Global Dough Based Premixes Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bread & Roll Mixes, Cake & Muffin Mixes, Pizza Dough Mixes, Pastry & Cookie Mixes, and Specialty & Functional Mixes), By Application (Commercial Baking, Food Service, Food Manufacturing, and Retail & Consumer), By Distribution Channel (Direct Sales, Distributors & Wholesalers, Retail Channels, and Equipment & Technology Partnerships), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Food & BeveragesGlobal Dough Based Premixes Market Insights Forecasts to 2035

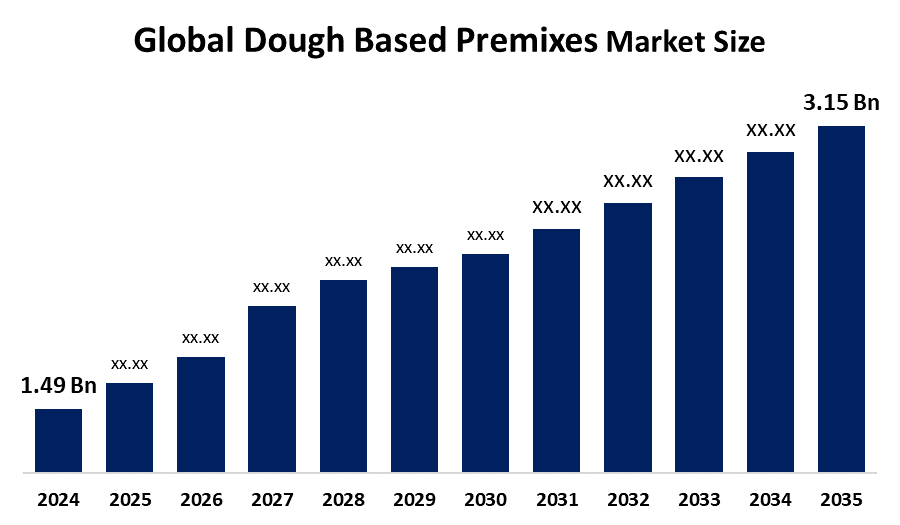

- The Global Dough Based Premixes Market Size Was Estimated at USD 1.49 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.04% from 2025 to 2035

- The Worldwide Dough Based Premixes Market Size is Expected to Reach USD 3.15 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Dough Based Premixes Market Size Was Worth Around USD 1.49 Billion in 2024 And Is Predicted To Grow To Around USD 3.15 Billion By 2035 With a Compound Annual Growth Rate (CAGR) of 7.04% From 2025 to 2035. The Global Dough-Based Premixes Market is growing due to the increasing demand for convenient food solutions, rising levels of urbanization, busy lifestyles, growing bakeries and foodservice industries, and consumer demand for quality, innovative, and healthy premix solutions.

Market Overview

The Global Dough Based Premixes Market Size refers to the manufacturing and subsequent sales of ready-to-use mix compositions that are predominantly comprised of flour, yeast, and other functional materials. This type of pre mixture predominantly makes use of premixed ingredients for facilitating easy preparation of baked products such as bread, pizzas, pastries, and other bakery products. Several factors account for the growth of this market due to increased consumer demand for convenience and easy-preparation foods. Additionally, market growth factors include increased levels of consumer urbanization and dual-income households.

In November 2025, India announced another round of its Production Linked Incentive scheme for the Food Processing Industry. The move is expected to encourage manufacturing and increase competitiveness, and will provide huge support to premix and bakery ingredient manufacturers in India. Opportunities lie in the innovation of new and healthy product formulations and extensions in the e-commerce/retail segment. The key players, such as General Mills, Associated British Foods, Cargill, Puratos, and Bakels, are engaged in innovation and improving product quality and distribution to increase market share. The rise of home baking and processed foods also favors market growth.

Report Coverage

This research report categorizes the Dough Based Premixes Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dough based premixes market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dough based premixes market.

Global Dough Based Premixes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.49 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.04% |

| 2035 Value Projection: | USD 3.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Puratos Group Cargill, Incorporated General Mills Inc. Associated British Foods Lesaffre Nestlé Kerry Group Dawn Food Products Corbion Nisshin Seifun Group Inc. AB Mauri Oy Karl Fazer Ab Bakels Group Archer Daniels Midland (ADM)And Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Dough-Based Premixes Market Size is driven by the increasing consumer demand for convenience food as people have busy lifestyles. As people become more urban and have dual-income households, there is an increasing demand for premix dough for making breads, pizzas, pastries, and snacks. An increasing food service sector, such as restaurants and bakeries, is also adding to this demand. As people become health-conscious and develop new eating habits with increasing disposable incomes, there is growing acceptance of dough-based premixes with different and healthy ingredients such as whole grain and gluten-free.

