Global Electric Vehicle Charging Station Market Size, Share, and COVID-19 Impact Analysis, By Level of Charging (Level 1, Level 2, and Level 3), By Connector Type (AC Charging, DC Charging, and Wireless Charging), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Automotive & TransportationGlobal Electric Vehicle Charging Station Market Insights Forecasts To 2035

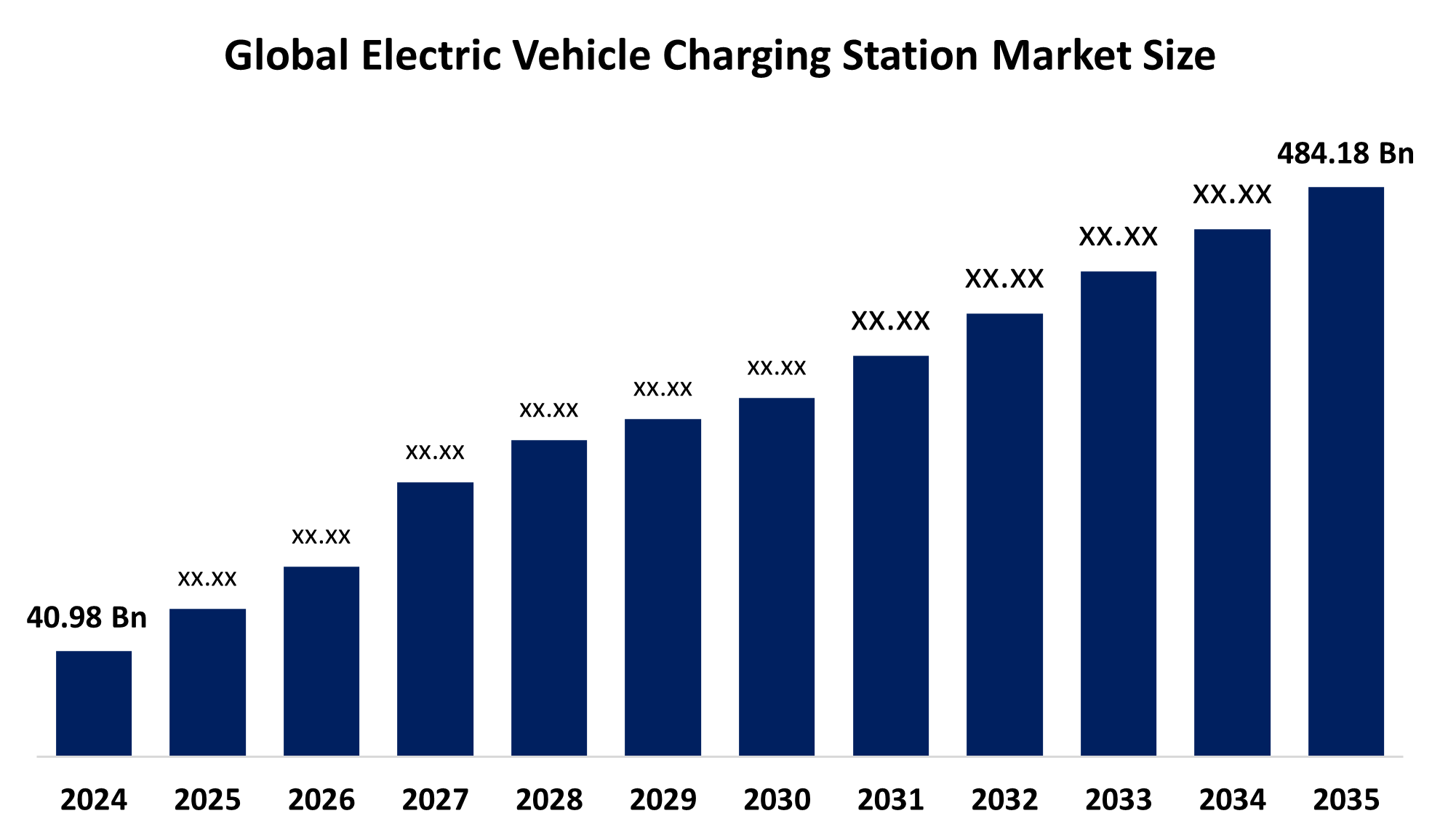

- The Global Electric Vehicle Charging Station Market Size Was Estimated at USD 40.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 25.17% from 2025 to 2035

