Global Dichloroethane Market Size, Share, and COVID-19 Impact Analysis, By Product Type (1,1-Dichloroethane and 1,2-Dichloroethane), By Application (Vinyl Chloride Monomer Production, Degreasing Agent, Paint Remover, Chemical Intermediate, and Others), By End-User (Chemical, Pharmaceutical, Automotive, Paints and Coatings, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Dichloroethane Market Insights Forecasts to 2035

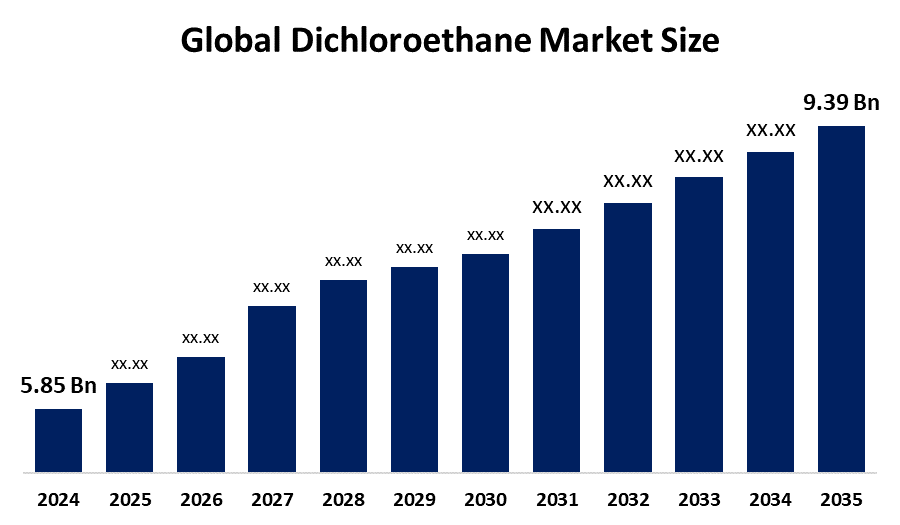

- The Global Dichloroethane Market Size Was Estimated at USD 5.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.4% from 2025 to 2035

- The Worldwide Dichloroethane Market Size is Expected to Reach USD 9.39 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global dichloroethane market size was worth around USD 5.85 billion in 2024 and is predicted to grow to around USD 9.39 billion by 2035 with a compound annual growth rate (CAGR) of 4.4% from 2025 to 2035. The main factor contributing to the increasing consumption of EDC on a worldwide basis is the continuously higher demand for PVC, particularly from the growing construction and vehicle sectors of the world.

Market Overview

Dichloroethane is a colorless, volatile chlorinated hydrocarbon and is an intermediate in the vinyl chloride monomer process. This product is further converted into polyvinyl chloride. Polyvinyl chloride finds wide application in the construction industry due to its low cost and durability. This translates to the significance of dichloroethane in the industry. The dichloroethane market is recognized to be fueled by the growth of PVC due to factors such as the development of infrastructure and the advancement of industries in developing countries.

Opportunities for the industry are in brownfield expansion, technology development for clean production, and rising spending on integrated petrochemical complexes. The Asia Pacific region leads in demand, driven by manufacturing expansion, whereas the North American and European regions concentrate on efficiencies and sustainable practices. Key companies acting in the global dichloroethane market are Dow, Occidental Petroleum, Formosa Plastics, Westlake Chemical, INEOS, and Shin-Etsu Chemical. They perform various exercises of competitiveness based on scale, integration, and technological capabilities. In September 2025, India’s Bureau of Indian Standards revised the Ethylene Dichloride (Quality Control) Amendment Order, which made the production and importation of EDC products dependent on certification from BIS. The timeline for compliance has now been extended to avoid supply disruptions and to enhance quality standards, safety measures, and environmental responsibility in the chemical supply chain.

Report Coverage

This research report categorizes the dichloroethane market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dichloroethane market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dichloroethane market.

Global Dichloroethane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.4% |

| 2035 Value Projection: | USD 9.39 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application, By End-User, By Regional Analysis |

| Companies covered:: | The Dow Chemical Company, INEOS Group Holdings, Formosa Plastics, AkzoNobel N.V., Occidental Petroleum Corporation, Westlake Chemical, AGC Inc., Solvay S.A., Merck KGaA, Tokuyama Corporation, Nouryon, SABIC, PPG Industries, Inc., Shin-Etsu Chemical Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major driver for the global dichloroethane market is its pivotal role as an important intermediate component in the polyvinyl chloride industry. The fast-paced urbanization and development activities, including the rising demand for the construction sector, especially in emerging nations, drive the demand for polyvinyl chloride in pipes, cables, and profiles. The packing, automotive, and medical applications are other supporting sectors for the polyvinyl chloride demand and, therefore, the dichloroethane demand. The development in the chemical industry, solvents, and industrial development in the Asia Pacific region are additional supporting sectors for dichloroethane development. The capacity increase, process innovations, and economic mergers of ethylene-chlorine plants are supporting dichloroethane development.

