Global Diisopropyl Ether Market Size, Share, and COVID-19 Impact Analysis, By Purity Level (99% Purity and Less Than 99% Purity), By Application (Solvent, Fuel Additive, Pharmaceutical Intermediate, and Laboratory Reagent), By End-Use (Pharmaceuticals, Petrochemicals, Paints & Coatings, and Agrochemicals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Diisopropyl Ether Market Insights Forecasts to 2035

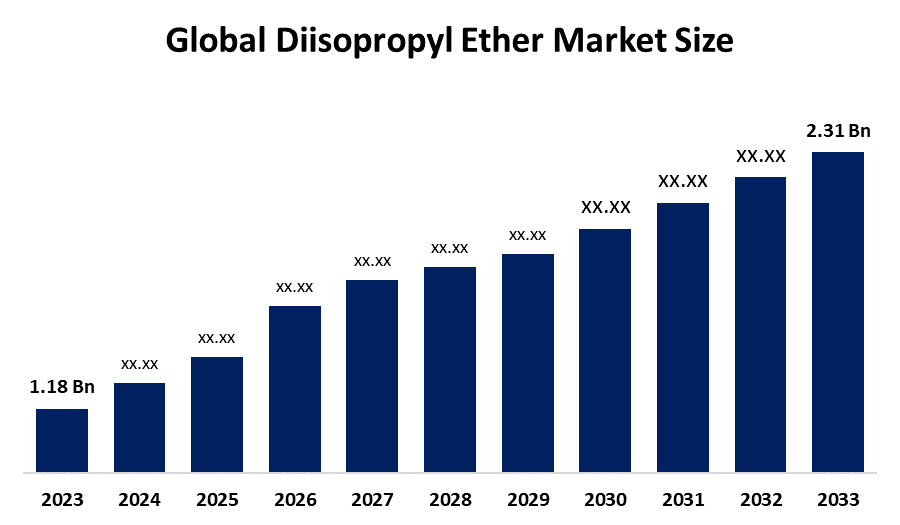

- The Global Diisopropyl Ether Market Size Was Estimated at USD 1.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.3% from 2025 to 2035

- The Worldwide Diisopropyl Ether Market Size is Expected to Reach USD 2.31 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global diisopropyl ether market size was worth around USD 1.18 billion in 2024 and is predicted to grow to around USD 2.31 billion by 2035 with a compound annual growth rate (CAGR) of 6.3% from 2025 to 2035. The worldwide diisopropyl ether market is expanding due to rising needs in pharmaceuticals, chemical manufacturing and fuel uses, along with its role as a solvent and octane booster, driven by growing operations in areas such as the Asia Pacific and North America.

Market Overview

The worldwide diisopropyl ether (DIPE) industry refers to the manufacturing and utilization of an organic solvent commonly used in chemical production, pharmaceuticals, fuel formulation and industrial settings. DIPE functions as a solvent, extraction medium and intermediate component in producing chemicals, resins, adhesives and coatings. Additionally, its role as an octane enhancer in gasoline boosts engine efficiency, increasing demand within the energy industry. The growth of the market scale is driven by the increasing need for solvents in the chemical sector and swift industrial advancement in areas such as the Asia Pacific and North America.

Prospects are available in improving handling methods, eco-conscious uses and high-purity DIPE types along with expanding markets in the chemical industries. Key players leading the market comprise BASF SE, Dow Inc., LyondellBasell Industries, ExxonMobil, Eastman Chemical Company and Arkema, who utilize innovations, strategic collaborations and geographic growth to preserve their dominance. In September 2025, the U.S. EPA suggested updates to the TSCA chemical assessment procedure designed to enhance health and environmental safeguards while offering direction. These changes affect solvents and industrial chemicals such as diisopropyl ether (DIPE), advancing safety assessments, compliance protocols and comprehensive chemical management criteria across industries.

Report Coverage

This research report categorizes the diisopropyl ether market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the diisopropyl ether market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the diisopropyl ether market.

Global Diisopropyl Ether Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.18 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.3% |

| 2035 Value Projection: | USD 2.31 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Purity Level, By Application |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide diisopropyl ether (DIPE) market is propelled by its applications as a solvent, fuel additive and synthesis intermediate. Growing consumption in industries for DIPE as a reagent and extraction solvent fuels the market’s growth. Its use in paints, coatings, adhesives and polymer manufacturing also leads to demand. Broader use as an octane enhancer in gasoline to improve engine efficiency and lower emissions additionally fuels its growth. Furthermore, the expanding chemical and automotive sectors in the Asia Pacific and North America, along with progress and emphasis on high-purity solvents, serve as growth factors.

