Global Dipropylene Glycol Monomethyl Ether Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Industrial Grade, Cosmetic Grade, Reagent Grade, and Others), By Formulation Type (Solvent-based Formulations, Water-based Formulations, Emulsions, and Others), By End-User (Chemicals, Pharmaceuticals, Food and Beverage, Automotive, Consumer Goods, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Dipropylene Glycol Monomethyl Ether Market Size Insights Forecasts to 2035

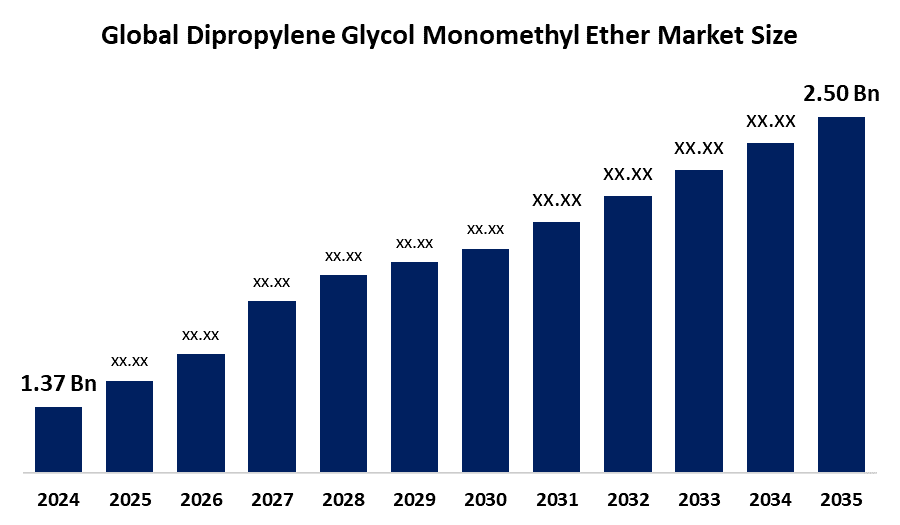

- The Global Dipropylene Glycol Monomethyl Ether Market Size Was Estimated at USD 1.37 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.62% from 2025 to 2035

- The Worldwide Dipropylene Glycol Monomethyl Ether Market Size is Expected to Reach USD 2.50 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Dipropylene Glycol Monomethyl Ether Market Size was worth around USD 1.37 Billion in 2024 and is predicted to Grow to around USD 5.19 Billion by 2035 with a compound annual growth rate (CAGR) of 5.62% from 2025 to 2035. The worldwide market for dipropylene glycol monomethyl ether (DPM) is expanding because the demand for sustainable solvents that emit minimal volatile organic compounds (VOC) in paint and coating and cleaning products continues to increase. The industrial development that characterizes the Asia-Pacific region, together with the use of DPM in personal care products, drives this market expansion.

Market Overview

Dipropylene glycol monomethyl ether DPM functions as a colorless solvent with low viscosity, which belongs to the glycol ether family because it possesses low toxicity and a high boiling point, and functions as an excellent solvent for water and various organic solvents. The substance obtains industrial value because it establishes multiple industrial applications, which permit the creation of stable product formulations through its ability to dissolve numerous materials. DPM operates as a component in paints and coatings because it helps products achieve optimal flow and leveling effects while enabling manufacturers to create low-VOC products. The market shows growth because construction work and automotive manufacturing increase while customers demand superior architectural and industrial coatings. The electronics and printing industries drive up market demand.

Environmental awareness has increased, which provides manufacturers with opportunities to create environmentally friendly solvents. Dow Inc. introduced ISCC PLUS-certified sustainable propylene glycol products, which will launch in March 2024. The United States Food and Drug Administration has confirmed that dipropylene glycol monomethyl ether (DPM, CAS No. 34590-94-8) serves as an authorized food additive that can be used indirectly according to 21 CFR Sections 175.105, 176.180 and 176.300. The Food Contact Substance Notification No 1412 received a Finding of No Significant Impact, which confirmed its safety for environmental use in approved food contact applications.

Report Coverage

This research report categorizes the dipropylene glycol monomethyl ether market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dipropylene glycol monomethyl ether market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dipropylene glycol monomethyl ether market.

Global Dipropylene Glycol Monomethyl Ether Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.37 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.62% |

| 2035 Value Projection: | USD 2.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 168 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Formulation Type and COVID-19 Impact Analysis |

| Companies covered:: | Shell plc, BASF SE, INEOS Group Limited, LyondellBasell Industries N.V., Dow Inc., Eastman Chemical Company, Arkema S.A., LG Chem Ltd., Huntsman Corporation, SK Global Chemical Co., Ltd., Hannong Chemicals Inc., Tokyo Chemical Industry Co., Ltd., SABIC, Mitsubishi Chemical Group Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global dipropylene glycol monomethyl ether (DPM) market experiences growth because industrial sectors require eco-friendly solvents that have low toxicity and emit low volatile organic compounds. The market expansion depends on two main factors, which include rising demand for water-based industrial applications and the ability of the product to perform effectively in industrial cleaning products and degreasers. The personal care and cosmetics industry expands its market through DPM, which serves as a fragrance stabilizer while the automotive and electronics sectors show increasing demand for DPM as well. Manufacturers currently face environmental regulations that compel them to choose safer and more sustainable solvent alternatives instead of traditional solvents, which have harmful effects.

