Global Electric Manual Toothbrush Market Size, Share, and COVID-19 Impact Analysis, By Age Group (Adults and Children), By Distribution Channel (Supermarkets, Online, Pharmacy/Drugstores, and Specialty Retail Stores), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Electric Manual Toothbrush Market Size Insights Forecasts to 2035

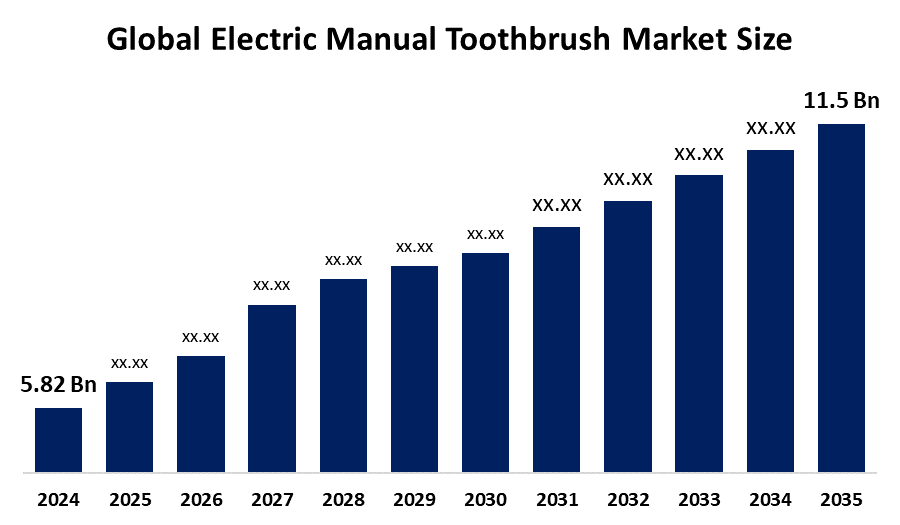

- The Global Electric Manual Toothbrush Market Size Was Estimated at USD 5.82 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.39% from 2025 to 2035

- The Worldwide Electric Manual Toothbrush Market Size is Expected to Reach USD 11.5 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Electric Manual Toothbrush Market Size was worth around USD 5.82 Billion in 2024 and is predicted to Grow to around USD 11.5 Billion by 2035 with a compound annual growth rate (CAGR) of 6.39% from 2025 to 2035. The ageing population, increased disposable income, technological improvements, improved accessibility and affordability, and growing online retail presence all contribute to the growth of the global manual and electric toothbrush market.

Market Overview

The global electric manual toothbrush market encompasses both powered and non-powered toothbrushes that aim to enhance oral hygiene by effectively removing plaque, promoting gum health, and offering convenient, efficient teeth-cleaning options. The growing awareness of oral hygiene and technological improvements are driving the continuous expansion of the global market for electric and manual toothbrushes. The World Journal of Biology, Pharmacy, and Health Sciences 2024 reports that while strong preventative programs in Western European nations like Sweden and Germany lead to better oral health outcomes, more than 70% of Romanian youngsters experience dental caries, highlighting regional differences.

According to the CDC, 90% of adults over 20 have had at least one cavity, and 52% of children between the ages of 6 and 8 have cavities in their primary teeth. The market demand is being driven by the increasing use of children's electric toothbrushes with soft bristles and interactive timers. High-end electric toothbrushes with pressure sensors, gum care technologies, and several brushing modes are likewise becoming more and more popular. However, their ease and wide selection of products, e-commerce platforms account for a significant portion of manual toothbrush sales. Growing sustainability trends, which reflect customer demand for greener products worldwide, have sparked breakthroughs in eco-friendly toothbrushes manufactured from bamboo and corn starch. Parents are increasingly liking children's electric toothbrushes that have interactive features, soft bristles, and built-in timers. At the same time, the demand for premium and luxury electric toothbrushes is growing due to consumer preferences for sophisticated electric toothbrushes with enhanced technology, pressure sensors, and multiple brushing modes for gum care.

Report Coverage

This research report categorizes the electric manual toothbrush market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the electric manual toothbrush market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the electric manual toothbrush market.