- The Worldwide Electric Vehicle Charging Station Market Size is Expected to Reach USD 484.18 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Electric Vehicle Charging Station Market Size was worth around USD 40.98 Billion in 2024 and is Predicted to Grow to around USD 484.18 Billion by 2035 with a compound annual growth rate (CAGR) of 25.17% from 2025 and 2035. The market for electric vehicle charging stations has a number of opportunities to grow due to government investments and activities, which are important, for instance, India's PM E-DRIVE Program aims to build public EV charging stations across the country. The efficiency and convenience of EV charging are improved by technological developments, including wireless charging systems and high-power chargers.

Market Overview

An electric vehicle charging station is a facility with electrical infrastructure designed to supply electricity for recharging EV batteries. The market for electric vehide charging stations is highly attractive and profitable. The increase in EV charging stations occurring globally coincides with the increasing adoption of EVs throughout the world. According to figures, Norway leads the world with the highest perceritage with 49.1% of EV sales of total sales consisting of EVs, followed by Iceland with 19.1%, Sweden with 8%, the Netherlands with 6.7%, Finland with 4.7%, and China with 4.4% Furthermore, figures demonstrate that the number of EVs registered in the US is 1,019,260 as of 2020, with California, Florida, and Texas touting the total number of EVs registered. This is mainly due to attractive government programs designed to reduce the number of emissions produced by vehicles Future expectations for costs to continue to decrease remain in place however, supply chain challenges may threaten the decreasing trend in battery prices. During the past decade, costs, on a per kWh basis

have gone down rignificantly due to battery advancements in technology, as well as ongoing updates to currens battery technology As a result, several new companies have launched offering improved battery technologies that will offer substantial improvement in energy deruty at lower cons October 2022, an ultrafast EV charging network named Mobile Fast Charge vas lasinched

The Indian government initiated the Pit Electric Drive Revolution on the trovate venie Entarsement program with a two-year investment of 10.000 crore to accelerate the adoption of electric velcies and provide a robust infrastructure for charging them a les component of thin thimative is the construction of more than 72.300 public EV charging stations across national highways and urtion arees, including 1800 for fectric buses and truck, 48, 400 for two and thred wheelens and 22:100 for electric foul wheelers the government is providing sushes to cover van so 80% of the cons of upstream shastructure, such escales and testers to the non of these charging mamons

Report Coverage

This research report categorizes the electric vehicle charging station market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the electric vehicle charging station market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the electric vehicle charging station market.

Global Electric Vehicle Charging Station Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 40.98 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 25.17% |

| 2035 Value Projection: | USD 484.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Level of Charging, By Connector Type, By Region |

| Companies covered:: | ABB Ltd., ChargePoint, Inc., EVgo Services LLC., Allego, Scheinder Electric, Blink Charging Co., Wi Tricity Corporation, Toshiba Corporation, AeroViroment, Inc., Mojo Mobility, Inc., General Electric, Robert Bosch GmbH, Chargemaster plc., Evatran Group, HellaKGaAHueck& Co., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The electric vehicle charging station market is driven by the expanding acceptance of electric vehicles. Recent years have experienced significant growth in the world automobile industry, largely due to rapidly rising sales of electric vehicles. These trends can be attributed to increasing purchasing trends towards zero emission vehicles, rising government regulations designed to reduce vehicle emissions, incentives, and transport electrification tax credits from government organizations. According to the International Energy Agency in 2021, global sales of electric vehicles roughly doubled, following the easing of lockdowns in 2020, and sales surpassed ten million electric vehicles by 2022. Market growth can also be attributed to the falling prices of electric vehicle battery packs, increased environmental awareness from the public, and generally rising fossil fuel prices. Further, between 2010 and 2021, the price of battery packs fell by about 90% in real terms.

