Global Diacetone Alcohol Market Size, Share, and COVID-19 Impact Analysis, By Application (Solvents, Chemical Intermediates, Cleaning, Drilling Fluids, and Preservatives), By End User (Paints & Coatings, Textiles, Automotive, and Oil & Gas), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Diacetone Alcohol Market Insights Forecasts To 2035

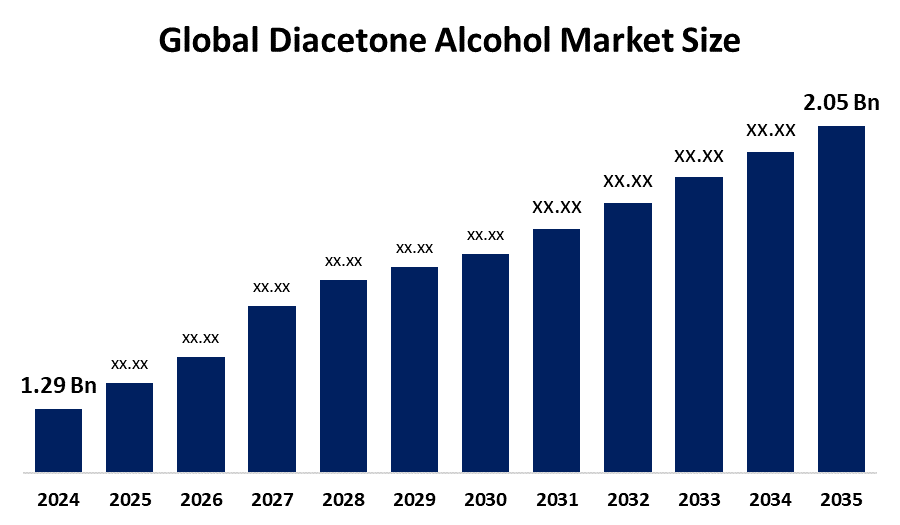

- The Global Diacetone Alcohol Market Size Was Estimated At USD 1.29 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 4.3 % From 2025 To 2035

- The Worldwide Diacetone Alcohol Market Size Is Expected To Reach USD 2.05 Billion By 2035

- Asia Pacific Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Diacetone Alcohol Market Size Was Valued At Around USD 1.29 Billion In 2024 And Is Predicted To Grow To Around USD 2.05 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 4.3 % From 2025 To 2035. Opportunities are presented by the growing demand for diacetone alcohol in coatings, medicines, and cosmetics, which is driven by developments in sustainable chemical manufacturing techniques, industrial growth, and solvent applications.

Market Overview

The Market Size Includes The Production, Distribution, And Use Of Diacetone Alcohol (Chemical Formula: CH3C(O)CH2C(OH)(CH3)2). Diacetone alcohol is a multipurpose organic solvent that is colorless, aromatic, and low in toxicity.DAA is mainly used in the coatings, paints, solvents, inks, and cleaning industries. It is valued in solvent-based formulations for improving flow, gloss, leveling, and drying efficiency. The automotive and architectural industries together account for nearly 60 percent of total demand.In September 2025, Monument Chemical announced a price increase for diacetone alcohol. This increase was implemented after the supply chain recovered from disruptions caused by severe cold weather conditions.The diacetone alcohol market is growing due to increasing environmental regulations, regulatory compliance requirements, and rising demand for paints and coatings. Additionally, the use of diacetone alcohol is expanding in the personal care and cosmetics industry.

Report Coverage

This Research Report Categorizes The Diacetone Alcohol Market Size Based On Various Segments And Regions, Forecasts Revenue Growth, And Analyzes Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the diacetone alcohol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the diacetone alcohol market.

