Global Diphenylamine Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Technical Grade, Industrial Grade, High Purity Grade, Derivatives, and Custom Formulations), By Application (Rubber & Tire Antioxidants, Fuel Additives (Stabilizer), Explosives Stabilizer, Pharmaceutical Intermediates, and Others), By End-Use (Automotive & Transportation, Chemicals Manufacturing, Pharmaceuticals, Energy & Fuels, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Diphenylamine Market Size Insights Forecasts to 2035

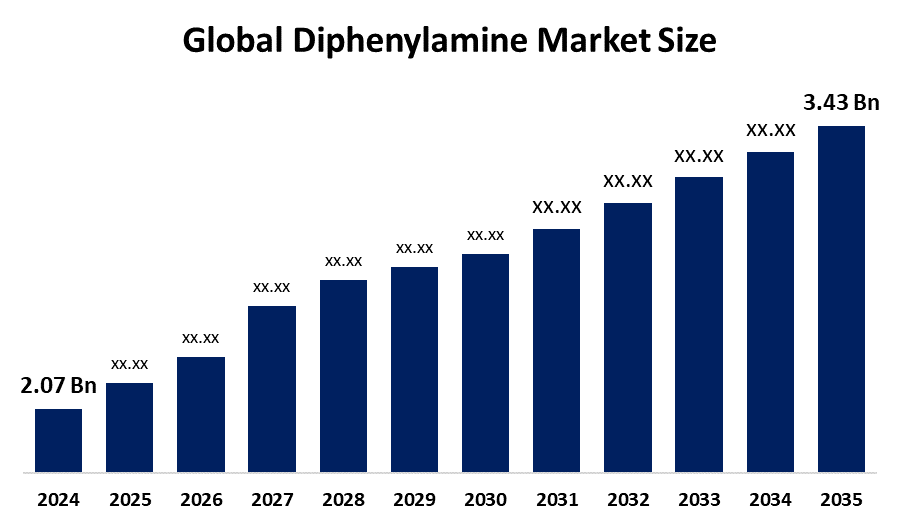

- The Global Diphenylamine Market Size Was Estimated at USD 2.07 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.7% from 2025 to 2035

- The Worldwide Diphenylamine Market Size is Expected to Reach USD 3.43 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Diphenylamine Market Size was worth around USD 2.07 Billion in 2024 and is predicted to Grow to around USD 3.43 Billion by 2035 with a compound annual growth rate (CAGR) of 4.7% from 2025 to 2035. The demand for diphenylamine from industries such as rubber, plastics, and the automotive industry, greater usage as an antioxidant in lubricants, increasing applications of agrochemicals, and also industrialization and chemical manufacturing activities in growth-oriented countries are propelling the growth of the global diphenylamine market.

Market Overview

Diphenylamine is a typical organic aromatic amine chemical that acts as an antioxidant, stabilizer, and chemical intermediate. It finds widespread applications in the production of rubber, lubricants, plastic, agrochemicals, pharma, dyes, and explosives. The rising use of diphenylamine in the automotive industry, specifically in tires and rubber products, and industrial lubricants, drives the global diphenylamine market. The growing use of agrochemicals in agriculture also supports the market.

In February 2024, a contract worth $192.5 million was awarded by the United States Department of Defense to enhance local production of strategic chemicals such as diphenylamine (DPA) in the country. The contract, worth $86.2 million, was received by Lacamas Laboratories in the state of Oregon, while Synthio Chemicals received $8.2 million in the state of Colorado, bolstering the value chain for the use of diphenylamine as a stabilizer and burning rate modifier in defense systems. There are market opportunities in emerging high-quality antioxidant formulation products, the use of diphenylamine in the specialty chemical sector, and rising capacity in the emerging markets. The Asia Pacific region leads the market with the growing pace of industrialization, while the regions of North America and Europe emphasize research and development and regulatory issues. The main participants competing in the diphenylamine market are Lanxess AG, Eastman Chemical Company, BASF SE, Huntsman Corporation, Arkema, and Tokyo Chemical Industry Company.

Report Coverage

This research report categorizes the diphenylamine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the diphenylamine market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the diphenylamine market.

Global Diphenylamine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.07 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.7% |

| 2035 Value Projection: | USD 3.43 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, LANXESS AG, Eastman Chemical Company, Merck KGaA, Arkema, Huntsman International LLC, The Lubrizol Corporation, Duslo a.s., SI Group, Inc., Tokyo Chemical Industry Company, Solvay S.A., LyondellBasell Industries, Songwon Industrial Co. Ltd., Daicel Corporation, Seiko Chemical Co. Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The primary driver in the international diphenylamine market is its widespread use as antioxidants and stabilizers in the rubber and plastics or lubricants industry. The growing demand for automotive products, such as tire rubber, is propelling the marketplace further. Rising demand in agrochemicals, acting as a principal intermediate in fungicides and pesticides, is boosting the demand for the product further. The rising chemical manufacturing industry, industrialization in emerging regions, and growing lubricant demand in the automotive and industrial machinery industries are contributing significantly to the market. In addition, product demand in the pharmaceutical, dyes, and specialty chemical industries, and developments in manufacturing technology and a growing desire for performance and durability, are propelling the global diphenylamine marketplace further.

