Global Digital Remittance Market Size, By Type (Inward, Outward), By Channel (Banks, Money Transfer Operators, Online Platforms, Others), By End-use (Migrant Labor Workforce, Small Businesses, Personal, Others), By Geographic Scope and Forecast, 2022 - 2032

Industry: Banking & FinancialGlobal Digital Remittance Market Size Insights Forecasts to 2032

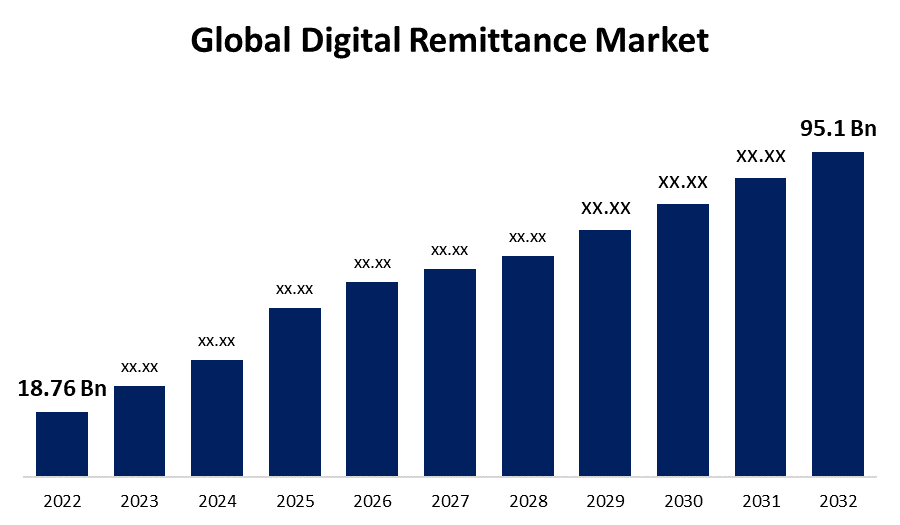

- The Digital Remittance Market Size was valued at USD 18.76 Billion in 2022.

- The Market Size is Growing at a CAGR of 17.6% from 2022 to 2032

- The Worldwide Digital Remittance Market Size is expected to reach USD 95.1 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Digital Remittance Market Size is expected to reach USD 95.1 Billion by 2032, at a CAGR of 17.6% during the forecast period 2022 to 2032.

Remittances, also known as international money transfers, are commonly used by migrant workers worldwide for support and sustenance for their dependents back home. International migrants can currently send cash or digital remittances using online remittance services provided by Money Transfer Operators (MTOs), banks, or mobile operators. As a result, digital remittances are cross-border money transfers made by the migrant population to family in their home nations over the Internet. In response to increased demand, digital remittances have evolved in tandem with mobile and online banking technologies, and many new operators have entered the market and created global enterprises in digital and mobile commerce. Furthermore, even before the pandemic, digital remittances were becoming a Growing trend, but isolation requirements, blocked borders, and lockdowns increased their Growth. Furthermore, digital remittances provide numerous advantages over traditional cash remittances, including faster transmission, fewer transactional fees, real-time tracking, and numerous additional benefits. Moreover, digital remittance services provide unparalleled confidentiality and money safety for consumers. The Growing popularity of smartphones and the availability of low-cost internet connectivity have both contributed significantly to the rise of the digital remittance market.

Market Outlook

Digital Remittance Market Price Analysis

Digital remittances constitute an essential transformation in the context of global finance. At its most basic, digital remittance refers to the act of sending money electronically as opposed to the more traditional means of cash or check transfers. Originally, a few foremost competitors, such as Western Union and MoneyGram, dominated international money transfers. Their services, while trustworthy, were frequently reprimanded for exorbitant prices and poor transaction times. With the advent of multiple players such as TransferWise (now Wise), Remitly, and Revolut, pricing is under significant pressure. Among their primary differentiators, these platforms frequently offer price transparency and competitive exchange rates. As a result, conventional players have been forced to reconsider their pricing patterns in order to remain relevant and competitive. Given the current trajectory, it is realistic to expect additional price compression in the digital remittance sector. Companies will, however, need to strike an equilibrium between competitive price and profitability as the industry Grows. Businesses are also expected to broaden their service offerings, moving beyond remittances to provide entire financial solutions.