Restraining Factors

The global dipropylene glycol monomethyl ether (DPM) market faces two main barriers, which include unstable propylene oxide raw material costs that depend on crude oil price changes. The industry faces growth restrictions in North America and Europe because of three main factors, which include strict environmental regulations for VOC emission control, rising competition from bio-based solvent alternatives and expensive compliance requirements.

Market Segmentation

The dipropylene glycol monomethyl ether market share is classified into product type, formulation type, and end-user.

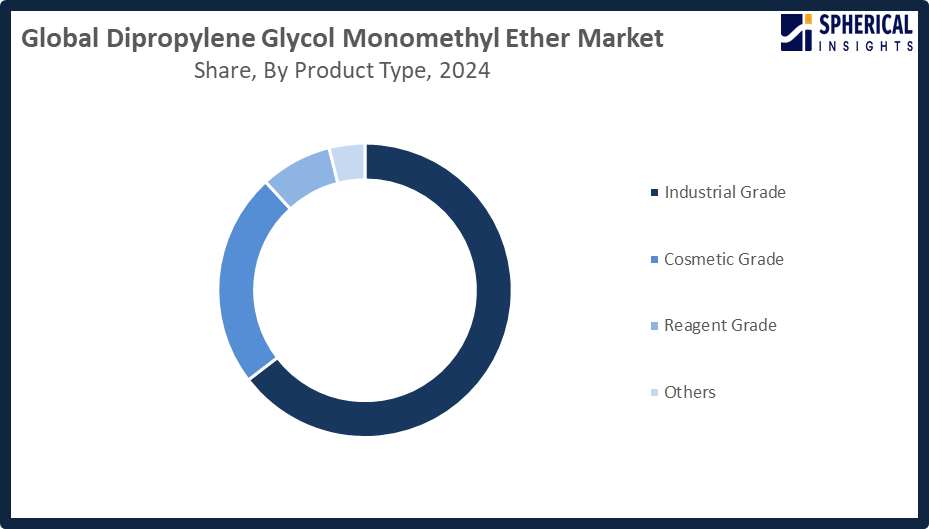

- The industrial grade segment dominated the market in 2024, approximately 65% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the dipropylene glycol monomethyl ether market is divided into industrial grade, cosmetic grade, reagent grade, and others. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The widespread adoption of industrial-grade dipropylene glycol monomethyl ether in paints, coatings, cleaners, and degreasers leads to its current market dominance. The product achieves market adoption because it combines water-based and oil-based systems with effective solvency and minimal scent, and full compliance with VOC regulations. The automotive refinishing industry, together with industrial cleaning and printing inks select this material because it delivers performance benefits and cost savings, safe use, controlled evaporation and capacity for industrial use.

Get more details on this report -

- The solvent-based formulations segment accounted for the largest share in 2024, approximately 57% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the formulation type, the dipropylene glycol monomethyl ether market is divided into solvent-based formulations, water-based formulations, emulsions, and others. Among these, the solvent-based formulations segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The industry maintains its current market control because companies need fast-drying solvent-based systems that provide high-performance results during both industrial and commercial operations. Dipropylene glycol monomethyl ether offers strong solvency, low volatility, and enhances flow and film formation. The automotive industry, printing industry, and heavy-duty cleaning industry use these formulations because they need products that perform well in tough conditions and work with all their equipment.

- The chemicals segment accounted for the highest market revenue in 2024, approximately 34% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the dipropylene glycol monomethyl ether market is divided into chemicals, pharmaceuticals, food and beverage, automotive, consumer goods, and others. Among these, the chemicals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The leading market share demonstrates how essential dipropylene glycol monomethyl ether is to industrial cleaners and degreasers and intermediate products. The product enables resin blending, emulsion stabilization and reaction processes because it delivers strong solvency, low toxicity and high boiling point. The chemical manufacturers use the product because of its ability to function in both organic and aqueous systems while maintaining regulatory compliance, convenient handling and complete compatibility.