Restraining Factors

The diphenylamine market across the globe is facing limitations imposed by stringent environmental and safety rules, especially in Europe and the North American regions, because of the toxic nature of the chemical. Fluctuations in the price of raw materials, production costs, and the availability of other antioxidants and stabilizers are acting as limitations for widespread use of the chemical.

Market Segmentation

The diphenylamine market share is classified into product type, application, and end-use.

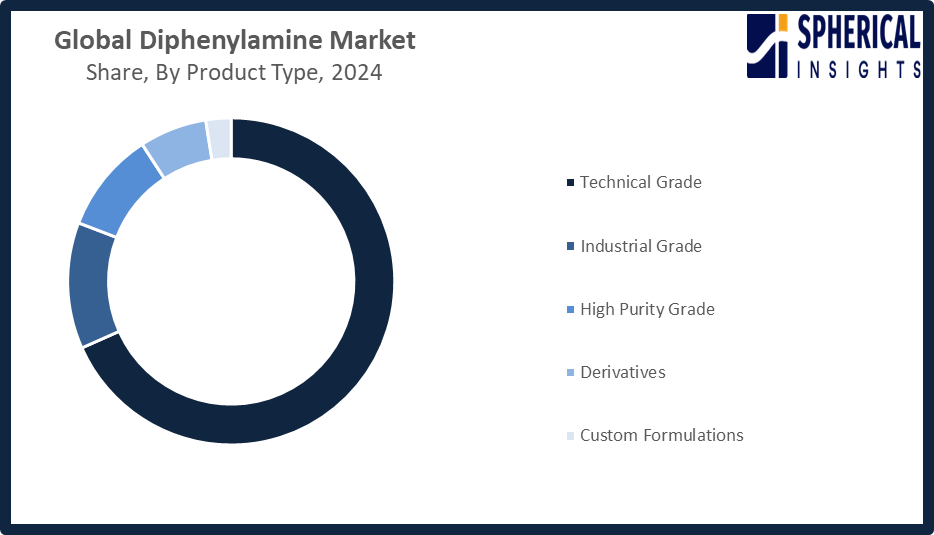

- The technical grade segment dominated the market in 2024, approximately 68% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the diphenylamine market is divided into technical grade, industrial grade, high purity grade, derivatives, and custom formulations. Among these, the technical grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The technical grade diphenylamine category led the way in terms of market growth due to its wide application in rubber as an antioxidant. Further driving the growth of this market through the increasing demand for autos and the rising need in emerging countries for high-quality materials are major reasons why this category represents the largest in the diphenylamine market.

Get more details on this report -

- The rubber & tire antioxidants segment accounted for the largest share in 2024, approximately 72% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the diphenylamine market is divided into rubber & tire antioxidants, fuel additives (stabilizer), explosives stabilizer, pharmaceutical intermediates, and others. Among these, the rubber & tire antioxidants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The rubber and tire antioxidants segment currently has the largest market share based on the high usage of diphenylamine in inhibiting the oxidation process in tires and rubber products. Fast growth in the automotive sector, rising manufacturing of vehicles, and increased industrialization, mainly in emerging countries, have fueled high usage, resulting in the segment maintaining a strong market position and growing at a considerable pace.

- The automotive & transportation segment accounted for the highest market revenue in 2024, approximately 58% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the diphenylamine market is divided into automotive & transportation, chemicals manufacturing, pharmaceuticals, energy & fuels, and others. Among these, the automotive & transportation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The automotive & transportation industry is experiencing growth in the market due to an increase in the use of diphenylamine as an antioxidant in tires and rubber parts, and as a lubricant stabilizer. Increased manufacturing of autos, the development of the automobile industry in the developing world, and the use of high-performance materials in autos have led to the dominance of the industry.

Regional Segment Analysis of the Diphenylamine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the diphenylamine market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the diphenylamine market over the predicted timeframe. The Asia Pacific region is expected to have the 58% market share in diphenylamine due to increased industrialization, automobile production, and chemical production in countries such as China and India. Increasing consumption of diphenylamine antioxidant in tires, rubber, and lubricants is a driving force for growth in the market. The government’s efforts to develop industries, increase production facilities for chemicals, and increased urbanization make a significant contribution to market growth. The increased automotive market and overall growth in industries and agricultural production in the region lead to increased consumption of diphenylamine, solidifying Asia-Pacific’s dominant market position globally.

