Global Digital Health For Obesity Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By End-user (Patients, Providers, Payers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Digital Health For Obesity Market Insights Forecasts to 2035

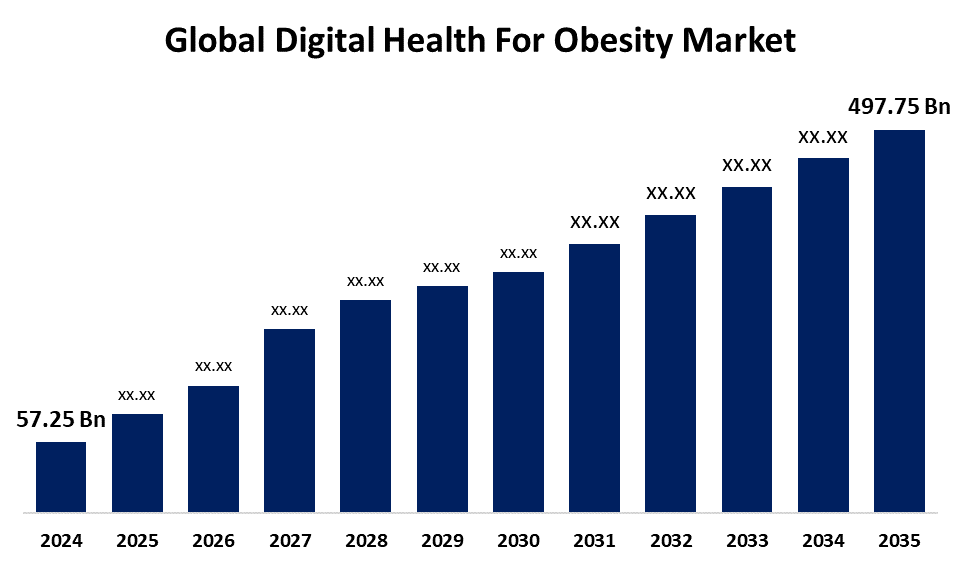

- The Global Digital Health For Obesity Market Size Was Estimated at USD 57.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.73% from 2025 to 2035

- The Worldwide Digital Health For Obesity Market Size is Expected to Reach USD 497.75 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Digital Health For Obesity Market Size was worth around USD 57.25 Billion in 2024 and is Predicted to Grow to around USD 497.75 Billion by 2035 with a CAGR of 21.73% from 2025 to 2035. The market growth is boosted by the digital health tools that are transforming obesity management through personalized, accessible, and AI-driven solutions. Growing adoption of mHealth apps and wearable tech highlights their potential in combating lifestyle-related health challenges.

Market Overview

The digital health for obesity market refers to the prevention, management, and treatment of obesity through the use of digital technologies, including wearable technology, telemedicine, mobile apps, artificial intelligence (AI), and remote monitoring tools. In order to improve results and increase patient engagement, these systems give real-time feedback, virtual coaching, behavior change, and access to healthcare specialists. They also track physical activity, diet, sleep, and metabolic health to assist with tailored weight management.

The market is driven by the growing rates of obesity worldwide and the need for affordable, individualized treatment. With real-time tracking, customized interventions, and remote assistance, wearable technology, digital therapies, and AI-powered apps are improving weight management. Accessibility is enhanced via telehealth and virtual coaching, and innovation is encouraged by more financing and regulatory support. Digital health solutions are viable substitutes for conventional weight loss techniques, notwithstanding issues with data privacy and long-term effectiveness. These tools have the potential to revolutionize public health and obesity treatment approaches as technology develops.

Report Coverage

This research report categorizes the digital health for obesity market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the digital health for obesity market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the digital health for obesity market.

