Global E. coli Testing Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments and Consumables), By Test Type (Clinical Test and Environmental Test), By End-User (Diagnostic Laboratories, Hospitals, Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal E. coli Testing Market Size Forecasts to 2033

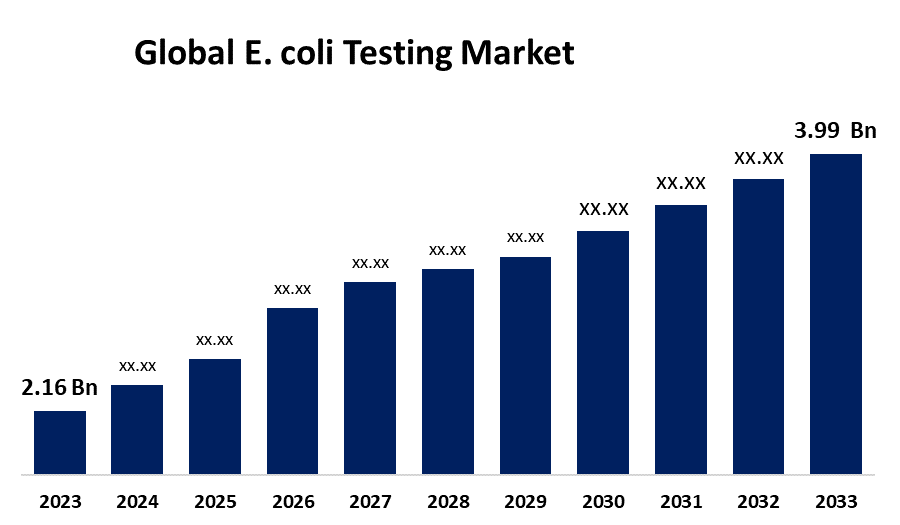

- The Global E. coli Testing Market Size Was Estimated at USD 2.16 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 6.33% from 2023 to 2033

- The Worldwide E. coli Testing Market Size is expected to reach USD 3.99 billion by 2033

- Asia Pacific is predicted to grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global E. coli Testing Market Size is predicted to exceed USD 3.99 Billion by 2033, Growing at a CAGR of 6.33% from 2023 to 2033.

Market Overview

The global E. coli testing market is categorized under the medical sector, which involves the detection and evaluation of the E. coli bacteria in various samples such as food, water, etc. A gram-negative bacterium called Escherichia coli causes several diarrheal diseases, such as dysentery and traveller’s diarrhea. It is the most prevalent pathogen that causes pneumonia, bacteremia, and other extraintestinal diseases in addition to simple cystitis. Patients and healthcare systems are greatly burdened by E. coli's sickness, which requires early detection and suitable treatment. There are several methods for the identification and analysis of E. coli in various food and water samples, such as polymerase chain reaction (PCR), gold nanoparticles, solid phase cytometry, membrane filtration, enzyme enzyme-linked immunosorbent assay (ELISA). E. coli is a type of bacteria found in both human and animal intestines, often causing minor gastrointestinal discomfort to serious infections. E. coli testing is conducted in clinical settings to identify pathogenic strains, such as urinary tract infections, sepsis, newborn meningitis, and gastrointestinal illnesses like diarrhea. Membrane filtration and enzyme substrate methods are common techniques used to detect E. coli. Food industries, particularly those dealing with cheese, raw milk, undercooked products, and unpasteurized milk, require stringent E. coli testing to prevent contamination and foodborne illnesses. Contaminated food and water sources can lead to widespread outbreaks, causing significant economic and health consequences. E. coli testing is crucial for maintaining public health and safety, ensuring safe food and water supplies. As global focus on food safety and water quality grows, the demand for advanced and accurate E. coli testing solutions is expected to increase.

The rising prevalence of E. coli infections escalates the need for E. coli testing, which results in market growth. For instance, Escherichia coli (STEC) is a significant public health concern due to its potential to cause severe disease outbreaks, with estimates suggesting it causes 265,000 illnesses, 3,600 hospitalizations, and 30 deaths annually in the United States.

