Global Destroyers Market Size By Product Type (Propulsion System, ASW System, Radar Absorbent Material Command and Control System, Missile Launching System, and Radar System), Application (Government and Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Destroyers Market Insights Forecasts to 2033

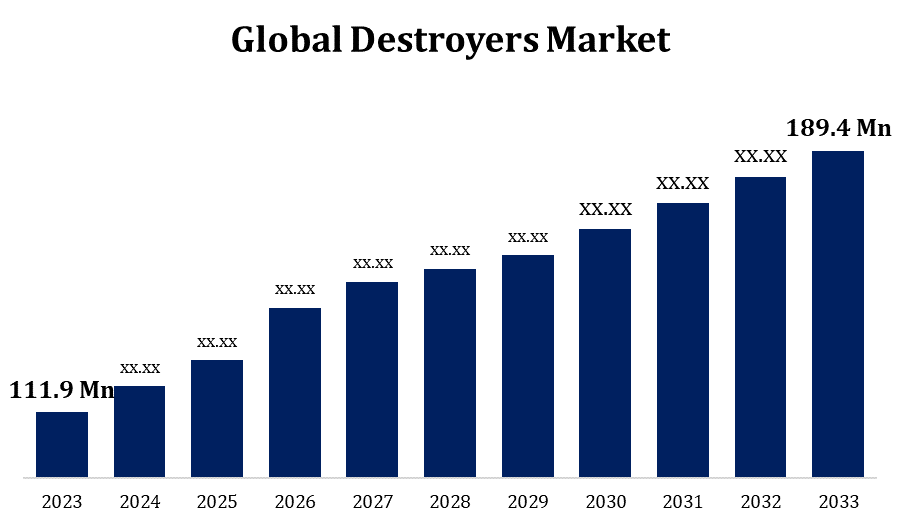

- The Global Destroyers Market Size was valued at USD 111.9 Million in 2023.

- The Market Size is Growing at a CAGR of 5.40% from 2023 to 2033.

- The Worldwide Destroyers Market Size is expected to reach USD 189.4 Million By 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Destroyers Market Size is expected to reach USD 189.4 Million by 2033, at a CAGR of 5.40% during the forecast period 2023 to 2033.

Many countries have invested in modernising their naval fleets. Upgrading or acquiring new destroyers is an important part of naval modernization programmes. Modern destroyers' designs and capabilities have been impacted by advances in naval technology, such as radar systems, missile capability, stealth features, and electronic warfare systems. The trend is towards designing destroyers that can handle a variety of tasks. This includes the capacity to engage airborne threats, surface targets, and submarines. Some regions have seen a naval arms race, with countries investing in modern naval systems, such as destroyers, to maintain strategic advantages and project power. With the changing threat scenario, there is a greater emphasis on incorporating modern missile defence systems onto destroyers to combat future missile threats.

Destroyers Market Value Chain Analysis

R&D entails the investigation of novel naval technologies, materials, and design concepts. This stage focuses on enhancing destroyers' capabilities, stealth, and efficiency. Design and engineering teams use research findings to create detailed designs and specifications for destroyers. This stage entails designing the ship's architecture, propulsion systems, weaponry, and electronic components. Shipbuilding facilities produce and assemble destroyer components in accordance with design specifications. This stage entails building the hull, integrating the propulsion systems, installing weapons and sensors, and outfitting the various ship systems. The integration of sophisticated weapon systems, such as missile launchers, gun systems, and anti-submarine warfare (ASW) systems, is crucial. This phase guarantees that the destroyer is fully prepared for its multi-mission capability. This stage includes the integration of modern radar systems, communication systems, electronic warfare (EW) suites, and command and control systems. The destroyer is extensively tested to ensure that all systems function properly. Throughout its service life, the destroyer requires regular maintenance, repairs, and logistical support. The destroyer is used for a variety of naval activities, including exercises, patrols, and possible war situations.

Destroyers Market Opportunity Analysis

Many countries are investing in navy modernization programmes to strengthen their marine capabilities. There are opportunities for defence contractors to engage in the development and delivery of advanced destroyer-class ships. There is an increasing demand for destroyers with varied capabilities that can handle a variety of missions, such as anti-submarine warfare, anti-aircraft warfare, and anti-surface warfare. Manufacturers might focus on creating and marketing multi-mission platforms. The demand for stealthy destroyers with low radar cross-sections is growing. Manufacturers of stealth technology can look into ways to improve the survivability of destroyers. There is an increasing emphasis on energy-efficient naval systems and environmentally friendly procedures. Companies creating environmentally friendly technologies, such as hybrid propulsion systems or alternative energy sources, can benefit from this sector.

Global Destroyers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 111.9 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.40% |

| 2033 Value Projection: | USD 189.4 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Region And Segment Forecasts, By Geographic Scope And Forecast |

| Companies covered:: | BAE Systems Plc., Austal USA, Northrop Grumman Corporation, Lockheed Martin, General Atomics, Fincantieri, Mazagon Dock Shipbuilders, Huntington Ingalls Industries, United Shipbuilding, DCNS, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Destroyers Market Dynamics

Rise in Demand for Maritime Border Security

The rise of transnational threats such as piracy, illegal fishing, smuggling, and terrorism highlights the importance of robust maritime border security. Destroyers with excellent observation and interception capabilities are critical for combating these threats. Nations are increasingly concerned about defending their Exclusive Economic Zones, which extend beyond national waters. Destroyers are sent to monitor and enforce restrictions within designated zones, ensuring that economic interests and resources are protected. The adaptability of destroyers enables them to patrol and monitor maritime borders, preventing illegal intrusions by unauthorised vessels. Their advanced sensors and communication systems help to detect and respond to potential threats. Nations invest in advanced destroyers as part of navy modernization programmes to improve maritime border protection.