Global Electric Manual Toothbrush Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.82 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.39% |

| 2035 Value Projection: | USD 11.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Age Group, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Philips Sonicare, Oral-B (P & G), Panasonic, Colgate - Palmolive, Wellness Oral Care, Interplak, Church & Dwight, quip, Waterpik, Lebond, Ningbo Seago, Risun Technology, SEASTAR Corporation, JSB Healthcare, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing consumer awareness of oral hygiene and preventative healthcare is driving the market for electric and manual toothbrushes and increasing spending on personal care items. Because of their greater cleaning capabilities, regular brushing action, and integrated technologies like pressure sensors and smart timers, electric toothbrushes are becoming more popular. Demand is further increased by digital health platforms that offer adapted dental treatment. Brushing efficiency is increased by technological innovations such as real-time monitoring, AI integration, connection features, and customized reminders. Innovations like gum care modes and smart features provide electric toothbrushes with a competitive edge and improve their ability to remove plaque, prevent gum disease, and maintain general oral health, which drives market expansion.

Restraining Factors

The market for manual and electric toothbrushes faces numerous challenges, including competition, changing customer preferences, and continuous advancement in technology, which all pressure companies to pursue a differentiation strategy. With relatively low market entry barriers, companies can face an additional burden. Global distribution is further complicated by differing safety standards and regulations between countries. New oral care technologies, such as water flossers and teeth-whitening devices, present a threat to consumer spending and possibly increase the loss of market share from traditional manual and electric toothbrushes.

Market Segmentation

The Electric Manual Toothbrush market share is classified into age group and distribution channel.

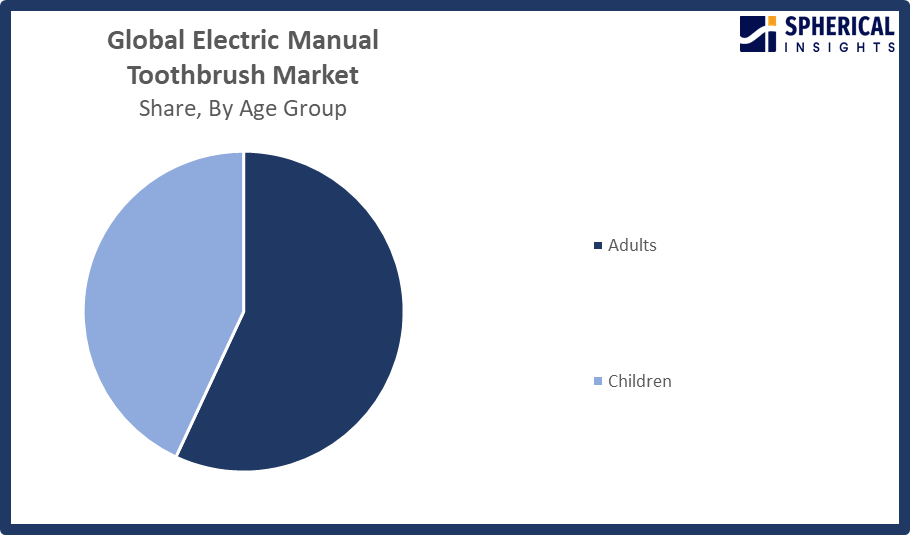

- The adults segment dominated the market in 2024 with approximately 75.5% and is projected to grow at a substantial CAGR during the forecast period.

Based on the age group, the electric manual toothbrush market is divided into adults and children. Among these, the adults segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Rising dental hygiene awareness, rising disposable incomes, and a preference for cutting-edge electric toothbrushes with features like pressure sensors, numerous brushing modes, and smart timers are the main causes of this domination. Adults are more likely to spend money on high-end dental care products, which helps explain the segment's sizable market size and anticipated steady expansion over the course of the projection period.

Get more details on this report -

- The supermarkets segment accounted for the largest share in 2024, approximately 41.3% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the electric manual toothbrush market is divided into supermarkets, online, pharmacy/drugstores, and specialty retail stores. Among these, the supermarkets segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Their widespread accessibility, large range of products, and ability to allow customers to visually check items before making a purchase are the reasons for their prominence. Supermarkets also draw a sizable client base with their competitive prices and special offers. Their leadership is fuelled by their broad product range, ease of accessibility, and capacity to allow customers to personally inspect items before purchasing. Their position is further reinforced by competitive pricing, exclusive deals, and the ease of one-stop shopping.

Regional Segment Analysis of the Electric Manual Toothbrush Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 35.88% of the Electric Manual Toothbrush market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the electric manual toothbrush market over the predicted timeframe. The primary drivers of North America's leadership position in both electric and manual toothbrushes are high levels of personal consumption expenditures, broad retail and e-commerce distribution networks, and an increasing consumer interest in innovative dental care products. In the U.S., a mature market, awareness of consumers regarding product features that include pressure sensors, multiple brushing modes, and connectivity to assistive devices is in continuous development to accelerate the adoption of smart toothbrush technology while also fueling market expansion throughout the region.