Report Coverage

This research report categorizes the global E. coli testing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global E. coli testing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global E. coli testing market.

Global E. coli Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.16 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.33% |

| 2033 Value Projection: | USD 3.99 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Test Type, By End-User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Idexx Laboratories inc., Pro-Lab Diagnostics, Thermo Fisher Scientific, Alere Inc., Qiagen N.V., Accugen Laboratories Inc., Bio-Rad Laboratories Inc., Nanologix Inc., Becton Dickinson and Company, Meridian Bioscience Inc., Cell Culture Technologies LLC, Merck & Co., Inc., and Others Key Vendor. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors:

The demand for quicker diagnostics in gastrointestinal infections, particularly E. coli, has led to the development of high-speed testing methodologies. Newer PCR-based tests, like Thermo Fisher's TaqPath Enteric Bacterial Select Panel, yield results within two hours, allowing health providers to diagnose and treat infections more promptly, reducing patient wait times and hospital stays. Global food safety regulations are driving the demand for advanced E. coli testing solutions, emphasizing compliance with testing protocols to mitigate contamination risks in food production and distribution chains. Automated testing systems are being adopted to ensure compliance and optimize operational efficiency. Rising consumer awareness about food safety and hygiene is encouraging industries to invest in robust testing frameworks to safeguard public health and maintain brand integrity. Point-of-care (POC) testing for E. coli is increasingly supported through molecular diagnostic technologies like PCR, LAMP, and mass spectrometry, providing rapid, on-site results for pathogens in water, food, and stool samples.

Restraining Factors

The E. coli testing market faces challenges such as high costs, complex regulatory compliance, limited awareness, technological barriers, and environmental challenges. These factors limit accessibility for smaller organizations and regions, hindering market expansion.

Market Segmentation

The global E. coli testing market share is classified into product, test type, and end-user.

- The consumables segment dominated the market with 80.51% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period.

Based on the product, the global E. coli testing market is categorized into instruments and consumables. Among these, the consumables segment dominated the market with 80.51% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period. The segment growth is owing to the extensive usage of rapid kits, growing demand for contamination-free results, rising prevalence of waterborne and foodborne diseases, innovations and technological advancements, enhanced accuracy, and implementation of safety regulations.

- The environmental test segment accounted for the largest market share of 58.25% in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the test type, the global E. coli testing market is categorized into clinical test and environmental test. Among these, the environmental test segment accounted for the largest market share of 58.25% in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The segmental expansion is attributed to the extensive usage of the membrane filtration and enzyme substrate methods in hospitals and laboratories. Growing public health awareness, cost-effective testing, and accessibility.

- The hospitals segment held the largest market share of 63.78% in 2023 and is predicted to grow at a significant CAGR throughout the projected timeframe.

Based on the end-user, the global E. coli testing market is categorized as diagnostic laboratories, hospitals, clinics, and others. Among these, the hospitals segment held the largest market share of 63.78% in 2023 and is predicted to grow at a significant CAGR throughout the projected timeframe. The segmental growth is attributed to the rising prevalence of infectious diseases, availability of the kits and the chemicals for the conduct of infectious diseases, rising proportion of inpatient services and admissions for the emergency care department, doctors are diagnosing infections, and innovations in the testing methodologies.

Regional Segment Analysis of the Global E. coli Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global E. coli testing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global E. coli testing market over the predicted timeframe. The market for E. coli testing in North America is a major component of the healthcare and diagnostics sector, propelled by the development of diagnostic technology, stricter regulations, and the increasing demand for food and water safety. The market is anticipated to expand steadily as a result of rising awareness of foodborne illnesses and the use of sophisticated testing techniques. E. coli testing is essential for detecting bacterial contamination and guaranteeing public health safety in several fields, such as food safety, water quality monitoring, and clinical diagnostics. Rapid diagnostic tests are growing in prominence owing to their accuracy and efficiency, and technological developments like automated testing systems and molecular diagnostics are driving market expansion. In the US, stringent laws enforced by the FDA and USDA are encouraging the use of trustworthy testing methods, guaranteeing adherence to safety requirements, and safeguarding consumers. The region's robust regulatory frameworks and well-established healthcare infrastructure have encouraged the adoption of state-of-the-art testing methods in several important industries.