Digital Remittance Market Distribution Analysis

The digital remittance market's distribution dynamics are constantly changing, affected by technical improvements, regulatory settings, and increasing consumer preferences. Because smartphones are so widely used, several digital-first remittance providers have created user-friendly apps to streamline the remittance process. In-app chats, transaction tracking, and currency conversion calculators all improve the customer experience. Additionally, web platforms enable consumers to initiate, track, and receive remittances via desktops or laptops. They frequently contain analytics to help organizations or frequent users better track and manage their transactions. The continuous expansion of mobile money platforms, particularly in developing nations, is anticipated to stimulate more collaboration with digital remittance providers. Furthermore, as the worldwide legal perspective on cryptocurrencies becomes clearer, it is possible that more remittance companies will integrate blockchain-based solutions, widening distribution channels even further.

Global Digital Remittance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 18.76 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 17.6% |

| 2032 Value Projection: | USD 95.1 Billion |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Channel, By End-use, By Geographic Scope and COVID 19 Impact. |

| Companies covered:: | Azimo Limited, Digital Wallet Corporation, InstaReM Pvt. Ltd., MoneyGram, PayPal Holdings, Inc., Ria Financial Services Ltd., TransferGo Ltd., Paytm, TransferWise Ltd., Western Union Holdings, Inc., WorldRemit Ltd., Xoom (a PayPal service), Wise Payments Limited, SingX Pte Ltd., TNG Limited, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Market Dynamics

Digital Remittance Market Dynamics

The Growing migrant population demands the use of cross-border money transfers.

The increasing number of users of digital remittance services especially migrant workers, who use them to send money to their relatives, has compelled numerous regulatory agencies to pay attention to and oversee the digital remittance industry. Furthermore, international remittances are critical to the economic development of developing nations. As a result, authorized regulators limit and monitor money transfer fees in order to encourage customers to maintain their use of digital remittance services and effectively boost the economic Growth of their nation of origin. Over the forecast period, these factors ought to make a contribution to market Growth.

Rising penetration of internet connectivity and higher adoption of smartphones

The ubiquity of smartphones and the widespread availability of low-cost internet connectivity have both contributed significantly to the rise of the digital remittance industry. As more individuals acquire ownership of smartphones and the internet, they will be able to use digital platforms and mobile applications for financial activities such as remittances. The simplicity and affordability provided by these technologies have pushed consumers to use digital remittance solutions, resulting in market Growth.

Restraints & Challenges

Digital remittances raise security issues and represent vulnerabilities.

The security issues and risks arising from online transactions are a key impediment to the Growth of the digital remittance market. The possibility of data breaches, hacking incidents, and fraudulent activity jeopardizes the security of financial transactions conducted via digital platforms. Cybercriminals exploit weaknesses in remittance systems to get illicit access to private information, potentially resulting in financial loss, misuse of identity, and compromising personal data. These security issues erode users' trust and confidence in digital remittance services, impeding market expansion and acceptance. To avoid these dangers and assure the safety of online transactions, service providers must adopt comprehensive security measures such as data encryption, multi-factor verification, and fraud detection techniques.

