Global Diabetes Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Insulin, DPP-4 Inhibitors, GLP-1 Receptor Agonists, SGLT2 Inhibitors, and Others), By Diabetes Type (Type 1 and Type 2), By Route of Administration (Oral, Subcutaneous, and Intravenous), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, and Retail Pharmacies) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Diabetes Drugs Market Insights Forecasts to 2035

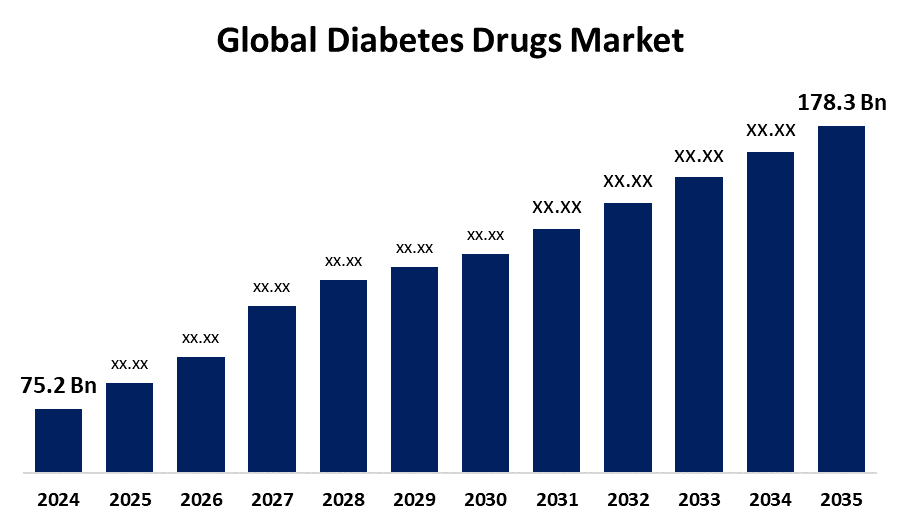

- The Global Diabetes Drugs Market Size Was Estimated at USD 75.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.16% from 2025 to 2035

- The Worldwide Diabetes Drugs Market Size is Expected to Reach USD 178.3 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Diabetes Drugs Market Size was worth around USD 75.2 Billion in 2024 and is predicted to Grow to around USD 178.3 Billion by 2035 with a compound annual growth rate (CAGR) of 8.16% from 2025 to 2035. Rising diabetes prevalence, ageing populations, rising obesity rates, improvements in drug development, increased knowledge, better access to healthcare, and a greater need for cutting-edge, efficient treatment alternatives worldwide are all factors propelling the market for diabetic medications.

Market Overview

The global diabetes drugs market refers to the global industry dedicated to developing, manufacturing, and distributing pharmaceutical medicines that aid in the management of blood glucose levels and accompanying issues in patients with type 1 and type 2 diabetes. The growing number of diabetics worldwide, obesity, sedentary lifestyles, and poor diets are all contributing factors to the growth of the diabetes medication industry. Growth is further reinforced by new drug sales, more usage in developing nations, and technological developments. Innovations in diabetes diagnosis, such as continuous glucose monitoring devices and portable glucometers, are also propelling the market. Ascensia Diabetes Care, for example, got FDA certification in February 2022 for its next-generation Eversense E3 CGM system, which improves glucose monitoring and helps promote diabetes management and market expansion. Nearly 1 in 8 adults, or 853 million individuals, are expected to have diabetes by 2050, a 46% rise. Type 2 diabetes affects more than 90% of consumers and is caused by genetic, environmental, demographic, and socioeconomic variables. Diabetes remains a significant world health challenge, leading to lower quality of life and increasing costs of healthcare. Multiple factors, such as ageing populations, rising incidence, and advances in drug delivery, contribute to rapid market growth. In October 2024, a national program to target 75 million individuals for diabetes and hypertension treatment was launched jointly by the WHO and the MoHFW in India. Additionally, new classes of treatment, such as GLP-1 analogues and SGLT2 inhibitors, are slowly being adopted globally. Demand for these solutions is driven by advancements in diabetes technology in medical devices, including the recent introduction of high-end insulin delivery pens and insulin pumps. Leading manufacturers are focused on developing innovative products and technology-based solutions in order to gain a proportion of the market.

Report Coverage

This research report categorizes the diabetes drugs market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the diabetes drugs market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the diabetes drugs market.

