Global Dense Soda Ash Market Size, Share, and COVID-19 Impact Analysis, By Manufacturing Process (Solvay Process, and Trona Ore Processing), By Application (Glass, Soaps & Detergents, Chemicals, Alumina & Mining, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Dense Soda Ash Market Insights Forecasts to 2035

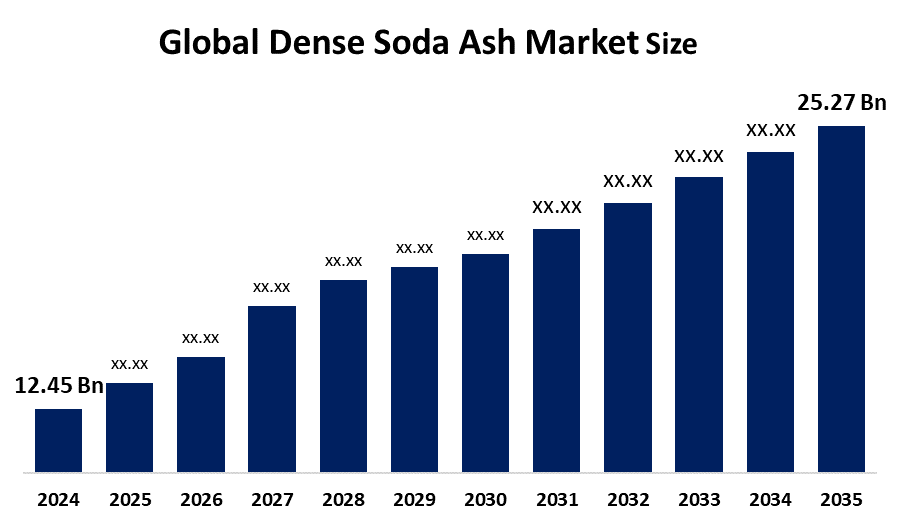

- The Global Dense Soda Ash Market Size Was Estimated at USD 12.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.65% from 2025 to 2035

- The Worldwide Dense Soda Ash Market Size is Expected to Reach USD 25.27 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global dense soda ash market size was worth around USD 12.45 billion in 2024 and is predicted to grow to around USD 25.27 billion by 2035 with a compound annual growth rate (CAGR) of 6.65% from 2025 to 2035. The opportunities for developing industrial applications, rising demand in the glass and chemical industries, production technology developments, geographic market expansion, sustainable manufacturing practices, and strategic alliances to improve global supply chains are all presented by the dense soda ash market.

Market Overview

The lobal industry that produces, distributes, and sells dense soda ash, also referred to as sodium carbonate (Na2CO3), is known as the "dense soda ash market." The global trade and manufacturing of sodium carbonate (Na2CO3) in its high-bulk-density granular form, which is distinguished by better handling efficiency and lower dust emissions than light forms, are included in the Dense Soda Ash Market. It is mostly used in the production of detergents, chemicals, water treatment, and flat and container glass (which accounts for 50% of demand), supporting sectors essential to sustainability and building. One of the biggest users of dense sodium carbonate is the glass manufacturing sector, which is driving the dense soda ash market substantial expansion. As manufacturers strive to lessen their environmental effect, the market for dense soda ash is seeing an increasing trend toward sustainable production methods. Solvay continues to innovate by moving toward carbon capture-integrated production models. Increased demand from the chemical and glass industries, bolstered by infrastructural development and urbanization, will propel dense soda ash market expansion.

Report Coverage

This research report categorizes the dense soda ash market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dense soda ash market. Recent market developments and competitive strategies, such as expansion, Manufacturing Process launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dense soda ash market.

Global Dense Soda Ash Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.45 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.65% |

| 2035 Value Projection: | USD 25.27 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Manufacturing Process, By Application |

| Companies covered:: | Solvay sisecam InoChem. QEMETICA GHCL Limited Eti Soda Elektrik Tata Chemicals Ltd. Sudarshan Mineral Tokuyama Corporation Tangshan Sanyou Group Co., Ltd. Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for thick soda ash has been greatly boosted by the expanding packaging sector and the rising demand for residential and commercial constructions. The demand for soda ash is continuing to rise due to the growing preference in many industries for long-lasting and sustainable glass products. The primary factor propelling the dense soda ash market is the growing glass production sector. The widespread use of dense soda ash in the glass manufacturing sector is one of the main factors driving market expansion. Additionally, technological developments and the growing demand for energy-efficient buildings have fueled the expansion of the glass sector, which in turn has increased demand for dense soda ash.

Restraining Factors

High energy and production costs, environmental regulations, the availability of substitute chemicals, market price volatility, reliance on raw material supply, and limited adoption in emerging applications are all factors restricting the growth of the dense soda ash market.

Market Segmentation

The dense soda ash market share is classified into manufacturing process and application.

- The solvay process segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the dense soda ash market is divided into solvay process, and trona ore processing. Among these, the Solvay process segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Sodium carbonate is created when sodium chloride, ammonia, and carbon dioxide react using the Solvay process. The main reasons for using this synthetic technique are its scalability for industrial requirements, consistent purity levels, and regulated output. The Solvay process is used in the production, which is highly appreciated in sectors like chemical synthesis and glass manufacturing that demand consistent quality.

