Dimethylcyclosiloxane (DMC) Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Octamethylcyclotetrasiloxane ,Decamethylcyclopentasiloxane, Dodecamethylcyclohexasiloxane, and Others), By Application (Personal Care, Pharmaceuticals, Textiles, Electronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Industry: Chemicals & MaterialsGlobal Dimethylcyclosiloxane (DMC) Market Insights Forecasts to 2035

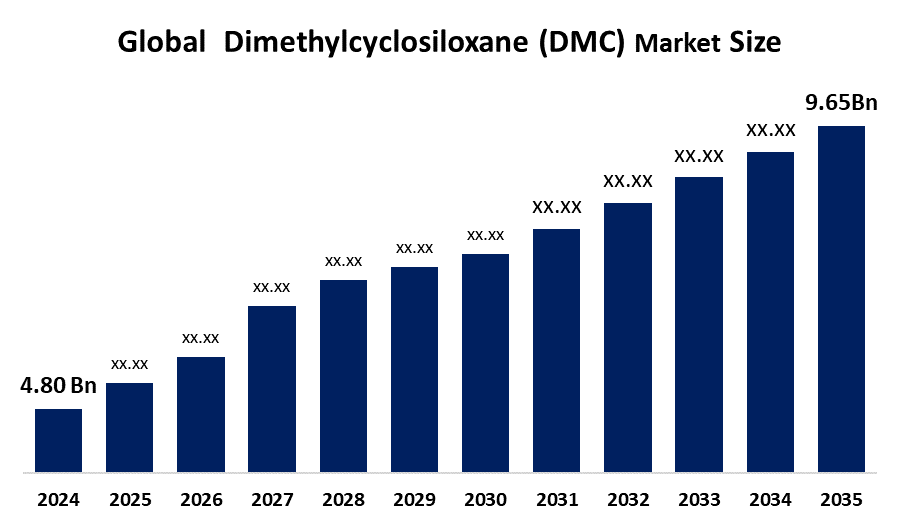

- The Global Dimethylcyclosiloxane (DMC) Market Size Was Estimated at USD 4.80billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.55% from 2025 to 2035

- The Worldwide Dimethylcyclosiloxane (DMC) Market Size is Expected to Reach USD 9.65 billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global dimethylcyclosiloxane (DMC) market size was worth around USD 4.80billion in 2024 and is predicted to grow to around USD 9.65 billion by 2035 with a compound annual growth rate (CAGR) of 6.55% from 2025 to 2035. Opportunities in high-performance silicone manufacture, electronics, personal care, construction, and medical applications are presented by the dimethylcyclosiloxane (DMC) market, which is fueled by the rising need for materials that are flexible, long-lasting, and heat-resistant.

Market Overview

The market for dimethylcyclosiloxane (DMC) involves the entire process from production to commercialization and then to the end users of cyclic siloxanes, which mostly consist of D4, D5, and D6. These silicon-based raw materials are essential for silicone polymers, fluids, elastomers, and resins manufacturing. In the chemical industry, DMC is a major intermediate for getting a variety of silicones such as elastomers, coatings, and sealants, besides their applications in different sectors like personal care, electronics, automotive, construction, and medical devices. The U.S. EPA estimates that the amount of D4 that will be released in 2022 will exceed 1,000 metric tons per year, and then the import tariffs of 2025 will come into force to promote domestic production and reduce environmental risks. The growing need for silicone-based products across a variety of industries, especially in electronics and personal care, is a major growth factor driving this market's expansion. DMC's versatility in formulation and its favorable qualities, such as high volatility, low surface tension, and thermal stability, have increased its use in a variety of applications, further propelling market expansion.

Report Coverage

This research report categorizes the dimethylcyclosiloxane (DMC) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dimethylcyclosiloxane (DMC) market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the dimethylcyclosiloxane (DMC) market.

