Global Dimethyl Sulphate Market Size, Share, and COVID-19 Impact Analysis, By Purity (Reagent Grade and Technical Grade), By Application (Chemical Intermediates (Alkylation Reactions, Methylation Reactions, Agrochemical Intermediates, Pharmaceutical Intermediates, Others), Dyes and Pigments, Film Coatings, Pesticides, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Dimethyl Sulphate Market Insights Forecasts to 2035

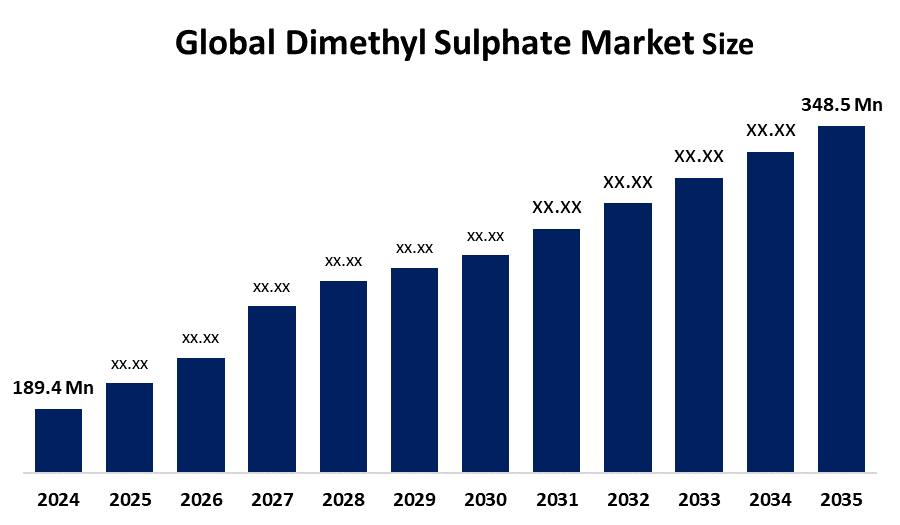

- The Global Dimethyl Sulphate Market Size Was Estimated at USD 189.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.7% from 2025 to 2035

- The Worldwide Dimethyl Sulphate Market Size is Expected to Reach USD 348.5 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report published by Spherical Insights and Consulting, The Global Dmethyl Sulphate Market Size was worth around USD 189.4 Million in 2024 and is predicted to Grow to around USD 348.5 Million by 2035 with a compound annual growth rate (CAGR) of 5.7% from 2025 to 2035. The dimethyl sulphate (DMS) market is growing due to its wide applications as an important methylating agent for the manufacture of high-value speciality chemicals, mainly for pharmaceuticals and the agrochemical industry. The growing need for new drugs and effective crop protection active ingredients globally is the major force driving the market.

Market Overview

The global dimethyl sulphate market refers to the production and consumption of DMS, an extremely reactive chemical that finds its core usage as a methylating agent in dye synthesis, in the pharmaceuticals, agrochemicals, and specialty chemicals industries. In addition, it is used in cellulose derivatives, flavoring agents, and intermediates for organic compounds. Expansion in the pharmaceutical and agrochemical industry, increasing chemical manufacturing activities in the emerging economies, and fueling demand for specialty chemicals have driven the market. New, safer and more environmentally friendly technology development for production and new applications in high-value chemicals and advanced materials development can give opportunities.

Large market players are primarily involved in capacity expansions, collaborations, and technological developments for improving the efficiency and safety of production processes. Large players operating in the international DMS market include Hubei Xingfa Chemicals, Solvay S.A., Eastman Chemical Company, BASF SE, and Shanghai Chemical Industry Park Enterprises, who all contribute significantly to the development of this market. In June 2025, U.S. OSHA presented an update regarding the Globally Harmonized System of classification and labelling of chemicals. This update may affect the safety data sheets or hazard communication requirements for dimethyl sulphate chemicals used in U.S. industries.

Report Coverage

This research report categorizes the dimethyl sulphate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dimethyl sulphate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dimethyl sulphate market.

Global Dimethyl Sulphate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 189.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.7% |

| 2035 Value Projection: | USD 348.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Solvay S.A., BASF SE, Evonik Industries AG, Honeywell International Inc., Eastman Chemical Company, CABB Chemicals, Hubei Xingfa Chemicals, LANXESS AG, DuPont de Nemours, Inc., GRILLO-Werke AG, Chevron Phillips Chemical Company, Merck KGaA, Mitsubishi Chemical Group, Industrial Solvents & Chemicals Pvt. Ltd., Others, and key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The chief drivers for the global dimethyl sulphate (DMS) market are its vast applications as a methylating agent for pharmaceuticals, agrochemicals, dyes, and pigments. The increasing demand for herbicides, pesticides, specialty chemicals, etc., stimulates their use as industrial agents. The fast-growing pharmaceutical and agrochemical industry in the Asia-Pacific region stimulates its demand. Advancements in chemical synthesis techniques, as well as their demand as a chemical in lab applications, stimulate its demand. The increasing industrialization and chemical production across the world also stimulate its demand. The DMS has diverse applications for the synthesis of various valuable chemicals, ensuring its status as an important chemical material.