Restraining Factors

The electric vehicle charging station market is restricted by factors like the absence of standardization, which has led to incompatibility of EV users, due to different nations and individual automobile manufacturers using unique charging standards and connector types.

Market Segmentation

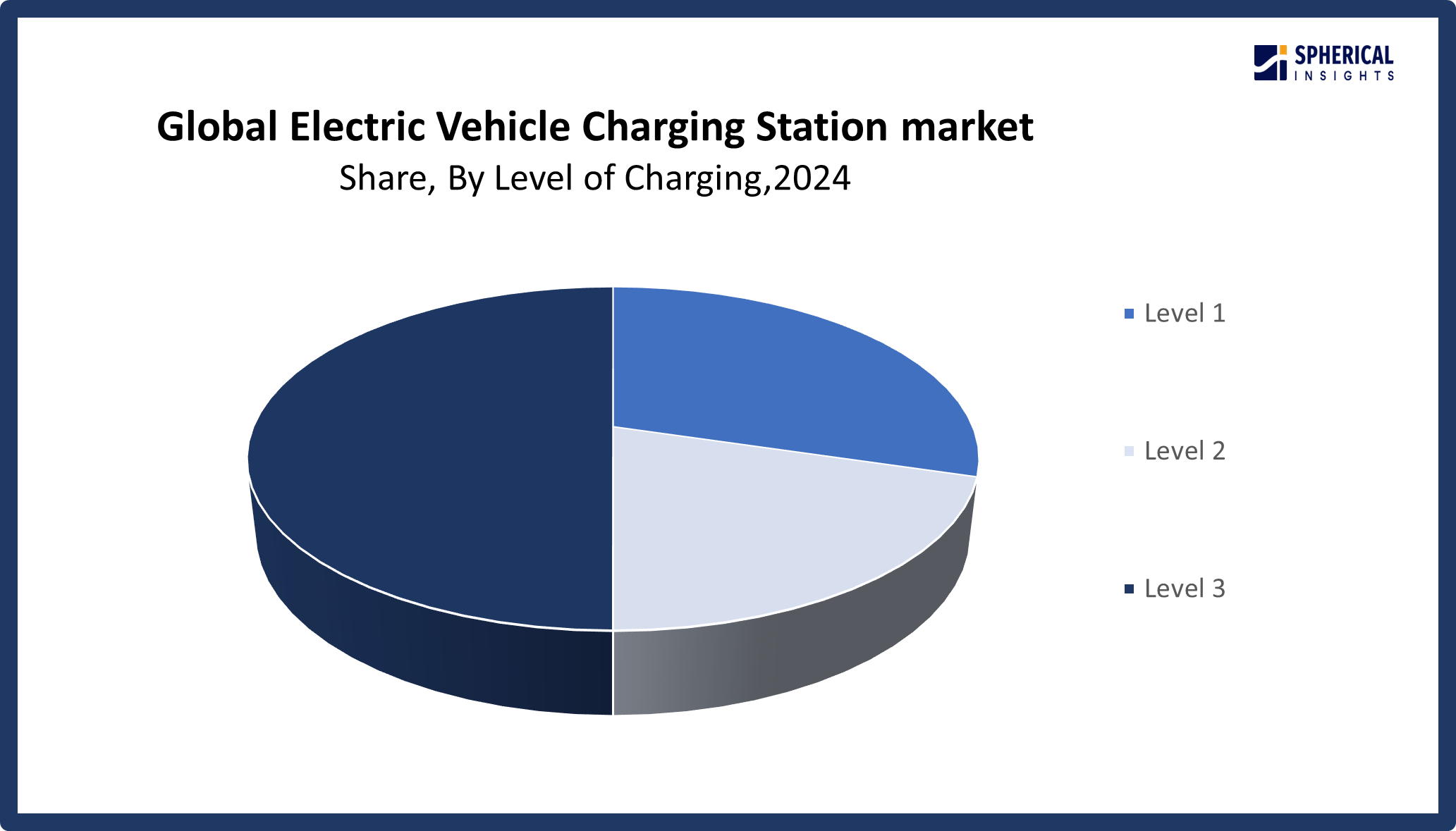

The electric vehicle charging station market share is classified into the level of charging and connector type.