Global Dimethylcyclosiloxane (DMC) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.80 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.55% |

| 2035 Value Projection: | USD 9.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Bluestar Silicones International, Dongyue Group Limited, Dow Corning Corporation, Elkem ASA, Evonik Industries AG, Guangzhou Tinci Materials Technology Co., Ltd., Hoshine Silicon Industry Co., Ltd., Jiangsu Hongda New Material Co., Ltd., KCC Corporation, Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Silchem Inc., Wacker Chemie AG, Zhejiang Xinan Chemical Industrial Group Co., Ltd., and Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors driving the DMC market's expansion is the personal care sector. The market's growth has been greatly aided by the growing demand for skincare and cosmetic goods around the world, which is being driven by consumers' growing awareness of personal grooming and self-care. The market for DMC is anticipated to grow due to the continuous improvements in electronic manufacturing techniques and the increase in demand for small and portable electronics. The market for DMC has also increased because of the shift to high-end, organic personal care products, which frequently include silicone-based chemicals for improved performance.

Restraining Factors

Strict environmental laws, high production costs, potential health and ecological problems associated with cyclic siloxanes, and raw material supply instability are some of the issues limiting the market for dimethylcyclosiloxane (DMC). Together, these limitations hinder widespread industrial adoption and market growth.

Market Segmentation

The dimethylcyclosiloxane (DMC) market share is classified into product type and application.

- The octamethylcyclotetrasiloxane segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the dimethylcyclosiloxane (DMC) market is divided into octamethylcyclotetrasiloxane, decamethylcyclopentasiloxane, dodecamethylcyclohexasiloxane, and others. Among these, the Octamethylcyclotetrasiloxane segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The widespread use in a variety of sectors, octamethylcyclotetrasiloxane is the most popular product type in the DMC market. Market dynamics are being impacted by changes in regulations and environmental concerns related to the use of octamethylcyclotetrasiloxane.

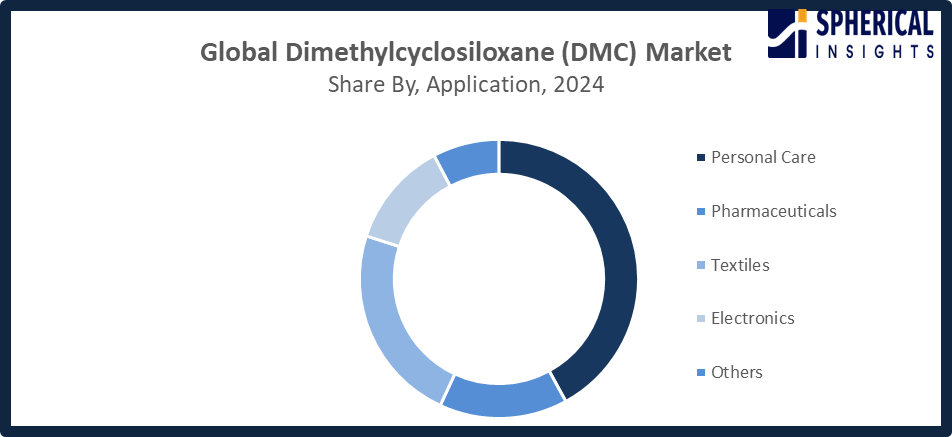

- The personal care segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the dimethylcyclosiloxane (DMC) market is divided into personal care, pharmaceuticals, textiles, electronics, and others. Among these, the personal care segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing need for skincare and cosmetics items, the personal care segment dominates the DMC market's application landscape. The demand for DMC is further highlighted by the ongoing consumer trend toward high-performance, natural, and organic beauty products, as it meets the need for safe yet effective ingredients in personal care formulations.

Get more details on this report -

Regional Segment Analysis of the Dimethylcyclosiloxane (DMC) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dimethylcyclosiloxane (DMC) market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the dimethylcyclosiloxane (DMC) market over the predicted timeframe. The growing middle class and rising disposable incomes in the Asia Pacific area are driving demand for high-end consumer electronics and personal care products, which in turn is driving demand for DMC. The region's market is further strengthened by rising investments in silicon technology and advantageous government policies that promote industrial development. Leading the way in this expansion are China, India, and Japan, which have benefited from large expenditures in manufacturing and technical development. Although emissions rules limit volatile organic compounds to 100 mg/m³, government data from China's Ministry of Ecology and Environment indicates that over 500,000 metric tons of DMC will be produced annually in 2024 due to subsidies under the 14th Five-Year Plan for innovative materials.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the dimethylcyclosiloxane (DMC) market during the forecast period. The use of DMC in a variety of medical applications has been made easier by the region's advanced healthcare infrastructure and emphasis on technical innovation, increasing the region's market share. According to data from the U.S. Environmental Protection Agency (EPA), DMC imports increased by 15% to 120,000 metric tons in 2024, demanding increased bioaccumulation risk monitoring under the Toxic Substances Control Act. Contaminated DMC from specific Asian suppliers is the focus of the U.S. FDA's January 2025 update to Import Alert 45-02, which supports domestic manufacturing incentives through CHIPS Act expenditures surpassing USD 50 million for semiconductor materials. Sustainability initiatives and green chemistry advancements in North America create opportunities for eco-friendly DMC formulation growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dimethylcyclosiloxane (DMC) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bluestar Silicones International