Regional Segment Analysis of the Dipropylene Glycol Monomethyl Ether Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dipropylene glycol monomethyl ether market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the dipropylene glycol monomethyl ether market over the predicted timeframe. The industrial growth in Asia Pacific countries, with an approximate 43% share, together with their strong requirement for dipropylene glycol monomethyl ether, exists because of their usage in paints, coatings, and cleaning products, plus their application in chemical manufacturing. China controls the market because its construction and automotive sectors require large quantities of solvents. The infrastructure projects in India, together with the advanced electronics and specialty chemical production in Japan and South Korea, drive market expansion. Southeast Asia receives increasing industrial funding. In October 2025, Haryana issued its advisory about glycol-based solvent monitoring, which indicates stricter pharmaceutical regulations that will affect how businesses obtain and manage these substances throughout the area.

North America is expected to grow at a rapid CAGR in the dipropylene glycol monomethyl ether market during the forecast period. The dipropylene glycol monomethyl ether market in North America will experience a 30% share growth due to the increased need for high-performance solvents, which serve coatings, industrial cleaning and specialty chemical fields. The United States leads growth with strong automotive refinishing, construction, and regulatory preference for low-VOC formulations. Canada enables business growth through its manufacturing and oil & gas maintenance industries. The regional market expansion occurs because industries prefer environmentally safe solvents, and technological improvements streamline formulation development.

The European dipropylene glycol monomethyl ether market expands because businesses need low-VOC solvents for cleaning and coating applications that comply with strict environmental protection regulations. Germany leads with strong automotive manufacturing, France through construction, and the UK through sustainable inks. The European Chemicals Agency uses the REACH framework to control hazardous substance registration processes while providing EU member states with standardized guidelines for substance registration and hazard reporting and risk management procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dipropylene glycol monomethyl ether market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shell plc

- BASF SE

- INEOS Group Limited

- LyondellBasell Industries N.V.

- Dow Inc.

- Eastman Chemical Company

- Arkema S.A.

- LG Chem Ltd.

- Huntsman Corporation

- SK Global Chemical Co., Ltd.

- Hannong Chemicals Inc.

- Tokyo Chemical Industry Co., Ltd.

- SABIC

- Mitsubishi Chemical Group Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, INEOS Olefins & Polymers Europe launched a new Recycl-IN hybrid polymer grade containing 70% recycled material. Designed for contact-sensitive cosmetics packaging, the product combines mechanically recycled plastics with advanced booster polymers, enhancing sustainability, reducing CO2 emissions, and maintaining strength, aesthetics, and processing performance.

- In October 2025, Dow and MEGlobal finalized an agreement for Dow to supply an additional 100 KTA of ethylene from its Gulf Coast operations to support MEGlobal’s ethylene glycol production at the Oyster Creek site.

- In March 2024, Dow launched two sustainable propylene glycol solutions in North America using bio-circular and circular feedstocks. Produced via a mass balance approach and ISCC PLUS-certified in Freeport, Texas, the new grades offer externally verified sustainability benefits across diverse high-performance applications.

- In September 2022, INEOS completed its first sales of new Propylene Glycol n-Butyl Ethers (PnBs) from its Antwerp site following a major investment. Widely used in industrial coatings and cleaning, the new PnBs enhance efficiency, reduce solvent requirements, and lower production time and costs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dipropylene glycol monomethyl ether market based on the below-mentioned segments:

Global Dipropylene Glycol Monomethyl Ether Market, By Product Type

- Industrial Grade

- Cosmetic Grade

- Reagent Grade

- Others

Global Dipropylene Glycol Monomethyl Ether Market, By Formulation Type

- Solvent-based Formulations

- Water-based Formulations

- Emulsions

- Others

Global Dipropylene Glycol Monomethyl Ether Market, By End-User

- Chemicals

- Pharmaceuticals

- Food and Beverage

- Automotive

- Consumer Goods

- Others

Global Dipropylene Glycol Monomethyl Ether Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the dipropylene glycol monomethyl ether market?The global dipropylene glycol monomethyl ether market size is expected to grow from USD 1.37 billion in 2024 to USD 2.50 billion by 2035, at a CAGR of 5.62% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the dipropylene glycol monomethyl ether market?Asia Pacific is anticipated to hold the largest share of the dipropylene glycol monomethyl ether market over the predicted timeframe.

-

3. What is the global dipropylene glycol monomethyl ether market?The global dipropylene glycol monomethyl ether market involves the production and sale of this solvent for paints, coatings, cleaners, and industrial applications worldwide.

-

4. What government policies affect the market?Agencies such as the U.S. Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA) have established guidelines for the handling, disposal, and usage of DPM to minimize health risks and environmental impact

-

5. What are the main challenges restricting wider adoption of the dipropylene glycol monomethyl ether market?Main challenges for the DPM market include stringent environmental regulations on VOC emissions, volatile raw material prices (crude oil), health concerns regarding inhalation, and competition from bio-based alternatives.

-

6. How does DPM affect global supply chains?DPM affects global supply chains by linking petrochemical feedstocks to downstream industries like paints and electronics. Tariff disruptions and regional production shifts reshape trade flows, while specialized logistics requirements impact transportation and storage networks worldwide.

Need help to buy this report?