Global Diacetone Alcohol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.29 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 4.3% |

| 2023 Value Projection: | USD 2.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End User |

| Companies covered:: | Arkema Group, Development Co., Ltd, KH Neochem Co., Ltd, Mitsubishi Chemical Corporation, Monument Chemicals, Inc., Prasol Chemical Pvt. Ltd., SI Group, Inc., Solvay S.A, Solventis Ltd, TCI Chemicals Pvt. Ltd., Tianjin Daofu Chemical New Technology, and Others, key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Demand For Diacetone Alcohol Is Rising Significantly Due To The Paint And Coatings Sector. One of the primary driving forces is the growing demand from the paints and coatings industry, which appreciates diacetone alcohol for its higher solvency, high boiling point, and ability to improve film formation. The molecule's increasing use in pharmaceuticals and cosmetics helps to market expansion because it is utilized in formulation processes and as a chemical intermediary. Moreover, the development and modernization of chemical manufacturing methods have contributed to improved efficiency in production and product quality, which draws more customers to the market. The focus of regulations on solvent performance and efficiency has also driven the Diacetone Alcohol market.

Restraining Factors

The Market Size For Diacetone Alcohol Is Restricted By Strict Environmental Laws, health and safety concerns, fluctuating raw material prices, the availability of alternative solvents, and the growing industry demand for low-VOC and environmentally friendly chemical substitutes.

Market Segmentation

The diacetone alcohol market share is classified into application and end user.

- The solvents segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based On The Application, The Diacetone Alcohol Market Size Is Divided Into Solvents, chemical intermediates, cleaning, drilling fluids, and preservatives. Among these, the solvents segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The demand for effective solvents like diacetone alcohol has increased due to growing industrialization, urbanization, and the growth of end-use sectors, including consumer goods, construction, and automobiles. Because of their capacity to dissolve other materials, solvents are essential in many different sectors. They are particularly useful in paint and coating formulas.

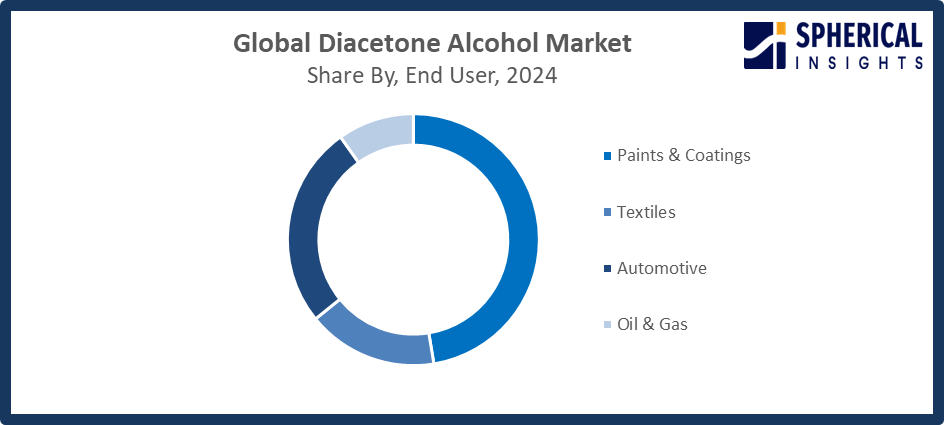

- The paints & coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based On The End User, The Diacetone Alcohol Market Size Is Divided Into Paints & Coatings, textiles, automotive, and oil & gas. Among these, the paints & coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Diacetone alcohol is necessary to produce high-quality paints and coatings because it increases the solubility of resins, improves viscosity, and encourages uniform layer formation. The paints and coatings industry continues to be the market's leading end-user segment due to a mix of growing industrial activity, growing consumer demands for high-performance finishes, and regulatory compliance for volatile organic compound (VOC) reduction.

Get more details on this report -

Regional Segment Analysis of the Diacetone Alcohol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the diacetone alcohol market over the predicted timeframe.