Asia Pacific is anticipated to grow at the fastest CAGR throughout the projected timeframe. The market for E. coli testing in Asia Pacific is growing rapidly as a result of rising food production and awareness of food safety. Effective testing procedures are being funded by both the public and private sectors, especially for food and beverage firms. New technologies like lateral flow immunoassays and multiplex PCR are widely used. While India is enhancing its testing infrastructure, South Korea and Japan are implementing sophisticated testing procedures for food exports.

Europe is projected to hold a significant share of the E. coli testing market throughout the predicted timeframe. Europe's market for E. coli testing is growing as a result of stringent food safety laws and growing health concerns. E. coli isolates with the blaNDM-5 gene have been connected to travel to Asia and Africa. Proper food preparation, vegetable washing, and hand hygiene are all advised by the ECDC. One of the main causes of bacterial infections is E. coli, which has raised the need for sophisticated testing equipment. Innovation and demand for E. coli testing are being driven by Germany, France, and the UK. New testing technologies are being invested in as food sustainability and traceability gain attention. Strict testing procedures and legal enforcement, especially in the UK, are driving market expansion owing to attempts to prevent waterborne contamination.

South America is estimated to hold a significant share of the E. coli testing market during the forecast period. This is attributed to the rising acute and chronic microbial infections, improvement in the food safety standards, growing investment in bacterial testing from the Brazil and Argentina region, and providing sophisticated and innovative testing facilities for food products and drinking water.

Middle East and Africa is predicted to hold a significant share of the E. coli testing market over the forecast period. This is owing to extensive usage of the rapid test kits, the government of Saudi Arabia is implementing the food safety regulations, which lead to hygienic food delivery and storage and spending expenditures on the testing facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global E. coli testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Idexx Laboratories inc.

- Pro-Lab Diagnostics

- Thermo Fisher Scientific

- Alere Inc.

- Qiagen N.V.

- Accugen Laboratories Inc.

- Bio-Rad Laboratories Inc.

- Nanologix Inc.

- Becton Dickinson and Company

- Meridian Bioscience Inc.

- Cell Culture Technologies LLC

- Merck & Co., Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, QIAGEN was cleared by the FDA to use its QIAstat-Dx Gastrointestinal Panel 2 Mini B for clinical use, focusing on bacterial infections like Campylobacter, Salmonella, Escherichia coli, Shigella, and Yersinia enterocolitica. This panel complements the QIAstat-Dx Gastrointestinal Panel 2 Mini B&V, which covers Campylobacter, Salmonella, Escherichia coli, Shigella, and Norovirus.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global E. coli testing market based on the below-mentioned segments:

Global E. coli Testing Market, By Product

- Instruments

- Consumables

Global E. coli Testing Market, By Test Type

- Clinical Test

- Environmental Test

Global E. coli Testing Market, By End-User

- Diagnostic Laboratories

- Hospitals

- Clinics

- Others

Global E. coli Testing Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global E. coli testing market?The global E. coli testing market is projected to expand at 6.33% during the forecast period.

-

2. Who are the top key players in the global E. coli testing market?The key players in the global E. coli testing market are Idexx Laboratories Inc., Pro-Lab Diagnostics, Thermo Fisher Scientific, Alere Inc., Qiagen N.V., Accugen Laboratories Inc., Bio-Rad Laboratories Inc., Nanologix Inc., Becton Dickinson and Company, Meridian Bioscience Inc., Cell Culture Technologies LLC, Merck & Co., Inc., and others.

-

3. Which region holds the largest share of the market?North America is anticipated to hold the largest share of the global E. coli testing market over the predicted timeframe.

Need help to buy this report?