Global Dimethylaminopropylamine Market Size, Share, and COVID-19 Impact Analysis, By Application (Personal Care, PU Catalyst, Water Treatment, Agriculture, Pharmaceuticals, and Others), By Distribution Channel (Direct sales, Distributors and wholesalers, Online sales, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Dimethylaminopropylamine Market Insights Forecasts to 2035

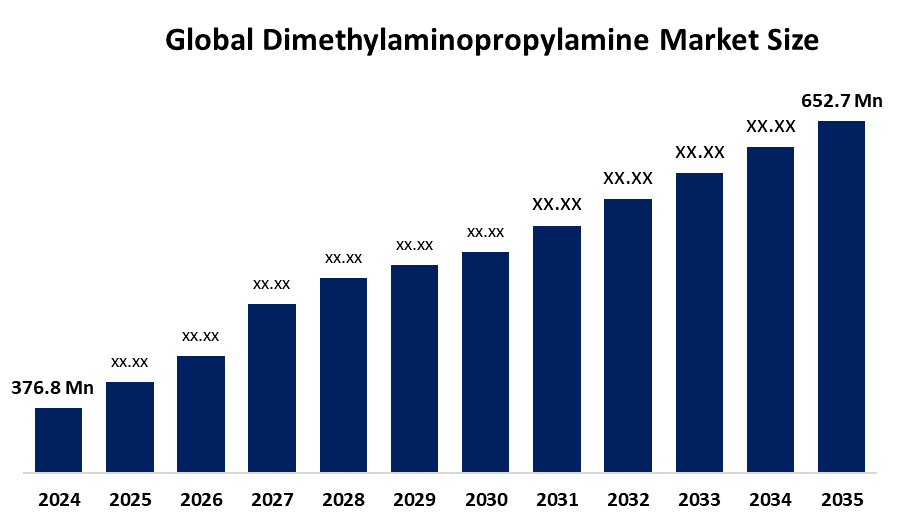

- The Global Dimethylaminopropylamine Market Size Was Estimated at USD 376.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.12% from 2025 to 2035

- The Worldwide Dimethylaminopropylamine Market Size is Expected to Reach USD 652.7 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Dimethylaminopropylamine market size was worth around USD 376.8 Million in 2024 and is predicted to grow to around USD 652.7 Million by 2035 with a compound annual growth rate (CAGR) of 5.12% from 2025 to 2035. It's increasing use in the pharmaceutical sector. The synthesis of different medications and active pharmaceutical ingredients (APIs) in the pharmaceutical industry uses DMAPA as a reagent. Medications like antihistamines and anti-infectives are made with it.

Market Overview

The global dimethylaminopropylamine market involves the production and application of this versatile amine used in personal care products, surfactants, pharmaceuticals, and water treatment chemicals across various industries. The growing demand for dimethylaminopropylamine in the industrial, agrochemical, and personal care sectors is propelling the market's robust expansion globally. DMAPA improves the texture and functionality of creams, shampoos, and conditioners by acting as an emulsifier, stabiliser, and thickener in the personal care and cosmetics industry. Technological developments in the manufacturing process have increased production capacity, efficiency, and quality control, while lowering costs for firms. With DMAPA employed in pesticides and herbicides to increase crop protection and production in the face of mounting worries about global food security, the agrochemical industry also makes a substantial contribution to market expansion. Furthermore, product distribution is changing due to the growth of e-commerce and digital marketing, which is expanding accessibility and customer reach.

While safer leave-on applications are supported by enhanced purification procedures, regional brands in Asia are pushing rinse-off cosmetic forms. BASF's low-VOC catalyst portfolio, which was released in June 2022, demonstrates the trend towards reactive amines that bond into the matrix to reduce emissions and indoor air pollutants. Similar catalysts are also being used by Chinese appliance manufacturers to comply with energy-label updates, which is boosting adoption worldwide. Demand in North America and Europe is rising as a result of water utilities' growing use of DMAPA-based flocculants for the removal of PFAS and micropollutants. DMAPA catalysts improve energy-efficient insulation in polyurethane foams while adhering to environmental standards. In the meantime, China and Brazil's agricultural productivity is strengthened by their use of high-performance pesticides and herbicides. Technological developments, growing industrial applications, and a focus on sustainability all contribute to the global acceleration of the DMAPA market.

Report Coverage

This research report categorizes the dimethylaminopropylamine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dimethylaminopropylamine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dimethylaminopropylamine market.