Global Diabetes Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 75.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.16% |

| 2035 Value Projection: | USD 178.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drug Class, By Diabetes Type and COVID-19 Impact Analysis |

| Companies covered:: | Novo Nordisk, Eli Lilly and Company, Sanofi, Merck & Co., Inc., AstraZeneca plc, Johnson & Johnson Services Inc., Boehringer Ingelheim, Novartis AG, Takeda Pharmaceutical Company, Bayer AG, Sun Pharmaceuticals, Dr. Reddy’s Laboratories, Teva, Mylan, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of diabetes, which may be caused by obesity, sedentary lifestyles, and poor diets, will significantly impact the global diabetes medication market. Technology improvements in drug delivery, such as insulin pumps, smart pens, and autoinjectors, increase the ease and uptake of medications. There are also improved drugs coming to the market with improved efficacy that support growth. For example, in July 2020, Xeris Pharmaceuticals launched the Gvoke HypoPen in the United States for the treatment of severe hypoglycemia. Additionally, global research funding and governmental initiatives are supporting innovation in diabetes care, improving the market picture despite the rising incidence of diabetes worldwide.

Restraining Factors

Many cases of diabetes go undetected, especially in developing countries like China and India, because of social obstacles, lack of symptoms, and inadequate access to healthcare. Drug demand rises with rising prevalence, but adoption is hampered by high treatment costs and costly advanced therapies. Growth is also hampered by lengthy approval processes and severe regulatory restrictions. For example, metformin's labelling for patients with poor renal function was recently modified by the FDA. In general, the market for diabetes medications is still severely constrained by the financial burden and regulatory issues.

Market Segmentation

The diabetes drugs market share is classified into drug class, diabetes type, route of administration, and distribution channel.

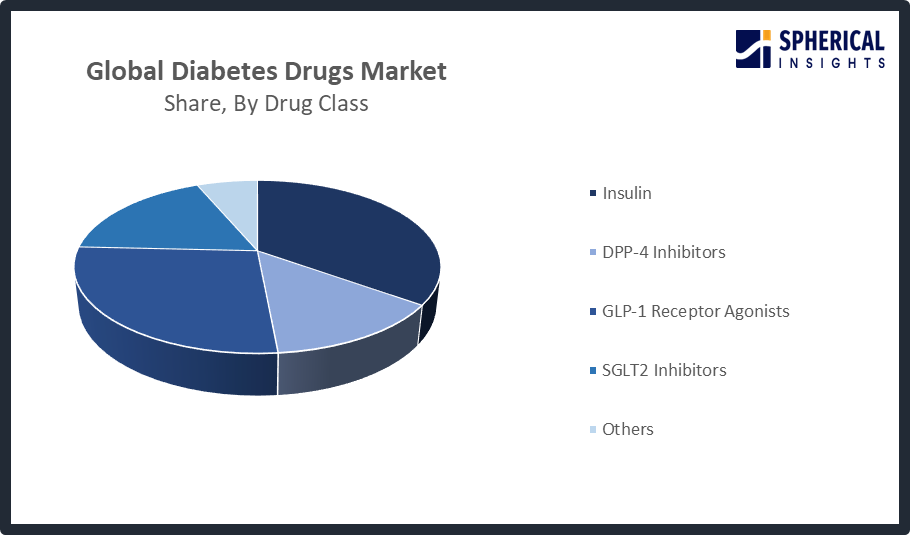

- The insulin segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the drug class, the diabetes drugs market is divided into insulin, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT2 inhibitors, and others. Among these, the insulin segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The increasing requirement from individuals suffering from Type 1 diabetes and requiring insulin therapy for their lives to not only survive but also effectively manage their diabetes. The segment's dominance and substantial market share worldwide have also been aided by the increasing prevalence of Type-2 diabetes patients requiring insulin therapy, along with advancements in administration systems such as smart pens and pumps.

Get more details on this report -

- The type 2 segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the diabetes type, the diabetes drugs market is divided into type 1 and type 2. Among these, the type 2 segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The condition's sharply rising global prevalence. Demand is still being driven by rising obesity rates, sedentary lifestyles, and poor eating habits. Additionally, it is projected that growing clinical trials and promising pipeline medications for the treatment of type 2 diabetes will hasten market expansion.

- The oral segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the route of administration, the diabetes drugs market is divided into oral, subcutaneous, and intravenous. Among these, the oral segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Besides lifestyle modification, oral anti-diabetic agents are recommended for use if intensifying treatment for type 2 diabetes is necessary. These drugs are available globally. Patients want less invasive, effective diabetes treatment options. The FDA welcomes new treatment options that can help patients better manage their disease. For the FDA's Centre for Drug Evaluation and Research, Division of Metabolism and Endocrinology Products.

- The retail pharmacies segment accounted for the largest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the diabetes drugs market is divided into online pharmacies, hospital pharmacies, and retail pharmacies. Among these, the retail pharmacies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This dominance can be expected due to the growing availability of various diabetes medications at reasonable prices across retail pharmacies. The growth of this segment is also supported by the growing number of retail pharmacies across the globe to meet the high demand for diabetes medications.

