Global Dental Wounds Treatment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Wound Healing Agents, Analgesics, Rinses/Solutions, Lozenges, Film-forming & Mucoadhesive Systems, and Membranes & Scaffolds), By Application Area (Acute Dental Wounds, Chronic Oral Wounds, Periodontal Surgery Wounds, Implant-related Wounds, Orthodontic-related Mucosal Injuries, and Others), By Sales Channel (Hospital Pharmacies, Retail/Pharmacy Sales, Online/E-commerce, Clinic Pharmacies, and Group Dental Practices), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Dental Wounds Treatment Market Insights Forecasts to 2035

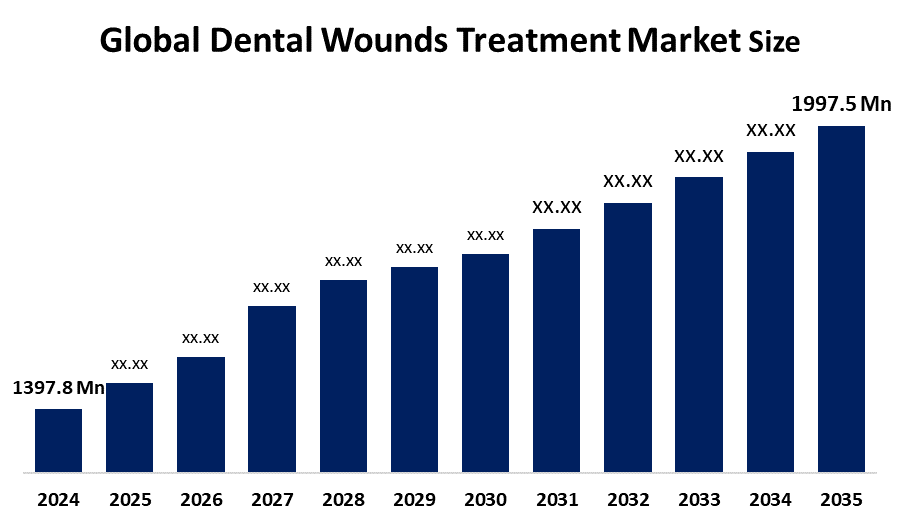

- The Global Dental Wounds Treatment Market Size Was Estimated at USD 1397.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.3% from 2025 to 2035

- The Worldwide Dental Wounds Treatment Market Size is Expected to Reach USD 1997.5 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global dental wounds treatment market size was worth around USD 1397.8 million in 2024 and is predicted to grow to around USD 1997.5 million by 2035 with a compound annual growth rate (CAGR) of 3.3% from 2025 to 2035. Increasing prevalence of dental disorders and surgical procedures, a rising geriatric population, and a higher incidence of traumatic injuries act as drivers for the growth of the dental wounds treatment market. Technological advancements in treatment, such as using bioactive materials and smart dressings, along with a heightened awareness of effective oral healthcare, have also contributed to increased market growth.

Market Overview

The Global Dental Wounds Treatment Market Size refers to a range of specialized products and therapies that manage and accelerate the healing of oral soft and hard tissue injuries, including extraction sites, implant placements, periodontal surgical wounds, mucosal trauma, and other operative defects. These treatments are externally applied topical gels, antimicrobial dressings, mucoadhesive films, absorbable membranes, and scaffold-based materials by dental professionals that help reduce the risk of infection, support tissue regeneration, and shorten recovery intervals. The market is experiencing an increase in volume from dental surgeries and implant procedures, along with enhanced patient awareness regarding postoperative intracavity healing and the adoption of biomaterials for advanced wound care. Innovation is strong, with manufacturers developing collagen-based dressings, platelet-rich plasma therapies, and regenerative scaffolds specifically for oral wound environments, and integrating these products with controlled-release bioactive agents and regenerative cues in order to enhance outcomes.