Restraining Factors

The Dough Based Premixes Market Size worldwide is hampered by the volatile pricing of raw ingredients, such as wheat, which impacts the costs of production. Moreover, consumer acceptance is impeded by health concerns regarding preservatives used in processed food. The tough regulations regarding food safety and competition from fresh food options are other factors hampering dough based premixes.

Market Segmentation

The dough based premixes market share is classified into product type, application, and distribution channel.

- The bread & roll mixes segment dominated the market in 2024, approximately 34% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, The Dough Based Premixes Market Size is divided into bread & roll mixes, cake & muffin mixes, pizza dough mixes, pastry & cookie mixes, and specialty & functional mixes. Among these, the bread & roll mixes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth in this segment of bread and roll mixes is being led by their consistency in terms of quality, taste, and texture, which are imperative in both industrial and retail bakeries. Increasing consumer demand for healthy sorts made at home, along with increased productivity, has again upheld their maximum market share.

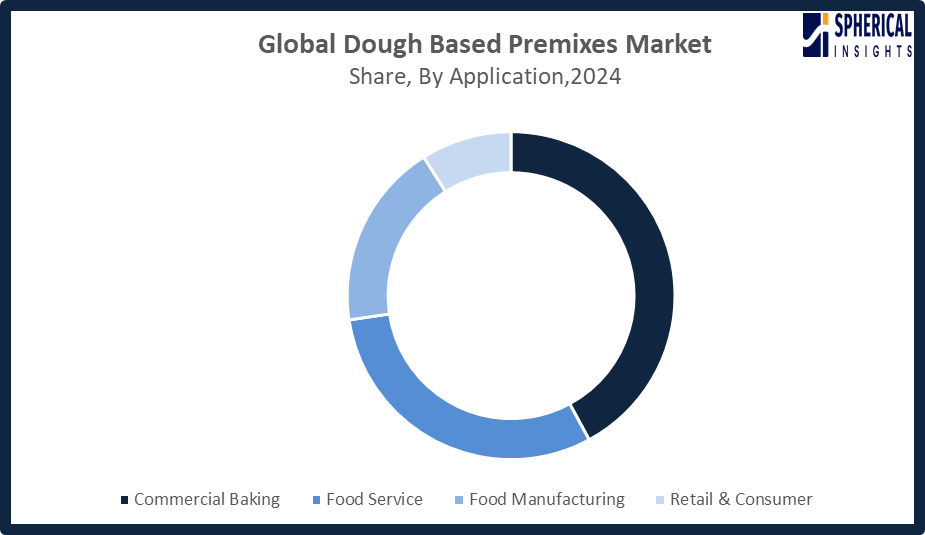

- The commercial baking segment accounted for the largest share in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, The Dough Based Premixes Market Size is divided into commercial baking, food service, food manufacturing, and retail & consumer. Among these, the commercial baking segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The driving factor for the growth of the commercial baking premixes market is the demand for standardized solutions from industrial bakeries and quick service restaurants. Premixes help in ensuring uniform taste, appearance, and shelf life, which is not possible in the case of conventional baking. The ability to be processed through automated lines also adds to market leadership.

Get more details on this report -

- The direct sales segment accounted for the highest market revenue in 2024, approximately 37% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, The Dough Based Premixes Market Size is divided into direct sales, distributors & wholesalers, retail channels, and equipment & technology partnerships. Among these, the direct sales segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The direct sales segment expands with strong manufacturer interaction with commercial bakeries, providing tailored premix solutions for the sizes, processes, and flavors involved. Advantages offered are technical support, logistics, and fast quality feedback. Strong alliances, long-term contracts, and increasing coverage in emerging countries improve the overall market dominance and coverage attained by this sales segment.

Regional Segment Analysis of the Dough Based Premixes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the dough based premixes market over the predicted timeframe.

North America is anticipated to hold the largest share of the Dough Based Premixes Market Size over the predicted timeframe. North America will be a 34% shareholder of the dough-based premix market in 2024, owing to the high demand for convenience bakery products, easy-to-use solutions, and developments in commercial bakeries, as well as quick-service restaurants. Leading the way in NORTH AMERICA is the United States, thanks to its well-developed processed foods industry, high technological sophistication, and high use of e-commerce channels. Tariffs imposed on Canada, Mexico, and China in 2025 of 25%, ranging from 10% to 125%, for flour, sweetener, and emulsifier ingredients, respectively, are expected, with an industry-wide hit of USD 454 million, for which an exemption has been pleaded by the American bakers Association.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the dough based premixes market during the forecast period. Asia Pacific is anticipated to have a 23% of the dough-based premix market, owing to factors such as urbanisation, an increase in disposable income and the demand for bakery products that are convenient to bake and available readily. Asia Pacific countries such as China, India, Japan, and South Korea contribute largely to this market because of growth in foodservice and home baking, and developments in the baking sector towards adopting modern premix solutions for baking products of consistent quality and taste by adopting modern bakery solutions.