Restraining Factors

The diisopropyl ether market faces restraints due to its high flammability and explosive nature, posing safety and handling challenges. Strict environmental and regulatory restrictions on volatile organic compounds, combined with the availability of safer alternative solvents, limit widespread adoption and increase operational costs for manufacturers.

Market Segmentation

The diisopropyl ether market share is classified into purity level, application, and end-use.

- The 99% purity segment dominated the market in 2024, approximately 73% and is projected to grow at a substantial CAGR during the forecast period.

Based on the purity level, the diisopropyl ether market is divided into 99% purity and less than 99% purity. Among these, the 99% purity segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The 99% purity category led the market due to its importance in high-accuracy uses within pharmaceuticals, chemical production and lab procedures. Its minimal impurity content guarantees performance, increased reaction efficiency and higher product quality. This grade is favored by industries, for formulations resulting in robust demand and fostering ongoing market growth through dependability and steady results.

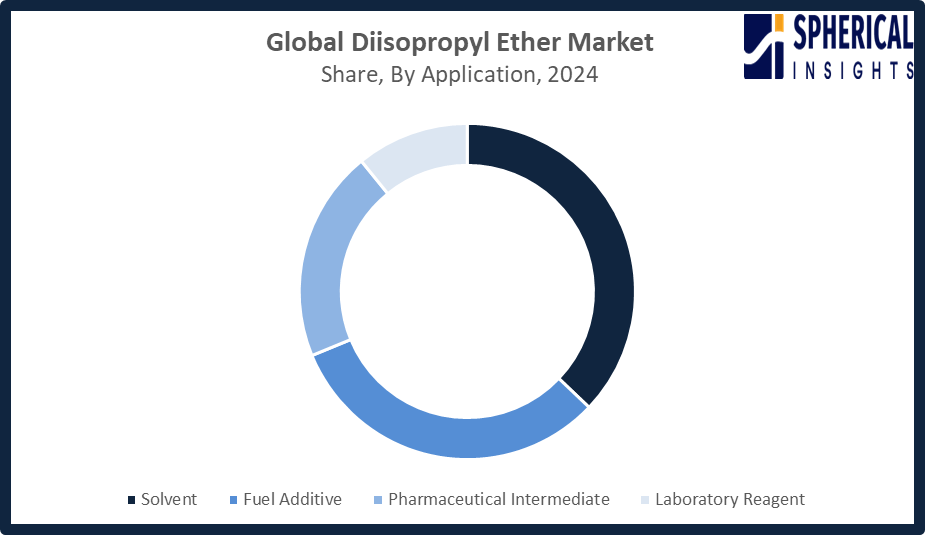

- The solvent segment accounted for the largest share in 2024, approximately 37% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the diisopropyl ether market is divided into solvent, fuel additive, pharmaceutical intermediate, and laboratory reagent. Among these, the solvent segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The solvent category held the portion owing to DIPE’s broad use in chemical synthesis, extraction processes and industrial applications. Its excellent solvency, limited water miscibility and effectiveness in purification render it a favored option in the pharmaceutical, petrochemical and specialty chemical sectors. Increasing production operations and growing demand for solvents continue to drive its expansion.

Get more details on this report -

- The pharmaceuticals segment accounted for the highest market revenue in 2024, approximately 34% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the diisopropyl ether market is divided into pharmaceuticals, petrochemicals, paints & coatings, and agrochemicals. Among these, the pharmaceuticals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pharmaceuticals segment market growth is due to DIPE’s essential role as a reaction solvent, extraction agent, and purification medium in drug formulation and API manufacturing. Its high purity, stability, and compatibility with sensitive processes make it indispensable in pharmaceutical production. Expanding global healthcare demand and increased drug development activities further reinforce the segment’s dominance.

Regional Segment Analysis of the Diisopropyl Ether Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the diisopropyl ether market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the diisopropyl ether market over the predicted timeframe. The diisopropyl ether (DIPE) market is anticipated to have a 43% market share of the Asia-Pacific region, propelled by growth in pharmaceutical and chemical production and a growing demand for solvents. China, India and Japan are players, with China excelling in mass production, India enhancing API manufacturing and progressing chemical projects, and Japan concentrating on chemical technology advancements. Affordable manufacturing, an available labor force and favorable government regulations also contribute to the expansion of the market. In May 2025, a petition incorporated DIPE into the U.S. Superfund chemical list ratified in August, establishing a late-2025 levy ranging from 0.12 to 0.29 cents per pound, promoting eco-friendlier options.