Opportunities abound in emerging economies, where dental service infrastructure is expanding, disposable incomes are rising, and dental tourism is growing, thus providing avenues for both cost-effective and premium wound care solutions. The key players in the market are Ultradent Products Inc., Straumann Group, Geistlich Pharma AG, Septodont, among others, who are investing in R&D, distribution expansion, and strategic partnerships in efforts to capture shares of this market. In 2024, the FDI World Dental Federation's World Dental Development Fund called for grant applications to support oral health projects around the world. This global public health initiative strengthens dental infrastructure, significantly promotes better oral care practices, and indirectly increases the demand for specialized treatments, such as dental wound care products, through improved access and quality of service.

Report Coverage

This research report categorizes the dental wounds treatment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dental wounds treatment market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dental wounds treatment market.

Global Dental Wounds Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1397.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.3% |

| 2035 Value Projection: | USD 1997.5 Million b |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application Area |

| Companies covered:: | 3M Dentsply Sirona Medtronic Smith & Nephew Coloplast Molnlycke Health Care Henry Schein Straumann Group Zimmer Biomet Septodontl Ultradent Products Inc. Alliance Pharma plc Geistlich Pharma AG Premier Dental Products Company Atlantis Consumer Healthcare Inc. and others, key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main factors driving the growth of the global dental wounds treatment market include the rising number of dental procedures, such as extractions, implants, and periodontal surgeries, which increase the demand for the management of these wounds. Growing awareness among patients and healthcare professionals about oral health and post-operative care also drives the demand. Technological advancements in wound care materials, such as bioactive dressings, absorbable membranes, and tissue scaffolds, improve healing outcomes and expand treatment options. Additionally, other contributory factors include an ageing population with complex dental needs and slower recovery rates, along with rising disposable incomes and the growth of dental tourism.

Restraining Factors

High costs of advanced wound care products restrain the dental wounds treatment market, as most of its products are unaffordable in price-sensitive regions. In addition, limited awareness of specialty dental wound management, particularly within developing countries, and the availability of traditional, low-cost alternatives restrict the adoption rate. Besides, strict regulatory requirements and challenges related to reimbursement slow market growth further.

Market Segmentation

The dental wounds treatment market share is classified into product type, application area, and sales channel.

- The wound healing agents segment dominated the market in 2024, approximately 61% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the dental wounds treatment market is divided into wound healing agents, analgesics, rinses/solutions, lozenges, film-forming & mucoadhesive systems, and membranes & scaffolds. Among these, the wound healing agents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The wound healing agents segment dominated the dental wounds treatment market due to the increasing number of dental surgeries, along with rising awareness regarding post-operative oral care, which has made these agents highly effective in accelerating tissue regeneration while reducing infection risks and improving overall healing outcomes. Innovations in bioactive and collagen-based formulations continue to act as a catalyst for this market.

- The acute dental wounds segment accounted for the largest share in 2024, approximately 19% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application area, the dental wounds treatment market is divided into acute dental wounds, chronic oral wounds, periodontal surgery wounds, implant-related wounds, orthodontic-related mucosal injuries, and others. Among these, the acute dental wounds segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment dominated the dental wound treatment market due to the increasing number of dental extractions, traumatic oral injuries, and surgical procedures worldwide. Increasing patient awareness of proper post-operative care, along with advancements in wound healing agents and materials, fuels this demand for effective management of acute dental wounds.