Digital Health For Obesity Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 57.25 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.73% |

| 2035 Value Projection: | USD 497.75 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By End-user, and COVID-19 Impact Analysis |

| Companies covered:: | BioAge Labs, WW International, Sidekick Health, MyFitnessPal, WellDoc, Teladoc Health, Inc., Tempus, Fitnesskeeper Inc., PlateJoy HEALTH, Healthify (My Diet Coach), Noom, Fitbit, Inc., Omada Health, Ro, Xenetic Biosciences, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The need for digital health solutions is being driven by the rising rate of obesity, sedentary lifestyles, and smartphone usage. Wearable technology and smartphone apps with AI capabilities provide individualized, affordable, and easily accessible weight-management options. Adoption rates are rising as a result of mHealth apps' widespread appeal among consumers and medical professionals. The industry is also driven by the emphasis on preventive treatment and the dangers of chronic diseases associated with obesity. Platforms such as Fitbit and HealthifyMe offer behavioral assistance, customized regimens, and real-time tracking. Digital health tools are poised to revolutionize the management of obesity worldwide as they develop further.

Restraining Factors

The market growth is hindered by the issues related to data privacy, the short-term effectiveness of digital therapies, and low user engagement or retention rates over time. Furthermore, widespread adoption is hampered by the fact that not all patients, especially those in rural or low-income areas, have equal access to cellphones and internet connectivity.

Market Segmentation

The digital health for obesity market share is classified intocomponent and end-user.

- The services segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the component, the digital health for obesity market is classified into hardware, software, and services. Among these, the services segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the increasing need for installation, training, and maintenance services. At the same time, the software market is expanding quickly as a result of the growing use of EMRs and EHRs. Software adoption is also being accelerated by the drive for digital transformation in the healthcare industry and growing costs. When taken as a whole, these patterns show that contemporary healthcare systems have a strong need for software and service solutions.

- The patients segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the end-user, the digital health for obesity market is divided into patients, providers, payers, and others. Among these, the patients segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the increasing emphasis on patient-centered treatment and the need for people to take charge of their health. Additionally, businesses are revolutionizing the healthcare sector by implementing patient-care gadgets and virtual consultations to restore mobility or track and monitor a number of health metrics.

Regional Segment Analysis of the Digital Health For Obesity Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the digital health for obesity market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the digital health for obesity market over the predicted timeframe. The regional growth can be attributed to the increasing spending on healthcare IT, the availability of sufficient digital infrastructure, technological developments, the rise of startups, encouraging government programs, the increasing use of smartphones, the willingness to embrace cutting-edge technological solutions, ongoing advancements in internet connectivity, and an increase in funding and investments. The industry's growth is also attributed to a number of variables, including improvements in coverage networks, rising smartphone penetration, an increase in lifestyle problems, and a notable rise in the prevalence of chronic diseases.

Asia Pacific is expected to grow at a rapid CAGR in the digital health for obesity market during the forecast period. The region's growth is being driven by the increasing rate of obesity and increasing smartphone usage. This trend is also being fueled by government programs like India's Ayushman Bharat Digital Mission. These initiatives provide access to individualized weight management strategies by promoting telemedicine and mobile health apps. As a result, people in many areas can now obtain convenient and reasonably priced obesity treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the digital health for obesity market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BioAge Labs

- WW International

- Sidekick Health

- MyFitnessPal

- WellDoc

- Teladoc Health, Inc.

- Tempus

- Fitnesskeeper Inc.

- PlateJoy HEALTH

- Healthify (My Diet Coach)

- Noom

- Fitbit, Inc.

- Omada Health

- Ro

- Xenetic Biosciences

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2023, Hims & Hers, a digital health startup, launched its weight loss program, which includes digital monitoring tools, educational content, and medication access. Notably, the present offering does not include prescriptions for the hot weight loss drugs known as GLP-1s.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the digital health for obesity market based on the below-mentioned segments:

Global Digital Health For Obesity Market, By Component

- Hardware

- Software

- Services

Global Digital Health For Obesity Market, By End-user

- Patients

- Providers

- Payers

- Others

Global Digital Health For Obesity Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the digital health for obesity market over the forecast period?The global digital health for obesity market is projected to expand at a CAGR of 21.73% during the forecast period.

-

2. What is the market size of the digital health for obesity market?The global digital health for obesity market size is expected to grow from USD 57.25 Billion in 2024 to USD 497.75 Billion by 2035, at a CAGR of 21.73% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the digital health for obesity market?North America is anticipated to hold the largest share of the digital health for obesity market over the predicted timeframe.

Need help to buy this report?