North America is expected to grow at a rapid CAGR in the diisopropyl ether market during the forecast period. The American diisopropyl ether (DIPE) sector is projected to have a 28% market share, propelled by rising needs for high-purity solvents in pharmaceuticals, chemical manufacturing and niche applications. The U.S. Dominates due to its production capabilities, adherence to regulations and preference for friendly solvents, whereas Canada fosters growth through its growing chemical manufacturing industry and R&D initiatives. In May 2025, a petition included DIPE in the U.S. Superfund list of chemicals ratified in August, establishing a late-2025 levy of 0.12-0.29 cents per pound to promote more environmentally friendly options.

Europe is witnessing steady growth in the diisopropyl ether (DIPE) market due to high demand in pharmaceuticals, paints & coatings, and chemical industries. Germany, France, and the UK are key contributors: Germany leads with advanced chemical manufacturing, France emphasizes sustainable solvent use, and the UK focuses on pharmaceutical R&D. Strict environmental regulations and increasing adoption of eco-friendly, high-purity solvents further drive market expansion across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the diisopropyl ether market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil Corporation

- Sasol Limited

- Dow Inc.

- BASF SE

- Eastman Chemical Company

- Arkema

- Haike Group

- LyondellBasell Industries

- JX Nippon Oil & Energy

- Merck KGaA

- INEOS Group Limited

- LG Chem Ltd.

- Xinhua Chemical

- Mitsubishi Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, the U.S. EPA proposed Significant New Use Rules (SNURs) under TSCA for certain chemicals, including DIPE, restricting non-approved uses to reduce health and environmental risks such as volatility and groundwater contamination. Final regulations are expected to be issued in early 2026.

- In December 2024, BASF inaugurated its Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. The facility supports pilot-scale chemical catalyst synthesis, accelerates global customer access to innovative technologies, and advances new solids processing methods.

- In September 2024, Eastman launched EastaPure electronic grade isopropyl alcohol (IPA) for U.S. semiconductor manufacturers. Serving as a high-quality wet-clean solvent in wafer fabrication and advanced packaging, it ensures contaminant-free, reliable performance, supporting growing semiconductor demand while maintaining strict quality and production standards.

- In June 2024, BASF launched a high-purity DIPE grade for pharmaceutical synthesis, reducing impurities to

- below 10 ppm. By 2025, it gained significant adoption in API production, with expanded distribution across Europe and North America, supporting high-quality pharmaceutical manufacturing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the diisopropyl ether market based on the below-mentioned segments:

Global Diisopropyl Ether Market, By Purity Level

- 99% Purity

- Less Than 99% Purity

Global Diisopropyl Ether Market, By Application

- Solvent

- Fuel Additive

- Pharmaceutical Intermediate

- Laboratory Reagent

Global Diisopropyl Ether Market, By End-Use

- Pharmaceuticals

- Petrochemicals

- Paints & Coatings

- Agrochemicals

Global Diisopropyl Ether Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the diisopropyl ether market over the forecast period?The global diisopropyl ether market is projected to expand at a CAGR of 6.3% during the forecast period.

-

2. What is the market size of the diisopropyl ether market?The global diisopropyl ether market size is expected to grow from USD 1.18 billion in 2024 to USD 2.31 billion by 2035, at a CAGR of 6.3% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the diisopropyl ether market?Asia Pacific is anticipated to hold the largest share of the diisopropyl ether market over the predicted timeframe.

-

4. What is the diisopropyl ether market?The diisopropyl ether (DIPE) market involves the production and sale of DIPE, a solvent used in pharmaceuticals, chemicals, and industrial applications.

-

5. Who are the top 10 companies operating in the global diisopropyl ether market?ExxonMobil Corporation, Sasol Limited, Dow Inc., BASF SE, Eastman Chemical Company, Arkema, Haike Group, LyondellBasell Industries, JX Nippon Oil & Energy, Merck KGaA, and Others.

-

6. What factors are driving the growth of the diisopropyl ether market?The diisopropyl ether (DIPE) market is growing due to rising demand from the booming pharmaceutical and chemical industries (as a solvent), stricter emission norms pushing its use as a fuel additive, a general shift towards greener, safer solvents, and industrial expansion in emerging economies, all supported by innovation in production.

-

7. What are the market trends in the diisopropyl ether market?Increasing demand for high‑purity solvents, focus on sustainable chemical practices, expanded pharmaceutical applications, and regulatory emphasis on safer solvent alternatives are key market trends.

-

8. What are the main challenges restricting wider adoption of the diisopropyl ether market?The main challenges include flammability, health hazards, strict environmental regulations, high production costs, and handling risks, limiting wider diisopropyl ether adoption.

Need help to buy this report?