- The level 3 segment dominated the market in 2024, accounting for approximately 69.5% of the total market, and is projected to grow at a substantial CAGR during the forecast period.

Based on the level of charging, the electric vehicle charging station market is divided into level 1, level 2, and level 3. Among these, the level 3 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment driven as they provide fast charging of EVs to full capacity in about an hour. The wait time for charging would be less than for level 1 or 2 charging stations, and drivers typically charge their EVs in public settings, such as rest stops along highways and public charging stations in cities. EV drivers have opted for Level 3 charging due to its speed and convenience. In March 2024, Francis Energy, one of the leading developers of electric vehicle charging networks in the United States, established a joint venture with Wallbox to install Level 3 DC fast chargers for underserved areas nationwide, with a focus on following National Electric Vehicle Infrastructure regulations to enable the capability of fast charging for longer distance travel.

Get more details on this report -

- The AC charging segment accounted for the largest share in 2024, accounting for approximately 68% of the total market, and is anticipated to grow at a significant CAGR during the forecast period.

Based on the connector type, the electric vehicle charging station market is divided into AC charging, DC charging, and wireless charging. Among these, the AC charging segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the EV customers responding positively to the well-known connection manufacturer's specification for AC charging, which is widely used in Taiwan, Europe, Australia, and Southeast Asia. The type 2 connection is different than other types because it doesn't have a pin. SINBON provides its customers with 20A and 32A options, among others. The electric vehicle charging station demand continues to grow with the increase in electric vehicle demand, increasing the number of different standards for EV charging stations and products.

Regional Segment Analysis of the Electric Vehicle Charging Station Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, capturing 60.70% of the electric vehicle charging station market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share and capture 60.70% of the electric vehicle charging station market over the predicted timeframe. In the Asia Pacific market, the market is rising due to the with 12.82 million population connectors and a 25% annual increase in installations. To date, national initiatives have installed 6,000 highway service areas, offering satisfactory long-distance coverage in relation to the 40.9% composition of new energy vehicle sales in the country. While India's two-wheeler battery swapping stations illustrate how basic transport needs can drive charger density, Japan is taking the lead in developing megawatt systems for heavy duty trucks. With concerns about trade, South Korea has begun to develop a secondary source for battery materials, while Australia is placing funding in sites to delineate corridors in remote areas across its sizable interstate distances.

Europe is expected to grow at a rapid CAGR of 42.68% in the electric vehicle charging station market during the forecast period. The Europe area has a thriving market for electric vehicle charging stations due to the spark alliance provide 100% renewable energy and transparent pricing by installing 11,000 high power connectors in 25 countries. Germany recently announced plans to install more than a million new charging stations by 2030, consistent with EU policies connecting infrastructure quotas and EV registrations. Norway continues to have the most chargers per individual in the world, while France is utilizing low interest financing to encourage private deployments. To build customer confidence, UK policy mandates payment card interoperability at population chargers and bans the sale of most new gasoline powered vehicles beginning in 2035.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the electric vehicle charging station market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB Ltd.

- ChargePoint, Inc.

- EVgo Services LLC.

- Allego

- Scheinder Electric

- Blink Charging Co.

- Wi Tricity Corporation

- Toshiba Corporation

- AeroViroment, Inc.

- Mojo Mobility, Inc.

- General Electric

- Robert Bosch GmbH

- Chargemaster plc.