Asia Pacific is expected to grow market share with approximately 32.5% at a rapid CAGR in the electric manual toothbrush market during the forecast period. Rising disposable incomes, growing urbanisation, and increased awareness of dental hygiene in nations like China, India, and Japan are all factors contributing to this domination. The region is also seeing a rise in the use of electric toothbrushes due to technological developments including timers, pressure sensors, and mobile app connectivity.

Europe is expected to grow at a rapid CAGR in the electric manual toothbrush market during the forecast period. The emergence of new electric toothbrush technologies, rapid disposable income growth, and increasing consumer awareness about oral hygiene have all contributed to the usage of electric toothbrushes in these regions. Countries such as Germany, France, and the UK are showing increased demand for premium, smart toothbrushes with applications such as pressure sensors, multiple brushing modes, and networking. Growth in the regions has also been bolstered by great retail and e-commerce networks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the electric manual toothbrush market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Philips Sonicare

- Oral-B (P & G)

- Panasonic

- Colgate - Palmolive

- Wellness Oral Care

- Interplak

- Church & Dwight

- quip

- Waterpik

- Lebond

- Ningbo Seago

- Risun Technology

- SEASTAR Corporation

- JSB Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Suri 2.0 Sustainable Sonic Toothbrush was introduced with 33,000 sonic vibrations per minute, a pressure sensor, 40+ day battery life, and a UV-C charging case eliminating 99.99% of bacteria.

- In January 2025, the Philips Sonicare 5000–7000 Series was introduced with eco-friendly brush heads composed of 70% bio-based plastic, adaptive brushing technology that can provide up to 62,000 sonic motions per minute, and optical pressure detection.

- In January 2025, the Oral-B iO Series 2 (iO2) electric toothbrushes, which use cutting-edge iO technology, were introduced in Berlin by the Procter & Gamble brand ORAL-B. With its 150% improved plaque removal, the recently released product guarantees thorough tooth cleaning, even in difficult-to-reach places.

- In July 2024, the quip 360 Oscillating Toothbrush was the company's first oscillating electric toothbrush. With a battery life of up to 30 days, this new product has a pressure sensor with three brushing intensities. The American Dental Association (ADA) approved it as well.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the electric manual toothbrush market based on the below-mentioned segments:

Global Electric Manual Toothbrush Market, By Age Group

- Adults

- Children

Global Electric Manual Toothbrush Market, By Distribution Channel

- Supermarkets

- Online

- Pharmacy/Drugstores

- Specialty Retail Stores

Global Electric Manual Toothbrush Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Electric Manual Toothbrush market over the forecast period?The global Electric Manual Toothbrush market is projected to expand at a CAGR of 6.39% during the forecast period.

-

2. What is the market size of the Electric Manual Toothbrush market?The global Electric Manual Toothbrush market size is expected to grow from USD 5.82 Billion in 2024 to USD 11.5 Billion by 2035, at a CAGR of 6.39% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Electric Manual Toothbrush market?North America is anticipated to hold the largest share of the Electric Manual Toothbrush market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Electric Manual Toothbrush market?Philips Sonicare, Oral-B (P & G), Panasonic, Colgate - Palmolive, Wellness Oral Care, Interplak, Church & Dwight, quip, Waterpik, and Lebond.

-

5. What factors are driving the growth of the Electric Manual Toothbrush market?Growing awareness of oral hygiene, increased disposable incomes, and trends in preventative healthcare are driving the market for electric and manual toothbrushes. Global market expansion is also fuelled by the growing use of electric toothbrushes, technological advancements such as pressure sensors and smart timers, digital health platforms, and consumer demand for high-end, kid-friendly goods.

-

6. What are the market trends in the Electric Manual Toothbrush market?Technological developments like artificial intelligence (AI) and pressure sensors, smart connectivity with mobile apps, rising demand for eco-friendly products, increased use of high-end models, and growing e-commerce channels that boost accessibility and sales are some of the major trends in the market for electric and manual toothbrushes.

-

7. What are the main challenges restricting wider adoption of the Electric Manual Toothbrush market?High product costs, fierce competition, quickly shifting customer tastes, a lack of regionally uniform laws, and the rising acceptance of substitute oral hygiene products like water flossers and teeth-whitening technology are the primary obstacles.

Need help to buy this report?