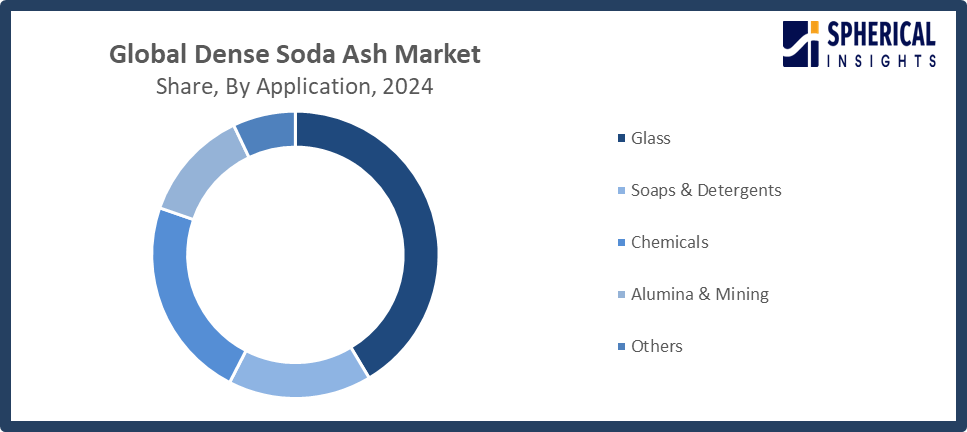

- The glass segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the dense soda ash market is divided into glass, soaps & detergents, chemicals, alumina & mining, and others. Among these, the glass segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the dense soda ash business, glass is an essential raw material that serves as a flux to lower the melting temperature of silica. This improves the glass's durability and clarity while using less energy during production. Growth in the construction, automotive, and packaging industries, all of which rely significantly on a variety of glass products, is driving the demand for dense sodium carbonate in this sector.

Get more details on this report -

Regional Segment Analysis of the Dense Soda Ash Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dense soda ash market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the dense soda ash market over the predicted timeframe. Rapid urbanization, industrialization, and growing consumer demand are the main drivers of Asia Pacific. The leading nations in this area are China and India, with Southeast Asian nations making substantial contributions. Important growth contributors include government programs that support construction, automobile manufacturing, and infrastructure development. Significant soda ash use is driven by the growing glass production industry as well as growing demand from chemicals, detergents, and alumina mining.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the dense soda ash market during the forecast period. Glass manufacture, chemicals, soaps, and alumina mining are among the sophisticated industrial sectors that drive the North American market. The region in question is dominated by the United States, which is supported by technological developments and a well-established manufacturing infrastructure. The need for the dense soda ash industry, which is mostly used in glass production, is further stimulated by rising investments in the building and automotive industries. Furthermore, dense sodium carbonate is a crucial raw material for the detergent sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dense soda ash market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay

- sisecam

- InoChem.

- QEMETICA

- GHCL Limited

- Eti Soda Elektrik

- Tata Chemicals Ltd.

- Sudarshan Mineral

- Tokuyama Corporation

- Tangshan Sanyou Group Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2023, Solvay unveiled the Solvay process, a novel method for producing soda ash. This innovative method offers a 50% reduction in CO2 emissions, a 20% reduction in energy, water, and salt consumption, and a 30% reduction in limestone use and wastes.

- In June 2023, A USD 968.0 million capital expenditure plan, which includes a 380 KT salt capacity addition in the United Kingdom and Mithapur, India, has been announced by Tata Chemicals. India's worldwide salt capacity would increase to 2.3 MT and 1.8 MT as a result. Growth, sustainability, and higher production across important product lines are all supported by the investments.

- In May 2022, Solvay ordered AGC's remaining 20% minority share in their joint venture for soda ash in Green River, Wyoming, making Solvay the facility's sole owner. By increasing its supply of less carbon-intensive soda ash, this action supports Solvay's sustainability objectives and solidifies its position as a leader in the manufacturing of trona-based soda ash.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dense soda ash market based on the below-mentioned segments:

Global Dense Soda Ash Market, By Type

- Solvay Process

- Trona Ore Processing

Global Dense Soda Ash Market, By Application

- Glass

- Soaps & Detergents

- Chemicals

- Alumina & Mining

- Others

Global Dense Soda Ash Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dense soda ash market over the forecast period?The global dense soda ash market is projected to expand at a CAGR of 6.65% during the forecast period.

-

2. What is the market size of the dense soda ash market?The global dense soda ash market size is expected to grow from USD 12.45 billion in 2024 to USD 25.27 billion by 2035, at a CAGR of 6.65% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the dense soda ash market?Asia Pacific is anticipated to hold the largest share of the dense soda ash market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global dense soda ash market?Solvay, Şişecam, InoChem, QEMETICA, GHCL Limited, Eti Soda Elektrik, Tata Chemicals Ltd., Sudarshan Mineral, Tokuyama Corporation, Tangshan Sanyou Group Co., Ltd., and others.

-

5. What factors are driving the growth of the dense soda ash market?The growth of the dense soda ash market is driven by rising demand in glass manufacturing, detergents, chemicals, and water treatment, alongside industrial expansion and technological advancements in production processes.

-

6. What are the market trends in the dense soda ash market?The market trends include sustainable manufacturing practices, technological innovations, capacity expansions, strategic partnerships, and growing adoption of dense soda ash across emerging economies and high-demand industrial sectors.

-

7. What are the main challenges restricting wider adoption of the dense soda ash market?The challenges include high energy and production costs, stringent environmental regulations, raw material dependency, market price volatility, and limited awareness or adoption in developing industrial applications.

Need help to buy this report?