Europe’s dough based premixes market is expected to register steady growth due to the growing need for high-quality, ready-to-bake bakery items. The top markets in Europe are Germany, France, and the UK, which are aided by well-established food processing facilities, stringent safety regulations, and a desire for a healthy, ready-to-bake diet. In the year 2025, global regulations, such as the EU’s Farm to Fork Strategy and the Indian FSSAI fortification regulation, are brought into focus at IBIE 2025, focusing on sustainability, safety, and the problem of filling 53,500 empty baking positions by the year 2030.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dough based premixes market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Puratos Group

- Cargill, Incorporated

- General Mills Inc.

- Associated British Foods

- Lesaffre

- Nestlé

- Kerry Group

- Dawn Food Products

- Corbion

- Nisshin Seifun Group Inc.

- AB Mauri

- Oy Karl Fazer Ab

- Bakels Group

- Archer Daniels Midland (ADM)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Flowers Foods, Inc. unveiled its 2025 product lineup, including new breads, buns, rolls, and snacks under Nature’s Own, Dave’s Killer Bread, and Canyon Bakehouse. The launch features small loaves for smaller households and expands the Wonder brand into sweet baked goods, enhancing its better-for-you portfolio.

- In May 2024, Puratos launched Sapore Lavida, the first fully traceable active sourdough produced in Belgium using 100% wholewheat flour from regenerative agriculture. Designed for mainland Europe, it meets demand for sustainable, locally sourced sourdough while delivering tangy, fruity flavor notes and enhanced fiber content in bread applications.

- In January 2023, AB Mauri launched Pure ProGrains, a new range of healthy, nutritional bread mixes designed to meet growing consumer demand for gut health and better-for-you bakery products. The versatile mixes offer fiber, protein, and digestive benefits, requiring only flour, yeast, and water to produce various breads and rolls.

- In November 2021, General Mills announced an agreement to sell its European dough businesses to Cerelia, a global leader in ready-to-bake dough solutions. The deal includes branded and private-label operations in Germany, the UK, and Ireland, such as Knack & Back and Jus-Rol, with closures expected by fiscal 2022, pending regulatory and labour approvals.

- In June 2018, Corbion introduced Organic 522, a new organic dough improver for the premium baked goods market. Designed for organic and non-GMO formulations, the clean-label solution improves machinability, oven spring, volume, and, in some cases, reduces mixing time to meet growing demand for healthier bakery products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dough based premixes market based on the below-mentioned segments:

Global Dough Based Premixes Market, By Product Type

- Bread & Roll Mixes

- Cake & Muffin Mixes

- Pizza Dough Mixes

- Pastry & Cookie Mixes

- Specialty & Functional Mixes

Global Dough Based Premixes Market, By Application

- Commercial Baking

- Food Service

- Food Manufacturing

- Retail & Consumer

Global Dough Based Premixes Market, By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Retail Channels

- Equipment & Technology Partnerships

Global Dough Based Premixes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dough based premixes market over the forecast period?The global dough based premixes market is projected to expand at a CAGR of 7.04% during the forecast period.

-

2. What is the market size of the dough based premixes market?The global dough based premixes market size is expected to grow from USD 1.49 billion in 2024 to USD 3.15 billion by 2035, at a CAGR of 7.04% during the forecast period 2025-2035

-

3. Which region holds the largest share of the dough based premixes market?North America is anticipated to hold the largest share of the dough based premixes market over the predicted timeframe

-

4. What is the dough based premixes market?The dough based premixes market involves ready-to-use flour blends that simplify the preparation of breads, rolls, pizzas, and other bakery products.

-

5. Who are the top 10 companies operating in the global dough based premixes market?Puratos Group, Cargill, Incorporated, General Mills Inc., Associated British Foods, Lesaffre, Nestlé, Kerry Group, Dawn Food Products, Corbion, Nisshin Seifun Group Inc, and Others

-

6. What factors are driving the growth of the dough based premixes market?The growth of the dough-based premixes market is driven by several key factors, primarily the increasing demand for convenience and time efficiency, the expansion of the foodservice industry, and evolving consumer preferences for health-focused and specialty products

-

7. What are the market trends in the dough based premixes market?Key market trends in the dough based premixes market include rising demand for convenient, time-saving bakery solutions, clean-label and fortified formulations, gluten-free and health-oriented products, and artisan/premium premixes innovation

-

8. What are the main challenges restricting the wider adoption of the dough based premixes market?The main challenges restricting the wider adoption of the dough-based premixes market involve supply chain volatility, consumer health perceptions, operational complexities for some users, and regulatory hurdles

Need help to buy this report?