Restraining Factors

The worldwide market for dichloroethane is hindered by stringent regulations regarding the environment and health, as it is a toxic and carcinogenic chemical. The fluctuating pricing patterns of raw materials, along with the preference for environmentally friendly substitutes, hinder the growth of this market.

Market Segmentation

The dichloroethane market share is classified into product type, application, and end-user.

- The 1,2-dichloroethane segment dominated the market in 2024, approximately 55% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the dichloroethane market is divided into 1,1-dichloroethane and 1,2-dichloroethane. Among these, the 1,2-dichloroethane segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The 1,2-dichloroethylene component of the market is a major contributor to the growth of the market, mainly because it is a precursor for vinyl chloride monomer and further for the production of PVC. Increasing demand for PVC materials around the globe, particularly in the emerging nations, is a major cause for this growing demand.

- The vinyl chloride monomer production segment accounted for the largest share in 2024, approximately 70% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the dichloroethane market is divided into vinyl chloride monomer production, degreasing agent, paint remover, chemical intermediate, and others. Among these, the vinyl chloride monomer production segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The vinyl chloride monomer segment had the largest market share, as VCM is an extremely important component of PVC. Indeed, its main application is in constructing and building different infrastructural and industrial structures. In recent times, infrastructure development in different countries of the world, especially in developing nations, has stimulated huge demand for VCM, thus prompting swift expansion in the dichloroethane market.

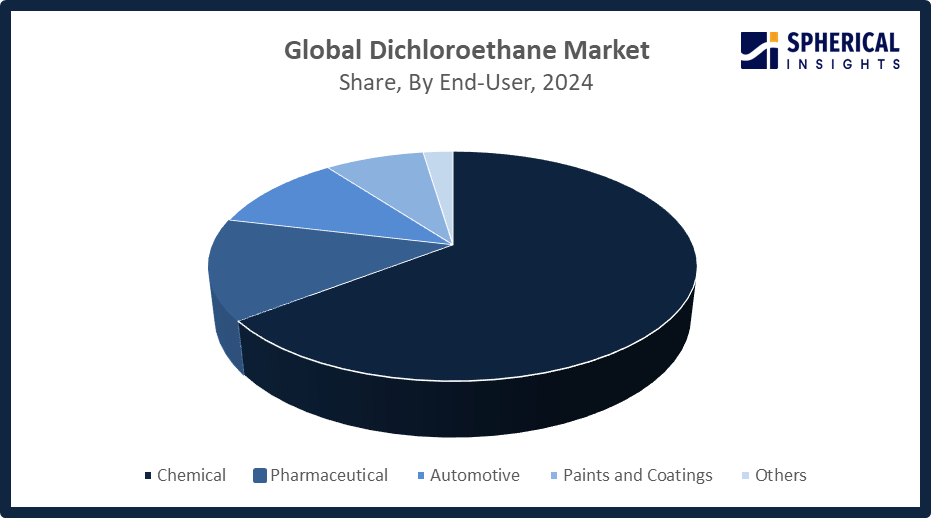

- The chemical segment accounted for the highest market revenue in 2024, approximately 65% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the dichloroethane market is divided into chemical, pharmaceutical, automotive, paints and coatings, and others. Among these, the chemical segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The chemical industry recorded growth in the market due to the vast consumption of dichloroethane products, especially 1,2-dichloroethane, being used in vinyl chloride monomer and PVC production. Demand for PVC has increased for uses in construction, packaging, and industrial purposes due to the increased growth in industry and infrastructure developments in developing countries.

Get more details on this report -

Regional Segment Analysis of the Dichloroethane Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dichloroethane market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the dichloroethane market over the predicted timeframe. The Asia Pacific market is projected to have a 48% market share of the worldwide market for dichloroethane, owing to its fast-growing industrialization and urbanization rate. China and India are major contributors, given the fact that there are large chemical and petrochemical plants capable of large-scale production of 1,2-dichloroethane. Supporting government policies for industrial growth, investments in integrated chemical complexes, and increasing exports further boost the demand for the market. For example, in January 2025, the Indian Ministry of Chemicals and Fertilizers rescinded several orders related to Quality Control Orders, including on EDC, thereby removing compulsory BIS certification. The effect is that compliance obligations have been reduced, regulatory procedures simplified, and smoother production and trade of EDC are supported.

