technologies is further accelerating market expansion. Easy processability and compatibility with advanced manufacturing techniques position polymer films as a preferred choice across industries, making this segment one of the most dynamic in the electronic films landscape.

Insights by Application

The Electronic Display segment accounted for the largest market share over the forecast period 2025 to 2035. The growth is driven by increasing demand for advanced display technologies in both consumer and industrial applications. Developments in OLED, LCD, MicroLED, and flexible displays are boosting the use of high-performance films that offer improved durability, optical clarity, and touch sensitivity. These films are essential in smartphones, tablets, laptops, wearables, and other smart devices. The expansion of digital signage, automotive infotainment systems, smart appliances, and medical monitors is also accelerating the adoption of electronic films in display applications. As manufacturers strive for thinner, more energy-efficient, and high-resolution displays, the need for specialized films continues to rise. This segment is expected to maintain strong momentum, supported by continuous innovation and growing end-user demand across sectors.

Recent Market Developments

- In June 2022, Leland Weaver, President of DuPont’s Water & Protection division, recently conducted a virtual teach-in focused on the Shelter Solutions business line.

Competitive Landscape

Major players in the market

- TORAY INDUSTRIES, INC. (Japan)

- DuPont (US)

- Saint-Gobain (France)

- Coveris (US)

- Nitto Denko Corporation (Japan)

- SABIC (Saudi Arabia)

- Gunze (Japan)

- The Chemours Company (US)

- 3M (US)

- Eastman Chemical Company (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Electronic Films Market, Film Type Analysis

- Conductive

- Non-Conductive

Electronic Films Market, Material Type Analysis

- Polymer

- Metal Mesh

Electronic Films Market, Application Analysis

- Electronic Display

- Semiconductors

Electronic Films Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Electronic Films Market?The global Electronic Films Market is expected to grow from USD 9.2 billion in 2024 to USD 17.8 billion by 2035, at a CAGR of 6.82% during the forecast period 2025-2035.

-

2. Who are the key market players of the Electronic Films Market?Some of the key market players of the market are TORAY INDUSTRIES, INC. (Japan), DuPont (US), Saint-Gobain (France), Coveris (US), Nitto Denko Corporation (Japan), SABIC (Saudi Arabia), Gunze (Japan), The Chemours Company (US), 3M (US) and Eastman Chemical Company (US).

-

3. Which segment holds the largest market share?The electronic display segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?