Global Driveline Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Hybrid Vehicles (HEV), Battery Electric Vehicle (BEV), Plug-In Electric Hybrid (PHEV)), By Transmission Type (Electronic Continuously Variable Transmission (E-CVT), Automatic Transmission (AT), Dual Clutch Transmission (DCT)), By Architecture (Power Spilt, Series, EV Driveline, Parallel), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Driveline Market Size Forecasts to 2033

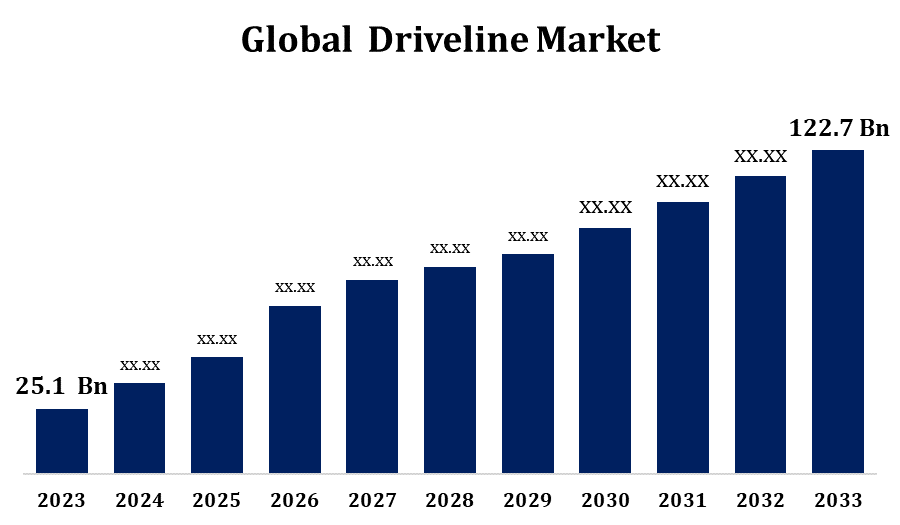

- The Global Driveline Market Size was valued at USD 25.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 13.34% from 2023 to 2033.

- The Worldwide Driveline Market Size is expected to reach USD 87.8 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Driveline Market Size is Expected to reach USD 87.8 Billion by 2033, at a CAGR of 13.34% during the forecast period 2023 to 2033.

The driveline market encompasses the components responsible for transmitting power from a vehicle's engine to its wheels, ensuring efficient movement. This market includes essential parts like transmissions, axles, driveshafts, and differential systems, which are critical for vehicle performance, handling, and fuel efficiency. Technological advancements, such as the integration of electric drivetrains in electric vehicles (EVs) and hybrid models, have significantly impacted the market, promoting the development of lighter, more efficient driveline systems. The growing demand for fuel-efficient and high-performance vehicles has also driven innovation, while stringent environmental regulations are pushing manufacturers toward sustainable and eco-friendly driveline solutions. As the automotive industry evolves, the driveline market continues to adapt to meet the needs of modern mobility solutions, including autonomous and electric vehicles.

Driveline Market Value Chain Analysis

The driveline market value chain consists of several interconnected stages, beginning with raw material suppliers who provide essential inputs like steel, aluminum, and composites. These materials are then used by component manufacturers to produce driveline parts such as transmissions, axles, and differentials. System integrators and Tier 1 suppliers assemble and integrate these components into complete driveline systems tailored to vehicle specifications. Automotive OEMs (Original Equipment Manufacturers) install these systems into vehicles during production. Post-manufacturing, the aftermarket segment offers maintenance, replacement parts, and upgrades. Research and development play a crucial role across the value chain, driving innovation and efficiency. Additionally, logistics and distribution ensure timely delivery of components globally. Each stage in the value chain contributes to the performance, cost-effectiveness, and sustainability of driveline systems in modern vehicles.

Driveline Market Opportunity Analysis

The driveline market offers significant growth opportunities fueled by the rapid shift toward electric and intelligent vehicles. The rising adoption of electric and hybrid vehicles is increasing demand for advanced driveline technologies such as e-axles and electronic CVTs that improve efficiency and performance. Innovations like modular driveline designs and smart control systems are enabling greater adaptability across vehicle platforms. Integration with advanced driver assistance systems (ADAS) is also enhancing vehicle safety and automation. Expanding automotive production in emerging markets, especially in Asia-Pacific, is further boosting demand. Additionally, the aftermarket sector is growing as more electric and hybrid vehicles require specialized maintenance and upgrades. Companies investing in lightweight, energy-efficient, and intelligent driveline solutions are well-positioned to benefit from these evolving trends and changing mobility needs.

Driveline Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.34% |

| 2033 Value Projection: | USD 87.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Vehicle Type, By Transmission Type, By Architecture and COVID-19 Impact Analysis |

| Companies covered:: | Borgwarner, Continental, Denso, Robert Bosch, GKN, Delphi, Valeo, Hitachi, Schaeffler, ZF, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Market Dynamics

Driveline Market Dynamics

Increasing demand for four-wheeled vehicles to boost the market growth

The increasing demand for four-wheeled vehicles is expected to significantly drive the growth of the driveline market. As consumer preference shifts toward personal mobility and convenience, the production and sales of passenger cars and light commercial vehicles continue to rise globally. This trend is especially prominent in emerging economies where rising income levels and urbanization are accelerating vehicle ownership. Four-wheeled vehicles require efficient and reliable driveline systems to ensure optimal performance, fuel efficiency, and handling. Additionally, the growing adoption of electric and hybrid four-wheelers is fueling the need for advanced driveline technologies such as e-axles and integrated electric drive units. Automakers are focusing on enhancing driveline performance to meet evolving consumer expectations and regulatory standards, thereby creating a favorable environment for sustained market expansion.