North America is expected to grow at a rapid CAGR in the dichloroethane market during the forecast period. North America is estimated to have a 25% market share of the dichloroethane market owing to an increase in the demand for PVC in the building, automotive, and electronics sectors, as well as advancements in chemical process technology. The United States currently leads the market because of advancements in modern petrochemical plants and their compliance with sustainable production methods. Increased industrial production and upgrading of infrastructure contribute to growth. In July 2025, a risk evaluation on TSCA published by the U.S. EPA concluded that there are unreasonable health and environmental hazards presented by three specified uses of 1,1-dichloroethane.

The European market for dichloroethane is experiencing steady growth. The German market is an important segment of dichloroethane in Europe. This is mainly due to the developed manufacturing infrastructure in the chemical industry and strict compliance by German manufacturing with environmental and safety standards. Initiatives in sustainable manufacturing methods and strict compliance by German manufacturing to environmental and safety standards are some of the key contributors to efficient dichloroethane utilization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dichloroethane market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Dow Chemical Company

- INEOS Group Holdings

- Formosa Plastics

- AkzoNobel N.V.

- Occidental Petroleum Corporation

- Westlake Chemical

- AGC Inc.

- Solvay S.A.

- Merck KGaA

- Tokuyama Corporation

- Nouryon

- SABIC

- PPG Industries, Inc.

- Shin-Etsu Chemical Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, the U.S. EPA released a draft TSCA risk evaluation for 1,2-dichloroethane, identifying potential unreasonable risks to human health and the environment. The evaluation is open for public comment and could prompt future regulatory measures impacting the chemical’s production, use, and safety standards.

- In March 2025, PPG announced the launch of a waterborne automotive coatings plant in Samut Prakan, Thailand. The facility boosts local production of waterborne basecoats and primers, supporting growing demand from Southeast Asian automotive companies for environmentally friendly, sustainable coating solutions.

- In August 2020, Formosa Plastics USA declared force majeure on PVC supplies from its Texas and Louisiana plants due to challenges restarting an upstream chlor-alkali plant after a prolonged turnaround. This disruption tightened PVC availability, limiting exports as domestic customers turned to other producers to fulfil orders.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dichloroethane market based on the below-mentioned segments:

Global Dichloroethane Market, By Product Type

- 1,1-Dichloroethane

- 1,2-Dichloroethane

Global Dichloroethane Market, By Application

- Vinyl Chloride Monomer Production

- Degreasing Agent

- Paint Remover

- Chemical Intermediate

- Others

Global Dichloroethane Market, By End-User

- Chemical

- Pharmaceutical

- Automotive

- Paints and Coatings

- Others

Global Dichloroethane Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dichloroethane market over the forecast period?The global dichloroethane market is projected to expand at a CAGR of 4.4% during the forecast period.

-

2. What is the dichloroethane market?The dichloroethane market involves the production, trade, and consumption of dichloroethane, primarily used for PVC and chemical applications.

-

3. What is the market size of the dichloroethane market?The global dichloroethane market size is expected to grow from USD 5.85 billion in 2024 to USD 9.39 billion by 2035, at a CAGR of 4.4% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the dichloroethane market?Asia Pacific is anticipated to hold the largest share of the dichloroethane market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global dichloroethane market?The Dow Chemical Company, INEOS Group Holdings, Formosa Plastics, AkzoNobel N.V., Occidental Petroleum Corporation, Westlake Chemical, AGC Inc., Solvay S.A., Merck KGaA, Tokuyama Corporation, and Others.

-

6. What factors are driving the growth of the dichloroethane market?The dichloroethane market is driven by rising PVC demand, rapid industrialization, urbanization, infrastructure development, growth in construction, automotive, and packaging sectors, and the expansion of chemical manufacturing in emerging economies.

-

7. What are the market trends in the dichloroethane market?Key trends include rising PVC demand, adoption of sustainable production, technological advancements, and growth in emerging markets’ construction and chemical industries.

-

8. What are the main challenges restricting wider adoption of the dichloroethane market?The main challenges restricting the wider adoption of the dichloroethane (EDC) market are stringent environmental regulations, significant health and safety concerns, fluctuating raw material prices, and the push for sustainable, eco-friendly alternatives.

Need help to buy this report?