Global Digital Orthodontics Market Size, Share, and COVID-19 Impact Analysis, By Product (Clear Aligners, Braces, Retainers, Scanners, and Software), By Technology (3D Imaging, CAD/CAM Systems, 3D Printing, and AI Tools), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Digital Orthodontics Market Insights Forecasts to 2035

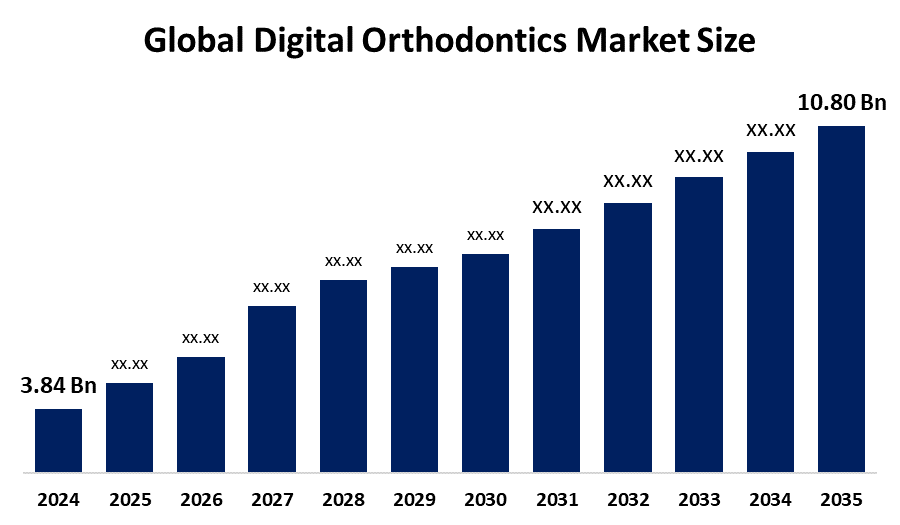

- The Global Digital Orthodontics Market Size Was Estimated at USD 3.84 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.86% from 2025 to 2035

- The Worldwide Digital Orthodontics Market Size is Expected to Reach USD 10.80 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Digital Orthodontics Market Size was worth around USD 3.84 Billion in 2024 and is predicted to grow to around USD 10.80 Billion by 2035 with a compound annual growth rate (CAGR) of 9.86% from 2025 and 2035. The market for digital orthodontics has a number of opportunities to grow due to the incorporation of artificial intelligence and 3D printing adoption.

Market Overview

The global industry of digital orthodontics encompasses the sale and use of advanced digital technologies in orthodontics, a field of dentistry that corrects misaligned teeth and jaws. Digitalization in the field of orthodontics is altering the way of orthodontic treatment, aiding in creating individualized orthodontic appliances. An increasing need for precise diagnosis and treatment leads to the digital revolution, transforming traditional techniques with modern technology. It includes intraoral scanners, 3D imaging, and CAD that aid in simplifying the patient-orthodontist communication as well as diagnostic & treatment planning.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the expanding partnerships for enhancing advancements. For instance, in April 2025, Medit, a global leader in digital dentistry solutions, and Graphy, a leading innovator in 3D printing dental materials, announced a strategic partnership. The growing technological innovation in digital orthodontics, including AI-powered predictive modelling, advanced 3D printing, and sophisticated intraoral scanning, is driving a huge surge in market growth.

Report Coverage

This research report categorizes the digital orthodontics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digital orthodontics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the digital orthodontics market.

Global Digital Orthodontics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.84 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.86% |

| 2035 Value Projection: | USD 10.80 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Product, By Technology and By Region |

| Companies covered:: | 3M, Dentsply Sirona, Stratasys Ltd., 3Shape, Altem Technologies (P) Ltd, Align Technology, Inc, Carestream Health, Planmeca Oy, Angelalign Technology, Dentaurum, Ormco, Deltaface, CADdent, Boss Orthodontics, FN Orthodontics, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

An increasing need for improved dental aesthetics, with an increasing number of adult patients seeking orthodontic treatments, is contributing to driving the market demand. The growing integration of computer-aided design and manufacturing technology (CAD/CAM) in orthodontics, as well as modern 3D printing technologies for creating efficient appliances, is propelling the market growth. Additionally, an increasing adoption of teleorthodontics like SmileDirectClub for remote consultation due to an increasing trend of virtual intervention is enhancing the market growth.

Restraining Factors

The digital orthodontics market is restricted by factors like increased initial costs for implementing technology and the lack of awareness, especially in rural areas. Further, the side effects caused due to the long-term orthodontic treatment are limiting the market expansion.

Market Segmentation

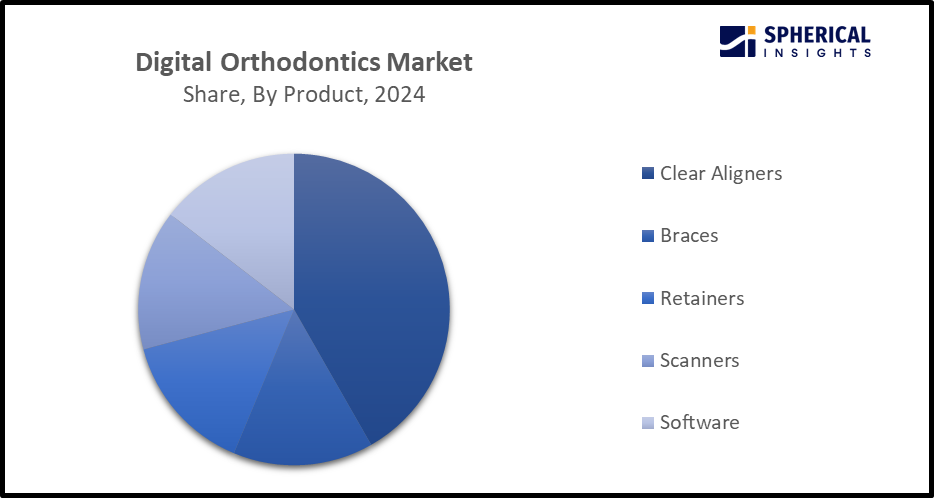

The digital orthodontics market share is classified into product and technology.