Get more details on this report -

North America Is Anticipated To Hold The Largest Share Of The Diacetone Alcohol Market Size Over The Predicted Timeframe. Paints and coatings, medicines, solvents, and specialty chemicals, all of which are significant users of diacetone alcohol, benefit from the region's sophisticated industrial infrastructure. With the help of major companies like Huntsman Corporation and Eastman Chemical Company, the United States dominates the industry. In order to improve compliance and sustainable production frameworks, the U.S. Environmental Protection Agency (EPA) extended health and safety data reporting deadlines for a number of chemicals, including solvents like DAA, until May 2026 under the Toxic Substances Control Act (TSCA). Targeting automotive coatings, BASF SE opened a cutting-edge specialty solvent production facility in Texas in August 2025. The facility uses energy-efficient techniques to increase DAA output by 20%.

Asia Pacific Is Expected To Grow At A Rapid CAGR In The Diacetone Alcohol Market Size During The Forecast Period. Asia Pacific is driven by the region's rapid industrialization and economic growth. The demand for solvents and chemical intermediates has dramatically expanded due to the expansion of manufacturing activity in nations like China, India, Japan, and South Korea. India's Smart Cities Mission, which was updated in October 2025 with an investment of INR 48,000 crore, speeds up urban development and will increase the market for protective coatings by 25% by 2030. According to 2025 pilot studies, Parsol Chemical Ltd. opened an R&D center in Mumbai in December 2025 with 20 experts, leading the way in aldol-condensation breakthroughs for 95% yield bio-DAA using Amberlyst catalysts.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Diacetone Alcohol Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arkema Group

- Development Co., Ltd

- KH Neochem Co., Ltd

- Mitsubishi Chemical Corporation

- Monument Chemicals, Inc.

- Prasol Chemical Pvt. Ltd.

- SI Group, Inc.

- Solvay S.A

- Solventis Ltd

- TCI Chemicals Pvt. Ltd.

- Tianjin Daofu Chemical New Technology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Prasol Chemicals launched a multi-year expansion to scale diacetone alcohol production, boosting capacity for industrial coatings, lubricants, and agrochemicals, leveraging its Khopoli and Mahad facilities amid rising market demand.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the diacetone alcohol market based on the below-mentioned segments:

Global Diacetone Alcohol Market, By Application

- Solvents

- Chemical Intermediates

- Cleaning

- Drilling Fluids

- Preservatives

Global Diacetone Alcohol Market, By End User

- Paints & Coatings

- Textiles

- Automotive

- Oil & Gas

Global Diacetone Alcohol Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the diacetone alcohol market over the forecast period?The global diacetone alcohol market is projected to expand at a CAGR of 4.3% during the forecast period.

-

2. What is the market size of the diacetone alcohol market?The global diacetone alcohol market size is expected to grow from USD 1.29 billion in 2024 to USD 2.05 billion by 2035, at a CAGR of 4.3 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the diacetone alcohol market?North America is anticipated to hold the largest share of the diacetone alcohol market over the predicted timeframe.

-

4. Who are the top companies operating in the global diacetone alcohol market?Arkema Group, Development Co., Ltd, KH Neochem Co., Ltd, Mitsubishi Chemical Corporation, Monument Chemicals, Inc., Prasol Chemical Pvt. Ltd., SI Group, Inc., Solvay S.A, Solventis Ltd, TCI Chemicals Pvt. Ltd., Tianjin Daofu Chemical New Technology, and Others.

-

5. What factors are driving the growth of the diacetone alcohol market?Rising demand from paints, coatings, medicines, industrial solvents, infrastructure construction, automobile manufacture, and growing specialty chemical manufacturing in both developed and emerging nations is driving the diacetone alcohol market.

-

6. What are the market trends in the diacetone alcohol market?Increasing use in high-performance coatings, emphasis on product purity, technological developments, sustainability initiatives, and a gradual shift toward efficient and specialist solvent uses are some of the major trends in the diacetone alcohol market.

-

7. What are the main challenges restricting the wider adoption of the diacetone alcohol market?Strict environmental laws, health and safety concerns, unstable raw material prices, the availability of substitute solvents, and the increasing demand for environmentally friendly chemical solutions are some of the main obstacles preventing the market for diacetone alcohol from expanding.

Need help to buy this report?