Restraints & Challenges

Many nations' defence budgets are constrained, restricting the financial resources available for navy modernization programmes and the acquisition of advanced destroyers. Integrating sophisticated technologies onto destroyers can be challenging. The rapid pace of technological change necessitates continuous updates and training, which may provide issues for naval personnel. The defence sector depends on a global supply chain. Disruptions like as geopolitical conflicts, natural disasters, and pandemics can all have an impact on the timely supply of destroyer construction components and supplies. Potential adversaries may use A2/AD methods to block access to specified marine areas. This presents issues for naval forces, notably destroyers, in terms of access and freedom of manoeuvre.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Destroyers Market from 2023 to 2033. North American destroyers are distinguished by their incorporation of advanced technologies such as the Aegis Combat System, advanced radar systems, and missile defence capabilities. The emphasis on technical superiority improves destroyers' overall capabilities, making them essential to naval operations. Governments assess budget allocations for defence, especially naval programmes. Budget constraints may have an impact on the pace of destroyer acquisition and upgrade programmes. The availability of finances has a direct impact on the size and timeliness of destroyer initiatives. Destroyers help to ensure homeland security by patrolling and securing maritime borders. This is especially essential for North American countries with long coastlines.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Several Asia-Pacific countries are aggressively modernising and upgrading their naval capabilities. This includes the development and acquisition of modern destroyers to increase maritime security. The South China Sea's geopolitical dynamics have had an impact on Asia-Pacific naval strategies. Countries in the region are building up their naval capabilities, including the deployment of sophisticated destroyers. Some Asia-Pacific countries are acquiring or building Aegis-equipped destroyers, which will use the Aegis Combat System to provide superior air and missile defence. Regional rivalries and security concerns frequently drive naval modernization projects. The Asia-Pacific area has seen rising competition for naval capabilities among neighbouring countries.

Segmentation Analysis

Insights by Product Type

The propulsion system segment accounted for the largest market share over the forecast period 2023 to 2033. The adoption of sophisticated propulsion technologies such as gas turbines, electric propulsion systems, and integrated power systems contributes to destroyers' overall efficiency and speed. The emphasis on reducing fuel use and enhancing overall efficiency is propelling the development of more fuel-efficient propulsion technologies. Increasing fuel efficiency is not only financially advantageous but also environmentally friendly. Integrated Power Systems (IPS) include both propulsion and power generation into a single system. This strategy improves overall efficiency, minimises maintenance requirements, and increases the ship's power management flexibility for propulsion and other onboard systems. Gas turbine engines are widely utilised in destroyers due to their high power-to-weight ratio, making them ideal for high-speed naval operations.

Insights by Application

The government segment accounted for the largest market share over the forecast period 2023 to 2033. Governments frequently launch naval modernization initiatives to improve or replace ageing fleets. Modern destroyers are an important component of these programmes, helping to grow the government segment. Governments prioritise national security, and maritime defence is an important component. Destroyers serve an important role in securing maritime borders, safeguarding economic interests, and projecting force in regional and international waters. The allocation of defence expenditures is a critical factor in the government's ability to invest in new destroyers. Governments may raise defense resources to buy modern naval capabilities, particularly destroyers. Governments seek destroyers with multi-mission capability to combat a variety of threats, including anti-submarine, anti-aircraft, and anti-surface warfare. The adaptability of destroyers matches the variety of problems that naval forces encounter.

Recent Market Developments

- In December 2021, MHI (Mitsubishi Heavy Industries) of Japan launched the fourth of 22 Mogami-class multirole frigates for the Japanese Maritime Self-Defense Force (JMSDF).

Competitive Landscape

Major players in the market

- BAE Systems Plc.

- Austal USA

- Northrop Grumman Corporation

- Lockheed Martin

- General Atomics

- Fincantieri

- Mazagon Dock Shipbuilders

- Huntington Ingalls Industries

- United Shipbuilding

- DCNS

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Destroyers Market, Product Type Analysis

- Propulsion System

- ASW System

- Radar Absorbent Material Command and Control System

- Missile Launching System

- Radar System

Destroyers Market, Application Analysis

- Government

- Others

Destroyers Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Destroyers Market?The global Destroyers Market is expected to grow from USD 111.9 million in 2023 to USD 189.4 million by 2033, at a CAGR of 5.40% during the forecast period 2023-2033.

-

2. Who are the key market players of the Destroyers Market?Some of the key market players of the market are BAE Systems Plc., Austal USA, Northrop Grumman Corporation, Lockheed Martin, General Atomics, Fincantieri, Mazagon Dock Shipbuilders, Huntington Ingalls Industries, United Shipbuilding, and DCNS.

-

3. Which segment holds the largest market share?The government segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Destroyers Market?North America is dominating the Destroyers Market with the highest market share.

Need help to buy this report?