Regional Forecasts

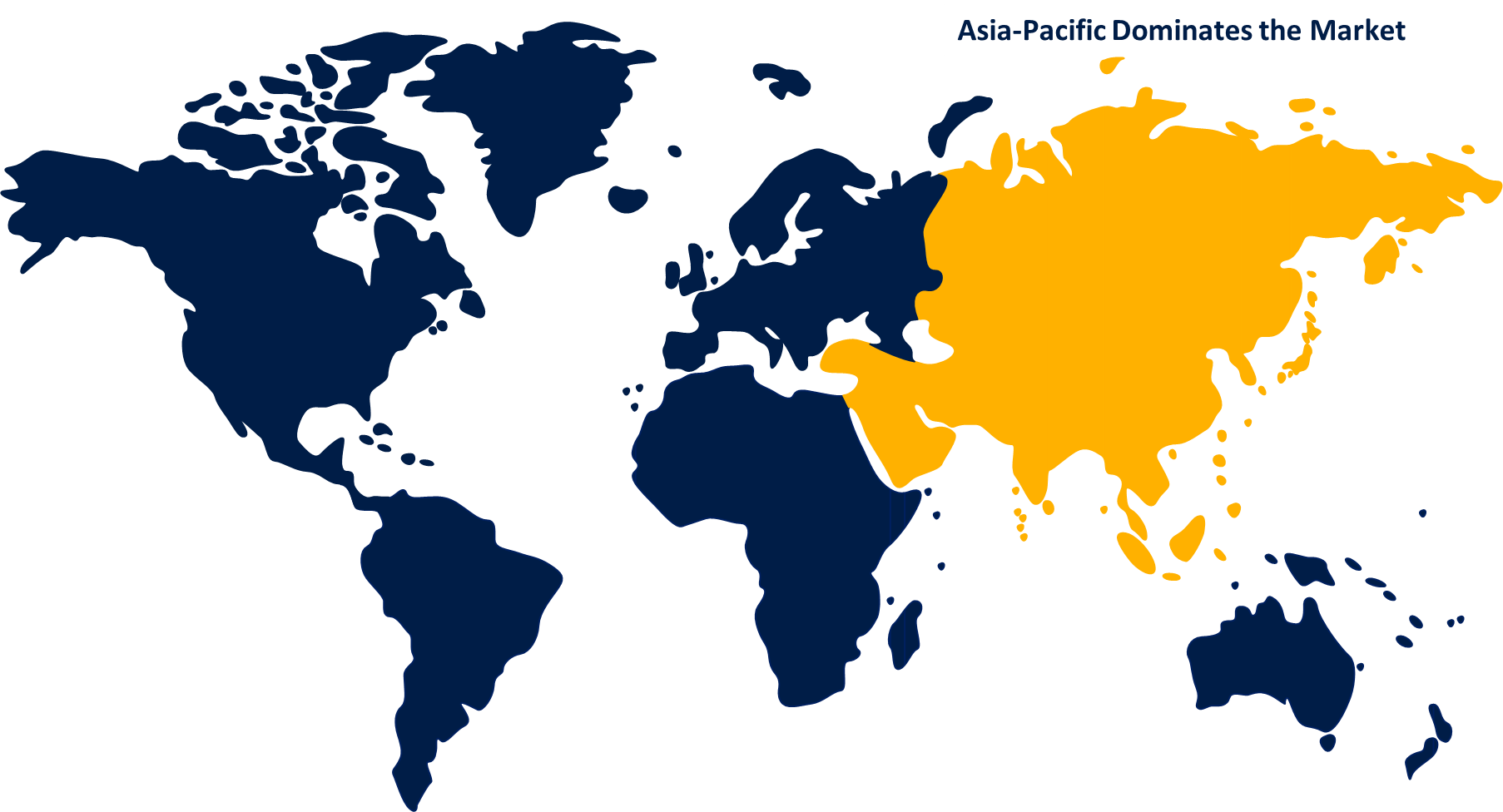

Asia Pacific Market Statistics

Get more details on this report -

Asia Pacific is anticipated to dominate the digital remittance market from 2023 to 2032. The large volume of remittances sent to countries such as India, China, and the Philippines, combined with these nations' quick use of digital payment platforms and mobile banking, contributes to the region's market dominance. The availability of a large population base, rising smartphone penetration, and supportive government measures all contribute to the Growth of the Asia Pacific digital remittance market. Traditional financial institutions and fintech firms compete in the Asia Pacific digital remittance industry. Furthermore, increased competition from prospective competitors, paired with clientele expansion, is likely to generate Growth prospects for the regional market throughout the projection period.

North America Market Statistics

North America is witnessing the fastest market Growth between 2023 to 2032. North America, which includes the United States, Canada, and Mexico, has a well-developed digital infrastructure, with a large majority of its population having access to the Internet and digital payment systems. A substantial number of expatriates live in the region and send money back to their home countries. Furthermore, the presence of various top fintech companies and remittance platforms, including PayPal, Western Union, and Remitly, fuels the expansion of this region's digital remittance market. Established businesses like PayPal, Western Union, and different fintech startups that offer fast and efficient means for individuals to send money internationally frequently hold the highest market share in North America's digital remittance sector.