Restraining Factors

The dimethyl sulphate (DMS) market worldwide has certain limitations imposed on it due to its toxic properties and danger to the environment. This requires that dimethyl sulphate be handled with extreme care. Also, its high production cost may resist its adoption on a large scale. There are safer alternatives to the substance as well that could hamper the dimethyl sulphate market.

Market Segmentation

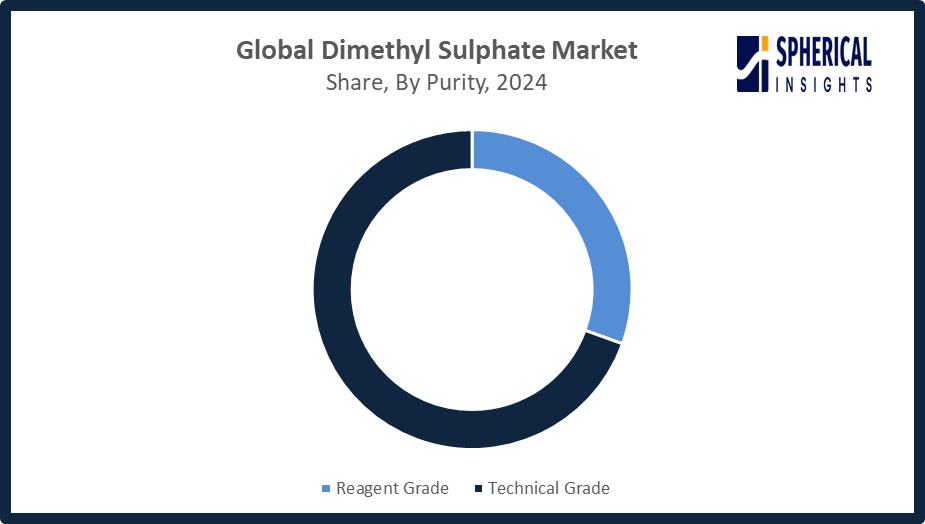

The dimethyl sulphate market share is classified into purity and application.

- The technical grade segment dominated the market in 2024, approximately 69% and is projected to grow at a substantial CAGR during the forecast period.

Based on the purity, the dimethyl sulphate market is divided into reagent grade and technical grade. Among these, the technical grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The technical grade market growth in the dimethyl sulphate market is mainly due to the substantial use of dimethyl sulphate in methylation reactions on a commercial scale, specifically for agrochemicals, dyes, and pharmaceuticals. It is cost-effective, more efficient, and compatible with commercial chemical synthesis systems, making it the preferred reagent for many manufacturers.

Get more details on this report -

- The chemical intermediates segment accounted for the highest market revenue in 2024, approximately 44% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the dimethyl sulphate market is divided into chemical intermediates (alkylation reactions, methylation reactions, agrochemical intermediates, pharmaceutical intermediates, others), dyes and pigments, film coatings, pesticides, and others. Among these, the chemical intermediates segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The chemical intermediates segment registered the maximum growth in the dimethyl sulphate market owing to its significant role as an intermediate in the manufacturing of pesticides, pharmaceuticals, dyes, and industrial additives. The significant role that the segment plays as a catalyst for methylation reactions, along with the increasing adoption of efficient reaction reagents for chemical processing, has contributed to the segment’s success.

Regional Segment Analysis of the Dimethyl Sulphate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dimethyl sulphate market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the dimethyl sulphate market over the predicted timeframe. The Asia Pacific region is expected to have a 45% market share, the leader in the dimethyl sulphate (DMS) market, due to the region’s robust chemical production infrastructure, availability of raw material, and economical production. China currently holds the leading position in the market with massive production of agrochemicals, dyes, and pharmaceuticals, while the Indian market receives a boost with the growing chemical industry, growing pharmaceutical industry, and government assistance. The rising domestic consumption, growing export of DMS derivatives, and specialized investment in the latest processing units in the Southeast Asian market further cement the position. In 2025, the Ministry of Ecology and Environment in China further modified the IECSC to make the chemical registration process more stringent.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the dimethyl sulphate market during the forecast period. The dimethyl sulphate (DMS) market for North America is expected to have a 23% market share, due to increasing demands for pharmaceuticals, agrochemicals, specialty chemical products. The US leads the way due to its well-developed chemical infrastructure, stringent quality, and R&D activities for methylation process development. Increase in use in downstream products such as dyes, surfactants, and intermediates is another major driver. In November 2025, the US EPA issued proposed compliance dates for risk management rules regarding hazardous substances and SNURs on certain DMS derivatives. A government shutdown in 2025 slowed chemical approvals and could have affected use in agrochemical applications.