- Evatran Group

- HellaKGaAHueck& Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Ballenoil launched its own EV charging network. The company plans to install 42 charging points and charging infrastructure, focusing on delivering over 150kW of power. The focus is on charging vehicles in just 10-20 minutes.

- In May 2025, ChargePoint and Eaton established an industry-first EV charging partnership to accelerate deployment of charging infrastructure across the US, Canada, and Europe, integrating EV charging solutions and co-developing technologies for bidirectional power flow and vehicle-to-everything capabilities.

- In April 2025, ChargePoint Holdings, Inc. raised USD500 million in a secondary public offering, increasing its market capitalization to over USD5 billion and strengthening its position as the leading EV charging network provider.

- In January 2025, Schneider Electric launched Schneider Charge Pro, a robust, energy-efficient electric vehicle charging solution with a simplified charging experience to accelerate EV adoption among commercial fleets and multifamily residences, addressing the EU Energy Performance of Buildings Directive requirements.

- In September 2024, Amazon and Global Optimism co-founded the Climate Pledge. They launched a network of shared charging stations for faster acquisition of electric mobility, with the Pledge signatories and partners looking to collectively invest over $2.65 million into the project by 2030.

- In August 2024, 3V Infrastructure declared its formation with a mission to accelerate widespread access to EV charging staffed with top-tier talent. 3V Infrastructure builds and functions Level 2 EV chargers in long-dwell properties like multifamily hotels and housing, eliminating upfront and ongoing costs for real estate portfolio owners and managers.

- In January 2024, Tesla, Inc. announced the launch of its new Supercharger V3 charging stations, capable of delivering up to 25 miles of range per minute of charging, making it the fastest charging network in the world.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the electric vehicle charging station market based on the below-mentioned segments:

Global Electric Vehicle Charging Station Market, By Level of Charging

- Level 1

- Level 2

- Level 3

Global Electric Vehicle Charging Station Market, By Connector Type

- AC Charging

- DC Charging

- Wireless Charging

Global Electric Vehicle Charging Station Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the electric vehicle charging station market over the forecast period?The global electric vehicle charging station market is projected to expand at a CAGR of 25.17% during the forecast period.

-

2. What is the market size of the electric vehicle charging station market?The global electric vehicle charging station market size is expected to grow from USD 40.98 billion in 2024 to USD 484.18 billion by 2035, at a CAGR of 25.17% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the electric vehicle charging station market?Asia Pacific is anticipated to hold the largest share of the electric vehicle charging station market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global electric vehicle charging station market?ABB Ltd., ChargePoint, Inc., EVgo Services LLC., Allego, Scheinder Electric, Blink Charging Co., Wi Tricity Corporation, Toshiba Corporation, AeroViroment, Inc., Mojo Mobility, Inc., General Electric, Robert Bosch GmbH, Chargemaster plc., Evatran Group, HellaKGaAHueck& Co., and Others.

-

5. What factors are driving the growth of the electric vehicle charging station market?The electric vehicle charging station market growth is driven by rising fuel prices, making EVs more cost competitive, technological advancements, i.e, faster chargers, smart grids, growing environmental awareness, and increased EV adoption as governments around the world set low emission goals and offer subsidies and regulatory incentives.

-

6. What are the market trends in the electric vehicle charging station market?The electric vehicle charging station market trends include DC Fast Charging, Smart Grid Integration & Vehicle‑to‑Grid, Standardization & Interoperability, Integration with Renewable Energy and Energy Storage, and Smart Charging and User Experience Enhancements.

-

7. What are the main challenges restricting wider adoption of the electric vehicle charging station market?The electric vehicle charging station market trends include high initial installation costs, particularly for DC fast chargers, a shoddy or antiquated grid infrastructure, delays in regulatory and permitting processes, a lack of uniformity in charging types and connectors, geographical disparities in station availability, particularly in rural or multi-unit housing, user range anxiety, and low consumer awareness.

Need help to buy this report?