Segmentation Analysis

Insights by Type

The inward segment accounted for the largest market share over the forecast period 2023 to 2032. The transfer of money into a country is referred to as inward remittance. This frequently entails migrants and expatriates sending money home from the countries where they currently dwell and work. Countries with a sizable diaspora or migratory worker population, such as India, the Philippines, Mexico, and several African countries, rely largely on remittances sent home by their inhabitants. These remittances are critical to the economies of many countries, providing a consistent stream of foreign currency and frequently outnumbering foreign aid or direct investments. The rise of digital platforms has made it easier, faster, and frequently cheaper for workers to send money home, fueling the Growth of this market.

Insights by Channel

The money transfer operators segment accounted for the largest market share over the forecast period 2023 to 2032. MTOs that specialize in remittances, such as Western Union, MoneyGram, and TransferWise (now Wise), have been at the forefront of serving the global diaspora. MTOs frequently offer speedier transfer times and more competitive exchange rates than traditional banks. They have physical branches in several cities and are progressively offering online services as well. Their combination of physical presence, trust built through time, and ambitious digital expansion methods has allowed them to retain a major piece of the market. Many people choose them because of their accessibility and speed, as well as their digital capabilities.

Insights by End-use

The migrant labor workforce segment accounted for the largest market share over the forecast period 2023 to 2032. Individuals who migrate to foreign nations in search of work, often in areas such as construction, domestic work, and agriculture, compose the migratory labor workforce. They often send a considerable amount of their earnings to their families back home. Remittances are typically utilized for necessities such as food, education, health care, and shelter. The constant nature of these remittances, along with the enormous number of migrant workers worldwide, implies that this group accounts for a sizable share of international money transfers. Their remittances are critical to the economies of many developing nations, and digital platforms have made the transfer procedure more accessible and affordable.

Competitive Landscape

Major players in the market

- Azimo Limited

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings, Inc.

- Ria Financial Services Ltd.

- TransferGo Ltd.

- Paytm

- TransferWise Ltd.

- Western Union Holdings, Inc.

- WorldRemit Ltd.

- Xoom (a PayPal service)

- Wise Payments Limited

- SingX Pte Ltd.

- TNG Limited

Recent Market Developments

- On August 2023, TNG Digital, the Malaysian company that operates and owns the Touch 'n Go eWallet, has teamed with Tranglo, a cross-border payment gateway. This collaboration aims to help TNG Digital expand its cross-border remittance services. To accomplish this, the Malaysian fintech will reportedly use Tranglo's network and infrastructure to enable its customers to send money from GOremit on the Touch 'n Go eWallet to payees in ten countries: Indonesia, the Philippines, Singapore, Thailand, Vietnam, Bangladesh, India, Nepal, Pakistan, and Sri Lanka.

- On January 2023, Xoom, PayPal's international money transfer service, announced the debut of Debit Card Deposit, a new cross-border money transfer product that allows Xoom clients in the United States to send money straight to their friends and family's qualifying Visa debit cards in 25 countries. The new functionality, developed in conjunction with Visa, will provide remittance receivers with quick, safe, and real-time access to cash delivered directly to a recipient's authorized Visa debit card.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Digital Remittance Market, Type Analysis

- Inward

- Outward

Digital Remittance Market, Channel Analysis

- Banks

- Money Transfer Operators

- Online Platforms

- Others

Digital Remittance Market, End-use Analysis

- Migrant Labor Workforce

- Small Businesses

- Personal

- Others

Digital Remittance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the digital remittance market?The Global Digital Remittance Market is expected to Grow from USD 18.76 Billion in 2023 to USD 95.1 Billion by 2032, at a CAGR of 17.6% during the forecast period 2023-2032.

-

Who are the key market players of the digital remittance market?Azimo Limited, Digital Wallet Corporation, InstaReM Pvt. Ltd., MoneyGram, PayPal Holdings, Inc., Ria Financial Services Ltd., TransferGo Ltd., Paytm, TransferWise Ltd., Western Union Holdings, Inc., WorldRemit Ltd., Xoom (a PayPal service), Wise Payments Limited, SingX Pte Ltd., TNG Limited

-

Which segment holds the largest market share?The inward segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the digital remittance market?Asia Pacific is dominating the digital remittance market with the highest market share.

Need help to buy this report?