Global Dimethylaminopropylamine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 376.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.12% |

| 2035 Value Projection: | USD 652.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Application, By Distribution |

| Companies covered:: | BASF SE, Alkyl Amines Chemicals Limited, Eastman Chemical Company, Huntsman, Solvay, Prasol Chemicals Limited, Silver Fern, Haihang Industry Co., Ltd., Feymer, Acar Chemicals, And Other Player |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for dimethylaminopropylamine (DMAPA) is growing as a result of increased demand from the agrochemical, water treatment, polyurethane, and cosmetic industries. DMAPA plays a key role in personal care by generating gentle, biodegradable surfactants like as cocamidopropyl betaine, which promote "skinimalism" movements. As construction boom propels the usage of low-VOC polyurethane foams, water utilities are progressively implementing DMAPA-based flocculants for the removal of PFAS and other pollutants. High-purity DMAPA improves the effectiveness and performance of pesticides in agriculture. Sustainability programs and technological advancements support the long-term demand and expansion of the global DMAPA market.

Restraining Factors

The market for dimethylaminopropylamine is constrained by toxicological issues and shifting raw material pricing. Production costs and financial risks are increased by the volatility of petroleum-based inputs such as acrylonitrile and dimethylamine, especially for smaller businesses. Additionally, purity standards are being tightened due to increased regulatory scrutiny about toxicity and skin sensitization. Stricter exposure restrictions and anticipated worldwide regulatory changes could present further difficulties for manufacturers, raising the expense of compliance and restricting the use of DMAPA in consumer-facing applications.

Market Segmentation

The Dimethylaminopropylamine market share is classified into application and distribution channel.

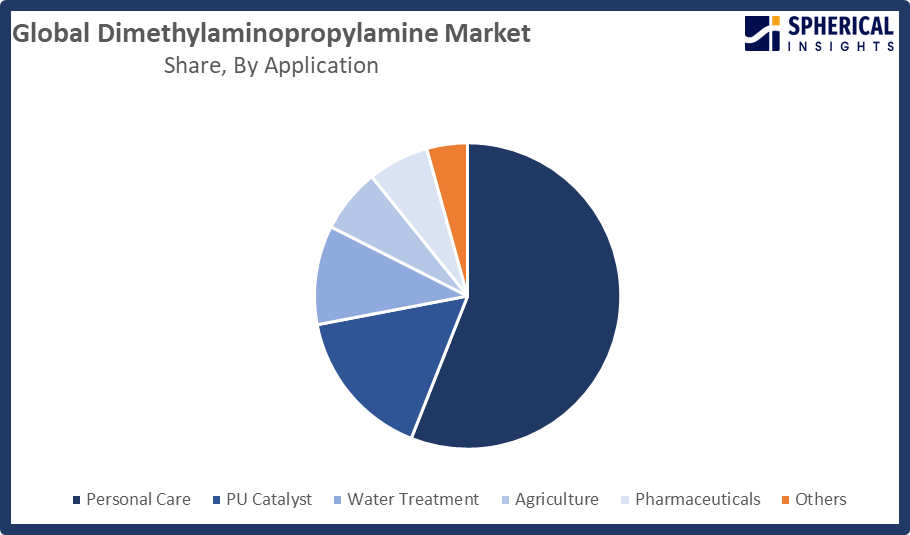

- The personal care segment dominated the market in 2024, approximately 56.7% and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the dimethylaminopropylamine market is divided into personal care, PU catalyst, water treatment, agriculture, pharmaceuticals, and others. Among these, the segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing use of cosmetics and personal care items. It works as a conditioning agent in hair care products, smoothing and lowering static to improve texture and manageability. DMAPA ensures a uniform texture in creams, lotions, and cleansers by acting as an emulsifier, stabilizer, and thickener in skin care products. Additionally, it serves as a pH adjuster to preserve the ideal balance of the skin and a solubilizer to include scents and active substances. Furthermore, DMAPA might lessen skin irritation, which makes it appropriate for formulations aimed at sensitive skin. Its multiple uses enhance the stability, efficacy, and sensory appeal of a range of personal care products.

Get more details on this report -

- The direct sales segment accounted for the largest share in 2024, approximately 38% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the dimethylaminopropylamine market is divided into direct sales, distributors and wholesalers, online sales, and others. Among these, the segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the dimethylaminopropylamine market, the direct sale distribution channel segment is expanding significantly due to a number of important aspects that improve customer interaction and ease market expansion. The growing focus on individualized client experiences is one of the main causes of this expansion. Manufacturers and companies can build a direct contact with customers through direct sales, which helps them better understand their tastes and adjust their products accordingly. Customers are more inclined to select DMAPA-containing items that they believe are in line with their unique demands when a personalized approach is used, as it not only increases brand loyalty but also develops trust.

Regional Segment Analysis of the Dimethylaminopropylamine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 53% of the Dimethylaminopropylamine market over the predicted timeframe.