North America is expected to grow at a rapid CAGR in the diphenylamine market during the forecast period. The North America region is anticipated to have a 28% market share of the diphenylamine market, mainly in the United States, due to its developed automotive, chemical, and industrial infrastructure. The high demand for diphenylamine antioxidant in tires, lubricants, and rubbers, and its usage in agrochemicals and specialty chemicals, is fueling the market. Further support is given to the expansion of this industry by technological advances, regulatory compliance, and investment in sustainable chemical production. In May 2025, new regulations regarding pesticide tolerance were proposed by the U.S. EPA in relation to diphenylamine. This may affect the limits of residues and agricultural use, thus requiring manufacturers to modify their practices for compliance.

Europe is witnessing an emerging market in diphenylamine, mainly driven by the substantial demand from the automotive and chemical sectors of Germany. Rising demand as an antioxidant in the tires and rubbers segment, as well as in lubricants, agrochemicals, and specialty chemical applications, is also propelling the market. Encouraging government policies concerning the use of high-quality materials and the latest technologies are also impacting the market positively. In March 2024, France's ANSES proposed EU-wide CLP classifications of two diphenylamine derivatives (BNPA and structurally related UVCBs) to enhance the labelling of hazards and prevent exposure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the diphenylamine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- LANXESS AG

- Eastman Chemical Company

- Merck KGaA

- Arkema

- Huntsman International LLC

- The Lubrizol Corporation

- Duslo a.s.

- SI Group, Inc.

- Tokyo Chemical Industry Company

- Solvay S.A.

- LyondellBasell Industries

- Songwon Industrial Co. Ltd.

- Daicel Corporation

- Seiko Chemical Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, SI Group completed its amine antioxidant capacity expansion at the Lasar plant in India. Since 2019, global antioxidant capacity has increased by 25%. Expansion projects in Jinshan, China, are operational, while a $50 million U.S. capacity expansion is underway, strengthening the company’s global antioxidant production.

- In October 2022, SI Group announced expansion at its Rasal, India facility to produce Ethanox 4757 aminic antioxidant, an octylated-butylated diphenylamine used in lubricants, greases, automotive, and industrial fluids. Commercial supply is expected in Q4 2022, adding several thousand tons of this critical antioxidant to the global market.

- In November 2018, SONGWON introduced SONGNOX 5057, a liquid butylated-octylated aminic antioxidant complementing its antioxidant portfolio. Designed for polyols, flexible polyurethane foams, elastomers, and hot melt adhesives, it enhances durability in applications across furniture, bedding, automotive components, and sports products, meeting diverse industrial performance and stability requirements.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the diphenylamine market based on the below-mentioned segments:

Global Diphenylamine Market, By Product Type

- Technical Grade

- Industrial Grade

- High Purity Grade

- Derivatives

- Custom Formulations

Global Diphenylamine Market, By Application

- Rubber & Tire Antioxidants

- Fuel Additives (Stabilizer)

- Explosives Stabilizer

- Pharmaceutical Intermediates

- Others

Global Diphenylamine Market, By End-Use

- Automotive & Transportation

- Chemicals Manufacturing

- Pharmaceuticals

- Energy & Fuels

- Others

Global Diphenylamine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the diphenylamine market over the forecast period?The global diphenylamine market is projected to expand at a CAGR of 4.7% during the forecast period.

-

2. What is the market size of the diphenylamine market?The global diphenylamine market size is expected to grow from USD 2.07 billion in 2024 to USD 3.43 billion by 2035, at a CAGR of 4.7% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the diphenylamine market?Asia Pacific is anticipated to hold the largest share of the diphenylamine market over the predicted timeframe.

-

4. What is the diphenylamine market?The diphenylamine market involves the production and sale of diphenylamine, used as an antioxidant, stabilizer, and chemical intermediate across industries.

-

5. Who are the top 10 companies operating in the global diphenylamine market?BASF SE, LANXESS AG, Eastman Chemical Company, Merck KGaA, Arkema, Huntsman International LLC, The Lubrizol Corporation, Duslo a.s., SI Group, Inc., Tokyo Chemical Industry Company, and Others.

-

6. What factors are driving the growth of the diphenylamine market?The diphenylamine market is driven by rising automotive and tire production, growing demand for antioxidants in rubber and lubricants, expanding agrochemical applications, industrialization in emerging economies, and increasing specialty chemical usage.

-

7. What are the market trends in the diphenylamine market?Key trends include rising demand in automotive and industrial applications, sustainable production focus, regulatory safety enhancements, and expanded use in agrochemicals and specialty chemicals.

-

8. What are the main challenges restricting wider adoption of the diphenylamine market?The main challenges restricting the wider adoption of the diphenylamine (DPA) market are primarily centered around strict environmental regulations, health and safety concerns due to its toxicity, the emergence of alternative products, and fluctuations in raw material prices.

Need help to buy this report?