Global Degermed Corn Flour Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Non-GMO Degermed Corn Flour and Organic Degermed Corn Flour), By Distribution Channel (Online Retail and Supermarkets/Hypermarkets), By Application (Food and Beverages, Animal Feed, Industrial, And Others), By End User (Household and Food Service Providers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Degermed Corn Flour Market Insights Forecasts to 2035

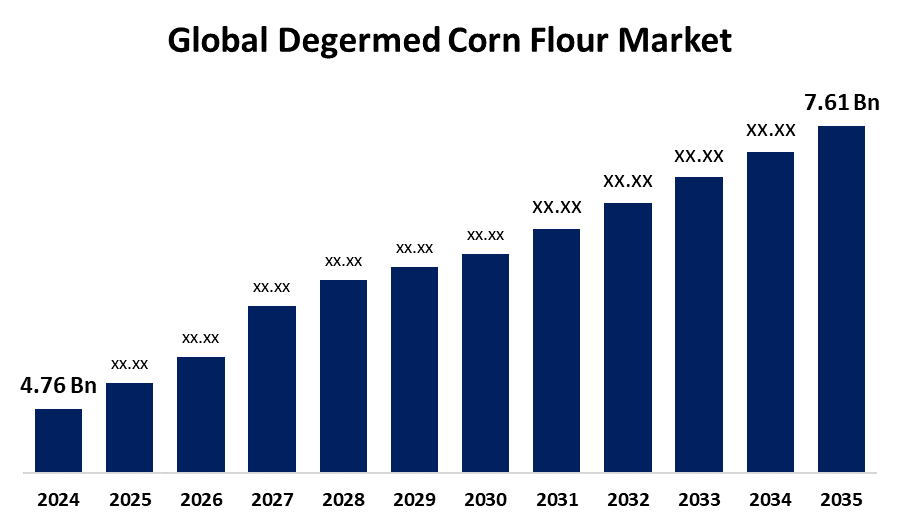

- The Global Degermed Corn Flour Market Size Was Estimated at USD 4.76 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.36% from 2025 to 2035

- The Worldwide Degermed Corn Flour Market Size is Expected to Reach USD 7.61 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest During the Forecast Period.

Get more details on this report -

The Global Degermed Corn Flour Market size was worth Around USD 4.76 Billion in 2024 and is Predicted to Grow to around USD 7.61 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 4.36% from 2025 to 2035. The degermed corn flour is emerging as a vital ingredient, driven by health trends, biofuel initiatives, and rising demand for convenience foods. Its role is set to expand across both the food and energy sectors, especially in rapidly developing regions.

Market Overview

The degermed corn flour market refers to the sale and use of maize flour made by removing the germ using a dry milling process, which produces a finer, more shelf-stable product. Because of its neutral flavor, superior binding and thickening qualities, and compatibility with gluten-free diets, this flour is frequently used in food and beverage applications, such as baked goods, sauces, and soups.

The growing customer demand for food products that are convenient, gluten-free, and shelf-stable. It is an important food ingredient because of its many uses in many cuisines and nutritional advantages. Urbanization, better retail infrastructure, and rising disposable incomes all help the industry. Because of their sophisticated food processing industries, North America and Europe are in the lead, but Asia-Pacific has significant growth potential. Product quality and distribution are being improved by sustainable practices and technological breakthroughs. In the dynamic global food market, degermed corn flour is an essential strategic ingredient.

Report Coverage

This research report categorizes the degermed corn Flour market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the degermed corn Flour market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the degermed corn Flour market.

Global Degermed Corn Flour Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.76 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.36% |

| 2035 Value Projection: | USD 7.61 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, By Application. |

| Companies covered:: | Cargill, Incorporated, Associated British Foods plc, Archer Daniels Midland Company, SunOpta Inc., Grain Processing Corporation, Ingredion Incorporated, Pacific Ethanol, Inc., Tate & Lyle PLC, Semo Milling, LLC, Grain Millers, Inc., C.H. Guenther & Son, Inc., Didion Milling Inc., Bunge Milling, Inc and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The growing desire for healthier and gluten-free dietary options. Its growing usage in cereals, baked products, and snacks is consistent with the global trend toward convenience foods. Demand is also increased by ethanol manufacturing projects in emerging economies, urbanization, and increased disposable incomes. The prognosis for the market is improved by government initiatives to encourage biofuels. The growth of e-commerce is changing accessibility and distribution, particularly in densely populated nations like China and India. All of these developments point to degermed maize flour as a crucial component of the food and energy industries of the future.