- The clear aligners segment dominated the market with the largest share of 50% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the digital orthodontics market is divided into clear aligners, braces, retainers, scanners, and software. Among these, the clear aligners segment dominated the market with the largest share of 50% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Clear aligners are plastic replicas of a person’s teeth that are created from impressions or digital scans that are taken at the beginning of treatment. With an increasing need for esthetic treatments, people's increasing need for alternatives for fixing orthodontic appliances is propelling the market in the clear aligners segment.

Get more details on this report -

- The 3D printing segment is dominating the market with a market share of 40% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the digital orthodontics market is divided into 3D imaging, CAD/CAM systems, 3D printing, and AI tools. Among these, the 3D printing segment is dominating the market with a market share of 40% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. 3D printing technology in orthodontics includes Stereolithography (SLA) and Digital Light Processing (DLP), facilitating the production of high-quality prints while significantly mitigating expenses. The combination of state-of-the-art technology in dental products is contributing to driving the market growth in the 3D printing segment.

Regional Segment Analysis of the Digital Orthodontics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the digital orthodontics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 40% in the digital orthodontics market over the predicted timeframe. The market ecosystem in North America is strong, due to the presence of dental startups like Candid, Beam Benefits, Zocdoc, and others that are implementing modern technology in the dental industry. The demand for digital orthodontics has been driven by the region's increasing disposable income and expanding orthodontic services via digital platforms. The United States is leading the North America digital orthodontics market with an estimated 85-91% share in the region. This is attributed to the evolving telehealth policies and reimbursement framework supporting remote consultations and digital workflows.

Asia Pacific is expected to grow at a rapid CAGR of 12% in the digital orthodontics market during the forecast period. The Asia Pacific area has a thriving market for digital orthodontics due to the growing urbanization, advanced healthcare infrastructure, and strategic partnerships. For instance, in July 2025, Align Technology, Inc., announced commercial availability in India of the Invisalign System, which is designed to deliver predictable mandibular advancement. China is leading the Asia Pacific digital orthodontics, with a major market share, owing to an expanding middle-class population and a strong local manufacturing and innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the digital orthodontics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Dentsply Sirona

- Stratasys Ltd.

- 3Shape

- Altem Technologies (P) Ltd

- Align Technology, Inc

- Carestream Health

- Planmeca Oy

- Angelalign Technology

- Dentaurum

- Ormco

- Deltaface

- CADdent

- Boss Orthodontics

- FN Orthodontics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Align Technology advances Digital Orthodontics with Invisalign through Best-in-Class Clinical Education and Peer-to-Peer Learning at its global faculty meeting of Doctor Educators.

- In April 2025, Medit, a global leader in digital dentistry solutions, and Graphy, a leading innovator in 3D printing dental materials, announced a strategic partnership to accelerate advancements in the digital orthodontics market.

- In December 2024, Smartee Denti-Technology, a global leader in clear aligners and digital orthodontic solutions, strengthened its presence in the Middle East by unveiling its groundbreaking Clear Mandibular Repositioning Technology.

- In September 2024, Carestream Dental secured $525 million in new funding to reduce debt, extend maturities, and invest in innovation. The company launched the Oral Healthcare Innovation Hub to revolutionize oral healthcare.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the digital orthodontics market based on the below-mentioned segments:

Global Digital Orthodontics Market, By Product

- Clear Aligners

- Braces

- Retainers

- Scanners

- Software

Global Digital Orthodontics Market, By Technology

- 3D Imaging

- CAD/CAM Systems

- 3D Printing

- AI Tools

Global Digital Orthodontics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the digital orthodontics market?The global digital orthodontics market size is expected to grow from USD 3.84 Billion in 2024 to USD 10.80 Billion by 2035, at a CAGR of 9.86% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the digital orthodontics market?North America is anticipated to hold the largest share of the digital orthodontics market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Digital Orthodontics Market from 2024 to 2035?The market is expected to grow at a CAGR of around 9.86% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Digital Orthodontics Market?Key players include 3M, Dentsply Sirona, Stratasys Ltd., 3Shape, Altem Technologies (P) Ltd, Align Technology, Inc., Carestream Health, Planmeca Oy, Angelalign Technology, Dentaurum, Ormco, Deltaface, CADdent, Boss Orthodontics, and FN Orthodontics.

-

5. Can you provide company profiles for the leading digital orthodontics manufacturers?Yes. For example, 3M is an American multinational conglomerate operating in the fields of industry, worker safety, and consumer goods, made $35.4 billion in total sales in 2021 and ranked number 102 in the Fortune 500 list of the largest United States corporations by total revenue. Dentsply Sirona is an American dental equipment manufacturer and dental consumables producer that markets its products in over 120 countries.

-

6. What are the main drivers of growth in the digital orthodontics market?Improvement in dental aesthetics and adoption of teleorthodontics are major market growth drivers of the digital orthodontics market.

-

7. What challenges are limiting the digital orthodontics market?An increased implementation cost and lack of awareness remain key restraints in the digital orthodontics market.

Need help to buy this report?