The DMS market is likely to register a consistent increase in the European region due to its application in the pharma, agrochemical, and speciality chemical industries. The key country in this region is Germany due to its superior infrastructure facilities in chemicals, strict legislation, and high-quality chemicals. The increasing application base in dyes, surfactants, and industrial additives, with a thrust on safe methylation practices, is accelerating the demand for DMS. In November 2025, a new update was made by the EU and South Korea for hazard classification, labelling, and handling chemicals, known as K-REACH 2025.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dimethyl sulphate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay S.A.

- BASF SE

- Evonik Industries AG

- Honeywell International Inc.

- Eastman Chemical Company

- CABB Chemicals

- Hubei Xingfa Chemicals

- LANXESS AG

- DuPont de Nemours, Inc.

- GRILLO-Werke AG

- Chevron Phillips Chemical Company

- Merck KGaA

- Mitsubishi Chemical Group

- Industrial Solvents & Chemicals Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, SDQH Chemical launched an innovative green product line offering a sustainable alternative to DMS, methyl halides, and phosgene, designed to transform methylation processes in pharmaceutical and agrochemical applications.

- In October 2025, ChemPoint LLC, a Univar Solutions subsidiary, and Eastman announced an expanded partnership for the sales, marketing, and distribution of TamiSolve NxG solvents across the United States and Canada, strengthening their long-standing collaboration in specialty chemical solutions.

- In December 2023, LANXESS completed a multi-kiloton expansion of its sustainable light-color sulfur carrier production at Mannheim, investing tens of millions. The project, executed over two years, will supply additional volumes starting in 2024.

- In June 2021, Eco World Research and Development and Solvay USA finalized a multi-year U.S. patent license agreement. Solvay gained rights to patents on enhanced fertilizer technologies involving dimethyl sulfoxide (DMSO), urease inhibitors, and nitrification inhibitors, controlled by Eco World, strengthening its agricultural innovation portfolio.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dimethyl sulphate market based on the below-mentioned segments:

Global Dimethyl Sulphate Market, By Purity

- Reagent Grade

- Technical Grade

Global Dimethyl Sulphate Market, By Application

- Chemical Intermediates

- Alkylation Reactions

- Methylation Reactions

- Agrochemical Intermediates

- Pharmaceutical Intermediates

- Dyes and Pigments

- Film Coatings

- Pesticides

- Others

Global Dimethyl Sulphate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the dimethyl sulphate market over the forecast period?The global dimethyl sulphate market is projected to expand at a CAGR of 5.7% during the forecast period.

-

2.What is the market size of the dimethyl sulphate market?The global dimethyl sulphate market size is expected to grow from USD 189.4 million in 2024 to USD 348.5 million by 2035, at a CAGR of 5.7% during the forecast period 2025-2035.

-

3.What is the dimethyl sulphate market?The dimethyl sulphate market involves the production, trade, and use of DMS, a chemical used in methylation and intermediates.

-

4.Which region holds the largest share of the dimethyl sulphate market?Asia Pacific is anticipated to hold the largest share of the dimethyl sulphate market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global dimethyl sulphate market?Solvay S.A., BASF SE, Evonik Industries AG, Honeywell International Inc., Eastman Chemical Company, CABB Chemicals, Hubei Xingfa Chemicals, LANXESS AG, DuPont de Nemours, Inc., GRILLO-Werke AG, and Others.

-

6.What factors are driving the growth of the dimethyl sulphate market?The growth of the dimethyl sulphate (DMS) market is primarily driven by its essential role as an efficient methylating agent across various chemical syntheses, coupled with increasing demand from key end-user industries and technological advancements.

-

7.What are the market trends in the dimethyl sulphate market?Increasing demand as a methylating agent in pharmaceuticals and agrochemicals, technological production advancements, and emphasis on safety and sustainability drive market trends.

-

8.What are the main challenges restricting wider adoption of the dimethyl sulphate market?The main challenges restricting the wider adoption of the dimethyl sulphate (DMS) market are its high toxicity and significant health risks, which lead to stringent regulatory scrutiny and the development of safer alternatives.

Need help to buy this report?