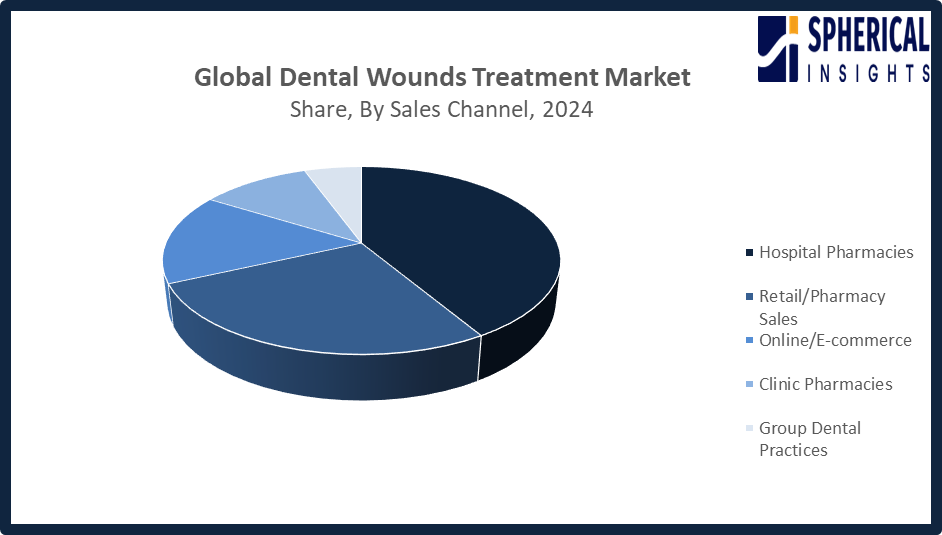

- The hospital pharmacies segment accounted for the highest market revenue in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the dental wounds treatment market is divided into hospital pharmacies, retail/pharmacy sales, online/e-commerce, clinic pharmacies, and group dental practices. Among these, the hospital pharmacies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital pharmacies segment growth is driven by the large volumes of dental procedures performed within a hospital setup, preference for professional supervision for dispensing specialized wound-care products, and the use of advanced healing agents and scaffolds are driving growth in this segment. The structured procurement and distribution systems in hospitals further give a boost to higher sales volumes within the hospital setting.

Get more details on this report -

Regional Segment Analysis of the Dental Wounds Treatment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the dental wounds treatment market over the predicted timeframe.

North America is anticipated to hold the largest share of the dental wounds treatment market over the predicted timeframe. North America is expected to contribute a 40% share in the dental wounds treatment market during the forecast period due to the established infrastructure for dental care, high expenditure on healthcare, and increasing awareness about oral health management. The rising incidences of dental surgery, periodontal diseases, and implant procedures increase the demand for novel wound-healing products. The United States accounts for a major share in the region owing to various research and development activities, the presence of major market players, and early adoption of innovative wound care technologies. Canada is the other major contributor to this region due to public initiatives such as the Canadian Dental Care Plan (CDCP), which helps extend dental treatments to more people.

Get more details on this report -

As of July 8, 2024, over 2.1 million Canadians are approved under the Canadian Dental Care Plan (CDCP), with around 250,000 having received care. The government is streamlining processes for dentists, hygienists, denturists, and specialists to treat patients and submit claims, ultimately providing oral health coverage for up to 9 million Canadians.

Asia Pacific is expected to grow at a rapid CAGR in the dental wounds treatment market during the forecast period. The Asia Pacific is rapidly growing in the dental wounds treatment market during the forecast period, with an approximate 25% market share, due to rising dental tourism, improving healthcare infrastructure in developing countries, and growing awareness of oral hygiene. Increasing disposable incomes and a higher incidence of dental disorders create demands for advanced wound-healing products. Major countries contributing to this growth include China and India due to a rise in dental clinics, along with large patient populations, whereas Japan and South Korea have a high adoption rate of novel biomaterials and regenerative dental technologies.

Europe is experiencing steady growth in the dental wounds treatment market due to increased dental surgeries, robust healthcare infrastructure, and higher adoption of advanced technologies for wound healing. Major contributors are Germany, the UK, and France, driven by a high level of awareness about oral health and government-supported dental care. Additionally, the growth in the elderly population and demand for regenerative dental treatments boost the market expansion across Europe, supported by continuous research and innovation in biomaterials and wound-management products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dental wounds treatment market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Dentsply Sirona

- Medtronic

- Smith & Nephew

- Coloplast

- Molnlycke Health Care

- Henry Schein

- Straumann Group

- Zimmer Biomet

- Septodontl

- Ultradent Products Inc.