Restraining Factors

The market growth is hindered by the corn yields are impacted by environmental concerns, decreased consumer spending, and growing unemployment. Growth is further hampered by price instability and competition from other gluten-free flours. Adoption may also be constrained by consumers' rising cynicism about processed meals. All of these elements work together to create obstacles to long-term market growth.

Market Segmentation

The degermed corn flour market share is classified into product type, distribution channel, application, and end user.

- The organic degermed corn flour segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the product type, the degermed corn flour market is categorized into non-GMO degermed corn flour and organic degermed corn flour. Among these, the organic degermed corn flour segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the growing demand from consumers for food products free of chemicals and genetically modified organisms. Because consumers in developed nations like North America and Europe are willing to pay more for sustainable and organic products, organic degermed corn flour is very popular there. The expansion of this market is also being aided by strict laws and certifications about organic farming. In order to satisfy the increasing demand from consumers and take advantage of the profitable prospects in this market niche, businesses are concentrating on growing their organic product lines.

- The online retail segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the degermed corn flour market is categorized into online retail and supermarkets/hypermarkets. Among these, the online retail segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the expanding e-commerce industry and shifting customer purchasing patterns. Online retail has been a popular choice for many customers due to its ease, competitive pricing, and large product selection. The growing use of cellphones and internet connection, especially in developing nations, supports this trend even more and is anticipated to fuel the expansion of degermed corn flour sales online.

- The food and beverages segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the degermed corn flour market is categorized into the food and beverages, animal feed, industrial, and others. Among these, the food and beverages segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the wide range of culinary possibilities for degermed maize flour. Degermed maize flour, prized for its texture and nutritional benefits, is a basic ingredient in baked goods, snacks, and prepared meals. As manufacturers adapt to these changing dietary choices, the increased consumer demand for plant-based and gluten-free meals is driving the market's adoption of degermed corn flour.

- The household segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the degermed corn flour market is categorized into the household and food service providers. Among these, the household segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to its many uses and health advantages, degermed maize flour is becoming more and more popular as more people cook and bake at home. It is becoming more and more popular among health-conscious consumers for cooking wholesome meals. This puts the household segment in a strong position for sustained growth.

Regional Segment Analysis of the Degermed Corn Flour Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the degermed corn flour market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the degermed corn flour market over the predicted timeframe. The regional growth can be attributed to the high demand for gluten-free products, a well-established food manufacturing sector, and a significant presence of big businesses like Cargill and ADM. The desire for easy, shelf-stable ingredients, customer awareness, and product innovation all support the United States' market supremacy in the region.

Asia Pacific is expected to grow at a rapid CAGR in the degermed corn flour market during the forecast period. The region's growth is being driven by the fast urbanization, growing middle-class population, rising disposable incomes, and growing health consciousness. The demand for processed and gluten-free foods is rising in nations like China and India, and the industry is expanding due to government programs encouraging the manufacture of ethanol and the increasing use of e-commerce.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the degermed corn flour market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Associated British Foods plc

- Archer Daniels Midland Company

- SunOpta Inc.

- Grain Processing Corporation

- Ingredion Incorporated

- Pacific Ethanol, Inc.

- Tate & Lyle PLC

- Semo Milling, LLC

- Grain Millers, Inc.

- C.H. Guenther & Son, Inc.

- Didion Milling Inc.

- Bunge Milling, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2021, Archer-Daniels-Midland, a food processing firm based in Illinois, announced the acquisition of Deerland Probiotic & Enzymes, a company situated in Georgia. The financial details of the deal were kept hidden. The transaction is likely to benefit Archer-Daniel-Midland's wellness and health portfolio.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the degermed corn flour market based on the below-mentioned segments:

Global Degermed Corn Flour Market, By Product Type

- Non-GMO Degermed Corn Flour

- Organic Degermed Corn Flour

Global Degermed Corn Flour Market, By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

Global Degermed Corn Flour Market, By Application

- Food and Beverages

- Animal Feed

- Industrial

- Others

Global Degermed Corn Flour Market, By End User

- Household

- Food Service Providers

Global Degermed Corn Flour Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the degermed corn flour market over the forecast period?The global degermed corn flour market is projected to expand at a CAGR of 4.36% during the forecast period.

-

2. What is the market size of the degermed corn flour market?The global degermed corn flour market size is expected to grow from USD 4.76 Billion in 2024 to USD 7.61 Billion by 2035, at a CAGR of 4.36% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the degermed corn flour market?North America is anticipated to hold the largest share of the degermed corn flour market over the predicted timeframe.

Need help to buy this report?