Regional Segment Analysis of the Diabetes Drugs Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the diabetes drugs market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the diabetes drugs market over the predicted timeframe. An ageing population and changing lifestyles are contributing to the region's relatively high prevalence of diabetes, mainly type 2. High healthcare spending and a well-established healthcare infrastructure can make it easier for consumers to seek treatment and illness management options. The area is home to a number of top pharmaceutical companies and research facilities that continuously create and launch cutting-edge antidiabetic medications and technology, supporting market expansion overall.

Asia Pacific is expected to grow at a rapid CAGR in the diabetes drugs market during the forecast period. Dietary habits, urbanization, and shifts in lifestyle are mainly responsible for the increase in type 2 diabetes prevalence. The area has a large and growing aged population, making it an important market for diabetes management options. Additionally, the rapid growth of digital health platforms and telemedicine is enhancing access to diabetes care. The market penetration in the area is expected to continue accelerating as technology becomes incorporated into diabetes treatment and management. Moreover, the projected expansion of the therapeutic landscape will also derive from the government's and healthcare providers' focus on improving early diagnosis and access to new treatment options. Japan's stable increase in antidiabetics will also be supported by the country's strong healthcare system.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the diabetes drugs market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Merck & Co., Inc.

- AstraZeneca plc

- Johnson & Johnson Services Inc.

- Boehringer Ingelheim

- Novartis AG

- Takeda Pharmaceutical Company

- Bayer AG

- Sun Pharmaceuticals

- Dr. Reddy’s Laboratories

- Teva

- Mylan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar to Novolog, was approved by the U.S. FDA for use in diabetic adults and children. Merilog, which is approved in 10ml vial and 3ml prefilled pen forms, is intended to enhance glycaemic management during meals. It is the third insulin biosimilar that has been authorised in the United States and is produced by Sanofi-Aventis U.S. LLC. The FDA's objective to increase access to affordable insulin treatments and promote a competitive biosimilar market for the treatment of diabetes is supported by this milestone.

- In July 2024, the US FDA has approved Zituvimet XR (sitagliptin and metformin hydrochloride extended-release), Zydus Lifesciences' new diabetes medication, for marketing. The medication was authorised to improve glycaemic management in persons with type 2 diabetes mellitus.

- In July 2024, Novo Nordisk A/S received the Complete Response Letter (CRL) covering the Biologics License Application for once-weekly basal insulin icodec for the treatment of diabetes mellitus in the U.S.

- In March 2024, Eli Lilly and Company partnered with Amazon Pharmacy to deliver its GLP-1 drugs through Amazon or Truepill. This increased the global penetration of Mounjaro and Zepbound, the company’s injectable GLP-1 medications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the diabetes drugs market based on the below-mentioned segments:

Global Diabetes Drugs Market, By Drug Class

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

- Others

Global Diabetes Drugs Market, By Diabetes Type

- Type 1

- Type 2

Global Diabetes Drugs Market, By Route of Administration

- Oral

- Subcutaneous

- Intravenous

Global Diabetes Drugs Market, By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Global Diabetes Drugs Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Diabetes Drugs market over the forecast period?The global Diabetes Drugs market is projected to expand at a CAGR of 8.16% during the forecast period.

-

2. What is the market size of the Diabetes Drugs market?The global Diabetes Drugs market size is expected to grow from USD 75.2 Billion in 2024 to USD 178.3 Billion by 2035, at a CAGR of 8.16% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Diabetes Drugs market?North America is anticipated to hold the largest share of the Diabetes Drugs market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Diabetes Drugs market?Novo Nordisk, Eli Lilly and Company, Sanofi, Merck & Co., Inc., AstraZeneca plc, Johnson & Johnson Services Inc., Boehringer Ingelheim, Novartis AG, Takeda Pharmaceutical Company, and Bayer AG., and Others.

-

5. What factors are driving the growth of the Diabetes Drugs market?Growing rates of diabetes worldwide, rising rates of obesity and sedentary lifestyles, ageing populations, and improvements in drug delivery technology are the main factors driving the market for diabetes medications. Global market expansion is further fuelled by government efforts and the growing use of innovative therapies.

-

6. What are the market trends in the Diabetes Drugs market?Rising use of cutting-edge treatments, the creation of new drug classes, the incorporation of smart delivery systems, a greater emphasis on type 2 diabetes, and an increase in market share in developing nations are some of the major developments in the diabetic medication industry.

-

7. What are the main challenges restricting wider adoption of the Diabetes Drugs market?The financial burden of managing chronic diabetes, severe regulatory standards, lengthy drug development delays, high treatment costs, and restricted access to healthcare in developing nations are some of the main obstacles preventing the broader use of diabetes medications.

Need help to buy this report?