- Alliance Pharma plc

- Geistlich Pharma AG

- Premier Dental Products Company

- Atlantis Consumer Healthcare Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Dentsply Sirona launched initiatives to enhance Single Visit Dentistry, expanding digital workflows and flexibility within the CEREC ecosystem. These advancements help dental professionals meet rising demand for efficient, high-quality care, optimise clinical outcomes, and strengthen the global CEREC community’s growth and potential.

- In February 2025, MIS introduced the advanced MIS LYNX implant, designed to redefine implant dentistry standards. Offering versatility and reliability, it matches the MIS C1 implant’s dimensions and prosthetic line, ensures primary stability across various bone qualities, and supports immediate placement in extraction sockets for diverse clinical applications.

- In October 2024, Septodont Inc. and Premier Dental announced a strategic US distribution agreement to advance dental pain management. Premier’s BufferPro, a one-step, single-use, fast, and cost-effective buffering solution, will streamline dental anesthetic procedures, making buffering easier and more efficient for dental professionals nationwide.

- In October 2022, 3M announced the launch of the 3M Filtek Matrix, a restorative dental solution designed to simplify composite placement. This innovative product offers dentists a less-invasive, more predictable method for improving patients’ smiles while providing a cost-effective and efficient treatment option for both practitioners and patients.

- In August 2022, Oral-B and Straumann formed a global alliance to emphasize prevention in periodontal and peri-implant health. The partnership aims to provide high-quality scientific education for dental professionals and support patients in achieving improved long-term oral health outcomes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dental wounds treatment market based on the below-mentioned segments:

Global Dental Wounds Treatment Market, By Product Type

- Wound Healing Agents

- Analgesics

- Rinses/Solutions

- Lozenges

- Film-forming & Mucoadhesive Systems

- Membranes & Scaffolds

Global Dental Wounds Treatment Market, By Application Area

- Acute Dental Wounds

- Chronic Oral Wounds

- Periodontal Surgery Wounds

- Implant-related Wounds

- Orthodontic-related Mucosal Injuries

- Others

Global Dental Wounds Treatment Market, By Sales Channel

- Hospital Pharmacies

- Retail/Pharmacy Sales

- Online/E-commerce

- Clinic Pharmacies

- Group Dental Practices

Global Dental Wounds Treatment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dental wounds treatment market over the forecast period?The global dental wounds treatment market is projected to expand at a CAGR of 3.3% during the forecast period.

-

2. What is the market size of the dental wounds treatment market?The global dental wounds treatment market size is expected to grow from USD 1397.8 million in 2024 to USD 1997.5 million by 2035, at a CAGR of 3.3% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the dental wounds treatment market?North America is anticipated to hold the largest share of the dental wounds treatment market over the predicted timeframe.

-

4. What is the dental wounds treatment market?The dental wound treatment market is a specialized segment of the wound care industry focused on products and therapies for healing wounds in the oral cavity, including those from surgery, trauma, or chronic conditions such as diabetic ulcers.

-

5. Who are the top 10 companies operating in the global dental wounds treatment market?3M, Dentsply Sirona, Medtronic, Smith & Nephew, Coloplast, Molnlycke Health Care, Henry Schein, Straumann Group, Zimmer Biomet, Septodont, Ultradent Products Inc., and Others.

-

6. What factors are driving the growth of the dental wounds treatment market?The growth of the dental wounds treatment market is primarily driven by several key factors, including the increasing prevalence of dental diseases and traumatic injuries, the expanding ageing population, and significant technological advancements in wound care

-

7. What are the market trends in the dental wounds treatment market?Market trends in dental wound treatment include the rise of advanced and interactive dressings, integration of smart technology for real-time monitoring, and a growing focus on biodegradable and sustainable products.

-

8. What are the main challenges restricting wider adoption of the dental wounds treatment market?The main challenges restricting the wider adoption of the dental wounds treatment market stem from a combination of high costs and inadequate insurance coverage, logistical and accessibility issues, lack of professional training and standardized guidelines, and patient-related psychological and awareness barriers.

Need help to buy this report?