North America is anticipated to hold the largest share of the dimethylaminopropylamine market over the predicted timeframe. The product's primary market is North America, which is home to several, varied businesses like pharmaceuticals and personal care and cosmetics. The substance is used in North America's sizable pharmaceutical industry to synthesise a variety of medications. The area does, however, contain some of the biggest pharmaceutical companies, including Pfizer Inc., Johnson & Johnson, and Eli Lilly & Co. The cosmetics and personal care sector in the United States is a major market for the product. Procter & Gamble, L'Oréal, Estee Lauder, and other major businesses in the cosmetics sector call it home. As a result, it is anticipated that the quickly expanding pharmaceutical and personal care and cosmetics sectors would increase demand for the product.

Get more details on this report -

Asia Pacific is expected to grow the fastest market share with approximately 45% at a rapid CAGR in the Dimethylaminopropylamine market during the forecast period. DMAPA's Asia-Pacific market has been growing gradually due to the expansion of industries like agrochemicals, pharmaceuticals, and personal care. Rapid industrialisation and rising consumer demand in the region's emerging economies, such as China and India, are fuelling this expansion. According to the International Trade Administration, the market for cosmetics and personal care products is expected to grow to an astounding USD 78 billion by 2025. The nation's product consumption is also anticipated to rise as a result of the growing demand for skincare and cosmetics brought on by an increase in disposable income.

Europe is expected to grow at a rapid CAGR in the Dimethylaminopropylamine market during the forecast period. Dimethylaminopropylamine is being used more and more in the personal care, cosmetics, and pharmaceutical industries in the UK, France, Spain, Germany, and Italy, which are important European markets. As stated by the Pharmaceutical Industries and Associations European Federation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dimethylaminopropylamine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- BASF SE

- Alkyl Amines Chemicals Limited

- Eastman Chemical Company

- Huntsman

- Solvay

- Prasol Chemicals Limited

- Silver Fern

- Haihang Industry Co., Ltd.

- Feymer

- Acar Chemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, BASF expanded its biomass balance portfolio to include DMAPA, with certifications now achieved at both its Ludwigshafen, Germany, and Geismar, Louisiana, facilities. This advancement is poised to enhance the DMAPA market by fostering sustainable and certified production solutions.

- In December 2023, Solvay declared that its Zhangjiagang plant in China has been certified to produce bio-circular DMAPA using the mass balance method of the International Sustainability and Carbon Certification (ISCC) PLUS system.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dimethylaminopropylamine market based on the below-mentioned segments:

Global Dimethylaminopropylamine Market, By Application

- Personal Care

- PU Catalyst

- Water Treatment

- Agriculture

- Pharmaceuticals

- Others

Global Dimethylaminopropylamine Market, By Distribution Channel

- Direct sales

- Distributors and wholesalers

- Online sales

- Others

Global Dimethylaminopropylamine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the Dimethylaminopropylamine market over the forecast period?The global Dimethylaminopropylamine market is projected to expand at a CAGR of 5.12% during the forecast period.

-

What is the market size of the Dimethylaminopropylamine market?The global Dimethylaminopropylamine market size is expected to grow from USD 376.8 Million in 2024 to USD 652.7 Million by 2035, at a CAGR of 5.12% during the forecast period 2025-2035.

-

Which region holds the largest share of the Dimethylaminopropylamine market?North America is anticipated to hold the largest share of the Dimethylaminopropylamine market over the predicted timeframe.

-

Who are the top 10 companies operating in the global Dimethylaminopropylamine market?BASF SE, Alkyl Amines Chemicals Limited, Eastman Chemical Company, Huntsman, Solvay, Prasol Chemicals Limited, Silver Fern, Haihang Industry Co., Ltd., Feymer, and Acar Chemicals.

-

What factors are driving the growth of the Dimethylaminopropylamine market?The market for dimethylaminopropylamine is expanding due to increased demand from the agrochemical, water treatment, personal care, and polyurethane foam sectors. Its capacity to provide high-performance catalysts, effective flocculants, and mild surfactants, along with developments in technology and sustainability, encourages broad use in a variety of international industrial and consumer applications.

-

What are the market trends in the Dimethylaminopropylamine market?Key trends in the Dimethylaminopropylamine market include rising use in eco-friendly personal care formulations, growing demand in water treatment and polyurethane foams, advancements in purification technologies, expansion in agrochemical applications, and increasing focus on sustainable, low-emission production processes to meet global environmental and regulatory standards.

-

What are the main challenges restricting wider adoption of the Dimethylaminopropylamine market?High production costs, intense regulatory oversight over toxicity and purity levels, fluctuating raw material prices, and a lack of knowledge about safer formulations are some of the main obstacles preventing dimethylaminopropylamine from being widely used worldwide.

Need help to buy this report?