- Dongyue Group Limited

- Dow Corning Corporation

- Elkem ASA

- Evonik Industries AG

- Guangzhou Tinci Materials Technology Co., Ltd.

- Hoshine Silicon Industry Co., Ltd.

- Jiangsu Hongda New Material Co., Ltd.

- KCC Corporation

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Silchem Inc.

- Wacker Chemie AG

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, Shin-Etsu Chemical launched a ¥100 billion investment plan to boost high-performance silicones, including dimethylcyclosiloxane, expanding eco-friendly products and upgrading facilities in Japan, Asia, the United States, and Hungary, building on its nearly completed ¥80 billion 2022 program, an investment expansion effort.

- In June 2022, Novagard launched a new UV-cured silicone gel incorporating Dimethylcyclosiloxane for off-road, automotive, aerospace, and industrial uses. The gel cuts weight by 50%, cures 50% faster, and delivers 0.18 W/m-K thermal conductivity with 10–20 Shore 00 hardness.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dimethylcyclosiloxane (DMC) market based on the below-mentioned segments:

Global Dimethylcyclosiloxane (DMC) Market, By Product Type

- Octamethylcyclotetrasiloxane

- Decamethylcyclopentasiloxane

- Dodecamethylcyclohexasiloxane

- Others

Global Dimethylcyclosiloxane (DMC) Market, By Application

- Personal Care

- Pharmaceuticals

- Textiles

- Electronics

- Others

Global Dimethylcyclosiloxane (DMC) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dimethylcyclosiloxane (DMC) market over the forecast period?The global dimethylcyclosiloxane (DMC) market is projected to expand at a CAGR of 6.55% during the forecast period

-

2. What is the market size of the dimethylcyclosiloxane (DMC) market?The global dimethylcyclosiloxane (DMC) market size is expected to grow from USD 4.80billion in 2024 to USD 9.65 billion by 2035, at a CAGR of 6.55% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the dimethylcyclosiloxane (DMC) market?Asia Pacific is anticipated to hold the largest share of the dimethylcyclosiloxane (DMC) market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global dimethylcyclosiloxane (DMC) market?Bluestar Silicones International, Dongyue Group Limited, Dow Corning Corporation, Elkem ASA, Evonik Industries AG, Guangzhou Tinci Materials Technology Co., Ltd., Hoshine Silicon Industry Co., Ltd., Jiangsu Hongda New Material Co., Ltd., KCC Corporation, Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Silchem Inc., Wacker Chemie AG, Zhejiang Xinan Chemical Industrial Group Co., Ltd., and Others.

-

5. What factors are driving the growth of the dimethylcyclosiloxane (DMC) market?The market for dimethylcyclosiloxane (DMC) is propelled by the increasing need for silicone-based products, technical developments, increased industrial applications, and rising consumption in the automotive, construction, electronics, and personal care industries.

-

6. What are the market trends in the dimethylcyclosiloxane (DMC) market?Increased use of high-performance silicones, improvements in environmentally friendly formulations, growing uses in cutting-edge electronics, and growing investments in R&D to improve product quality, efficiency, and sustainability are some of the major developments.

-

7. What are the main challenges restricting the wider adoption of the dimethylcyclosiloxane (DMC) market?The major challenges include stringent environmental regulations, concerns over cyclic siloxane emissions, high production costs, raw material supply volatility, and compliance requirements that hinder large-scale adoption and restrict global market expansion

Need help to buy this report?