Restraints & Challenges

The driveline market faces several challenges that could hinder its growth. A major concern is the high cost of advanced driveline systems, especially in electric vehicles, where components like electric motors and integrated drive units add to production expenses. Supply chain disruptions also affect the steady flow of critical materials and parts, impacting manufacturing timelines. The industry's transition from conventional internal combustion engines to electric and hybrid systems demands heavy investment in R&D, which can strain smaller manufacturers. Additionally, integrating driveline components with advanced driver-assistance systems (ADAS) increases design complexity. Strict emissions regulations and fuel efficiency standards further pressure manufacturers to innovate rapidly, often at a high cost. Market uncertainties, such as fluctuating raw material prices and global geopolitical issues, add further complications to strategic planning and long-term investment decisions.

Regional Forecasts

Get more details on this report -

North America Market Statistics

North America is anticipated to dominate the Driveline Market from 2023 to 2033. The North American driveline market is experiencing dynamic changes driven by shifting consumer preferences, technological evolution, and regulatory developments. While electrification efforts are gaining traction, traditional internal combustion engine (ICE) vehicles especially light trucks continue to see strong demand across the region. General Motors’ decision to boost transmission production in Ohio highlights this ongoing reliance on ICE drivetrains. However, the sector faces challenges such as new tariffs on auto imports, which could increase production costs and strain supply chains. Despite these obstacles, companies like American Axle & Manufacturing are showing resilience, reporting strong performance and securing new contracts, reflecting consistent demand for driveline components. As the market navigates the balance between electrification and conventional vehicle needs, manufacturers must remain agile and responsive to policy shifts and evolving consumer expectations to maintain growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China’s booming automotive industry is increasingly focusing on electric and hybrid vehicles, making it a crucial market for specialized driveline parts like e-axles and electronic continuously variable transmissions (E-CVTs). As the demand for EVs rises, manufacturers are investing heavily in innovative driveline systems to enhance performance and energy efficiency. In India, the growing middle class and improving infrastructure are contributing to a surge in vehicle production, further driving driveline demand. Japan, known for its advanced automotive technology, continues to lead in high-performance driveline solutions. The region’s strong manufacturing base, skilled labor force, and well-established supply chains provide a competitive advantage, solidifying its leadership in the global automotive parts market.

Segmentation Analysis

Insights by Vehicle Type

The Hybrid Vehicles (HEV) segment accounted for the largest market share over the forecast period 2023 to 2033. HEVs, which combine traditional internal combustion engines with electric drivetrains, offer enhanced fuel efficiency and lower emissions compared to conventional vehicles, making them appealing to environmentally conscious consumers who are not ready to fully transition to electric vehicles. The growing availability of HEV models from automakers, along with advancements in hybrid driveline technologies like regenerative braking and electronic continuously variable transmissions (E-CVTs), further boosts their popularity. Additionally, government incentives and tighter emissions regulations are accelerating HEV adoption. As a result, the HEV segment is set to continue expanding within the driveline market in the coming years.

Insights by Transmission Type

The Automatic Transmission (AT) segment accounted for the largest market share over the forecast period 2023 to 2033. AT systems provide effortless gear shifting and reduce driver fatigue, especially in congested urban traffic. Innovations such as dual-clutch transmissions and advanced electronic control units have enhanced the performance, efficiency, and reliability of these systems. The growing adoption of AT in hybrid and electric vehicles is also contributing to segment expansion, as it ensures seamless power delivery and supports better energy management. Moreover, manufacturers are investing in lightweight and compact AT designs to comply with strict emission standards and improve fuel economy. These advancements and consumer trends are collectively accelerating the growth of the automatic transmission segment across global driveline markets.

Insights by Architecture

The series segment accounted for the largest market share over the forecast period 2023 to 2033. In this configuration, the internal combustion engine functions primarily to generate electricity, which powers the electric motor that drives the vehicle’s wheels. This setup is especially efficient in stop-and-go city traffic, as it minimizes mechanical losses and enhances fuel efficiency while reducing emissions. The push for greener mobility solutions and the enforcement of strict emission standards are accelerating the adoption of series hybrid drivetrains. Additionally, ongoing improvements in battery systems and electric motor technologies are boosting the performance and attractiveness of these vehicles. With increasing demand for sustainable urban mobility, the Series Hybrid segment is expected to play a key role in the future growth of the driveline market.

Recent Market Developments

- In February 2024, LIQUI MOLY has launched a new additive for AdBlue® designed to protect the Selective Catalytic Reduction (SCR) system used in exhaust gas treatment from potential damage.

Competitive Landscape

Major players in the market

- Borgwarner

- Continental

- Denso

- Robert Bosch

- GKN

- Delphi

- Valeo

- Hitachi

- Schaeffler

- ZF

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Driveline Market, Vehicle Type Analysis

- Hybrid Vehicles (HEV)

- Battery Electric Vehicle (BEV)

- Plug-In Electric Hybrid (PHEV)

Driveline Market, Transmission Type Analysis

- Electronic Continuously Variable Transmission (E-CVT)

- Automatic Transmission (AT)

- Dual Clutch Transmission (DCT)

Driveline Market, Architecture Analysis

- Power Spilt

- Series

- EV Driveline

- Parallel

Driveline Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Driveline Market?The global Driveline Market is expected to grow from USD 25.1 billion in 2023 to USD 87.8 billion by 2033, at a CAGR of 13.34% during the forecast period 2023-2033.

-

2. Who are the key market players of the Driveline Market?Some of the key market players of the market are Borgwarner, Continental, Denso, Robert Bosch, GKN, Delphi, Valeo, Hitachi, Schaeffler, ZF.

-

3. Which segment holds the largest market share?The series segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?